My name is Alex Johnson.

I was bitten by a radioactive charge card.

And for the past four years, I have been the one and only fintech newsletter writer obsessed with credit builder products.

I’m pretty sure you know the rest.

What’s the Right Price for Credit Building?

I wasn’t planning to write about credit builder products this week … or any week in the foreseeable future. I was planning to take a break from this topic, hoping, perhaps, that such a pause might cause my long curse to finally end.

But no. I just can’t quit.

A former colleague of mine shared this news with me earlier this week:

Regions Bank and Self Financial, Inc. on Tuesday announced a collaboration designed to help Regions’ Consumer Banking customers further build their credit report files and, over time, improve their financial health.

Specifically, Regions will introduce its Consumer Banking customers to the option of leveraging Self’s credit-building service to have their rent, cell phone and utility payments reported to the three major credit bureaus – which helps create a more complete picture of consumers’ financial habits. This, in turn, gives people an opportunity to further establish their credit without having to take on new debt, such as credit cards or loans.

I’m probably more sensitive to the details of how these services work than any person on Earth, but this struck me as fairly inoffensive. Unlike most credit builder cards and loans, services that furnish rent and utility payment data strike the right balance of helping customers (get credit for the good things you’re already doing!) and ensuring that the credit bureaus’ data remains useful to lenders (utility and rent payment data have proven to be predictive of credit default, though older versions of FICO do not take rent data into consideration).

The only thing I’m not wild about is the cost – $6.95 per month. That feels a bit steep for credit building, although I recognize that Self has costs that it needs to cover while making a profit. Still, I would have hoped that Regions would have eaten the cost itself, given that this service will (theoretically) lead to more engaged and creditworthy customers whom Regions can cross-sell and up-sell to.

$7 a month is too much to ask consumers to pay for the simple privilege of improving their credit scores!

Boy, was I naive.

Changing Behavior is Hard

TomoCredit was founded in 2019 with the intent to help international students establish and build their credit histories. For TomoCredit co-founder and CEO Kristy Kim, this was a very personal mission, as she explained to me in a recent interview:

I started the company to solve my own pain point. I am originally from South Korea, and in South Korea, everyone starts in good standing, and your credit score only goes down if you make a mistake. That’s the opposite of how it works in the U.S., where you start from the bottom and have to work your way up.

It’s really hard to ask consumers to change their behavior. What’s easy is to let them continue with their behavior but, in the background, make it easy, almost automatic, for customers to achieve their goals without really thinking about it. I wanted to do that for credit building.

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

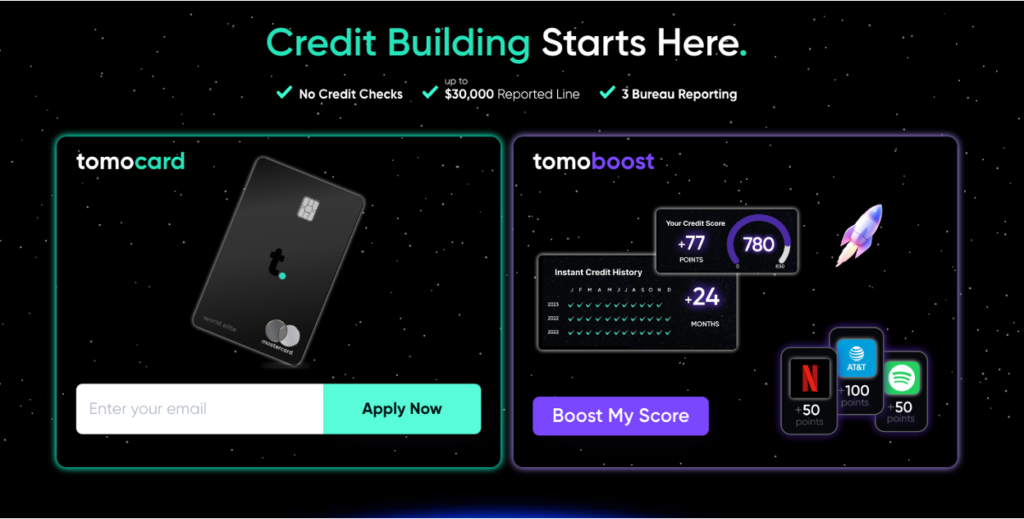

The initial solution that Kim came up with to do that was the TomoCard, a charge card that consumers qualify for based on their cash flow rather than their credit scores. The card, which offers a limit as high as $30,000, doesn’t allow consumers to revolve a balance. Instead, as a charge card, customers pay off the balance in full every 7 days, after which TomoCredit reports the on-time payments to the credit bureaus.

