02 June 2023 | FinTech

Birkin or House?

By Alex Johnson

I’m going to start by sharing the first three paragraphs of an article from Vice – Young People Are Moving Back in With Their Parents… to Save For Birkins:

“When I tell Hinge dates I’m working towards a Birkin by 30, the reaction goes one of two ways,” says 21-year-old Ellie, who’s chosen not to reveal her surname for privacy reasons, like others in this piece. “It’s either immediate laughter or an impromptu lecture – especially if it comes up that I still live with my parents.” She often wonders what these dates would say if they knew saving for a Birkin was the very reason she moved back home in the first place.

In the UK, 28 percent of people aged 20-34 live with their parents, according to the Office for National Statistics, and recent U.S. Census data shows that nearly half of 18 to 29-year-olds are still living at home – the highest it’s been since 1940. But instead of bunking in with mum and dad to save for traditional milestones like a house deposit or a splashy wedding, Ellie represents a growing wave of Gen Z and young millennials that are flipping the financial script. Some youngsters are setting their sights on more attainable, short-term (some could say short-sighted) luxury goals that would surely horrify fiscally-minded oldies and maybe just about anyone on the property ladder.

“Before I hit Birkin status, I have a few other short-term savings goals that I’ve set for myself as a sort of training schedule,” says the biomedical science graduate, listing an almost £8,000 Cartier watch and £4,000 vintage Chanel bag as her top priorities. “If I can do those, it’ll make the £13,200 Birkin goal seem more achievable.”

If you’re anything like me, you might be a bit dumbfounded by those paragraphs, so next, I am going to answer a few quick questions:

What is a Birkin?

It’s a leather handbag made by Hermès.

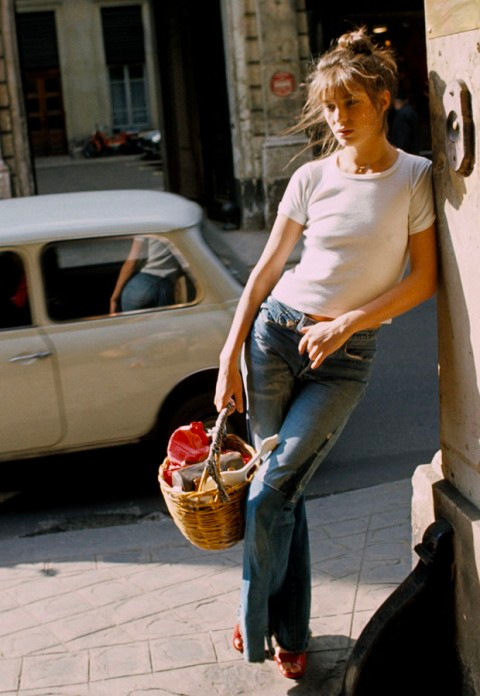

It’s named after English-French actress and singer Jane Birkin, who, on a flight from Paris to London in 1984, complained bitterly to the person sitting next to her that there wasn’t a stylish and practical leather weekend bag. The person sitting next to her just so happened to be Jean-Louis Dumas, the Executive Chairman of Hermès. They spent the flight sketching out ideas for a new bag, and one year later, the first Birkin bag was made for Jane Birkin.

Today, Birkin bags are considered the most exclusive handbags in the world. They are hand-sewn, buffed, painted, and polished by a single artisan (who has to spend at least five years apprenticing before being allowed to make a bag). The whole process takes 18 hours from start to finish.

Given the level of craftsmanship that goes into Birkins and the insane demand for them, they’re really expensive, anywhere from $12,000 to $300,000 typically (the most expensive Birkin ever sold was $2.94 million).

They’re also really hard to buy. After the waitlist system that Hermès was using became unwieldy (the waitlist got to six years!), it switched to a secret allocation system. Hermès manufactures a limited number of new bags each year and allocates a certain number to each store. The sales associates working in the stores have complete discretion to determine who to sell the bags to, which means if you want to get a Birkin, you need to get invited to buy one. This invitation process is shrouded in secrecy, but generally, you can help your chances by being famous, purchasing a lot of Hermès products, or being friends with a Hermès sales associate.

