We’re gonna do some problem-solving in today’s newsletter.

Specifically, I think there’s a way for us to feed two birds with one scone.1

Problem #1: Banks’ Balance Sheets are Out of Balance

Banking is an inherently cyclical business. Interest rates go up. Interest rates go down. Deposits ebb and flow. Loan defaults wax and wane. And banks continuously adjust their balance sheets to minimize risk and maximize profits.

It’s business as usual.

Until it isn’t.

In 2020, in an attempt to shore up the economy against the threat of the COVID-19 pandemic, the government dumped truckloads of money onto banks’ balance sheets.

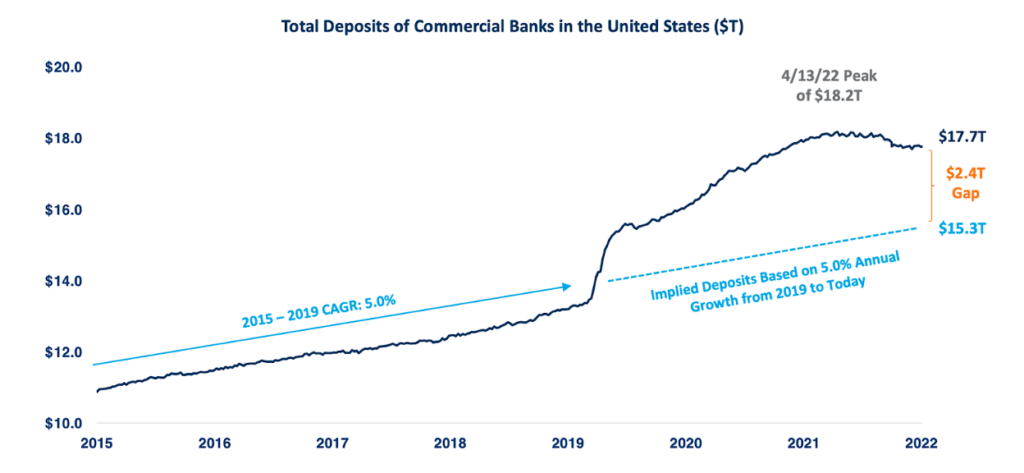

According to an analysis from Tom Michaud at KBW, commercial banks in the U.S. pulled in $2.4 trillion more in deposits between 2019 and 2022 than they were expecting:

$2.4 trillion more than they were expecting.

That is nuts.

And ever since then, banks (and the economy, more broadly) have been on tilt.

In 2020 and 2021, the problem for banks was finding a way to wring value out of all these cheap deposits. Lending to consumers and businesses surged (as the government hoped) and banks that couldn’t lend enough through their own direct channels invested, at a premium, in other banks’ loans through various secondary marketplaces.

Banks also bought a ton of securities (mostly treasury and mortgage bonds).

Then, as we know, rates started to rise, and everything tilted in the other direction.

Banks’ bond portfolios went underwater, and the unrealized losses on their books froze up the M&A market and led to this spring’s regional bank mini-crisis.

Borrowing money became more expensive, so lending slowed down (although credit quality has, so far, held up decently well).

And all of those cheap deposits? Those are long gone, and banks are now turning to more expensive and risky deposit-gathering channels to plug the holes in their balance sheets:

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

Banks collectively had more than $1 trillion in brokered deposits in the first quarter, according to the latest available data from the Federal Deposit Insurance Corp. That figure almost certainly increased in the second quarter.

Brokered deposits are a quick and easy way banks can bolster their balance sheets in a pinch. A bank can go to a firm such as Morgan Stanley or Fidelity to find people to invest in its certificates of deposit, often for large amounts.

But brokered deposits are typically much more expensive for banks. They can come with interest rates of 5% or more, putting pressure on profit margins.

Eventually, one imagines, the banking industry will come back to a better balance, and the extreme pressure on banks’ balance sheets will ease. But given the Fed’s most recent rate hike (which brought the federal funds rate to its highest level in 22 years) and Jay Powell’s apparent confidence that he can continue to raise rates without driving us into a recession, I don’t expect us to find that balance for a while.

