25 February 2023 | FinTech

The Bank Account Multiverse

By Alex Johnson

A bank account is basically three things:

- A safe place to keep your money.

- A convenient place to access your money.

- A command center for managing money and money-adjacent tasks.

Let’s go through each of those in a bit more detail.

First, a safe place to keep your money. I have argued many times in this newsletter that the most foundationally important job of a bank account is to ensure that the money I have in it today will be there tomorrow. You can offer the greatest benefits in the world (market-leading interest rates! White-glove customer service! chatbots!), but if there’s even a small chance that my money might not be there tomorrow, you’re not doing your job. We have a name for financial products where the balance may suddenly go to zero – investment accounts. And there is a very good reason why responsible companies ensure that they never market investment accounts like they’re bank accounts:

Three weeks after Celsius halted all withdrawals due to “extreme market conditions” — and a few days before the crypto lender ultimately filed for bankruptcy protection — the platform was still advertising in big bold text on its website annual returns of nearly 19%, which paid out weekly.

“Transfer your crypto to Celsius and you could be earning up to 18.63% APY in minutes,” the website read July 3.

Ralphael DiCicco, who disclosed holdings of roughly $15,557 in crypto assets on Celsius, said he was fooled by the marketing.

“I believed in all the commercials, social media and advertising that showed Celsius was a high yield, low risk savings account. We were ensured that our funds are safer at Celsius than in a bank,”

FDIC insurance matters.

Second, a convenient place to access your money. “Bank account” is a broad term. It can mean many different things. However, my definition of a bank account hinges on accessibility. Can a customer easily access their money (without a penalty) in ways that are convenient for their specific needs?

Checking accounts that come with debit cards, ATM access, and P2P payments functionality obviously qualify. Other deposit products that deliver more yield typically don’t because of restrictions on the ability of customers to withdraw their money. Certificates of Deposit (CDs) are a good example. If you want to pull money out of a CD early, your bank will charge you a penalty fee.

Savings accounts are an interesting gray area. Historically, Reg D has required banks to limit the number of “convenient withdrawals” – basically everything except ATMs and in-branch cash withdrawals – to 6 per month. However, this requirement was removed by the Fed in 2020 (out of concern for consumers’ financial health during the pandemic), and it hasn’t (yet) been reinstated. This means, technically, banks can offer savings accounts that are just as accessible as checking accounts (although most still limit withdrawals to 6 per month).

Another interesting example is the new Treasury Account launched by Public (emphasis mine):

To move money into your Treasury Account, link your bank account or make a deposit with your debit card. Then, you can put your money into T-bills with as little as $100.

As of 02/21/23, you can earn a 5.1% yield with T-bills. And because T-bills are a fixed-income asset, you lock in your rate of return at the time of purchase, providing you with a reliable yield.

A Treasury Account on Public offers many flexibilities of a bank account. You can access your cash at any time and manage your Treasury account in the same place as your stocks, crypto, and alternative assets.

It’s not quite as convenient as a checking account (once you cash out, you still need to transfer the money back to your checking account), but the money is accessible (without paying a penalty), and the asset you are investing in (T-Bills) is roughly as safe as an FDIC-insured deposit account.

And finally, a command center for managing money and money-adjacent tasks. This is the one that is the hardest to define because there isn’t really a clear example in the market of what it can look like at its best.

I think the best way of explaining what I mean by a “command center” is to take a minute and contemplate a future in which bank accounts disappear.

Do Embedded Bank Accounts Make Sense?

I love the concept of embedded finance.

Making financial products conveniently accessible within the specific contexts in which they’re needed makes all the sense in the world. Most financial products are enablers – they are a necessary ingredient in some larger project. You get a loan in order to acquire an asset that you want. You get insurance in order to protect your investment in that asset. Et cetera et certera.

One of the few exceptions to this, in my opinion, is the bank account.

