With the benefit of hindsight, it’s easy to see the truth in Jim Barksdale’s famous quote. Over a long enough time period, everything is indeed either bundling or unbundling.

I’m sure future historians of the media industry will be able to clearly explain the dynamics that drove the unbundling of cable and the rise of streaming. There will be a nice clean narrative that everyone can agree on, and that will seem, to those future historians, self-evident. Of course, it was always going to play out that way …

But I’ll tell you something — that’s not at all how it feels when you’re living in the middle of it.

When you’re in the middle of it, it feels like a fucking mess. There is no clarity. There are no answers you can look up in a textbook.

Was the fate of the cable bundle sealed the day Netflix launched its streaming service, or did the studios create a self-fulfilling prophecy by going all-in on chasing Netflix? Should Disney keep ESPN or sell it off? Are television and film writers wise to strike, or are they just making a bad problem for the whole industry worse?

We don’t know the answers to these questions! We won’t know them for a long time! History doesn’t feel like history when you’re living it. It feels like chaos.

Fintech has been feeling pretty chaotic to me over the last couple of years.

At a 30,000-foot level, we can tell a simple story about how a prolonged period of ZIRP led to a mass unbundling of financial services. And now that ZIRP is over, the rebundling of financial services has begun.

However, if we zoom in, that story becomes much less useful in helping us answer specific questions about what banks and fintech companies should do right now.

Should credit card issuers take BNPL seriously or ignore it (I weighed in on this question recently, but I might be totally wrong!) Will Chime be able to expand into lending without losing its shirt in the process? Does SoFi’s bundle work without student loan refinance? Will Robinhood’s frantic search for a post-meme stock identity result in a coherent product bundle?

We don’t know! It’s chaos!

The reason I bring all this up is that I have become fascinated by a related question, which is proving very difficult for me to answer — what will the dominant retail banking product bundle of the future look like, and which companies will be the primary providers of it?

Let me start by describing, in the abstract, what I think this bundle should look like, and then I’ll talk about a few companies that are building in that general neighborhood.

What Do I Want?

I would like a master money account. It has never really made sense to me why we need different accounts for spending, saving, and investing, so I’d like one account that seamlessly facilitates all three. I would like the savings portion of the account to offer competitive interest rates, including ones for time deposits (let’s make CDs sexy again!). I would like the investing portion of the account to offer both passive and active investment options, as well as tax-advantaged long-term investment options. I would like help automating the process of saving and investing because I know that I don’t have the time and self-discipline to manage those allocation decisions manually on a day-to-day basis. For spending, I would like a credit card, because it gives me the flexibility to extend my personal liquidity when needed and because I like rewards. And speaking of rewards, I would like to be tangibly rewarded for owning and responsibly using all of the different parts of this product bundle.

Who is Going to Give Me This?

As far as I can tell, this ideal retail banking product bundle doesn’t exist yet.

One of the closest examples I can find is HMBradley.

