22 December 2023 | FinTech

A Fintech Wish List

By Alex Johnson

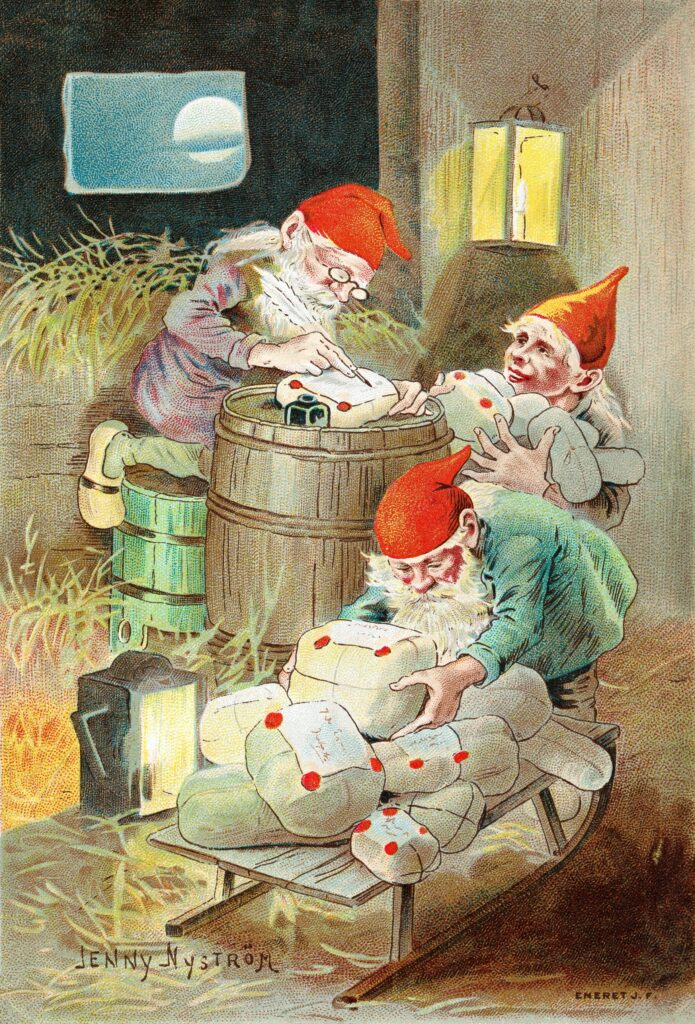

Saint Nicholas Eve is a holiday that is traditionally celebrated on or around December 5th. In many European countries, children observe the holiday by leaving shoes filled with carrots and hay for Saint Nicholas’ horse in the hope that he will return the favor by leaving oranges, chocolates, or small gifts for them.

In my family, we adapted the holiday a bit. Instead of leaving carrots and hay for Saint Nicholas’ horse, we left letters to Santa Claus in our slippers. The letters contained our best wishes for Father Christmas, along with detailed descriptions of all the presents we were hoping to get that year. While we were sleeping, the elves would come to collect our letters and would leave a few small treats and gifts in our slippers.

As a child, I never really questioned the org structure (Are Saint Nicholas of Myra and Santa Claus the same person? Does St. Nicholas work for Santa?) or the associated logistical challenges (How will Santa have enough time to make my presents if he is only getting my wish list on December 6th?) And true to form, my kids aren’t questioning anything either. It’s just a tradition!

This is why, around this time of year, I find myself writing down lists of various things with no real conscious thought. And I thought it might be fun to share one such list with you – my fintech wish list!

This list is curated from the many times in my newsletter I’ve idly asked, “Why doesn’t this exist?” as well as the Not Fintech Investment Advice! podcast, in which Simon Taylor and I always try to spend a few minutes ‘manifesting’ different ideas that we’d like to see come to life in the fintech ecosystem.

So, without further ado, my fintech wish list.

Dear Santa Claus,

I hope you, Mrs. Claus, and the elves have been doing well and have managed to take a bit of a break. Maybe somewhere sunny!

For Christmas this year, I would like the following:

A credit builder product that won’t drive me insane. There is a way to design a credit builder product that is customer-friendly *and* that generates useful behavioral signals for lenders. Please, somebody, build this for me!

(I’ve ranted about credit building more times than I can count. Here’s the most recent one. And here’s a visual of the challenge facing anyone trying to build in this area.)

Ramp for consumers. In the same way that successful businesses tend to be those that ruthlessly control their expenses, I’m becoming more and more convinced that the secret to happiness is doing the same thing with your personal balance sheet. I’d love to see a true Ramp equivalent in B2C fintech.

(This was one of the ideas I tossed out in my recent essay on happiness.)

Paycheck diversion as a standard feature in all consumer bank accounts. I tend to spend most of the money that is in my pocket most of the time, so please help me divert money from ever going into my pocket!

(We’re inching closer to this, as I wrote about here.)

Deposit allocation tracking. I know which companies my 401(k) is funding, and I have at least some control over that allocation decision, which allows me, as an individual, to balance the inherent trade-offs between ROI and my personal ethics. No such mechanism exists for deposits, but it should (at least for tracking where my deposits are going, if not steering their allocation).

