A majority of Americans are living paycheck to paycheck.

Across the thousands of B2C fintech pitch decks I’ve reviewed over the years, I can’t tell you how many have contained some version of that statement.

The purpose of its inclusion is to underline a broader point – Americans are financially unhealthy – and to make the case for whatever product the fintech startup is pitching; a solution that, if it hits, might help bring the percentage of consumers living paycheck to paycheck down.

This is an effective rhetorical device.

However, like most rhetorical devices, it’s also kinda bullshit.

Most B2C fintech products do little to positively impact consumers’ financial health because the builders of those products don’t understand why most consumers live paycheck to paycheck.

Why Consumers Live Paycheck to Paycheck

The best research that I have seen on U.S. consumers’ cash flow management comes from LendingClub and PYMNTS, which have teamed up for the last three years to conduct large-scale consumer surveys and publish a great research series – The Paycheck-to-Paycheck Report.

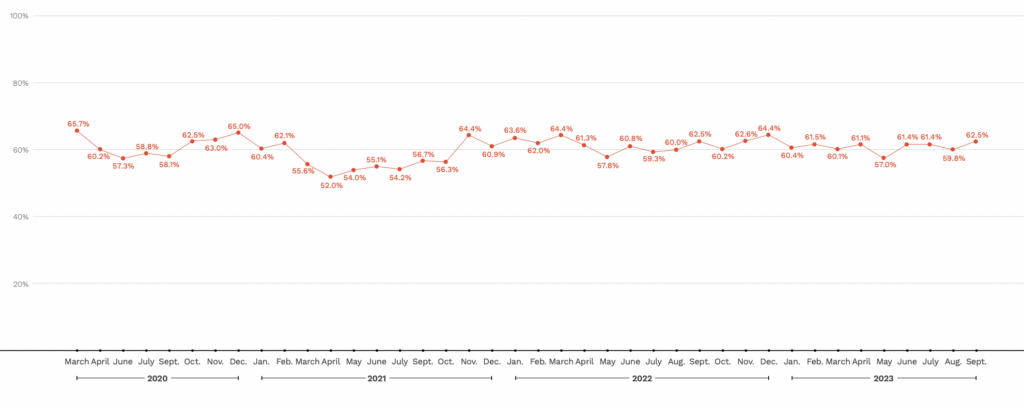

According to the data, a majority of Americans do indeed live paycheck to paycheck. To be precise, as of September of this year, 62% of U.S. consumers report living paycheck to paycheck.

That percentage has not meaningfully changed in the three years that LendingClub and PYMNTS have been fielding this survey:

But what exactly do they mean when they say “living paycheck to paycheck”? Can we get a bit more granular in our definition?

Yes! Yes, we can!

That 62% of consumers living paycheck to paycheck can be further divided up into two groups:

- Those who live paycheck to paycheck and routinely struggle to pay their monthly bills (22%).

- Those who live paycheck to paycheck but who don’t report having issues paying their monthly bills (40%).

What’s driving that split?

Presumably, some level of discretionary spending is responsible for the 40% who live paycheck to paycheck but who don’t have trouble paying their bills. Indeed, survey data reveals that 72% of consumers living paycheck to paycheck without issues paying their bills say they buy “nice-to-have” grocery items at least sometimes, and 69% say the same for “nice-to-have” retail items.

For the remaining 22% who are living paycheck to paycheck and struggling to pay their bills, it’s logical to assume that the size of the bills themselves, relative to these consumers’ incomes, is a more significant factor.

However, this should not be taken to mean that living paycheck-to-paycheck is exclusively a condition faced by low-income consumers.

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

Not so!