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

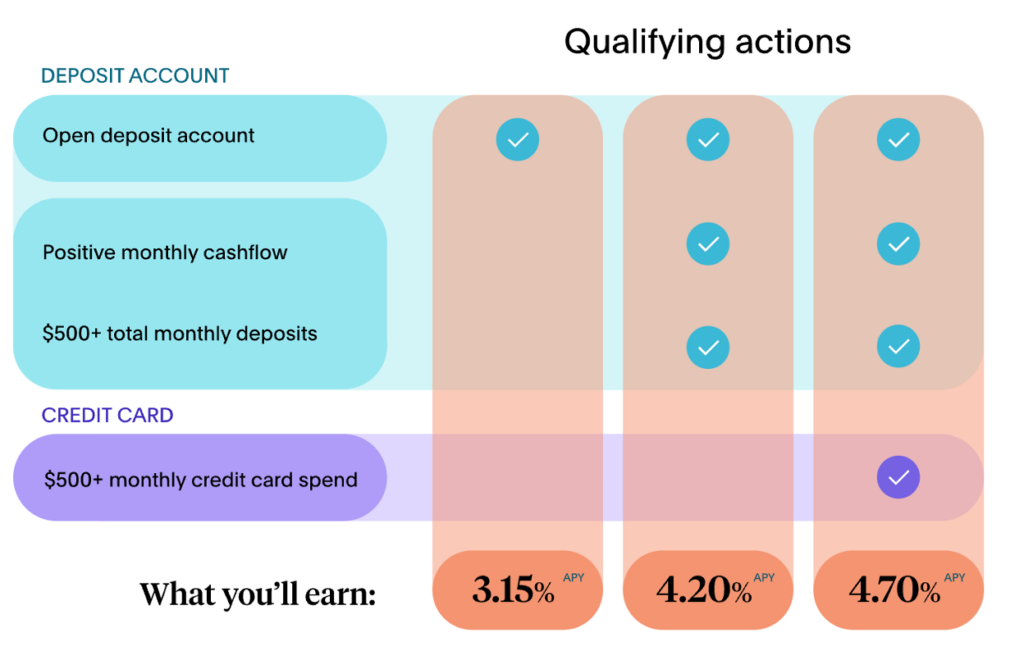

HMBradley offers a combined checking and savings account, which starts out at a 3.15% APY. If a customer deposits at least $500 per month in their account and maintains a positive monthly cash flow for that account, they earn 4.2%. And if they achieve those same metrics, but also have the HMBradley credit card — which provides a flat (and unlimited) rate of 1.5% cash back on all purchases — and they spend $500 or more on that card per month, they earn the highest possible interest rate — 4.7%.

HMBradley helps customers intelligently automate their allocation decisions using routines. Routines allow customers to designate specific triggers (e.g. whenever a new direct deposit is made to the account), which then kick off actions (e.g. transfer a certain % of a new deposit into a savings bucket) designed to help customers meet their long-term financial goals while managing their day-to-day financial needs.

HMBradley allows customers to design their own custom routines and to pick from a library of pre-built routines that codify good financial habits (like building up an emergency fund).

Now, obviously, HMBradley doesn’t check off every item on my bundle bucket list, like time deposits or investing. However, it comes decently close. And what’s interesting is that HMBradley took a pretty long and circuitous route to get where it is today.

HMBradley was founded in 2018. It launched the first iteration of its product in 2020, which consisted of the same combined checking and savings product and (a little while later) a companion credit card, but with a markedly more complex incentive structure.

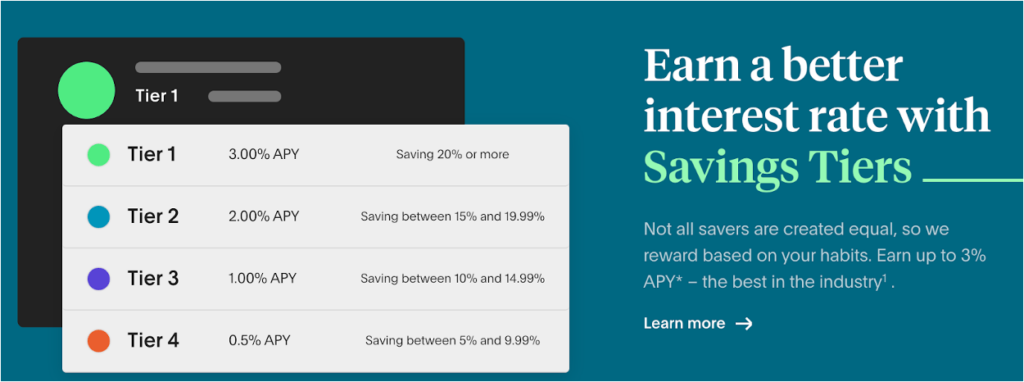

The deposit account utilized a four-tiered interest rate structure, in which a customer’s APY would be determined by a rolling calculation of the percentage of money from their direct deposits that they saved. So, for example, if a customer saved 22% of their direct deposits in Q1, they would earn 3% APY (remember, we were still ZIRPing at this time) in Q2. And if they only saved 6% of their direct deposits in Q2, they would drop down to 0.5% in Q3. And so on.

The credit card, which you had to have to unlock a special 3.5% interest rate tier, had a dynamic cash back structure, providing 3% cash back for purchases in a customer’s highest spending category in one billing cycle, 2% for their next highest category, and 1% for all additional charges.

And that was just the beginning of what HMBradley, which raised an $18M Series A round at the end of 2020, had planned. It was working on a raft of additional products, including (reportedly) a mortgage product.

However, before any of that could be launched, Hatch Bank (HMBradley’s partner bank), forced HMBradley to stop growing in order to prevent HMBradley’s deposit-heavy model from breaking the bank’s balance sheet. This led to a significant reduction in deposits (down from $565 million to about $200 million) and customers (down from 24,000 to roughly 10,000) by the end of 2022.

HMBradley was essentially forced to start over. It found a new partner bank (NYCB), with a balance sheet over $10 billion and an appetite to grow. It purchased its own core banking platform (from Thought Machine) so that it wouldn’t be dependent on its partner bank’s core system. And it relaunched its product back into the market earlier this year.

I think this was a lucky break for HMBradley.

I’m sure it didn’t feel that way at the time. Being told by your partner bank that you have to go into invite-only mode because you’ve been too successful had to have been galling. Finding a new partner bank, acquiring a core system, and rebuilding your products on top of that new core was, I’m sure, a ton of work. And HMBradley had to lay off members of its team during this time, which sucks.

