Join 11,000+ thoughtful healthcare professionals, executives, investors, and consultants and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Q3 Earnings Highlights from HCA, Tenet

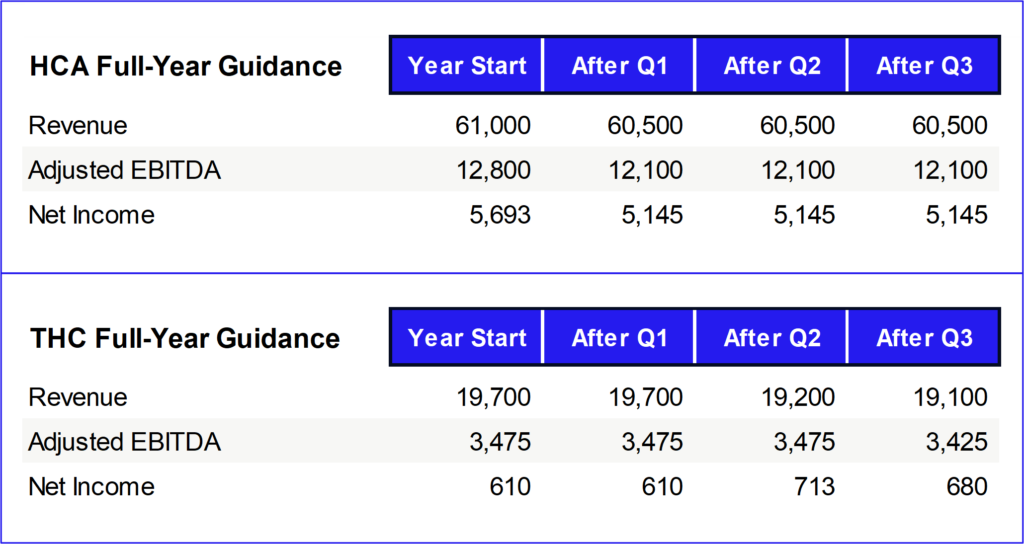

Q3 earnings are in full swing and the two best public hospital operators, HCA and Tenet, dropped their reports this week. Narrator: “it didn’t go well.”

Tenet stock sold off over 30% while HCA fell just under 10% on the day (and has since recovered quite a bit of that).

Themes to know: Remember that the hospital operators on their Q2 calls expected a return to normal utilization in the back half of the year and in 2023. The big 3 issues facing these guys right now are labor, low volumes as a result of shortages, and finally, inflation.

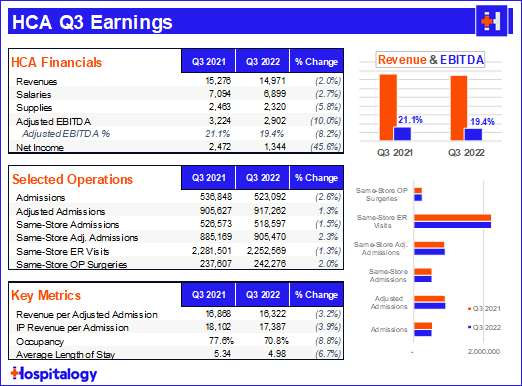

HCA highlights:

- Saw a stability in volumes, payor mix, and acuity during Q3. HCA mentioned that Q3 from ‘21 isn’t super comparable since there was a huge Delta surge (13% of admissions were ‘Rona related in ‘21).

- HCA expects demand/volume growth of around 1-2% (lower than normal) but inflation remains a huge unknown. They’ll give more guidance in January.

- For labor, HCA continues to invest in its nursing programs (Galen college of nursing). HCA’s contract labor cost dropped 19% from Q2 (and 7.2% of total salaries, wages, & benefits expense, down from 8+% in Q2) which really is a good sign – if even HCA can’t temper travel nursing costs, then no provider can. This drop was offset by nurse market wage increases, an average of over 4% over Q2. Supply costs were stable – another good sign.

- Mid-single digit rate lifts on commercial payor contracts, consistent with Q2 commentary

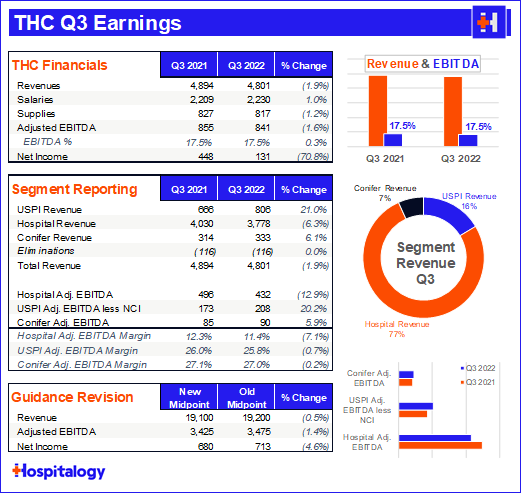

THC highlights:

- The more notable earnings call here was Tenet. Since it dropped 30+% on the day, I really wanted to understand what happened here. The theme of the quarter seems to be…delays.