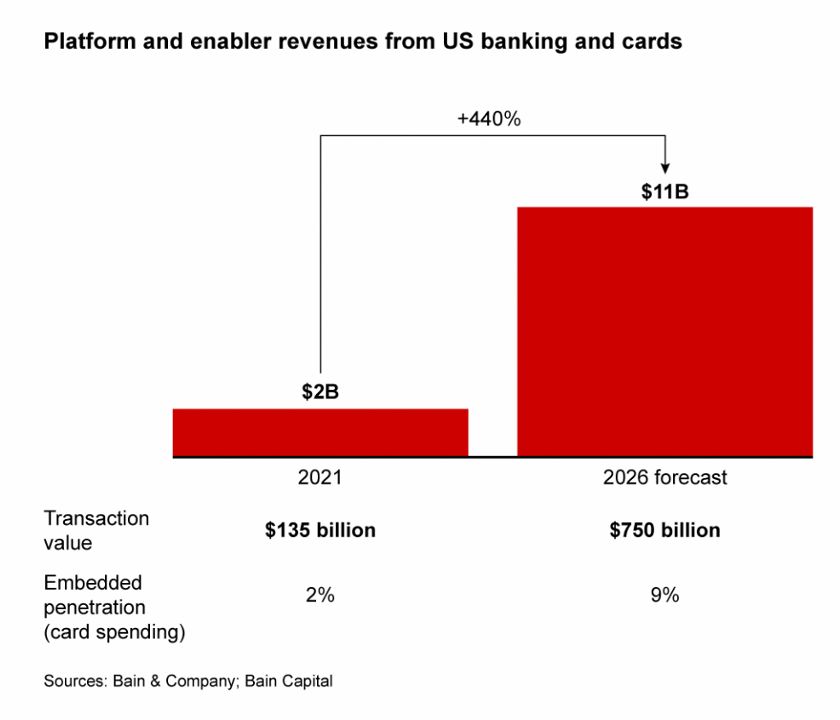

In a recent report, Bain Capital Ventures ventured a guess that embedded banking and cards would generate $11 billion in revenue by 2026, up from $2 billion in 2021.

I doubt it.

Bank accounts aren’t enablers of some other non-financial goal or activity. They aren’t utilities to be abstracted away until the end customer can’t even see them anymore. Customers want to see their bank accounts! They want to know how much money they have today. They want to know how much money they will have a week from today. They want to know if someone is stealing their money.

Put simply; bank accounts serve a purpose beyond the simple storage and movement of money – they convey information.

And this brings us back to the concept of a “command center.” Much like the bridge of the USS Enterprise, the function of a well-designed bank account should be to convey information and enable control.

The trouble with most bank accounts today is that they don’t do this especially well.

Through a Glass, Darkly.

Think about your bank account. Picture the online and/or mobile banking interface. What does it do? What information does it convey? What decisions does it help you make?

If your bank account is anything like the many that I have had in the last 15 years, it’s probably pretty basic. There is a current balance and a list of recent transactions. There are some tools for money movement (account-to-account transfers, P2P, maybe wires). There might be some light personal financial management (PFM) functionality. Maybe an option for a cash advance or short-term loan? if you’re lucky, there are automated savings capabilities.

And that’s probably about it.

Kinda disappointing, right?

I mean, these products do the first two core jobs of a bank account – a safe place to keep your money and a convenient place to access your money – well, but they’re not much of a “command center.” They’re not optimized to do anything specific. They’re more of a collection of features that have been glued together over the years as banks have slowly digitized their products.

And the disappointing thing is that most neobanks aren’t really that different. Sure, they look better on the surface. More polished. And they have a few extra bells and whistles. But they are still fundamentally designed to answer the same questions and enable the same set of decisions that traditional banks’ bank accounts are designed for.

It’s all so … meh.

I feel like we can do better.

And indeed, if you belong to the school of cosmology that suggests that there is an infinite number of parallel universes, then you could argue that these better versions of a bank do indeed exist … just not in our universe.

Well, dear reader, I do belong to that school of cosmology. I believe that the multiverse is real. And I believe that if we could get a glimpse into some of these parallel universes, Walter Bishop-style, then we would see bank accounts built with intention, designed to provide “command centers” for specific segments of consumers to solve specific problems.

So, for the remainder of this essay, let’s imagine that we can glimpse these parallel universes and the bank accounts contained within.

Let’s gaze into the bank account multiverse.

