Today we’re diving into a recent discussion I’ve noticed around hospital finances – non-operating investment losses, what they are, and what the truth is around operating performance. I’ve tried to break down the arguments and what you need to know below, and would love your feedback on the issue. I’m sure I’ll get some spicy replies that I’m fully prepared for lol.

Let’s dive in!

Key Takeaways: Why the answer on hospital losses is somewhere in the middle

The hospital industry – and the American Hospital Association (AHA) – has been screaming bloody murder about hospital losses. They’re lobbying for increased government support in the current operating environment.

On the other hand, Health Affairs and economists recently argued that most hospital losses from 2022 sit in non-operating investment losses and that the state of hospital operations aren’t as bad as characterized in lobbying efforts.

In reality, the answer to the hospital losses question sits in the middle of the two takes. Hospitals are struggling operationally – financial data from nonprofits supports this conclusion. There’s a level of support likely needed until the labor market stabilizes.

But there’s also deserved criticism around health system ‘hedge fund’ activities. And investment portfolios should ultimately be considered in assessing the financial health for informing policy, similarly to how bond ratings agencies do so in informing health system default risk.

Background and Context: Hospital Losses are nuanced

Recently, I’ve seen some drama surface related to hospital losses. How much are they actually losing? Are the cries of major losses nationwide true? Or are hospital financial losses more propaganda from lobbyists?

As if on cue, to kick the drama off, a recent Health Affairs analysis dropped related to health system investment losses. In the paper, the authors assert that hospitals’ operating margin (AKA, net revenues minus total operating expenses) doesn’t show the full picture of hospital financial performance.

- Rather, HA argues that investment gains/losses constituted the bulk of hospital reported losses on the income statement, and these assets should be considered when considering hospital payment policy. Definitely a fair assertion considering that health system investment funds are also analyzed in bond ratings to determine financial health.

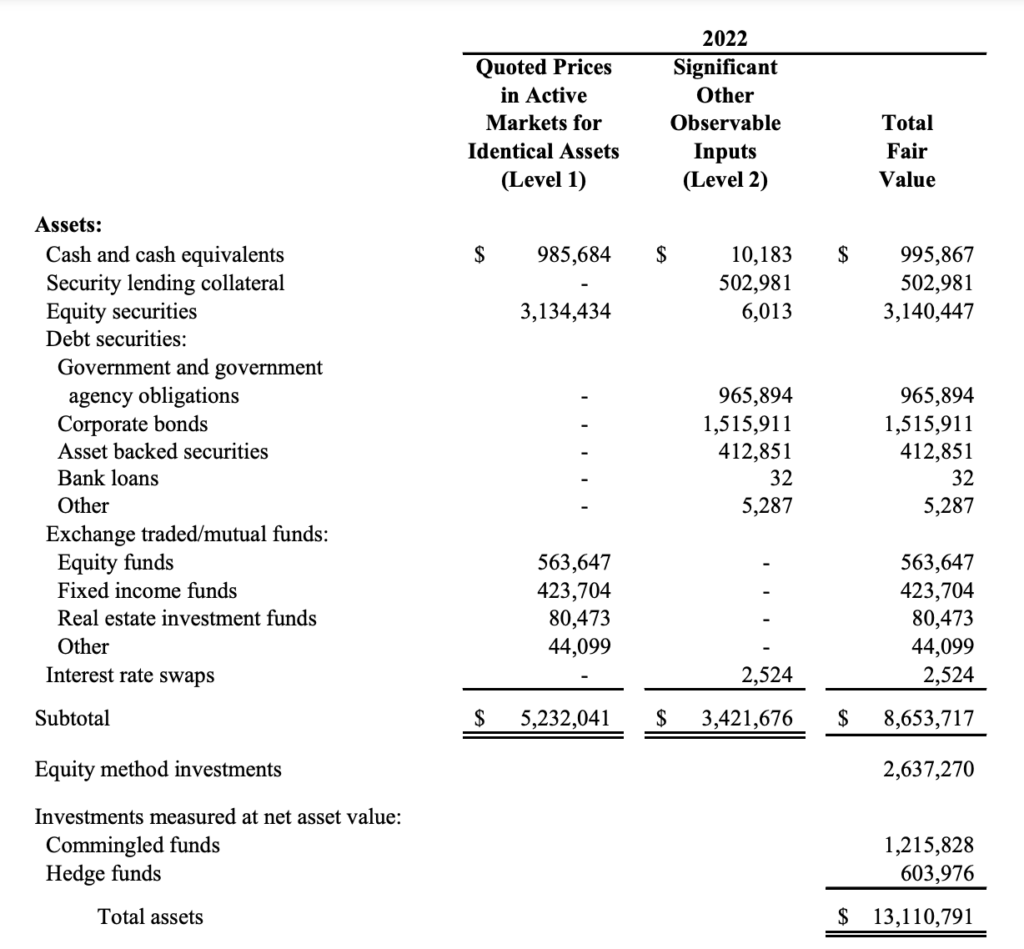

For context, most large nonprofits – in addition to day to day hospital operations – hold massive endowments and investment portfolios. The portfolios themselves consist of a mix of debt (government bonds, treasuries), publicly traded equity (ETFs and mutual funds, derivatives), and alternative investments (private equity funds, commingled funds, venture investment arms).

