08 April 2023 | Healthcare

Mega Deals Dominated Q1 Digital Health Funding, But Can the Industry Sustain It?

By workweek

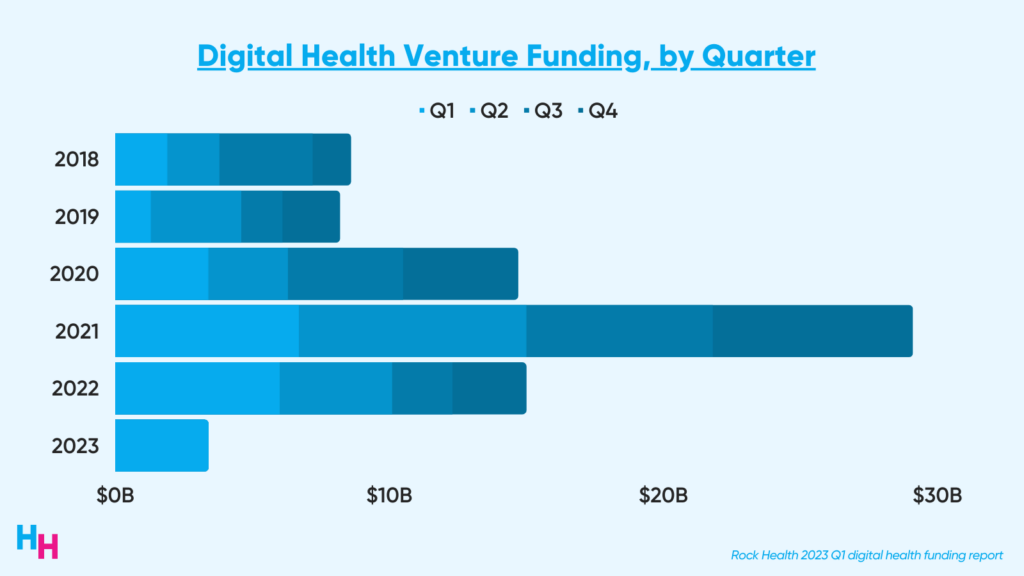

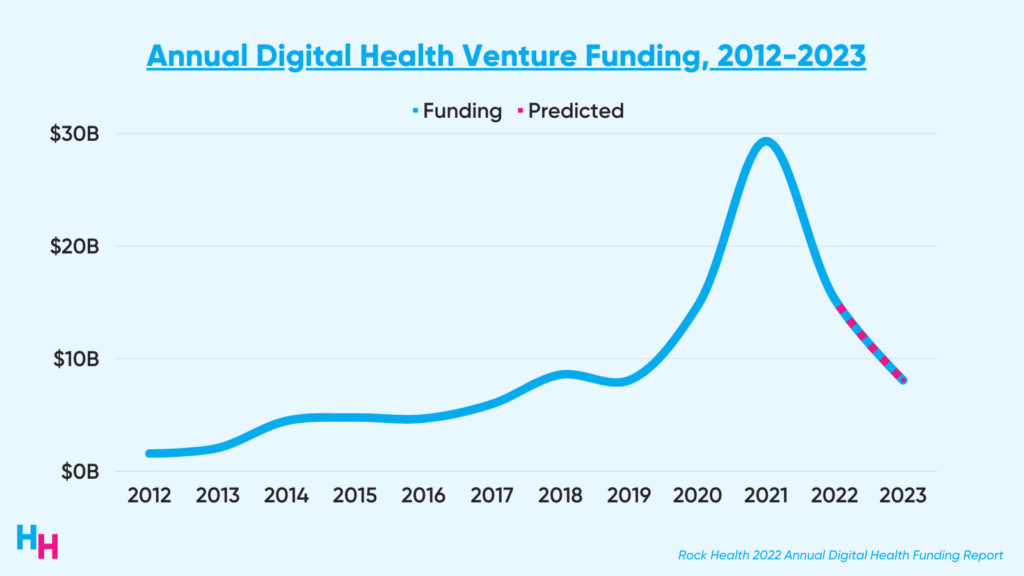

2023 is supposed to be a rebound year for digital health funding, following a relatively slow funding year in 2022. But new funding data from Q1 suggests 2023 is bound to be as slow a funding year as was 2019.

In this article, I’ll highlight Rock Health’s Q1 digital health funding report, touch on key trends, and share the digital health areas that excite me the most.

The Deets

Digital health funding reached $3.4 billion in the first quarter of this year across 132 deals, with an average deal size of $25.9 million.

Six mega deals (>$100 million raised) drove 40% of this $3.4 billion:

- Monogram Health ($375M)

- ShiftKey ($300M)

- Paradigm ($203M)

- ShiftMed ($200M)

- Gravie ($179M)

- Vytalize Health ($100M)

What does it mean for these mega deals to be driving Q1 funding?

[They] indicate that the sector’s more established players and investors are trying to find their sea legs in this market, selectively deploying those dry powder reserves they’ve been stockpiling since 2021 into teams and projects they know.

#Trending

2023 was supposed to be a rebound year for digital health, as digital health funding peaked in 2021 with around $30 billion raised, only to fall back to $15 billion in 2022. Adverse economic conditions led to a “return to normalcy” in 2022’s digital health funding:

- Supply chain issues wreaked havoc, causing increased demand and costs to skyrocket.

- Inflation jumped, disincentivizing consumers to spend money.

- Interest rates spiked, making borrowing money costly and therefore driving down investments.

Despite improvements in economic conditions, investors aren’t rushing to invest in a digital health gold mine like in 2021. Not at all.

