08 October 2022 | Healthcare

Digital Health Funding in Q3 Comes to a Halt

By workweek

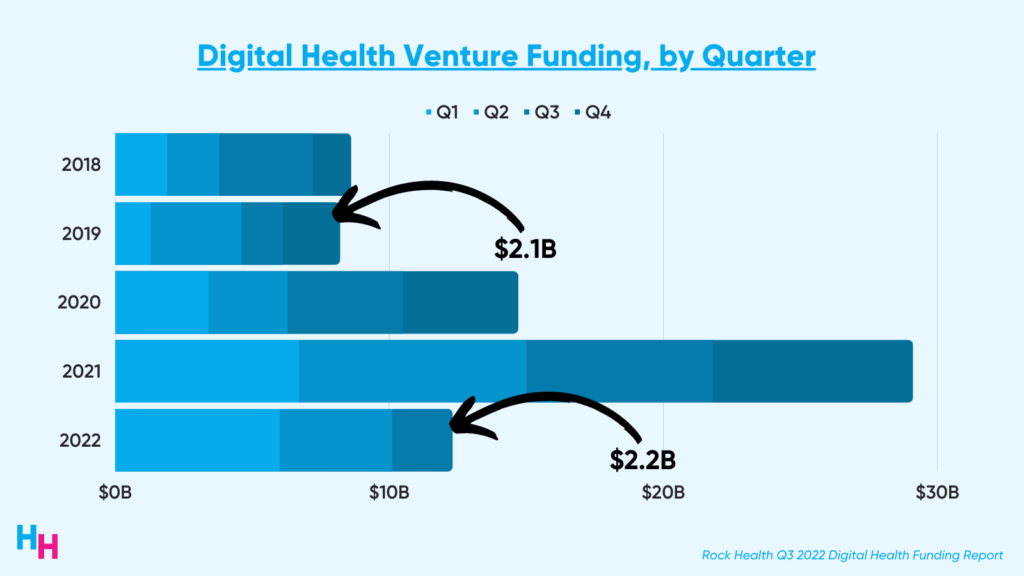

Digital health funding reached a relative halt in the third quarter of 2022 with only $2.2 billion in funding raised across 125 deals. This is the lowest funding for digital health since the fourth quarter of 2019. If this funding trajectory continues into Q4, 2022 funding may barely reach half of 2021’s total funding.

The Deets

Overall, digital health funding has slowed significantly in 2022 compared to 2021’s digital health explosion. Fundraising in each subsequent quarter this year has only slowed. However, while total Q3 funding decreased by 50% from Q2, the total number of deals made only decreased by 15%.

The majority of the 125 deals made were for early-stage funding. Late-stage funding was nearly absent, with only six funding raises for Series C or higher. For some perspective, there was an average of 22 deals for Series C or higher throughout each quarter of 2021.

Why was funding so slow in Q3? The authors of the Rock Health report give three reasons:

- Companies accelerated their 2022 funding rounds by raising towards the end of 2021 while the funding was hot. Perhaps “hot” is an understatement to describe the amount of funding raised in 2021, which is why I say funding was exploding.

- “Missing rounds” may account for underreporting of funding. Companies may have gone after extension rounds behind closed doors to prevent publicizing cash needs, which may be perceived as a bad look.

- Companies may have just forgone fundraising and instead leaned-up operations, as evidenced by the massive layoffs throughout the past two quarters.

Given the year’s choppy venture waters and public market correction, investors are holding back from the market, waiting to strike once things stabilize.

Rock Health

#Trending

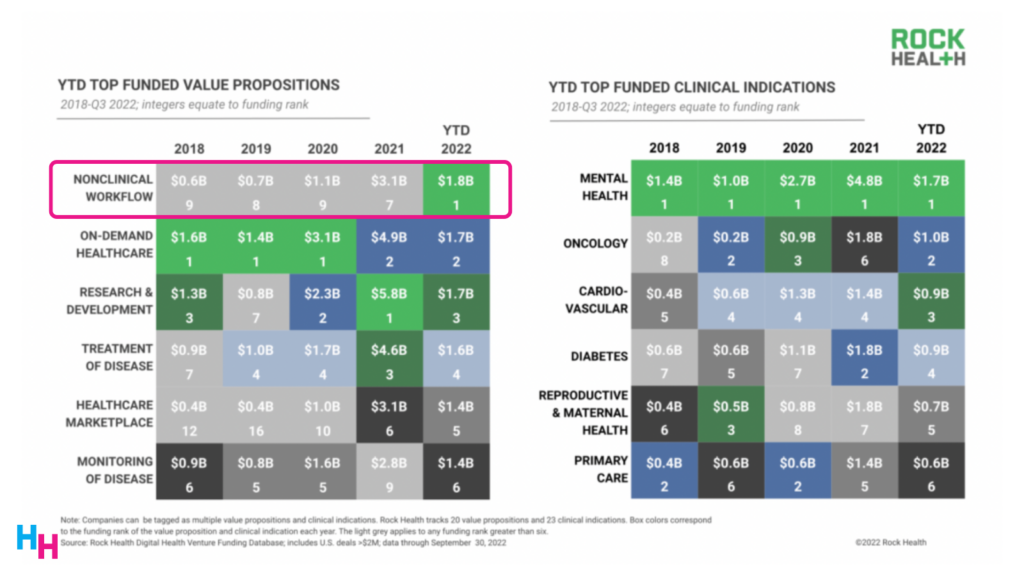

Funding for nonclinical workflow was the most funded value proposition, totaling $1.8 billion in Q3. Nonclinical workflow funding jumped from 7th place to 1st place in just one quarter, demonstrating that investors may be shifting focus to streamlining workflows to prevent healthcare workforce burnout. Companies within this workflow category include Alma (raised a massive $130 million), Grow Therapy ($75 million) and Tebra ($72 million). Workflow companies were essentially unheard of in 2021, and now they’re trending, something I’ve covered here and here.

Mental health remains the number one spot for top-funded clinical indications, with $1.7 billion raised in Q3. On the rise, however, is oncology funding, which jumped from 6th place to 2nd place, with $1.0 billion in funding.

Dash’s Dissection

I’m a workflow fanboy, whether it be clinical or nonclinical. Recall, compared to peer nations, the U.S. ranks dead last in administrative efficiency, which refers to health systems’ ability to reduce bureaucratic paperwork patients and clinicians encounter. Bureaucracy is a significant contributor to healthcare workforce burnout and is the one thing I dread most about becoming a practicing physician in the U.S. In my last discussion on quarterly digital health funding, I predicted that clinical and nonclinical workflow companies would start being the top-funded value propositions.

[https://twitter.com/jareddashevsky/status/1547252274690498560]

I guess I was right, except it didn’t take a decade for the workflow value proposition to reach a top funding spot. It took only one quarter.

Clinical and nonclinical workflow companies are perhaps more scalable than, let’s say, mental health companies. The main reason is digital mental health companies require mental health providers to provide their services through the companies’ tech-enabled services. Mental health providers are a hot commodity since there are not many of them. Workflow companies, however, don’t require providers as a means to deliver their services. Therefore, workflow companies can quickly establish their technology in private practices or health systems, improve workflows, and scale from there.

Overall, I’ll double down on my stance that the workflow value proposition area will continue to become a heavily-invested area.

Dive Deeper

- 2021 digital health funding explosion (link)

- What’s next for digital health? (link)

- H1 digital health funding breakdown (link)

- How to make outpatient scheduling more efficient (link)

If you enjoyed this recap, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.