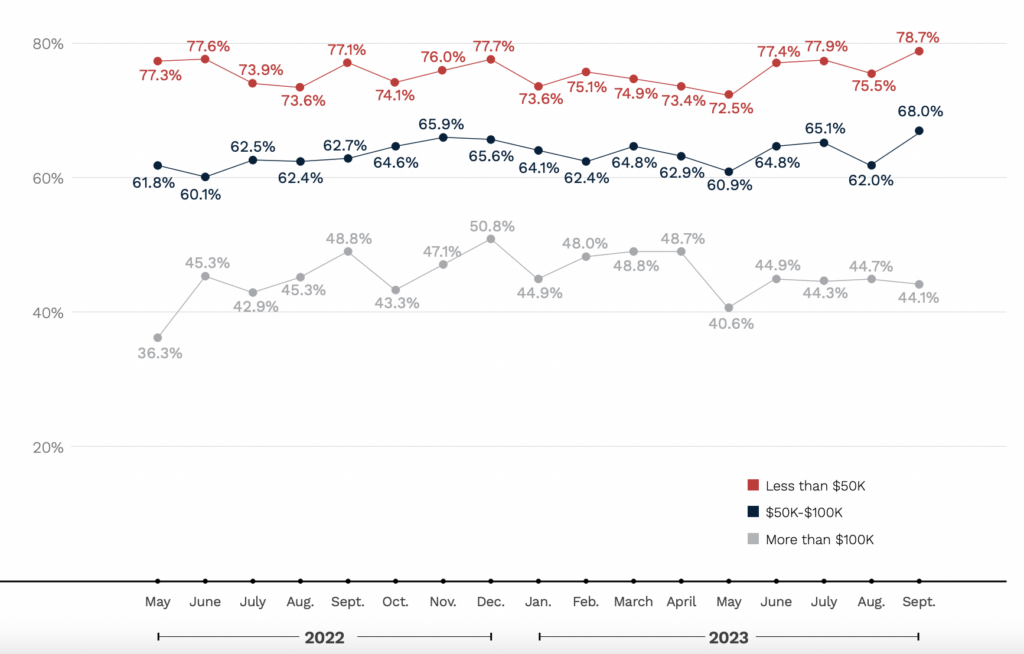

While it is true that low-income consumers are more likely to live paycheck to paycheck – 79% of consumers earning less than $50,000 annually identify as such – the percentage of consumers living paycheck to paycheck while earning between $50,000 and $100,000 is still a robust 68%, and for those earning $100,000 or more it’s 44%.

What does all of this data tell us?

Living paycheck to paycheck is a common and persistent financial condition that is influenced, but by no means determined by the amount of money consumers make.

Indeed, the more I study the data, the more it seems to me that consumers living paycheck to paycheck are more of a psychographic segment than a demographic one.

The clearest example of this is savings behavior.

According to the LendingClub/PYMNTS survey data, consumers who don’t live paycheck to paycheck reported that their ability to save money increased over the last year, an impressive accomplishment given persistent inflation and other macroeconomic headwinds.

Among consumers who do live paycheck to paycheck, the ability to save decreased significantly over the last year, regardless of income level. Even consumers living paycheck to paycheck while making between $100,000 and $200,000 a year were more likely to report that their ability to save had decreased in the last year (39%) than increased (28%). In fact, it’s not until you get to consumers living paycheck to paycheck and making more than $200,000 a year that you see those two percentages (barely) flip the other way.

This suggests to me that living paycheck to paycheck is (mostly) driven by behavior, not circumstance.

Put simply – people spend the money that is in their pockets.

The reason that is important is that living paycheck to paycheck makes it significantly more difficult for consumers to cultivate healthy financial behaviors and build wealth.

When LendingClub and PYMNTS asked consumers who don’t live paycheck to paycheck what factors are most important in choosing how to save and invest their money, those consumers said: minimizing risk, diversifying their portfolios, and generating the biggest return on their investments. All answers that Charlie Munger would have approved of.

Do you know what the top answers were for consumers living paycheck to paycheck? The amount of money required to save or invest and how fast and easy it is to pull the money back out.

Not great answers!

But also not surprising when you consider that consumers living paycheck to paycheck report having to pull a significant amount of money out of savings to cover a major expenditure every two and a half years on average, compared to every six years for consumers not living paycheck to paycheck.

So, How Do We Solve This Problem?

If we accept the premise that most consumers are always going to spend most of what is in their pockets, regardless of the size of their pockets, then the answer seems clear – we need to make it much easier for consumers to divert money from going into their pockets in the first place.

In an essay that I wrote at the beginning of this year, I proposed the idea of a Payroll Bank Account:

Imagine a bank account that pushed more of a customer’s financial allocation decisions – how much to save, how much to invest, etc. – out of the bank account itself. This account would have two different modes. The regular player mode would function like a normal checking account, with the customer paying bills and buying stuff on a daily basis. Then it would have a god mode, which would only be available to the customer once every two weeks. God mode would give them the ability to allocate how much of their money goes directly from their paycheck into their bank account versus into their passive savings account(s), investment account(s), and tax-advantaged retirement and health accounts.

The intent of this design would be to separate the temptations associated with managing day-to-day payments from the more strategic financial allocation decisions that are made (but rarely revisited!) at the payroll level.

This version of the idea, with the God mode that only activates every two weeks, is a bit dramatic (I think I was rewatching Person of Interest at the time), but you get the general idea.

By not forcing consumers to make long-term financial allocation decisions and short-term spending decisions at the same time within the same interface, we free consumers from the pressure of having to remain disciplined in their moment-to-moment financial decisions in order to improve their overall financial health and build wealth.

It’s the financial equivalent of eating better by keeping junk food out of the house.

And, of course, the control that we give to consumers over these financial allocation decisions would enable them to quickly reverse course when necessary. If a large unexpected expense occurs, the consumer can simply direct a bit more money back into their checking account until they get back on track.

This paycheck diversion capability would, if it were a standard feature in consumer banking, help to address the financial management challenges of a large percentage of consumers living paycheck to paycheck, especially those living paycheck to paycheck who don’t have trouble paying their bills.

However, for the consumers who live paycheck to paycheck and struggle to pay their bills on time (especially those who make less money and thus have less wiggle room in absolute terms), we will need to do more.

Helping Paycheck-to-Paycheck Consumers Who Struggle to Pay Their Bills

For many of these consumers, large unexpected expenses aren’t an inconvenience that temporarily diminishes their contributions to their 401Ks. They are full-blown catastrophes that frequently require turning to predatory alternatives like payday loans to survive.