Problem #2: BaaS Platforms are Caught Between a Rock and a Hard Place

I’ve always been a bit suspicious of Banking-as-a-Service (BaaS) platforms.

I get the theory – instead of requiring banks to directly acquire, integrate with, and manage fintech and non-bank partners, the platform can do those things on their behalf. And instead of requiring fintech companies and non-bank brands to directly evaluate, select, integrate with, and be managed by a partner bank, the platform can do those things on their behalf.

BaaS platforms are market makers and (in some cases) program managers, balancing out supply and demand and making it easier and faster for suppliers (banks) and buyers (fintech companies and non-bank brands) to work with each other.

The problem is that, in practice, it’s a tough model to make work.

While BaaS platforms are hugely appealing to banks and fintech companies at the beginning of their BaaS journeys (because of how easy they make it to get started), they become progressively less appealing as those banks and fintech companies mature (and start wondering why they’re splitting the pie up three ways when they could just be dividing it in half). This basic reality is why, over time, we’ve seen more and more late-stage fintech companies repatriate third-party infrastructure back in-house (Current ditching Galileo and processing card transactions directly with Visa is a good example), and why we’ve seen an increase in more modern, tech-first BaaS banks designed to directly appeal to fintech developers (Column, Lead Bank, etc.)

Additionally, the highly-regulated nature of banking makes any middleman infrastructure strategy that is focused on abstracting away complexity inherently risky. We’ve seen this play out countless times already, with Laso, provider of the “no-KYC Visa card” built on top of Stripe and Celtic Bank, being the latest example of an obvious compliance failure sneaking through the BaaS platform side door.

Because of these reasons (and the overall slowdown in fintech, which has reduced demand for BaaS), it hasn’t surprised me to see some consolidation in the BaaS platform space this year. Railsr went bankrupt. Fifth Third scooped up Rize Money. And FIS nabbed Bond.

I expect this consolidation trend to continue, or if these platforms don’t figure out a way to extend their value propositions, to accelerate.

Solution: Balance Sheet Augmentation-as-a-Service

BaaS, when done well, can be enormously beneficial to banks.

Take Panacea Financial as an example.

Panacea is a niche neobank, focused on serving doctors, dentists, and veterinarians.

A core point of differentiation for Panacea is its focus on acquiring customers as early in their careers as possible. Starting with fourth-year medical students and extending through residency and into licensed practitioners, Panacea provides unsecured personal loans and student loan refinancing, based on a combination of the individual’s credit history and verification of that individual’s credentials as a medical student, resident, or licensed practitioner. Panacea has, over time, augmented these lending products with consumer deposit products, mortgage and insurance products (through referral partners), and commercial lending and deposit products for medical professionals looking to start their own practices.

Panacea’s banking partner is Primis Bank, a $4 billion community bank based in Virginia.

Interestingly, Primis is also an investor in Panacea, which, judging by Primis’s most recent earnings report, turned out to be a very wise decision!