The Bank Account Multiverse

The Digital Commerce Bank Account

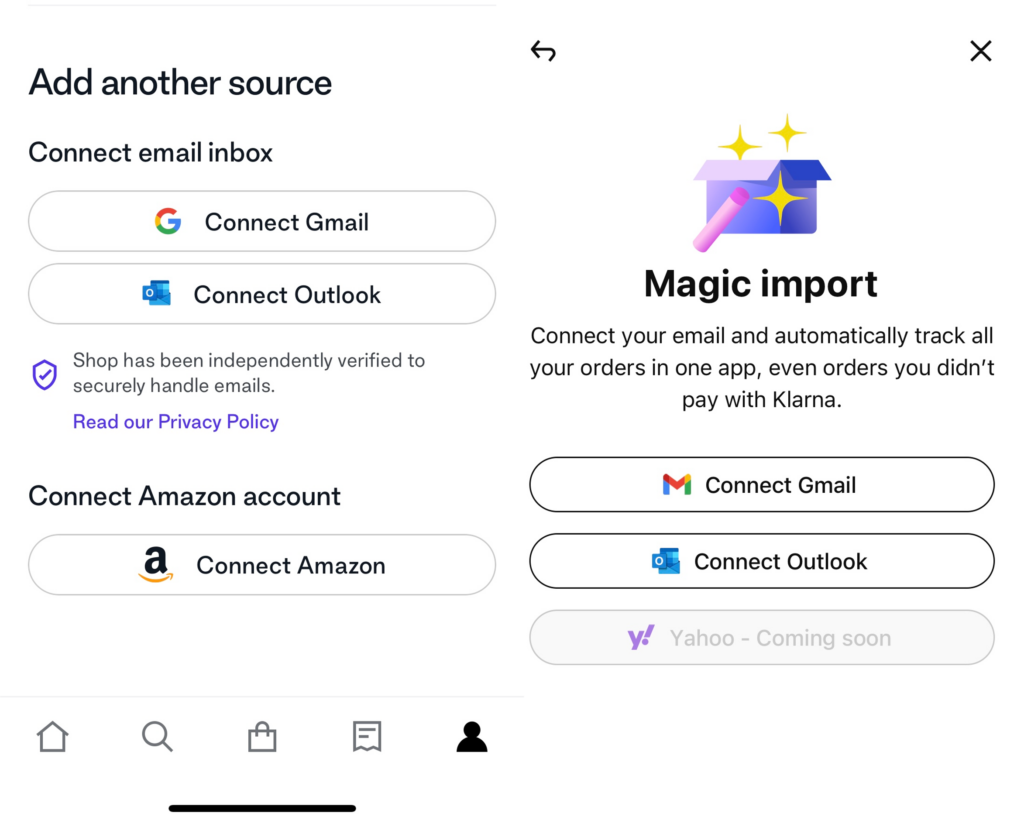

I recently asked on Twitter, “Why can’t I give my credit card issuer permissioned access to my email inbox so that it can automatically link my e-commerce purchases, keep track of delivery dates, and facilitate chargebacks if my order isn’t fulfilled?”

The idea underlying this question is that a large percentage of the financial transactions I engage in flow through my email inbox. It is, functionally, my command center for managing all of my e-commerce purchases, tracking shipments, and identifying and dealing with problems associated with those purchases. The issue is that email inboxes aren’t well-designed to manage those processes.

Imagine a bank account that pulled in data from customers’ email accounts (and all of their other digital communication services like WhatsApp) in order to provide them with a unified view of their digital commerce activity and tools for managing it. The account would automatically populate with personalized merchant offers and discounts based on their shopping history.

How realistic is this in our universe?

Very, it turns out!

Folks on Twitter pointed me to Klarna and the Shop app from Shopify, both of which allow customers to connect their email accounts in order to provide a unified interface for managing purchases and tracking shipments:

Both apps also, obviously, facilitate direct, in-app shopping and the presentation of merchant offers. Klarna, as a consumer lender, also provides financing. They’re not fully-fledged bank accounts, but there’s no reason they couldn’t eventually evolve into that.

The Financial Therapy Bank Account

Rather than a lame set of budgeting and other PFM capabilities bolted onto the side of a bank account, imagine a bank account built around a service (powered by generative AI?) designed to help customers understand their relationship to money and build, slowly over time, healthier financial habits.

The focus of this command center would be on helping customers reflect on their past financial behaviors in order to figure out critical, under-examined questions like – did that purchase bring me happiness? It would be completely subjective, personalized to each individual customer, based on the continuous feedback they supply, like the financial services equivalent of biofeedback.

How realistic is this in our universe?

I think we have a ways to go.

As I wrote about a while ago, PFM, as a product category, continues to be a bit of a question mark. There are plenty of interesting early-stage companies building in the space, but none of them have fully cracked the problem of helping consumers develop healthier relationships with money. And certainly none of them (yet) function as a standalone bank account.

Perhaps someday.

