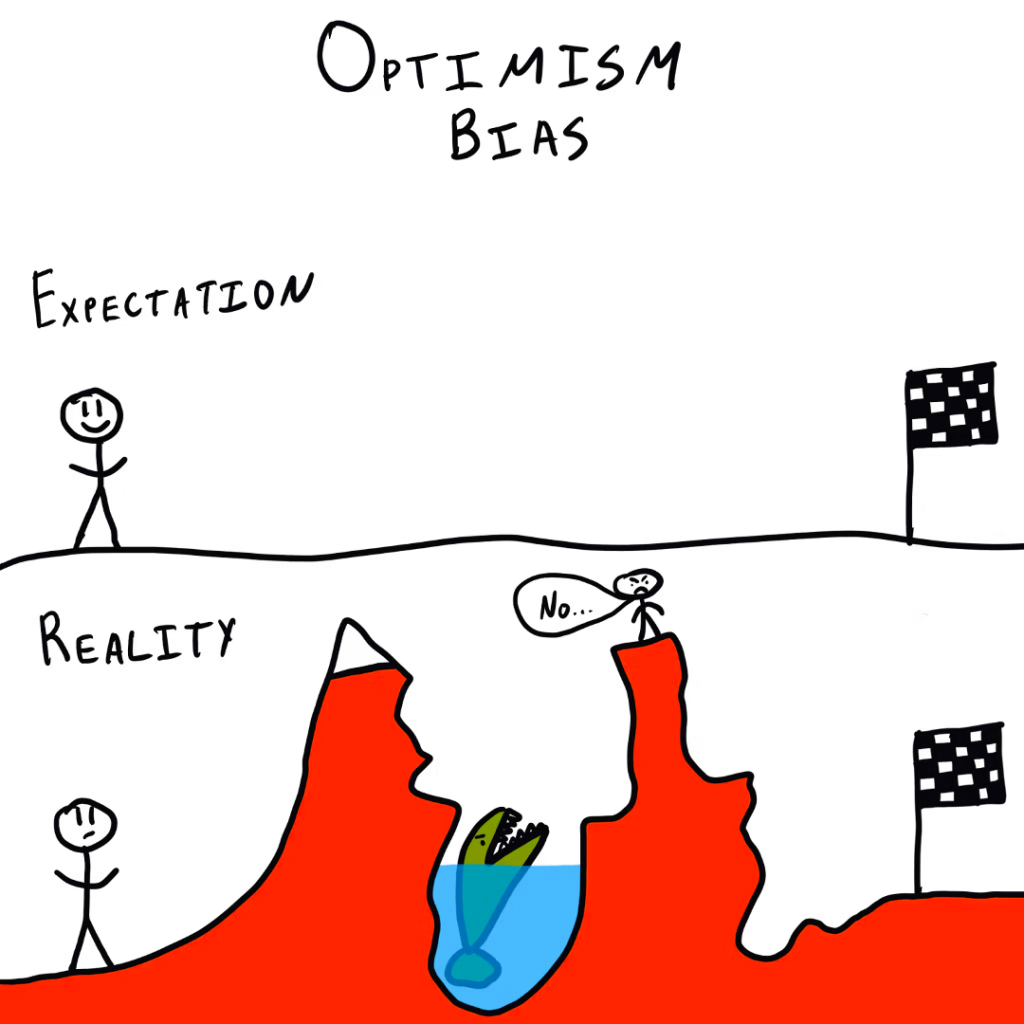

One of my favorite cognitive biases (yes, I have favorites, I’m a social studies teacher by training) is the optimism bias – the tendency for a person to believe that they are more likely than the average person to experience positive outcomes and less likely to experience negative ones.

The reason that it’s one of my favorites is because it has two rather unique characteristics that absolutely fascinate me:

- Negative trumps positive. The optimism bias is significantly stronger for negative events than for positive events. In other words, people are more likely to believe that they will avoid bad things than they are to believe they will experience good things. This drives a lot of risk-taking behaviors and makes humans less likely to prepare for worst-case scenarios.

- Impossible to eliminate. Despite extensive research by social psychologists and behavioral economists, no one has found an effective intervention for eliminating or reducing optimism bias. In fact, most efforts to reduce it tend to lead to even more optimistically biased results.

