14 January 2023 | Healthcare

Digital Health Funding Slows in 2022: Is the Hype Fading or is it a Temporary Setback?

By workweek

While 2022’s total digital health funding disappointed many, it was anything but unexpected. Throughout 2022, I frequently reported on digital health startups’ struggles, from fundraising to layoffs. While some digital health verticals had it tougher than others, it’s safe to say everyone suffered together.

In this article, I’ll recap Rock Health’s annual digital health funding report, highlight funding trends to watch in 2023, and reveal digital health’s winners and losers.

Digital Funding Returns to Baseline

Digital health startups raised $15.3 billion across 572 deals in 2022, with an average deal size of $27 million. For comparison, here were my exact words a year ago when I recapped 2021’s digital health funding:

A new Rock Health report showed digital health funding in 2021 nearly doubled from $14.9 billion to $29.3 billion, the largest year-to-year increase ever.

Even more…

The number of deals in 2021 increased by 50% to 729 deals. 2021 had some of the largest digital health deals ever, with 88 mega deals (over $100 million raised) accounting for 57% of the year’s total funding.

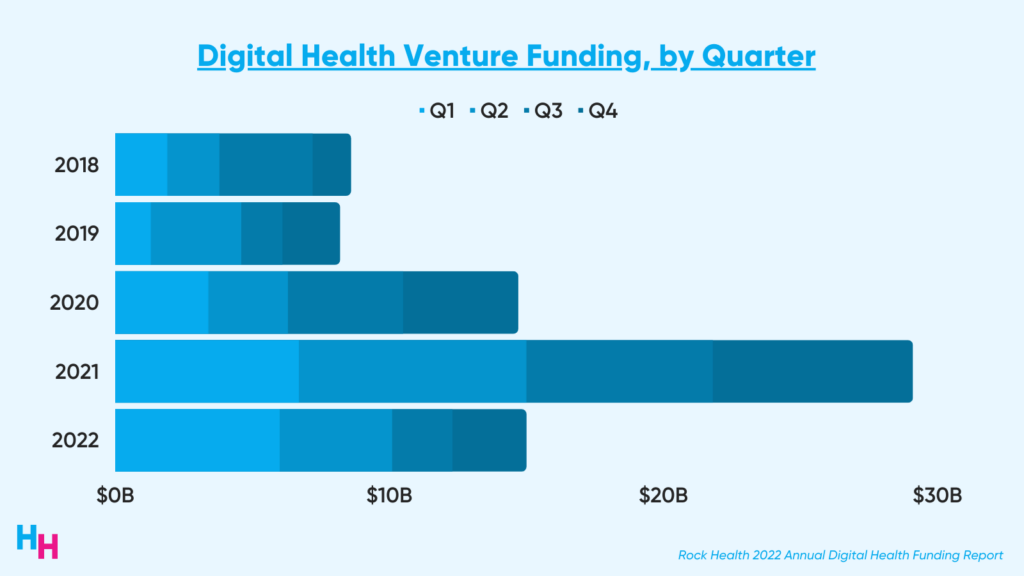

This is all to say 2022’s digital health funding was underwhelming, with startups raising just over half of 2021’s $29.3 billion and barely surpassing 2020’s $14.7 billion.

The next question is: why was digital health funding so successful in 2021 but less so in 2022?

Pandemic-related factors in 2021 catalyzed venture capital investment in startups: VC investment doubled between 2020 to 2021, reaching $330 billion across all industries. The public health emergency, relaxed healthcare regulations (especially in the telemental health space), and stimulus money incentivized investors to go big or go home. In digital health, VCs pumped money into Series A and B rounds, which grew by 38% and 23%, respectively.

Adverse economic conditions, however, caused the digital health funding wave to come crashing back down in 2022:

- Supply chain issues wreaked havoc, causing increased demand and costs to skyrocket.

- Inflation jumped, disincentivizing consumers to spend money.

- Interest rates spiked, making borrowing money costly and therefore driving down investments.