Ohh, and if you get an invitation to buy a Birkin, you say yes. You don’t get any say over the size, color, or price. You take what they offer you and say thank you.

Is there any quantitative evidence to suggest that young consumers are forgoing homeownership in order to buy luxury goods?

I’m cognizant of the possibility that this “trend” might just be three people that the author of that Vice article found on TikTok rather than some large-scale generational phenomenon.

(Personally, I would still argue that three people making this prioritization decision constitutes a trend worth being concerned about, but I digress.)

I couldn’t find any good qualitative data on this specific trade-off (luxury goods instead of a house), but there is a lot of evidence that Gen Z is unusually obsessed with luxury goods.

According to an analysis done by Bain, the global luxury goods market is predicted to continue seeing strong growth despite a looming recession due, in part, to “a more precocious attitude towards luxury, with Gen Z consumers starting to buy luxury items some 3 to 5 years earlier than Millennials.”

According to Klarna, young consumers are not only buying luxury goods earlier than they used to, but they are also buying more of them than their older counterparts:

In the past 12 months, Gen Z (60%) and millennial (63%) luxury purchases have outpaced spending by Gen X (46%) and baby boomer (18%) shoppers

And it’s not just handbags, scarves, and watches. It’s bigger items too. In a survey of Gen Z car buying behaviors, CDK Global found that Gen Z “were much more likely to buy luxury brands (39%) compared to Millennials (29%), Gen X (27%) and Baby Boomers (12%).”

What is driving these Gen Zers to prioritize the acquisition of luxury goods?

Two factors I want to highlight.

The first is social media.

One of the folks interviewed for the Vice article mentioned the impact that TikTok has had on shaping her desires for specific luxury items:

Sarah notes the surging luxurytok content – which has nearly 253 million views on TikTok videos from designer brand unboxing to extravagant first-class holidays – as one of the key drivers for her outlook.

“It’s so easy to end up with luxurytok videos on your For You page’” explains Sarah. “There’s always a new ‘it bag’ and I’ve made it my goal to start saving for a few designer pieces to take on my trips and pass down to future children.”

This anecdote is backed up by the stats. According to Klarna:

Thanks to social media, discovering and falling in love with luxury goods has never been more accessible, with 78% of Gen Z and 70% of millennials already following high-end brands on social channels.

The rise of social media influencers has also brought premium items into view among younger generations, with 1-in-2 Gen Zers looking to influencers to identify the latest trends in luxury.

Social media is also more than just a discovery channel. Of Gen Z and millennial consumers following luxury brands on social media, 84% and 81%, respectively, have purchased a product after seeing it on social media.

The second factor I want to highlight is the existential dread that many Gen Zers feel when thinking about how they can hit the same life milestones as their parents. Here’s the Vice article again:

The recent graduate feels that sometimes “there’s a smugness and this idea that our parents practically lived on wartime rations”. Ellie recognizes her method could be perceived as frivolous by people like her parents, but is adamant that the generations are practically incomparable. “They saved for a few years on wages for their house, it wasn’t grit, second jobs and decades of missing out,” she says. “It was the luck of the generational draw.”

Once again, the stats validate this feeling. Adjusting for inflation, the costs of housing have far outpaced wage growth:

Even after accounting for inflation, housing prices have increased 118% since 1965, while incomes have only increased 15%. In the last decade alone, the median home price increased by about 30%, despite incomes only improving by 11%.

So, to sum up:

- Birkins are stupidly expensive handbags.

- Younger consumers, Gen Z in particular, are much more likely to buy luxury goods (including Birkins) than older consumers.

- It is logical to assume that Gen Z is paying for the purchase of all of these luxury goods by prioritizing them over other possible expenses.

- One category of expense that Gen Z may be deprioritizing is homeownership, which is, relatively speaking, more expensive for them than it was for earlier generations.

Now please allow me a moment to editorialize.

This isn’t great.

Obviously people should be free to spend their money however they want and I don’t want to come across as old-millennial-yells-at-cloud guy here, but I don’t think it’s unreasonable to be troubled by this trend.

