What’s the difference between a wallet and a passbook?

We all know what a wallet is – a place to store currency and other credentials (payment cards, IDs, tickets, etc.) that help you facilitate transactions.

Passbooks aren’t as well known these days, but before the advent of direct banking in the 1990s, passbooks were one of the main ways that bank customers kept track of their money.

About the size of a passport, a passbook was a small paper book used to record bank transactions for a deposit account. When a customer would come into the branch to deposit or withdraw money, they would hand their passbook to the teller (the passbook also served as identification for the customer, as long as they were coming into their regular branch), and the teller would write the date, amount of the transaction and the updated balance and enter his or her initials by hand.

Dating back to the 18th century, passbooks were one of the first methods used by customers to keep direct track of their transactions rather than relying solely on their banks’ internal ledgers.

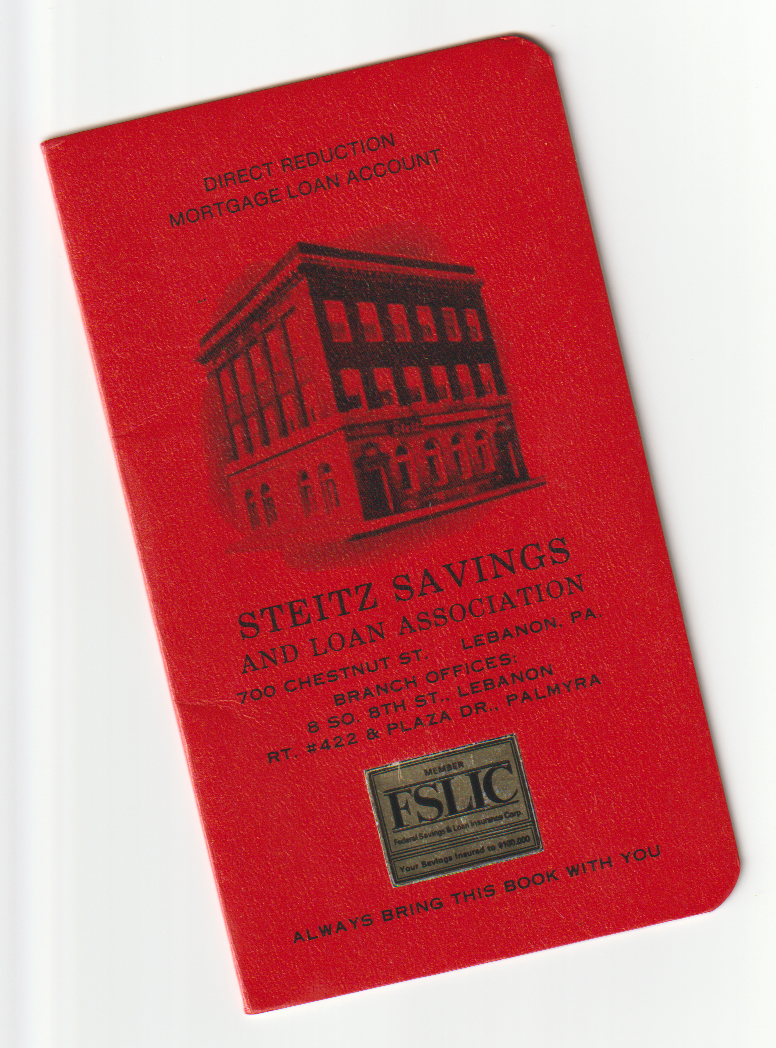

Passbook, issued by Steitz Savings and Loan Association in 1987.

So, to sum up, what’s the difference between a wallet and a passbook?

Wallets facilitate transactions. Passbooks convey information.

The reason I ask this question is because, back in 2012, I’m not sure Apple knew the answer. That’s when the iPhone maker introduced Apple Passbook, an app for iOS 6:

Apple just announced a new iOS app on-stage at WWDC called Passbook that aims to store all of your “passes” — a category that includes boarding passes, store cards, and movie tickets. This could be a boon for consumers, but bad news for Square and other startups.

The idea is to create one app that replaces a lot of the clutter in your wallet (or, if you’re an early-adopter, unifies an experience that was spread across multiple mobile apps). So you can open up Passbook whenever you need to board a flight, get into a movie, or get a discount at the store — it looks like the passes are mostly, but not exclusively, redeemed using QR codes.

The irony! The app was called Passbook, but it was, in every way, meant to be a wallet – a place to store credentials for facilitating transactions.

This became even more obvious when Apple introduced Apple Pay in 2014 (as part of iOS 8), allowing customers to load digital versions of their debit and credit cards into their iPhones. And in 2015, when Apple added even more functionality to Apple Pay and rebranded the Passbook app:

Apple Pay isn’t just for credit cards. Today at WWDC, the company has announced it will integrate rewards programs and store-issued credit cards into Apple Pay, and that Passbook will be renamed Wallet.