An example of a health system’s investment portfolio allocation, from Trinity Health:

The value of the portfolio is recorded on the balance sheet, updating each quarter based on the investment ‘fair value’ of the assets that the health system endowment has invested in. Then the difference in portfolio value from quarter to quarter is recorded on the income statement under non-operating items. If you’re an absolute freak and want to learn more about accounting policies, this method is called mark to market.

The portfolio team typically earmarks a certain amount per year to fund operations or capital projects. The rest is invested into index funds, and a smaller percentage is allocated toward alternative investments (private equity, venture, hedge funds).

In a typical nonprofit portfolio allocation, you might see about 50% of the funds invested in fixed income (U.S. government debt, other types of bonds), 25% allocated toward public equity (domestic and foreign ETFs and mutual funds), another 20% placed in alternative investments. What’s leftover is the funding earmarked for specific hospital capital projects as mandated by foundations or charitable organizations.

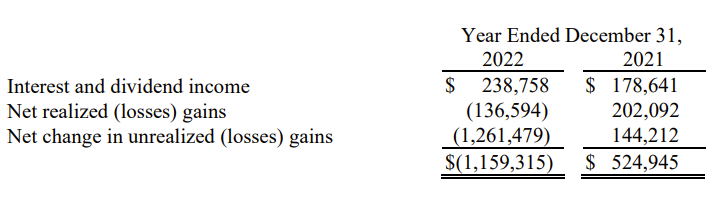

Almost ALL of the mark-to-market fluctuation – and losses – presented on the hospital income statement stem from publicly traded stock market performance.

And this method is the crux of Health Affairs argument. HA found that 85% of hospitals’ net profit/loss stemmed from these unrealized, non-cash, mark-to-market losses from health system portfolios.

Take AdventHealth for instance. Ignoring unrealized losses, for investments that the health system actually sold, and on interest and dividends received, it made money in 2022:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Any realized returns by the system’s portfolio gets reinvested back into capital projects or redeployed into the portfolio.

Translation: when market do bad, this is a loss (negative). When markets do good, health systems record a gain. That’s why you see so much fluctuation in overall net profits – the bottom line on the income statement – from health systems. And why it’s the wrong number to look at to determine operational health of the core business.

Investment Losses don’t tell the full picture on hospital finances

Here’s where the HA paper lost me, though. Health Affairs generally does a great job distilling current healthcare trends in an informative and balanced manner. Their main argument:

Operating margin, which does not take into account non-operating activities, offers an incomplete picture of hospitals’ overall financial performance.

This take, while credible, deserves more context and nuance than the article delivered.

If losses were driven by persistent labor and supply cost increases, then it might be reasonable to ask patients, employers, and insurers to consider these underlying cost drivers in their payments to hospitals.

To be honest, I was a bit bewildered by this statement. I don’t think the operating portion or trends present in the income statement was considered at all in this analysis. Persistent labor and supply costs increases are exactly what has affected hospitals over the past 3 years. So to prove that, I decided to do some dirty work on hospital finances.

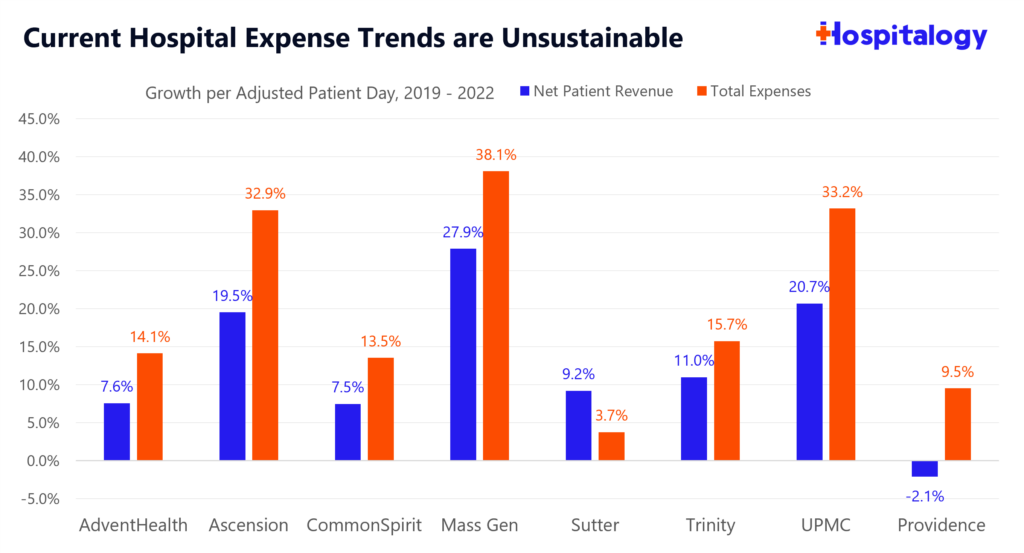

I grabbed the nonprofit health systems selected by the HA team, then cut down a few that hadn’t reported full year 2022 results. From there I tracked reported financial and operating metrics to analyze growth in net patient revenues and total operating expenses per adjusted patient day from 2019 to 2022. I considered Adjusted patient day as the most comparable measure considering the metric accounts for both inpatient and outpatient operations at a hospital.