I also think it’s something that banks and fintech companies should spend some time thinking about given that a lot of the revenue that we generate in financial services is built around helping consumers achieve traditional life milestones like a college education, homeownership, and a well-funded retirement.

Specifically, there are two observations that I want to emphasize for banks and fintech companies:

1.) Influencers shape customers’ values and priorities.

I understand that the increase in home prices has outpaced the increase in personal income and that has made it more difficult for young consumers to become homeowners. I get it.

But I still don’t buy the resulting logic – houses are crazy expensive so, whatever. I’m gonna save up for a Birkin and a bunch of other expensive luxury products that I found on TikTok instead.

That’s a hell of a leap and it’s built on top of some really bad reasoning. From the Vice article:

“Before I hit Birkin status, I have a few other short-term savings goals that I’ve set for myself as a sort of training schedule,” says the biomedical science graduate, listing an almost £8,000 Cartier watch and £4,000 vintage Chanel bag as her top priorities. “If I can do those, it’ll make the £13,200 Birkin goal seem more achievable.”

This is weird! It’s not like these consumers are looking at the situation and saying, “well I’ll never be able to afford a home so I might as well just blow all the money in my checking account and take out a bunch of BNPL loans.” That would be depressing, but logical.

Instead, these consumers are exercising an admirable level of financial discipline – a training schedule for savings! – but in pursuit of expensive accessories rather than a down payment for a house.

Something else is at work here. And it ties back to the first part of that quote – before I hit Birkin status.

Recall that Klarna stat that I shared earlier – 50% of Gen Zers look to influencers to help them identify the latest trends in luxury. That’s why, in 2020, Prada tapped Charli D’Amelio (one of the biggest influencers on Tiktok) to sit front row at its Milan fashion show to promote its collection. Prada’s reasoning for making this investment was probably pretty straightforward:

Lots of young people like Charli and want to be like her → Most of the attributes of Charli’s life, like her mansion in the Hollywood Hills, are completely inaccessible to most of her fans → But Prada clothing and accessories, while expensive, can be accessible and we want Charli’s fans to identify with them and want to buy them.

The reason this matters for those working in financial services is that fintech companies (and increasingly banks) are promoting their brands and their products through partnerships with influencers, including Charli D’Amelio, who is (we are constantly reminded) an investor in the teen neobank Step. These partnerships make sense from a customer acquisition perspective, but I think it’s worth considering the broader impact that these influencers may be having on the values and priorities of customers.

2.) We need to keep building better on-ramps.

Generally speaking, the two keys to achieving a financial goal are accessibility and understanding.

Buying luxury products is mostly a problem of accessibility. Luxury brands want to sell their products to everyone (Birkins, ironically, are a bit of an exception to this), but they are really expensive and it takes most people a lot of time to save up enough money to be able to buy them.

Accessibility is obviously a large and growing issue for homeownership as well, but this challenge is compounded by a problem that crops up all the time in financial services – understanding.

Consumers don’t know where to start when it comes to the homeownership journey.

Everything in the real estate market – brokers, real estate agents, lenders, etc. – is set up to help consumers once they are ready to buy a house. For consumers that aren’t ready yet, who may not know exactly where and when they want to buy or have enough money saved for a down payment or don’t have a credit score sufficient to qualify for an affordable mortgage, there aren’t a lot of solutions out there.

In other words, there aren’t a lot of good homeownership on-ramps.

This is an opportunity.

There’s a limit to what banks and fintech companies can do to help fix the accessibility problem in homeownership. That’s more of a problem for policymakers and YIMBY advocates. But banks and fintech companies can help with the understanding problem. They can build better on-ramps.

One good example is Gravy, a fintech company that helps renters become homeowners.

Gravy customers can start saving for a down payment, earn 5% cashback on rent payments (when redeemed towards the purchase of a home through a Gravy-partnered mortgage lender or real estate agent), track their mortgage-specific credit score, and get help creating a personalized plan for achieving their homeownership dream.

More of this please!