According to TomoCredit, the card has generated significant traction in the market. In September of 2021, Kim told TechCrunch that interest in the card had been much broader than expected:

TomoCredit has already pre-approved more than 300,000 customers and expects to issue a total of 500,000 cards by year’s end, according to Kim.

“We’ve grown 10x this year from the beginning of 2021,” Kim said. “Still, this round came together earlier than expected.”

Something that has been surprising to Kim is the interest from a variety of types of consumers.

“In the beginning, we thought international students and immigrants would be most interested in our product,” she told TechCrunch. “But after launching, we’ve realized that so many people can benefit — from gig economy workers to YouTubers to any young person who hasn’t had a chance to build credit yet. The market is way bigger than we even realized.”

This traction was enough to convince investors to plunk down a $10 million Series A in 2021 and a $22 million Series B (provided by Morgan Stanley and Mastercard, among others), along with $100 million in debt financing in 2022.

At the time, TomoCredit was focused on adding additional credit products for its credit-building customers to graduate into, including a premium ‘black card’ for users that demonstrated sufficiently good performance with the standard charge card and, eventually, auto loans and mortgages.

On one hand, this focus on expanding deeper into lending makes perfect sense. If you really are helping your users meaningfully improve their creditworthiness, then you should be eager to loan them more money. In 2022, TomoCredit was bullish on the idea that it had tapped into an underserved segment of high-performing credit customers, telling TechCrunch:

Kim maintains that the company’s default rate — at 0.11% — doesn’t reflect that risk. (For context, American Express reports a 2.5% default rate.)

“Our customers spend thousands per month, way more than any other fintech customers,” she said. “We learned this by talking to other neobanks.”

“Our customers are not in financial trouble…Once you identify them, and give them a card, they spend a lot and don’t default. Our performance has been great and that gave us and our investors the confidence to scale.”

Sharp observers might note here that comparing the default rate of a charge card with a 7-day repayment period to the traditional credit cards offered by American Express doesn’t make a lot of sense.

But even if we set that aside, the idea that credit builder products designed to never let their users default are a good on-ramp for riskier credit products is easily disprovable. If that were true, Chime would be doing a massive amount of unsecured lending to its credit builder card users right now.

The difficult truth is that such credit builder products aren’t reporting useful signals to the credit bureaus, and savvy lenders are already screening out these credit builder tradelines or treating them as negative signals in their underwriting models.

This likely explains, at least in part, why TomoCredit has not yet launched a premium card or expanded into auto or mortgage lending, although Kim did confirm in my conversation with her that those offerings are still on the roadmap.

In the meantime, TomoCredit is doubling down on credit building.

A Better Version of Lexington Law

TomoCredit’s newest product is called TomoBoost.

The vision for the product, as Kim described it to me, is to leverage the work that TomoCredit has done to build out its cashflow underwriting capabilities (which were necessary for the TomoCard), combined with generative AI tools, to create an automated credit building and credit repair service that can analyze a customer’s credit report and bank account data, provide tailored advice for improving their credit score and overall financial health, and furnish data to the credit bureaus to expedite those improvements.

When I asked her which (if any) credit builder products in the market she sees as competitors to TomoBoost, she responded with a very unexpected answer:

“Internally, we describe our product as a better version of Lexington Law.”

That’s interesting!

Lexington Law, for those of you who aren’t familiar, is one of the largest providers of credit repair services in the U.S. The company’s credit repair product – which is available at a few different tiers, ranging from $99.95 per month to $139.95 per month – includes various services such as credit bureau challenges and disputes, creditor interventions, credit report analysis and recommendations, and credit monitoring.

Credit repair services are, generally speaking, highly manual, inconvenient, shockingly expensive, and often the subject of regulatory crackdowns (the CFPB has had numerous run-ins with Lexington Law over the years).

It’s easy to understand why a fintech company like TomoCredit would see this as a space ripe for disruption.

What’s less easy to understand is exactly how TomoBoost works today.

While acknowledging that TomoBoost is a new product that is still in the process of being fully built out and that it’s part of a larger suite of products (including the TomoCard) and other products and features that are coming in the next few months, I have to say – TomoBoost, as it appears to work today, is a strange and troubling product.