So, did we witness an end to a “macro funding cycle,” as Rock Health put it?

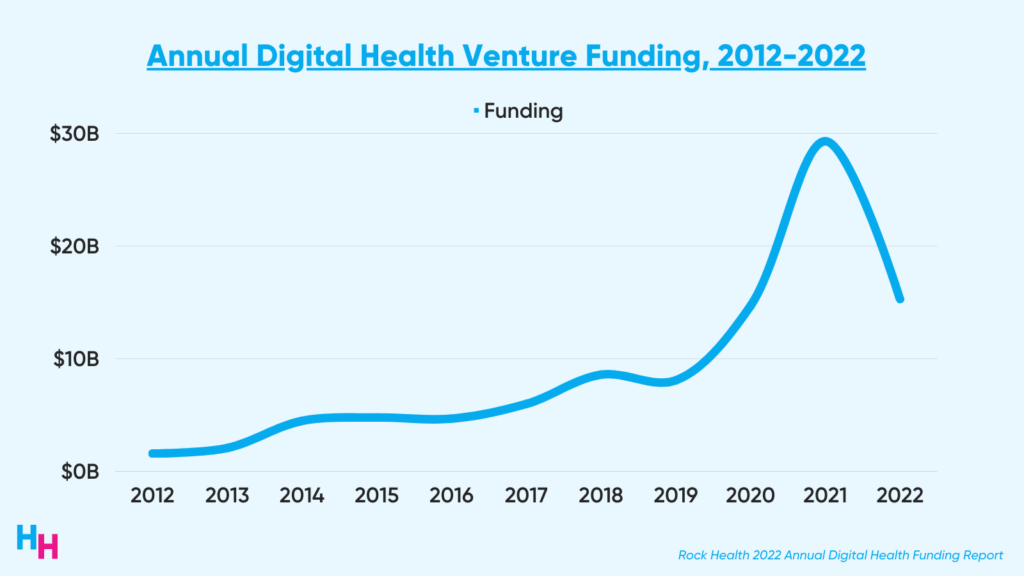

Annual digital health funding grew linearly until 2021, when it experienced a significant spike, and then returned to “baseline” in 2022. I wouldn’t call it a “cycle” until we can gather a better picture of the pattern (for example, seeing another digital health funding spike as significant as 2021’s in a couple of years). Maybe it’s better to describe 2021’s digital health funding as a one-off digital health funding event influenced by the pandemic. Overhyped?

#Trending

Some of the top trending digital health areas I’ll follow closely this year include on-demand healthcare, nonclinical workflow, and mental health.

On-demand Healthcare

On-demand healthcare was the top-funded value proposition, with $2.4 billion raised in 2022. Examples of on-demand healthcare include products or services that facilitate hospital-at-home programs, which have become more popular during the pandemic (I’ve written about home-based care here, here, and here). Human resources and health tech are needed for home-based care to be effective, making it superior to hospital-based care in many cases. On-demand healthcare is an area I’ll be eyeing throughout the year. I’ll dive into the role health tech has played in advancing the home-based care movement next week.

Workflow

Nonclinical workflow startups were the third most-funded value proposition, with $2.2 billion raised in 2022, jumping from 7th place in 2021. I’ve been covering the workflow vertical since I entered the healthcare arena in 2019. I gave a stab at my own workflow venture, which involved automating patient waitlists for physicians (read about it here!). The rise in workflow funding demonstrates that investors may be shifting focus. Streamlining workflows to improve efficiencies, saving (or making) physicians/hospitals money, and preventing healthcare workforce burnout is where the money is at. Workflow companies were essentially unheard of in 2021, and now they’re trending, something I’ve covered here and here.

Mental Health

Lastly, mental health was the top-funded clinical indication, with $2.1 billion raised, holding onto its first-place title for the fifth year. Mental health will remain a top-funded area for the time being, but it won’t be easy. Federal regulations will change to prevent once-lucrative startups like Cerebral from running Adderall pill mills and other startups from administering controlled substances like ketamine (while ketamine has efficacy in treating treatment-resistant depression, its role in an unsupervised setting is unclear). Telemental health has proven its effectiveness. It has increased access to mental health care, and nearly all state Medicaid programs have made permanent changes to maintain telemental health services.