Now, the ball is in the investors’ court, and it seems they’re being more cautious with their investments, as evidenced by increased investment in later-stage startups. So, if the next three quarters match the average funding from the previous three quarters in 2022, 2023 may be the lowest funding year since 2019.

Dash’s Dissection

Left out of the Rock Health report were hot digital health launches and M&A activity. There are three key digital health areas that I’ve been following and will continue to follow over the year. These include metabolic health, artificial intelligence, and mental health.

Metabolic Health

The metabolic health space has just begun to heat up with the advent of GLP-1 agonists advertised for weight loss (note: these are anti-obesity medications). Startups tackling obesity fall into several areas, including weight-loss coaching, nutrition counseling, “dieting,” medical or surgical therapies, and fitness. Some startups tap into all of these different areas, while others focus just on one.

During Q1, there were multiple instances of new or established companies diversifying into metabolic health. This included direct-to-consumer companies like Ro launching its Ro Body Program, offering a comprehensive weight loss program, including access to GLP-1 medications. Additionally, incumbent weight-loss company Weight Watchers acquired clinical weight-management company Sequence which offers GLP-1 agonist therapy.

So, I expect in Rock Health’s annual report (which will come out in Jan 2024), “Metabolic Health” will be discussed frequently as new and established companies launch products within this vertical. Plus, the FDA will likely approve Eli Lilly’s tirzepatide for obesity treatment this summer, adding another medication similar to semaglutide.

Artificial Intelligence

Digital health startups offering services with natural language processing capabilities (cough cough GPT) have gained traction during Q1—even the American Medical Association is talking about it.

The most significant use case for GPT-like technology is in clinical and non-clinical workflow.

- Nabla, for example, launched Nabla Copilot in March, helping physicians streamline their paperwork. Copilot uses GPT-3 to automatically translate physician-patient conversations into prescriptions, follow-up appointment letters, and consultation summaries.

- Microsoft recently integrated GPT-4 into Nuance’s automated clinical documentation app, DAX Express, which listens to doctor-patient conversations to transcribe notes.

- denyify, which launched in March, uses GPT to streamline claims processes to save physicians time arguing with insurance companies when a patient’s medication or procedure is denied.

While clinical and non-clinical workflow is what I’m eyeing, AI can touch nearly every area of healthcare. If you haven’t tried ChatGPT yet, give it a test run. If you’re too anxious about it, read my article here regarding its potential capabilities.

Mental Health

Mental health has reigned supreme as the top-funded clinical indication in Rock Health’s annual reports. The pandemic also helped attract investors to fund mental health startups. However, many mental health startups built business models around pandemic-related regulatory flexibilities. Unfortunately, many of these flexibilities are about to revert to how regulations were pre-pandemic.

Health and wellness investor Jess Schram wrote a comprehensive article about the impending impact of the public health emergency’s end on digital health companies. She covered the recently-proposed DEA rules that involve rolling back pandemic-related telemedicine flexibilities for controlled substances. These flexibilities allowed physicians to prescribe controlled substances without an initial in-person visit, which was previously the rule.

Again, hundreds, if not thousands, of digital health companies have built business models around these pandemic-related telehealth regulation flexibilities or benefited from them (Ophelia, Bicycle Health). Consequently, populations who previously lacked access to substance use disorder treatment, for example, could access care via these digital health services. So what happens now once these flexibilities revert to stricter regulations?

Investors will think twice before increasing investment in these digital mental health companies that will be impacted by the public health emergency’s end.

In summary, digital health funding in Q1 was underwhelming. 2023 was supposed to be a rebound year for digital health funding, but optimism for such a rebound is low. 2023 digital health funding may be on track to barely surpass 2019’s digital health funding. Aside from funding, three key digital health areas I’m following are metabolic health, artificial intelligence, and mental health.

OUTSIDE THE HUDDLE

1) The Truth About Hospital Losses

Blake published a well-written article discussing what’s behind hospitals’ financial losses they’ve been screaming “bloody murder” about over the past year. In my Outside the Huddle section last week, I included a publication from Health Affairs that looked at recent quarterly financial statements from ten large nonprofit health systems, finding that “labor shortages” wasn’t the main driver of poor margins—it was investments losses. However, there’s more to the story, which Blake covers quite well:

Hospitals are struggling operationally – financial data from nonprofits supports this conclusion. There’s a level of support likely needed until the labor market stabilizes.

But there’s also deserved criticism around health system’ hedge fund’ activities. And investment portfolios should ultimately be considered in assessing the financial health for informing policy, similarly to how bond ratings agencies do so in informing health system default risk.

2) Privacy is at risk as HIPAA fails to keep pace with digital health

Erin Brody and Tina Reed wrote a succinct piece on why HIPAA is an antiquated regulation that is in urgent need of update:

Nearly three decades old, HIPAA appears obsolete and riddled with new technology-induced gaps.

HIPAA was enacted in 1996, 24 years before I sent the first Healthcare Huddle newsletter discussing digital health trends, artificial intelligence, and wearable technology. HIPAA is essentially a vague piece of legislation that doesn’t touch on privacy aspects as they relate to digital health, for example. Meanwhile, digital health companies and hospitals are being fined left and right for having trackers on their websites for advertising purposes (a story for another time).

3) First Round of Medicaid Disenrollment Data Is In Quickly: What We Know and Don’t Know

Medicaid’s continuous enrollment period began to unwind last week (I wrote about it here), and we’re beginning to see the impact. In Idaho, 19,000 people lost coverage. In Arizona, Medicaid enrollment dropped by 35,000 from March to April. Georgetown Health Policy Institute is keeping track of everything here.

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.