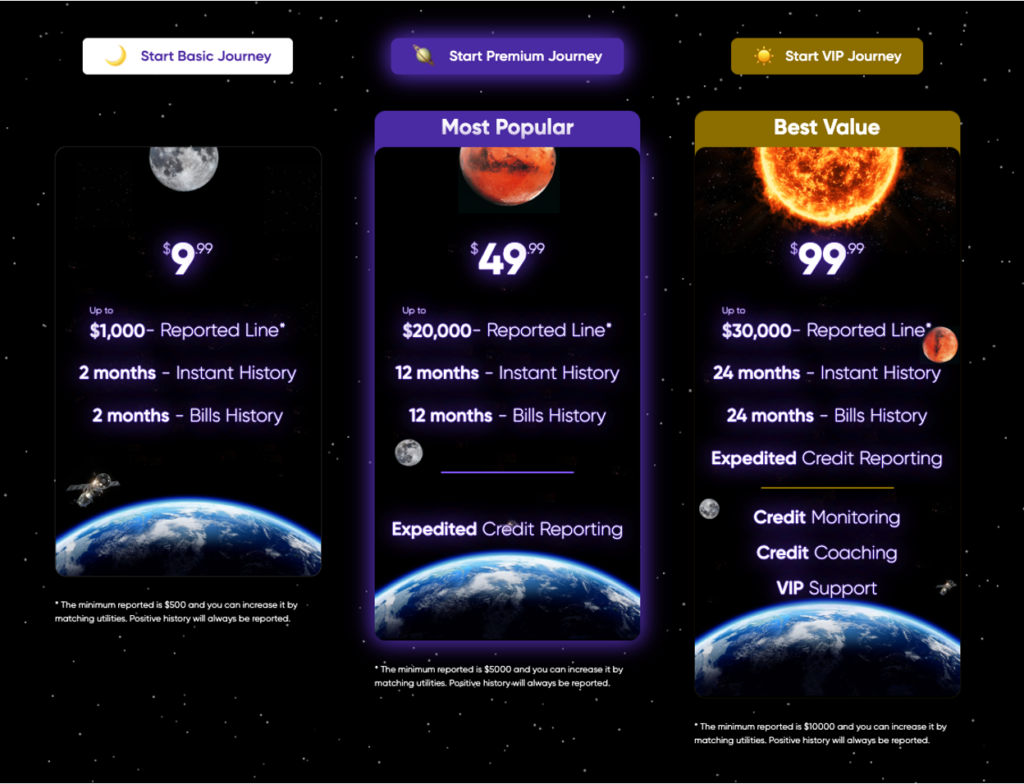

When you become a TomoBoost member, TomoCredit will report a credit line and credit history to the bureaus that is dependent on your membership tier. There are three tiers – basic, premium, and VIP.

A basic membership costs $9.99 per month and comes with a $500 “reported line,” which users can increase up to $1,000 by linking their utilities and bills (water, electricity, Netflix, gym memberships, etc.) to their Boost account. The basic membership also includes 2 months of “instant history” and 2 months of “bills history.” The premium membership ups the cost to $49.99 per month and gives users a $5,000 reported line, which can be increased up to $20,000 by linking utilities, along with 12 months of instant history, 12 months of bills history, and “expedited credit reporting.” The VIP membership tier costs $99.99 per month and gives users a $10,000 reported line, which can be increased up to $30,000 by linking utilities, along with 24 months of instant history, 24 months of bills history, expedited credit reporting, credit monitoring, credit coaching, and VIP support.

Setting aside the eye-watering costs, which are lower than Lexington Law but are still, you know, really high, there are a couple of things that stand out as confounding.

First, the credit line that comes with the membership ($500 for basic, $5,000 for premium, and $10,000 for VIP) doesn’t seem to actually be a credit line that customers can draw on to pay for things. As far as I can tell, it is just a loan that exists on paper for the purpose of being reportable to the bureaus. Hence the term “reported line” that TomoCredit uses on its website.

Linking utilities and other recurring bills to the line in order to increase it is also quite unusual. Ordinarily, these payments get reported to the bureaus individually rather than being aggregated into a single tradeline. Also, it’s unclear if TomoCredit is checking to see if these recurring bills are already being reported separately, which raises the risk of them being double-counted.