Dash’s Dissection

While all digital health startups took a hit, some performed better than others: early-stage startups were the winners, while direct-to-consumer startups were the losers.

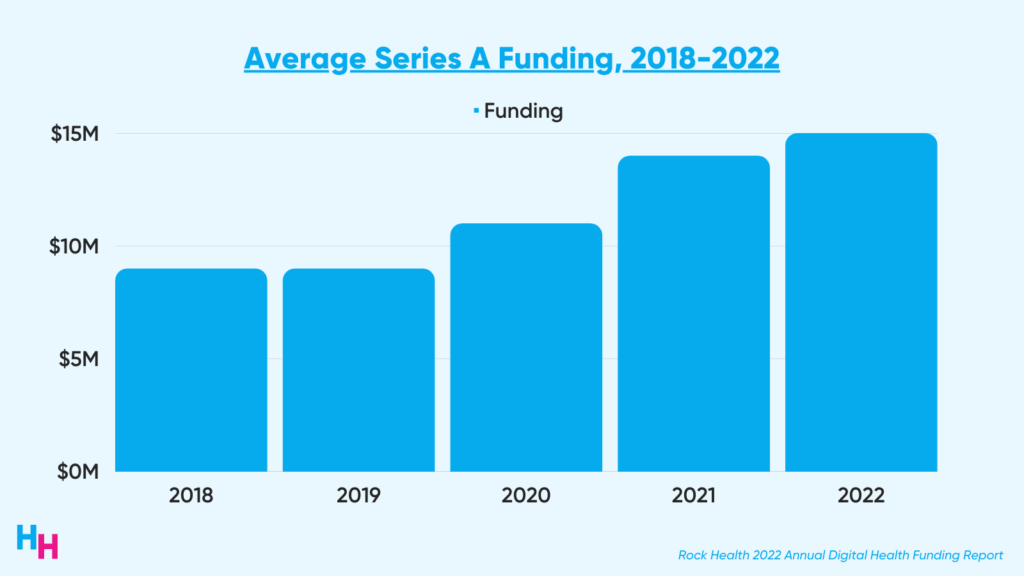

Early-stage startups landing Series A deals in 2022 saw the largest average deal sizes in history, coming in at $15 million. Series B and onward saw deal sizes shrank in 2022. We also saw this trend of heavy early-stage investment in 2021 and will likely see it continue in 2023. So, if you’re an early-stage startup, pre-seed, seed, or Series A, the investment trend is in your favor.

Digital health startups selling direct-to-consumer products or services—which were on top of the world in 2021—had a bit of a scare in 2022. That is, while the funding environment favored D2C startups in 2021, it was less favorable in 2022. First, startups selling DTC made up just 37% of all digital health companies that raised in 2022, compared to 43% in 2022. Sure, a difference of 5% doesn’t sound too bad. But the economic climate heading into 2023 doesn’t sound like it will improve.

As a recession looms, consumers will be less willing to spend money on the next wearable or mental health meditation app. Startups have known this. Throughout 2022, we saw companies like Calm and Oura shift to a business-to-business strategy, launching new offerings for employers and payers. Expect more D2C companies to shift to a B2B strategy to preempt decreased consumer spending during a recession (no matter how impactful the recession is).

In summary, digital health funding in 2022 returned to baseline after a monstrous funding year in 2021. Decreased funding resulted from unfavorable economic conditions, including supply chain issues, inflation, and increased interest rates. While all digital health startups suffered in 2022, some did better than others. Early-stage startups were more likely to land large Series A funding (average deal size: $15 million) than Series B and later deals. On the other hand, direct-to-consumer startups suffered as consumers sheltered their money in a high-inflation environment. Expect the same funding climate and patterns in 2023, especially with a looming recession.

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.