So, to sum up, in the face of overwhelming evidence that they are likely to fail, humans will (wrongly) believe that they can beat the odds, and any attempt to dissuade them from this will result in them becoming even more irreversibly convinced of their own infallibility.

If that’s not the perfect description of a startup founder, I’m not sure what is.

And the reason that this bias is on my mind is that after an extended period of optimism in fintech – low interest rates, bountiful infrastructure, the pandemic-fueled surge in deposits and digital engagement – we’ve now turned the page, and, as an industry, we need to wrestle with the resulting problems.

It was a really fun night, but now we have to deal with the hangover.

Luckily, I’m starting to see the emergence of a few different ‘fintech hangover cures’, which should make things a little bit easier.

Fraud

The most obvious example of excessive risk-taking in fintech over the last five years is fraud. Specifically, first-party fraud, in which a customer defrauds their financial services provider using their real identity.

I wrote about this in depth last year:

First-party fraud is flourishing inside many fintech companies’ portfolios, and it’s easy to explain why – fintech companies have tolerated obvious and excessive fraud, committed by their own customers, as the price for achieving rapid growth.

One of the biggest problems with fintech’s recent tolerance for first-party fraud is the message that it sends to consumers, particularly young consumers – cheating is OK. It’s acceptable to game the system. It’s OK to lie.

And, as I predicted at the time, dealing with this particular hangover has been incredibly painful.

Fintech companies, mindful of investors’ increased emphasis on strong unit economics rather than topline growth, have been working to tighten up their fraud mitigation processes.

And fintech infrastructure companies have been investing in new solutions to try to help, most notably fraud data consortiums.

In the last six months, three different fintech infrastructure companies – Unit21, Plaid, and Sardine – all launched (or deepened their investments in) fraud data consortiums. The purpose of these consortiums is to share intelligence across fintech companies (and banks!) in order to make it harder for folks looking to commit fraud to get away with it.

And while consortiums are certainly useful for identifying and preventing third-party fraud (where a bad guy steals a consumer’s identity) and synthetic identity fraud (where a bad guy creates a fictitious identity), they are especially useful for discouraging first-party fraud because they allow for a customer’s shitty behavior with one bank or fintech company to follow that customer to the next bank or fintech company that they try to scam.

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

BaaS

The hangovers aren’t limited to fintech companies.

Community banks that jumped into the banking-as-a-service (BaaS) gold rush over the last five years are also now dealing with a significant hangover, resulting from the combination of rapid growth (often fueled by BaaS middleware platforms), compliance failures, and increased regulatory scrutiny.

The answer, for some, is to pull back from BaaS (this is the “I’m never drinking ever again” response to a hangover). Blue Ridge Bankshares’ new CEO, Billy Beale, is working to wind down the bank’s fintech and BaaS partnerships in an attempt to get out from under a formal consent order with the OCC, which resulted from the bank’s BaaS compliance failures. He wants to get Blue Ridge back focused primarily on the normal business of being a community bank:

“There has been a lot of emphasis on building the fintech line of business. And then certainly, there has been a lot of emphasis and energy and money spent to try to resolve this written agreement,” Beale said. “The net result of that is what would be considered the core banking business has been not a priority. And so one of the things I’m trying to do [is] just to reenergize the core banking business, the more traditional community bank business and to try to grow core deposits.”

For banks that aren’t swearing off BaaS, the cure, as I wrote about a few months ago, is developing a robust methodology for onboarding and managing fintech partners and then scaling it up with technology:

Once a bank has developed a fintech compliance methodology that works and has mastered it at a slow speed and a low volume, it’s time to ramp things up.

Technology can help.

Remember, the central challenge in BaaS is building scalability without compromising risk, governance, and compliance. Humans are great at managing risk, but to scale them, you need technology.

However, BaaS banks that decide to stay in the fintech business and build a better approach to compliance will likely still have to deal with another, more specific issue.

Escheatment

Escheatment is the legal process of transferring unclaimed property to the state when the rightful owner cannot be found. Most types of financial accounts will be considered ‘inactive’ after 12 months of no customer-initiated activity. Then, depending on the state and account type, inactive accounts will be converted into ‘dormant’ accounts after 3-5 years. Once the accounts are considered dormant, the financial institution is required to attempt to reach out to the owners and notify them that their accounts are now dormant and their property will be turned over to the government. If the owners do not act, the property is transferred to the states.