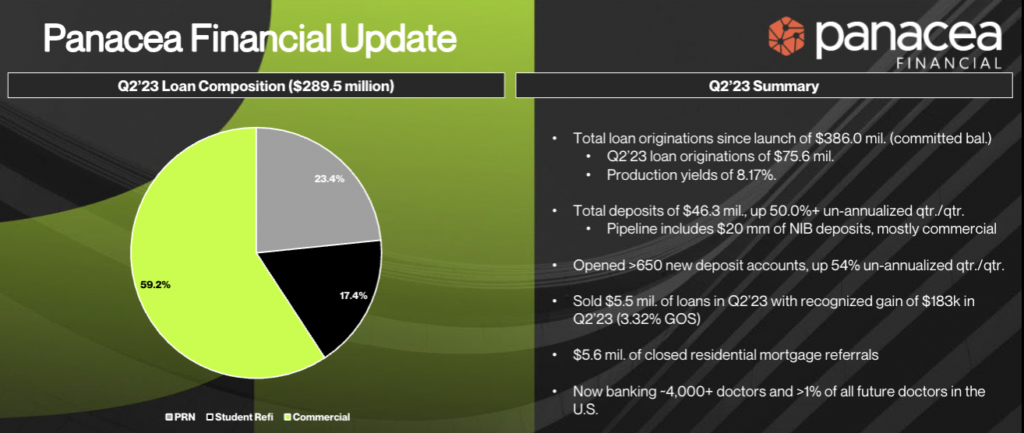

In Q2 of this year, Panacea originated nearly $76 million in loans for Primis, which represented about 45% of Primis’s total loan volume for the quarter and an even greater percentage of its quarter-over-quarter loan growth. Panacea also brought in more than 650 new deposit accounts (a substantial chunk of which were non-interest-bearing commercial operating accounts) and $5.6 million in closed residential mortgage loan referrals (mortgage lending is Primis’s primary direct lending business).

And here’s the really fascinating part – Primis isn’t getting nearly as much value out of its partnership Panacea as it could be.

During the bank’s Q2 earnings call, Primis CEO Dennis Zember claimed that without the constraints imposed by his bank’s balance sheet and the current rate environment, Panacea could easily be producing more than double the volume of loans that it is currently doing.

In other words, Primis is limiting Panacea.

Now, in the banking world, lots of mechanisms exist to help address this problem.

If a bank builds a loan origination engine that really hums and produces more loans than the bank’s balance sheet can accommodate, there are a multitude of platforms and marketplaces that facilitate loan syndication, sales, and participation.

On the other hand, if a bank excels at pulling in deposits and ends up with more liabilities on its balance sheet than it would like, there are a myriad of deposit placement networks that allow banks to sell off excess deposits and/or swap deposits in order to increase their effective FDIC insurance coverage.2

The basic function of these platforms and marketplaces and networks is to help ‘load balance’ banks’ assets and liabilities, allowing for each institution to optimize its earnings without having to materially change the way that it serves its customers.

However, the problem with these balance sheet load balancers is that they aren’t especially well set up to work with fintech companies.

If a fintech company’s partner bank is already using a LoanStreet or an IntraFi, then the partner bank can spread its excess assets or liabilities through those networks. But what if the partner bank has never needed load balancing assistance because, up until it started providing BaaS services, it never generated enough loans or deposits to throw its balance sheet out of whack? And what about the fintech company? I mean, it’s great if their bank partner is able to relieve the pressure on its balance sheet, but shouldn’t the fintech company get some other benefit for producing such outstanding results in the first place?

We need a better solution.

It’s important. And I’ll tell you why.

Fintech companies are the new relationship banks.3 They excel at honing in on specific customer segments, designing products that meet their unique needs, and building world-class brands within those customer segments.

This customer focus helps them win … a lot, as Ron Shevlin pointed out in a recent Forbes article:

Digital banks and fintechs captured nearly half (47%) of all new checking accounts opened so far in 2023.

Since 2020, digital bank’s and fintech’s share of new accounts grew from 36% to 47%. Over the same period, the megabanks’ share dropped from 24% to 17% while regional banks’ share declined from 27% to 21%. Community banks’ and credit unions’ share has remained [small but] stable.

Indeed, it helps them win so much that they often end up outgrowing the balance sheets of their partner banks, as HMBradley painfully discovered when its first partner bank, Hatch Bank, told it that it had to stop adding new customers in 2021. HMBradley’s second partner bank, NYCB, was specifically selected for its large balance sheet:

HMBradley’s subsequent choice of sponsor bank in early 2022, New York Community Bank in Hicksville, New York, is unusual in the banking as a service space. Most financial institutions that provide underlying banking services for fintechs have less than $10 billion of assets, which means they are not subject to debit interchange fee caps under the Durbin amendment. In fact, Bruhnke said he spoke with 20 potential partners, but most had hard deposit caps because the Durbin exemption requires them to contain asset growth, and thus deposits have to be reined in, too, to maintain proper asset-to-liability ratios. NYCB, a division of Flagstar Bank, holds $90.1 billion of assets and, as a result, much more capacity for deposits.