(This one is courtesy of Simon Taylor in our Not Fintech Investment Advice! podcast.)

Payment protection insurance as a required feature in all consumer loans. We don’t do nearly enough to proactively protect consumers’ ability to pay in the face of unforeseen and temporary disruptions. A narrowly tailored insurance product could really help, but it would work best if it was a required feature in all loans, which would allow us to spread the risk out as evenly as possible (like we do with car insurance).

(I wrote about the imperative to protect consumers’ ability to pay and the role that insurance can play in that here.)

Generative AI-powered loan underwriting assistants. Whenever lenders are significantly undeserving a specific segment of prospective borrowers, usually there’s a very simple explanation – the cost to safely underwrite them is just too high. Generative AI can help lower the costs of much of the back-office drudgery that still exists in many areas of lending.

(Small business lending is perhaps the best example of where this would be useful, as I wrote about here.)

Ubiquitous fraud data consortiums that are leveraged by both banks and fintech companies. The old adage, “I don’t have to be faster than a bear to get away; I just have to be faster than the person standing next to me,” is cute and everything, but it’s not a good life philosophy if the town you live in is absolutely overrun by a horde of murderous bears. Financial services is absolutely overrun by fraudsters, and it would be nice if banks and fintech companies could suppress their competitive instincts for a minute and cooperate in dealing with the problem.

(We’re in the midst of a hangover right now, but I hold out some hope that we’re headed in the right direction on this one.)

Open banking for regulatory reporting. In the same way that programmatic, real-time access to bank account data can give lenders a fundamentally different and more useful view into consumers’ cashflow than a shoebox of bank statements, so could bank regulatory reporting be made significantly better if it was done via always-on APIs rather than through PDFs and the filing of quarterly reports.

(Simon Taylor tossed this one out in a Not Fintech Investment Advice! episode and I think it’s brilliant.)

A ReFi robot. When interest rates start coming down, I would love to have a little robot helper that could automatically and continuously refinance my various loans without requiring me to lift a finger.

(A tip of the hat to the smart fintech folks over at a16z for this idea.)

A VIP adverse action experience for existing bank customers. I understand why new-to-bank applicants get generic and unhelpful adverse action notices, but why do existing customers of banks get the same treatment? Why aren’t banks giving these rejected applicants more specific and actionable advice?

(If you want to really nerd out on the subject of adverse action notices, read this essay.)

A master money account. We’ve made significant progress in collapsing some of the artificial distinctions that have traditionally been drawn between different retail banking products, but we’re still not far enough along. I’d like a combination checking account, savings account, investment account, and credit card, with intelligent allocation and routing capabilities, please!

(I wrote about why this would be my ideal retail banking product and why it’s so hard to create it here.)

Balance Sheet Augmentation-as-a-Service. I’ll admit that the name isn’t great, but I think the concept – a banking-as-a-service platform that is able to load balance the assets and liabilities of its fintech clients across a network of bank partners – is a very good (and needed) idea.

(Here’s my BaaS + BSAaaS essay, where I lay out this idea in a lot more detail. Also, take a look at this essay, which spells out why BaaS might be a good solution for the challenge of specialization in banking/fintech.)

A neobank for teachers. I know that niche neobanks aren’t in vogue right now, but I don’t care. This is personal for me and I want it to exist. I also think it’s a good business idea. Teaching is one of the only white-collar professions that doesn’t pay a white-collar salary. There are lots of very defined and specific financial needs that teachers have, which would be best served by a teacher-focused digital bank. Plus, teaching is one of the best professions to focus on from a lending perspective, as their involuntary unemployment rate is extremely low.

(I tried to manifest this one into existence in a Not Fintech Investment Advice! Podcast at the beginning of this year.)

The Next Credit Karma. General purpose credit scores (FICO, Vantage) are becoming increasingly poor indicators of consumers’ holistic creditworthiness (even as they remain incredibly valuable analytic tools). I would like a new consumer-facing product that helps people understand their creditworthiness across a wider range of data (traditional credit reports, BNPL repayment data, bank account and payroll data, etc.) and enables them to get prequalified for the best credit products based on that data.

(I touch on this idea in this essay on prescreen.)

An Apple Wallet that makes sense. Apple Wallet is a mess, which is a shame because the level of integration and intelligence that Apple has the potential to bring to every aspect of our financial lives is quite tantalizing. I’d like a version of Apple Wallet that is closer to that nirvana state.

(Why is Apple Wallet a mess? Read this.)

A better homeownership on-ramp. I know it’s a steeper climb to become a homeowner today than it has been in recent decades, but that just means we need better on-ramps! Why there aren’t more fintech apps designed to engage aspiring homeowners, early in their journeys, is beyond me.

(PSA – buy a house, not a Birkin!)

Bank accounts that have specific and opinionated designs. Traditional bank accounts are hopelessly generic. They try to be all things to all people, but end up being a mildly bad fit for everyone. Give me more specific products, built for specific customer segments and use cases! A financial therapy bank account. A bill pay bank account. A home management bank account. A freelancer bank account. Let’s get weird!

(Read The Bank Account Multiverse for a good primer on this.)