However, it does seem (from my external vantage point) as though this forced pause in HMBradley’s operations may have produced a more focused and compelling product vision.

When you’re growing really fast and sprinting to keep up with your competitors, it’s easy to slip into the mode of “just keep shipping”.

You rush to figure out every additional feature and product you can add to your bundle, regardless of how it impacts the overall value proposition of that bundle (for you and your customers), and you never revisit the product decisions that you’ve already made.

HMBradley managed to avoid this. It didn’t launch a mortgage product in 2020 or 2021 (thank goodness). It made some very thoughtful changes to its core product, which dramatically simplified the experience for the end customer (the four-tier savings incentive structure was way too complex) without undermining its essential value.

And it might not have happened this way if Hatch hadn’t forcibly slowed it down!

Building bundles is messy and uncertain work, even in favorable conditions.

Under less-than-favorable conditions?

It’s even harder.

Building a New Plane While Flying the Old One

This is my single favorite quote from anyone in financial services so far this year:

This is Brendan Coughlin, Head of Consumer Banking at Citizens Bank, explaining during the company’s Q2 2023 earnings call, how the bank has captured a greater share of primary banking relationships (which, among other things, generate the sticky, low-cost deposits that everyone wants right now) by adopting some of the basic customer-centric best practices of neobanks.

It’s easy to make fun of this quote. It’s easy to make fun of Citizens Bank offering existing customers in its retail branch footprint savings accounts paying a paltry 0.07% APY while offering prospective customers outside its branch footprint 4.5% APY through its digital bank brand Citizens Access. It’s easy to make fun of Citizens Bank’s half-hearted attempt to placate consumers and regulators on overdraft fees through its ‘Peace of Mind’ and ‘Fee Relief’ programs when almost everyone else is just getting rid of overdraft fees altogether. It’s easy to make fun of Citizens Bank for offering five distinct checking account products, three savings account accounts, and three credit cards, when one or two products, total, would probably do the trick.

But let’s not do the easy thing.

Let’s remember that unbundling and rebundling are messy, especially when you are an incumbent with something to lose.

Citizens Bank is one of the 20 biggest banks in the U.S. It has $222 billion in assets, which means it has a lot to lose if it unbundles and rebundles itself badly.

I don’t like its approach to helping its customers avoid overdraft fees. Nor do I like how it keeps deposit betas down by shopping attractive rates to prospective depositors through its Access brand while keeping rates for existing customers as low as possible.

I don’t like this stuff, but I can understand it.

And if you look past these choices and its overcrowded lineup of products and its somewhat clunky and unintuitive digital interfaces, you will find evidence of a fairly compelling product rebundling strategy:

- Like HMBradley, Citizens Bank is in the process of replacing its core system. It’s obviously a bit more complicated for Citizens than it was for HMBradley, hence why it’s taking longer. But the process is underway. The bank built and launched Citizens Access on top of its new core system in just eight months, and it is planning to merge its legacy core into the new platform in 2025.

- Citizens Access, as a standalone offering, is a compelling option in the market, even compared to fintech and neobank providers. It offers a no-fees, no-frills savings account and CD, paying out 4.5% and 5% (for a 1-year term), respectively. There aren’t any investing capabilities yet, but a checking account is being added at the end of this year (although I suspect it will be a standalone product rather than an integrated capability, which I would personally prefer).

- Citizens Bank provides incentives to customers to own and use multiple Citizens Bank products through its CitizensPlus loyalty program. These incentives include waived account fees and boosted savings and credit card cash-back rates.

- Citizens also has a unique take on BNPL. Unlike most of its big-bank peers, Citizens doesn’t view BNPL as a consumer product. Instead, it (rightly) views it as a product for its commercial customers, a tool to help them sell more of their products. The resulting product, CitizensPay, has been a big success, landing marquee customers like Apple and Microsoft, and, more recently, Wisetack, which will be bringing CitizensPay down to its small business customers through its embedded home services financing platform.

None of this is extraordinarily innovative, and there’s no guarantee that Citizens will be able to eventually pull all of these disparate threads together. However, I do think it’s evidence that even in the middle of a storm of unbundling and rebundling, it is possible for incumbents to build a plane while flying one.

With the Benefit of Hindsight

I don’t have a tidy summary of key takeaways for you today.

In keeping with the theme of this essay, my conclusion is going to be a bit of a mess.

We are living fintech history, right now.

We will look back on this time, a decade or two from now, and tell those younger than us how we always knew it was going to turn out the way that it did. We will tell them that it was obvious who the winners and losers of the great unbundling/rebundling era of financial services would be.

And we will hope that they aren’t smart enough to ask us why we didn’t get filthy-rich betting on those winners if it was so obvious at the time.