Over the years, we’ve seen many different solutions introduced to try to help these consumers bridge temporary cash flow shortfalls. Everything from credit cards and overdraft protection to earned wage access and BNPL.

None of these solutions are perfect (obviously!), but they are, in the aggregate, helpful in getting consumers the liquidity that they need to avoid the worst-case outcomes (taking out a payday loan, having utilities disconnected, getting evicted, etc.)

That said, I find it a bit weird that most of these solutions focus on getting more cash into consumers’ hands rather than refactoring their expenses to better match their existing income streams.

For example, if I generally make enough money to pay all of my bills every month, but I still struggle to pay a couple of specific bills because of when their due dates fall, why isn’t there a service that I can use to smooth out those specific bills across a more convenient payment window in exchange for a small fee?

In financial services, we’re great at building generic, one-size-fits-all products and trying to shoehorn as many consumers into them as possible.

We’re not so good at building tailored solutions around the cash flow patterns and spending behaviors of specific consumer segments.

However, I’m beginning to see some evidence that we’re getting better at it.

Steps in the Right Direction

This announcement from Block about a new feature in Cash App didn’t get a lot of attention when it was made, but it’s EXACTLY what I’ve been talking about:

In October, we started offering Auto-save paychecks and Paychecks applet, allowing customers to automatically save a percentage of each direct-deposited paycheck across savings, stocks, bitcoin, or their stored balance.

Here’s what it looks like in action:

Yes! Paycheck diversion!

It’s not precisely what I want – I’d love to give consumers options for diverting portions of their paychecks into accounts not controlled by the company offering the feature – but it’s a big step in the right direction!

I noticed a similar feature in Acorn’s new Mighty Oak debit card:

Yes! It’s happening! Feel the momentum!

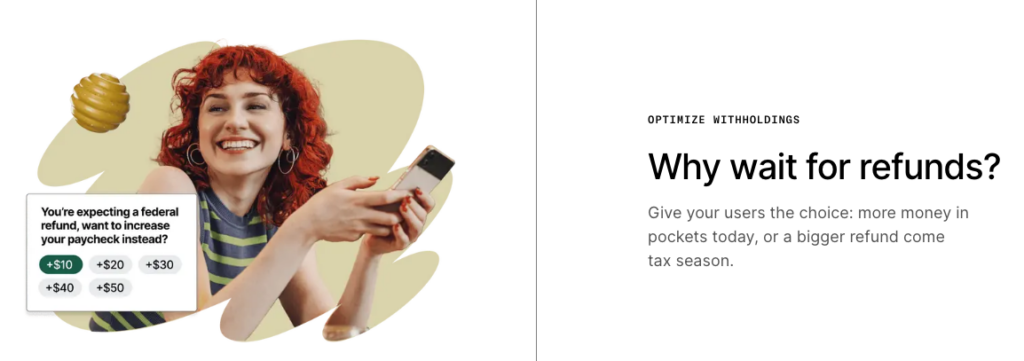

But what if we want to go beyond just diverting a consumer’s net pay into savings or investment accounts? What if we wanted to divert some portion of their gross pay – say, for example, a portion of the money they ordinarily withhold for taxes – in a new direction?

Well, April – a fintech infrastructure company that offers embedded tax prep and management capabilities – introduced a product that enables exactly that:

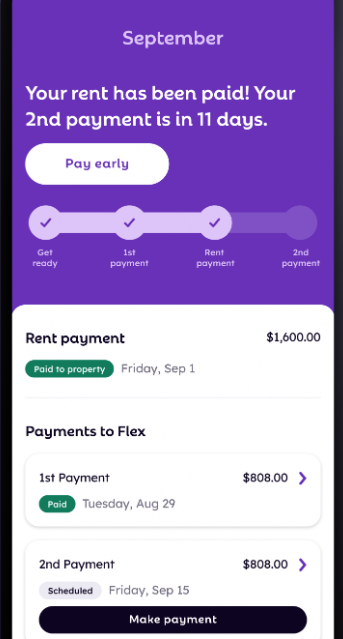

I’m even starting to see new fintech solutions being introduced to help consumers living paycheck to paycheck and struggling to pay their bills refactor their expenses to better match their income streams.

My friend Matthew Goldman (author of the terrific CardsFTW newsletter) recently introduced me to a fintech company – Flex – which allows consumers to split their monthly rent payment into two payments for a monthly fee:

How to Solve the Problem of Living Paycheck to Paycheck

The key to solving the problem of living paycheck to paycheck is to stop treating it as a condition that needs to be cured and start treating it as a condition that needs to be made as benignly chronic as possible.

We need to help low-income consumers who are living paycheck to paycheck and struggling to pay bills refactor their monthly cash flows to be more manageable. And we need to help all consumers who are living paycheck to paycheck divert more of their income out of their pockets and into the places where, over the long term, it will do the most good.

Getting to this end state isn’t going to be a quick or easy process, but it’s exciting to finally see some forward progress.