The Bill Pay Bank Account

Imagine a bank account built entirely around customers’ bills. It would make it simple to link all of their accounts together, identify recurring bills (including tricky ones that don’t look like bills, like regular P2P payments to the same recipient), and perfectly understand their cash flow. The account would provide customers with the option of generating biller-specific virtual cards (including auto-expiring cards for free trials), and it would facilitate the automated cancelation of unwanted services/subscriptions as well as bill negotiation. In the event of cash flow shortages, the account would help customers map out options for prioritizing bills to pay (based on their specific terms and penalties), and it would offer an overdraft-like lending service, which would enable customers to cover bills that they want to continue paying but can’t afford.

How realistic is this in our universe?

It’s honestly weird that we don’t already have this. Bill pay is so central to the month-to-month financial management and planning that most consumers do today, and yet, most bank account products are fairly ambivalent regarding this essential task.

What I really want is a combination of Prism (bill aggregation and payment), Rocket Money (subscription cancelation and bill negotiation), and Apple (deeply integrated subscription management) … along with a few other things that I know some early-stage fintech companies are already working on.

The Home Management Bank Account

Imagine a bank account that was built around customers’ mortgage payments and other household expenses. When they log into this account, customers see a comprehensive financial view of their most important financial asset – their home. Everything is in there. The mortgage. The taxes and insurance. Utilities (with an integrated bill negotiation service). Linked smart home sensors, appliances, and devices. A portal for managing contractors and other recurring service providers. And integrated, pre-approved options for tapping into the home’s equity.

How realistic is this in our universe?

Well, I’ve spent the last few years wishing it into existence, and I feel like we’re getting closer!

The Yield Optimization Bank Account

Imagine a bank account that was designed around the philosophy that every cent kept in a checking account that a customer doesn’t need to pay a bill in the immediate future is a wasted fucking opportunity. This account would be intensely and relentlessly focused on finding the best yield at all times. It would maintain a precise understanding of the customer’s cash flow needs, and it would have the ability to automatically move money between different deposit and investment accounts (using whatever payment rails were required to get the money where it needed to go when it needed to be there) in order to generate the best return (aligned with the customer’s risk tolerance and timeframe) without jeopardizing the customers’ short-term financial needs. It would even have the ability to open new accounts on behalf of the customer (with their permission) in order to quickly seize opportunities for yield that the customer might otherwise miss.

How realistic is this in our universe?

Not very.

The automation here is tricky (Digit recently got busted for accidentally overdrafting users’ accounts in a much simpler version of this proposition), and banks and neobanks have very little incentive to help customers maximize the amount of money outside of their core bank account, even though that might be better for the customers.