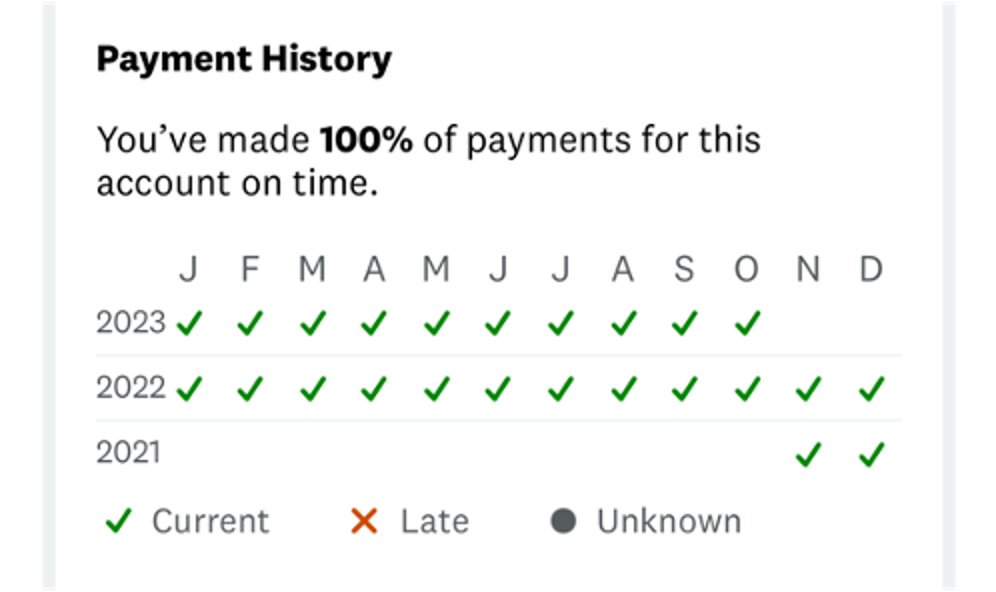

Second, the “instant history” feature is exactly what it sounds like. Say, for example, you sign up for the VIP membership tier; TomoCredit will immediately report a full 24 months of “repayment history” associated with your credit line.

According to FICO, the three most important factors driving a person’s credit score are their payment history (35%), their ratio of credit utilized to credit available (30%), and their length of credit history (15%).

The TomoBoost service is perfectly designed to maximize its positive impact on customers’ credit scores across these three factors. The service only reports positive repayment data because there are no actual payments. Customers’ utilization ratios are instantly improved because they are given a large credit line that can never be used. And the length of credit history is also improved because the service retroactively adds months or years of repayment history as soon as the credit line is created.

The trouble is that none of the data being reported to the bureaus by TomoBoost is real (with the exception of the aggregated utility bills, which are likely to be a small part of the total). It doesn’t reflect an improvement in consumers’ behavior in managing their credit obligations over a long period of time. It doesn’t reflect behavior at all. It’s an illusion.

TomoCredit Customers Aren’t Happy

The other bit of trouble for TomoCredit is that its customers don’t appear to be very happy with it right now.