But what if HMBradley hadn’t had to go through all of this rigamarole (which has also included buying a new core banking system to replace the one it lost when it left Hatch)?

What if, hypothetically, HMBradley had been working with a Banking-as-a-Service platform that was able to provide Balance Sheet Augmentation-as-a-Service?

What if they’d had BaaS + BSAaaS?

Here’s how it could work:

- The BaaS platform provides all of the same upfront bank partner selection and onboarding help that such platforms provide today. The fintech company integrates with the core banking system provided by the BaaS platform, selects a bank partner from the list provided by the BaaS platform, builds its initial product, and launches.

- If the fintech company achieves (or exceeds) the initial growth goals that it sets for itself, such that it starts to approach the outer boundary of what its partner bank’s balance sheet can accommodate, no problem! The BaaS platform’s BSAaaS network allows for the fintech company to make its loans and/or deposits available to any other bank in the BaaS platform’s network. This would allow these other banks to evaluate and bid on the available loans and deposits generated by the fintech company, in much the same way that traditional bank-to-bank marketplaces work today. The best bid(s) win and the resulting revenue is split between the fintech company, the BaaS platform, and the primary partner bank.

- And if the fintech company wants to switch primary partner banks (in order to get better contract terms or service) or add a secondary partner bank (in order to build products that the primary partner bank can’t or won’t support), the BSAaaS network would also allow them to do that easily and quickly, without having to switch core systems or make other substantial changes to their infrastructure or operations.

A BSAaaS network, built on top of an established BaaS platform, would create numerous benefits, including:

- A new revenue stream for BaaS platforms and a reduction in the incentives for fintech companies to graduate off the platform and for partner banks to compete directly with the platform.

- An incentive for the BaaS platforms and the partner banks to attract, onboard, and support only high-quality fintech companies that have substantial potential for growth.

- An incentive for the partner banks to help ramp up (rather than restrict) the growth of their most successful fintech companies.4

- An opportunity for banks, particularly larger banks, which may not be interested in or able to act as BaaS partner banks (i.e. renting out their charter), to still participate in the larger BaaS ecosystem as loan and/or deposit buyers.

- An extreme level of flexibility for the fintech company in selecting, moving, and adding partner banks and a greater ability to monetize the loans and deposits that they are generating.

And if this whole thing sounds a bit far-fetched, you should know that BaaS + BSAaaS is already kinda happening:

Treasury Prime … announced the launch of OneKey Banking.

As enterprises mature, their growth can often outpace their Banking as a Service (BaaS) solution. Treasury Prime OneKey Banking is the answer to that problem; it eliminates the need to change providers due to deposit growth or feature access. Flexible by design, OneKey Banking allows companies of any size and on any growth trajectory to seamlessly manage deposits, transfer funds, send instant payments, mitigate risk, scale, and access features via an easy-to-use interface, eliminating many common headaches seen across the BaaS landscape.

Not exactly what I’m envisioning for BSAaaS, but it’s a step in the right direction!

Endnotes:

- I’m generally resistant to any attempts to get me to change the idioms that I use, but this suggestion from PETA to say “feed two birds with one scone” rather than “kill two birds with one stone” is absolutely hilarious and, if you think about, much more practical. So I’m in!

- In its Q2 earnings call, Primis really emphasized the value of deposit placement networks, saying that, “the sweep [network] is important to us because … we can just grow almost infinitely and really not have any impact on our capital ratios, on our margins.” The basic idea is that the bank can keep its low-cost core deposits on its balance sheet to improve NIM while offloading any higher-cost deposits that it doesn’t need to fun its loans. Smart stuff.

- I originally made this argument when discussing the fallout from Silicon Valley Bank’s failure, which did not result from it doing a poor job serving its customers, but rather from it doing too good a job and not hedging the resulting risks well enough, “SVB’s problem, in [its] construction, was that it was a fintech company cosplaying as a bank.”

- Primis is very focused on setting up forward flow arrangements with other banks and investors in order to support Panacea in ramping up loan production, especially once interest rates start to go down and Primis has less incentive to hold loans on its books.