What I found lined up with anecdotal evidence from the market: Labor and supply cost increases are also where losses are happening at hospitals – to the actual business of running health system operations.

- This is why both takes – the AHA, and Health Affairs – are both true.

Take a look at revenue vs. expense growth on an adjusted patient day basis. Margins are getting squeezed. The main point presented by the hospital lobby is that this trend – if it continues – is unsustainable for hospital operations. Which, based on the below graph, is true.

Of course, the HA take is part true as well. Hospitals aren’t warranted in crying foul about unrealized losses. There have been a number of years (2019-2021) where unrealized gains have been incredible.

Source: Hospital EMMA disclosures, audited financial statements

When you take a look under the hood, the simple fact is that for the hospitals analyzed, operating expenses on the unit level are rising faster than revenues. For now, this trend is unsustainable and labor is where the number 1A focus is in C-suite hospital board rooms across the country.

And that’s the main problem at health systems right now. It’s more than just the investment losses. That argument detracts from the more pressing issue affecting hospitals across the country. These health systems, in an ironically similar fashion to startups, are trying to find ways to cut costs, retain clinicians, and boost revenues in any way they can.

So…what happens when your core business expenses are rising faster than your revenues?

You get squeezed on margin and in the case of hospitals, have to shut down inpatient service lines, or outsource your revenue cycle management to someone like Optum, or lay off an increasing number of non-core personnel (e.g., the Novant innovation team RIP). All of which we’ve seen happen in recent memory.

Why do you think we’re seeing these funky cross-market mega mergers or shutting down their existing joint operating companies (Centura, Amita, MercyOne)? The institution of the hospital is slowly crumbling, and chinks in the armor are forming. There’s no more low-hanging fruit. Payors and CMS will only budge so much on reimbursement, and for now, what’s left is the nitty gritty operating stuff that needs to get optimized.

When will things improve? As the labor market settles down and the nursing supply increases, volume will continue to return. Health systems will likely secure higher commercial reimbursement from payors over the next 2-3 years. Things may settle, and everything will be peachy if the AHA gets exactly what it wants…

..But these dynamics don’t address the more secular problems facing hospitals – E.g., the shift to Medicare (& Medicare Advantage), policy shifts aimed at reducing ED visits and admissions, and the general shift to outpatient as innovators optimize surgery and patient care delivery outside of the hospital.

Parting Thoughts: Let’s compromise.

While the criticism surrounding hospital investments and operating as de-facto hedge funds is credible, there are bigger fish to fry. There’s a disconnect between the arguments, and a disconnect in general in healthcare.

Do hospitals deserve constant financial support and policy babying? That’s an argument for another day, and a nuanced discussion – but that money could be used elsewhere in payment policy supporting a wide range of services. It gets tricky, because hospitals hold a ton of inefficiencies and admin bloat, yet they support jobs in local markets. They also provide care for local communities, and patient like them as I mentioned in my MedPAC analysis. Finally, portfolios are used to invest in economic development and innovation (despite the hedge fund criticism).

In general, hospitals are described as the ‘department stores’ or ‘all you can eat buffets’ of healthcare, and it’s hard to be an efficient operator when you do everything and are burdened by a ton of regulation or dumb governance structures that slow down everything known to mankind.

What do we want the end game to be for hospitals, with rising expenses and low political sympathy/appetite for support? I’m not a policy expert, but some fodder for discussion:

- If you think hospitals deserve to exist in the current status quo, then you should join the calls for increased government funding, higher payor reimbursement and support for hospital based care.

- On the other hand, if you think other care delivery models deserve to be supported amidst the secular shift to Medicare and outpatient care, then you should be asking hospitals to lean up, cut down on admin bloat, reign in executive pay, and focus on retaining & support of clinicians.

Me? I’m in the middle of the aisle. Let’s allow hospitals to evolve but also support that evolution. To do what they do best in caring for high acuity patients and extreme situations. Then let’s partner and work together on the other stuff, to deliver better patient care in better settings with less bureaucratic crap, prevent exploitation of policy, and reign in practices that burn out clinicians.

Hospitals will have to want to evolve, though. And that evolution will be painful.

That’s it for this week! Join 20,000+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!