So then we had Apple Wallet.

And for a while, it made sense. It was literally a replacement for the leather wallet that you were accustomed to carrying around. It stored digital versions of your existing payment cards, tickets, and passes and enabled the use of those credentials in the real world.

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

Then two things happened:

- Apple fully integrated Apple Pay into its operating systems. With iOS 9, Apple enabled customers to access Apple Pay directly from the iPhone’s lock screen by double-clicking the home button rather than unlocking the device and opening the wallet app. And in iOS 10, Apple extended Apple Pay into desktop and mobile e-commerce transactions.

- Apple started offering its own financial products. Apple Cash (checking account, digital debit card, P2P payments) in 2017. Apple Card (credit card) in 2019. And Apple Pay Later (BNPL) and Apple Savings (high-yield savings account) in 2023.

Now Apple is doing a lot more than simply replacing your physical wallet.

With Apple Pay’s deeper integration into iOS and MacOS, Apple has rendered the role of the wallet in facilitating transactions mostly obsolete. You still need to open the Wallet app to add in a new payment card or pass, but after that? The execution of transactions has become embedded within the context of the customers’ specific activities.

And with Apple now competing directly with banks and fintech companies to provide financial accounts and payment products to customers, Apple has stopped playing the role of the unbiased host. It now can (and does) push customers to its own financial products over those of its bank and fintech competitors.

And this has left Apple Wallet in an awkward spot.

I’m a huge fan of Apple, personally. Their hardware is head and shoulders above everyone else, and the tight integration of their hardware, software, and services makes for a delightful experience, day to day.

It’s an ecosystem that I am, for the most part, happy to be trapped in.

And I like their financial products! They’re not perfect, but I think the Apple Card is one of the most customer-friendly credit cards that you can find on the market. The P2P payments functionality works well. And the savings account offers a generous interest rate.

And yet, all that said, the experience of using these financial products kinda sucks.

I think Apple Wallet is to blame.

Here is a small sampling of some of the befuddling things that I, as a customer, have noticed in Apple Wallet:

- In order to see my Apple Cash balance, I first have to scroll past a bunch of Walt Disney World Resort passes in Apple Wallet, even though those passes expired more than a year ago.

- There is no way to see an aggregated list of all my transactions across all of the cards in Apple Wallet, even though each card’s transactions are accessible, individually, within the app.

- The virtual Apple Card in Apple Wallet has a weird color gradient, which, I think, corresponds to the categories of spend that my transactions fall into, but it’s not at all clear within the user interface.

- In order to use Apple Pay Later while buying something with Apple Pay, I first need to go into Apple Wallet and apply and get approved for a specific Apple Pay credit line. No other pay-in-4 BNPL product works this way.

- The Apple Savings Account is only available to Apple Card customers, and figuring out how to apply for and manage that product, within the Apple Card user interface inside Apple Wallet, is way way more difficult than it has any right to be.

I could keep going, but you get the point – Apple Wallet has, perhaps unintentionally, become the home for every banking and banking-adjacent dream that Apple has had for the last decade. It opens accounts. It stores payment and identity credentials. It facilitates transactions. It conveys information, in a mostly unclear fashion, about the accounts linked to it.

It’s a mess.

Indeed, it has gotten so bad that random anonymous Apple insiders are leaking mocked-up design changes for Apple Wallet to MacRumors in advance of upcoming WWDCs:

The Wallet and Health apps are rumored to be getting updates in iOS 17, and leaker @analyst941 today shared some mockups that allegedly represent the design changes that we can expect to see.

In the Wallet app mockup, there’s a navigation bar at the bottom that separates the different functions available in the app. Cards, Cash, Keys, IDs, and Orders are listed categories. … There’s also a “Passes & More” tab, and the leaker claims there are other features coming as well.

Users will reportedly be able to swipe down to access a search interface to find a specific card or pass, and there’s a “Transactions” button. Compared to the current Wallet app design, this would be a functional improvement because it would make finding certain features like specific passes and order details simpler. It would not be a surprise to see a design like this given the many functions the Wallet app now serves in addition to storing credit and debit cards.

And Apple keeps ignoring them:

A major redesign for the Wallet app that was rumored ahead of WWDC never materialized, with only modest changes made in iOS 17.

Apple Pay order tracking is getting several enhancements, including Apple Maps support, receipts for transactions, the ability to add an order to the Wallet app from an email attachment, and a new “Track with Apple Wallet” button for apps and websites.

iPhone users will be able to present a driver’s license or ID stored in the Wallet app at participating businesses and venues starting later this year. Users will simply hold their iPhone or Apple Watch near the business’s iPhone to verify their age and identity for things like alcohol, rental cars, and more.

But if anyone at Apple is reading this, please consider my request – stop overtaxing Apple Wallet. Let it focus on credential management and build a dedicated app for conveying information about your customers’ Apple and non-Apple financial accounts. I even have an idea for what you can call this new app – Passbook.