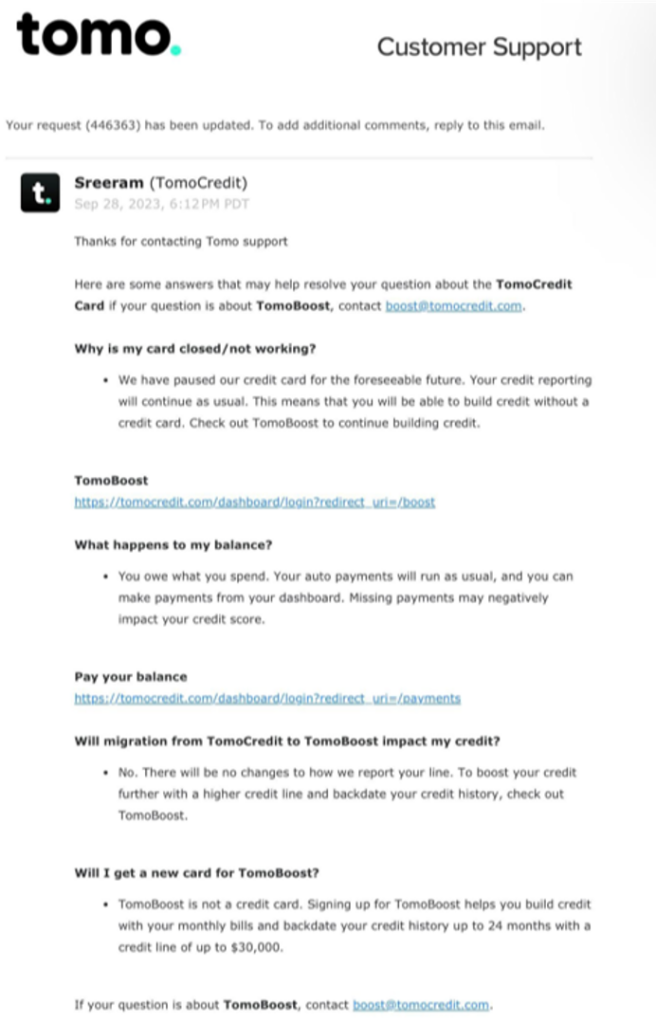

Across Reddit, TikTok, YouTube, and reviews at the Better Business Bureau, there are numerous consumers claiming that TomoCredit has been unexpectedly closing their TomoCard accounts without warning and aggressively pushing them to use TomoBoost instead.

In our interview, Kim claimed that a small number of card accounts have been closed recently due to risk management concerns and that others are in the process of being transitioned to a new card product that will be coming out towards the end of the year.

This screenshot of a TomoCredit customer support interaction, shared on Reddit, would seem to confirm that the current card product has been “paused”:

The transition process has apparently been quite rocky for many TomoCard users, who have been trying to contact TomoCredit’s customer service representatives without much luck. The situation is especially concerning for cardholders with unclaimed rewards or transaction refunds trapped in their now-defunct TomoCard accounts. As one Reddit user explains:

They have recently closed all of their cards without warning and have completely abandoned any support/customer service. I’ve been hearing other horror stories worse than mine, but personally, they have over a thousand dollars stuck in my account that I will never have access to because I had a few Amazon returns fund the account after the card closed. They will not get back to me; they have not and will not mail me a check for the balance.

Among customers who have signed up for TomoBoost, there appears to be significant confusion about whether or not the service is actually delivering what it promised. Some customers report no data being furnished to the bureaus, despite paying for TomoBoost for multiple months. Others report seeing a new tradeline showing up in their credit reports one month but then having it disappear the next month.

Given the mechanics of how TomoBoost seems to work and the lack of detailed information about the service on TomoCredit’s website (which users have also complained about), this confusion isn’t surprising.

And for TomoBoost users who are looking to cancel their memberships, there also appear to be some serious challenges.

A large percentage of the recent reviews on TomoCredit’s Better Business Bureau listing, where the company has an average rating of 1.18 stars out of 5 (based on 168 reviews), focus on TomoCredit making it essentially impossible for customers to cancel their TomoBoost subscriptions. Here’s one such complaint:

I have emailed multiple times requesting my subscription be canceled. I never received a reply, even acknowledging my request. It’s always a generic auto-reply and then nothing else ever. They’re basically stealing my money at this point.

Good Intentions Aren’t Enough

When my aunt was a little kid, she visited my great-grandfather’s ranch outside Bozeman, MT. While the grownups were inside talking, she went to the sheep barn to visit the ewes and baby lambs.

During her visit, she noticed that some ewes had no lambs while others had multiple lambs. This struck her tiny child brain as deeply unfair, so she decided to fix it. She rearranged all of the lambs so that each ewe had one.

Her grandfather quickly discovered what she had done when the ewes and lamps started raising holy hell, bleating louder and more panicked than he had ever heard them do before (he probably thought the barn had caught fire or something).

Of course, the problem was that there was no way to tell which lambs belonged with which ewes, so the only thing he could do was take the sheep out to the field and let them all loose so they could slowly sort themselves back out again.

This seems like an apt metaphor for fintech credit builder products.

The intentions are usually good, but there is a very valid reason why we have traditionally only reported repayment data to the credit bureaus if that data is reflective of the consumers’ behavior in managing financial obligations – that’s the data that is useful for making good credit risk decisions!

I understand that it’s a bit unfair that new-to-credit consumers need to start at zero when building their credit histories in the U.S. And I know it’s really difficult to get consumers to change their behaviors rather than simply automating all of their hopes and dreams into existence with the push of a button.

But you know what? That’s the way the world works! Behavior change is hard but necessary if you want to actually help people.

And much like my great-grandfather and the sheep, I’m guessing that the only way to fix this problem will be for all of these fintech credit builder product users to go out into the real world, apply for the loans they think they’re now qualified for, and let the free market sort it out.