Escheatment is a deeply annoying, eat-your-vegetables type activity for banks. The reporting deadlines for U.S. states are, for the most part, in the spring and the fall, so the process of dealing with inactive and dormant accounts tends to be a two-time-per-year fire drill, in which bank employees and/or external consultants comb through various systems to collect and analyze account data, send out customer notices, and file reports with the states.

Why is escheatment relevant to BaaS banks?

Well, according to Allen Osgood, co-founder and CEO of Eisen, community banks in the BaaS space are about to experience what he refers to as a ‘Mass Escheatment Event’:

3-5 years ago, think 2017 – 2020, we saw a slew of events that caused a massive surge of account openings including: COVID and the shift to digital banking, the GameStop short squeeze and digital retail investing, the rise and fall of crypto, and a rush of investment dollars fueling the rapid growth of B2C fintechs. Many people who opened accounts during those waves have abandoned those accounts ever since.

This has led to an increased number of dormant accounts and forecasts of unprecedented numbers of accounts FIs will have to escheat.

This is going to be a particularly thorny issue for the BaaS banks to deal with over the next 24 months because of the overly complex account structures and technology integrations that are commonly used in BaaS (how do you, as a community bank, determine which end customer accounts in an FBO account that isn’t managed by your core system are inactive, dormant, or needing to be escheated?)

Like other compliance problems in BaaSland, technology (like that provided by Eisen) can help. With the right system integrations and proactive monitoring (informed by the state-by-state rules governing unclaimed property), the escheatment headache can be made bearable.

But what about the fintech companies on the other side of this problem? Obviously, many of them will be dealing with this escheatment issue in collaboration with their partner banks (as I recently discovered with Current). But for some, the problem may go further.

With VC dollars drying up (especially for B2C fintech), what about the companies that don’t reach escape velocity?

Closure

It’s estimated that roughly 90% of startups fail. In the U.S., that translates to 700,000 to 1 million companies each year. The process of winding down a company is both emotionally devastating (Kristen Anderson and Amanda Peyton have both written very eloquently about this) and operationally intensive (it can cost upwards of $75,000 and take up to a year).

The good news is that we’re starting to develop solutions to make this – the most unfortunate yet common outcome for fintech startups – slightly less painful.

One example is SimpleClosure, a startup that helps other startups shut down:

The company says it leverages fintech, legal tech and artificial intelligence in order to automate the shutdown process in three stages: onboarding, dissolution & wind-up and actual shutdown.

First, SimpleClosure collects information to understand the challenges and intricacies specific to a company. It then initiates procedures and works on executing the specific dissolution and closure plan. That includes resolving any remaining obligations and tying up loose ends with customers, vendors, state agencies and employees. During that stage, the company prepares the necessary legal paperwork and works to secure required consents from stakeholders. Lastly, it handles the company’s intellectual property, settles any remaining financial obligations and handles fund distributions to investors. It also offers advice on post-closure activities, such as the retention and safe-keeping of vital company records.

And if you need any more evidence that fintech, unique among most industries, is in need of this type of hangover cure, here’s how SimpleClosure raised its pre-seed funding:

[SimpleClosure] raised $1.5 million in pre-seed funding — interestingly, in 24 hours and without a pitch deck.

“I was not looking to raise money originally, but after attending Fintech Meetup on a free ticket, I pitched the platform to a few investors there — saw the excitement — and had their buy-in the next day,” said [Dori] Yona [co-founder and CEO of SimpleClosure], who sold a startup called Earny in 2021 in a private transaction after raising $14 million in funding. “The fact that we were able to raise so quickly really underscored the market need for a solution like this.”

Vera Equity and Cambrian Ventures co-led the round, which included participation from a slew of executives from startups such as Brex, Plaid, Gusto and Nvidia, among others.

A Sign of Maturity

None of this is especially fun. However, I think the fintech industry’s increasing focus on fraud prevention, compliance, and even the quick and responsible dissolution of failed companies is an encouraging sign of maturation. It’s not going to stop fintech founders from being boundlessly (sometimes recklessly) optimistic (nor would we want it to!), but it should make tomorrow morning slightly more tolerable.