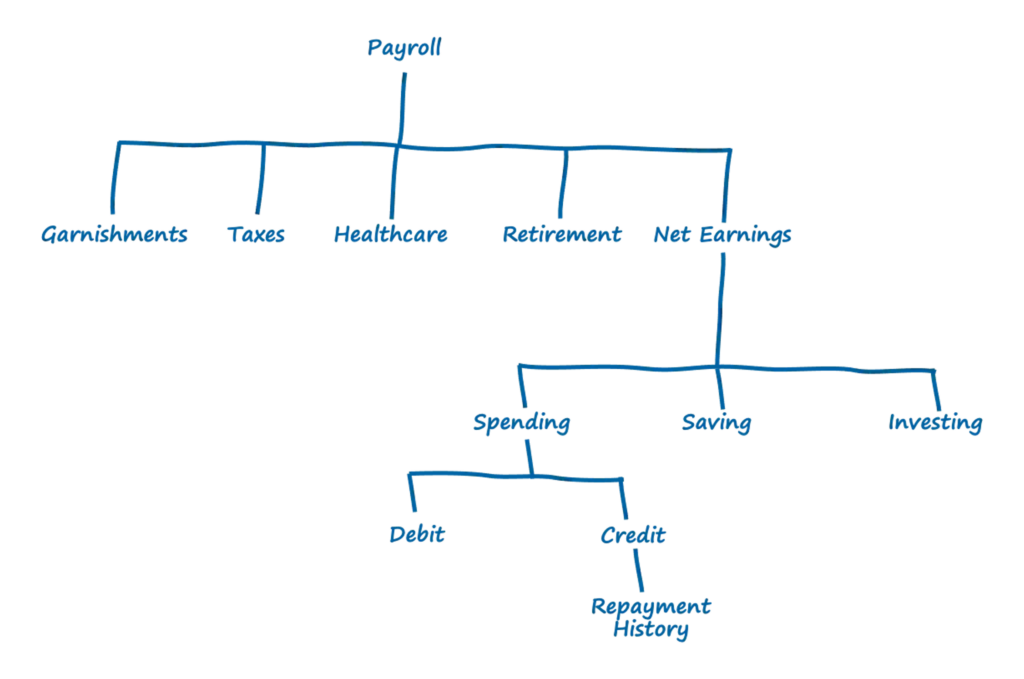

The Payroll Bank Account

Imagine a bank account that pushed more of a customer’s financial allocation decisions – how much to save, how much to invest, etc. – out of the bank account itself. This account would have two different modes. The regular player mode would function like a normal checking account, with the customer paying bills and buying stuff on a daily basis. Then it would have a god mode, which would only be available to the customer once every two weeks. God mode would be powered by a direct integration with the customer’s payroll account, and it would give them special access to allocate how much of their money goes directly from their paycheck into their bank account versus into their passive savings account(s), investment account(s), and tax-advantaged retirement and health accounts.

The intent of this design would be to separate the temptations associated with managing day-to-day payments from the more strategic financial allocation decisions that are made (but rarely revisited!) at the payroll level.

How realistic is this in our universe?

It’s very doable! We have built programmatic, consumer-permissioned access to payroll data. We just need someone to build the experience layers on top.

The Tax Optimization Bank Account

Imagine a bank account designed to give customers insight into the tax implications of every financial decision they make, before they make it, and to give them advice on how to make those decisions in order to optimize their overall financial health. This account would aggregate all the data required to file a tax return, streamline the tax filing process, and consistently surface actionable recommendations for customers to manage their tax liability and expenses throughout the year.

How realistic is this in our universe?

Very realistic!

Tax planning and filing are slowly becoming table-stakes features among neobanks. As the underlying infrastructure matures, I expect to see at least a couple of bank account products built with this functionality as a defining centerpiece.

The Freelancer Bank Account

Imagine a bank account that dramatically simplifies the experience of a customer managing multiple jobs and income streams while still aiding them in achieving long-term financial goals. This account would make it easy for a customer to link together all of the platforms and other services that they use to do freelance work, as well providing a command center for bookkeeping and accounting done outside of those platforms. The account would assist the customer in setting money aside for taxes (and filing tax returns), acquiring and managing benefits, and saving for retirement.

How realistic is this in our universe?

Fintech for freelancers and gig workers has been a popular area for the last couple of years, so I’m guessing we’ll see this one sooner rather than later.

Personally, I’d love to see a bank account wrapped with a combination of Catch (payroll, benefits, retirement) and Collective (bookkeeping, accounting, compliance) functionality.

The Credit On-ramp Bank Account

Imagine a bank account that was designed to help credit-invisible customers establish and improve their credit scores and, eventually, access affordable lending products whenever they need them. This account would be able to facilitate the import of credit history data from other countries (if the customer was a recent immigrant with an established credit history). It would come bundled with a low-limit credit card, underwritten with cash flow data, to assist the customer in establishing good repayment behaviors and reporting those repayments to the credit bureaus. It would enable the customer to monitor their credit score as it improved and get streamlined, pre-approved access to credit products from objectively well-rated third-party providers.

How realistic is this in our universe?

Credit Karma Money is probably the closest right now. The core Credit Karma service provides credit score monitoring and third-party product recommendations, and the Money product provides most of the standard bank account product features you’d expect.

That said, there are significant gaps between Credit Karma Money and this ideal Credit On-ramp Bank Account, and I don’t see anyone else in the ecosystem as far down this path as Credit Karma.

So, we may be waiting a while

The Relationship Management Bank Account

Imagine a bank account … or, more accurately, a set of different bank accounts designed to help improve the relationships between customers and the most important people in their lives.

One account would be built to help couples have more productive conversations about shared expenses and future financial goals. A different account would be designed to facilitate parents’ passing down financial values and philosophies to their children. Yet another account would be structured to empower adult children to protect their elderly parents from scams and fraud while enabling the parents to maintain the maximum feasible financial autonomy.

How realistic is this in our universe?

Multiplayer fintech is a well-established idea in this universe, and there are many B2C fintech companies that are building in this space. Banking for couples (e.g. Zeta) is a popular area. Banking for children and their elderly parents? Less so, but I’m optimistic that it (and other, less common use cases) will start to pick up more steam.