- Really the underperformance boils down to higher than normal cancellation rates and closures due to Hurricane Ian, but also from supply chain issues related to delays opening de-novo ASCs with Tenet’s recent purchase of SurgCenter Development ASCs, most of which were in developmental stages. Tenet also noted a slowdown in the buy-up of shares from physician minority shareholders at ASCs, something they are NOT going to push since physicians are extremely valuable to their USPI business model.

- Tenet got hit hard by another wave of Omicron in July which led to inflated contract labor costs (7.4% of SWB, up from 6.2% in Q2).

- Sequestration and 340B changes are expected to be a $80M headwind in 2023 ($40M each)

- Commercial rate lifts in the 3-5%

Resources:

- HCA Q3 transcript

- HCA Q3 press release

- THC Q3 transcript (SA Paywall)

- THC Q3 press release

Cerebral Lays off 1,000 Employees

Everyone’s favorite mental health company to rag on just received some more bad news: Cerebral is laying off 1,000 employees, reducing its workforce by 20%. It’s been 4 months since Cerebral announced its first round of layoffs, and just 10 months since it raised $300 million from Softbank and others in a December round.

Despite my desire for us to try and move past what happened with Cerebral and rooting for the next phase of the company, this news is an abject failure on 3 levels:

- Venture capital, for perpetuating grotesque incentives through a $4.8B valuation and a growth at all costs mindset.

- For mistreatment of employees, who have either been laid off or misled on internal communications and company initiatives.

- For patients, who are losing access to care across markets. Maybe they’ll end up getting better care elsewhere.

Madden’s Musing: Operations and investigations aside, it’s not just Cerebral performing poorly. Other virtual mental health providers aren’t immune to market conditions. Calm laid off 20% of its staff in August. It’s a sign of frothiness (AKA, valuations that didn’t make sense) in a competitive, crowded area of healthcare. Still, I have to wonder what percentage of venture dollars are being spent on legal fees.

Apple Health Insurance: Coming to you in 2024?

An analyst at CCS Insight is predicting that Apple will offer an insurance product as soon as 2024.

Madden’s Musing: Jared wrote a great deep dive on what this might mean for the future of big tech and healthcare, but I’m skeptical that Apple really has anything to offer right now that might give it an edge in insurance. The much more likelier option (IMO) is that Apple partners with someone like Humana and offers a few MA plans that provide Apple-based perks – perhaps to a group like veterans. (a la the United-Walmart partnership)

Market Movers

M&A Updates:

- Prime Medicine raised $175M in its IPO this week.

- Cano Health plummeted 42% after CVS was rumored to walk away from acquiring the value-based player. Yikes.

Partnerships & Strategy Updates:

- Calm announced a major move to B2B, launching Calm Health which will be accessible to payors, providers, and self-insured employers.

- Crossover Health is looking to expand into working with payors. Currently the primary care platform only offers its services to self-insured employers.

- Morgan Health is opening 3 ‘advanced’ primary care sites with Vera Whole Health.

- Allina Health and Flare Capital Partners launched Inbound Health with a $20M raise, which is designed as an infra and enablement company for the hospital and SNF@Home space.

- Northeast Georgia Health System launched a new venture arm through a partnership with Prinnovo. “The system will partner with these startups to rapidly co-create, pilot, validate and scale their solutions in the healthcare market. Validated companies will then be considered for investment by NGHV and their investment partners.”

- Direct primary care network Decent announced a partnership with One Medical. There were other interesting tidbits in the presser about direct primary care, too.

- Humana expanded its partnership with Cohere Health for prior auth and other admin services.

- Solv launched its same-day patient booking platform Solv Connect in partnership with Carbon Health.

Policy & Regulatory Updates:

- Home health agencies and advocates are now questioning the legality of CMS’ proposed rate cuts.

- An upcoming court case to be aware of related to Medicaid and safety net funding.

Other Random Updates:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- LifePoint Health has rebranded to Lifepoint Health. Thank. Goodness.

- There’s a potential ‘triple-demic’ brewing as the flu, ‘Rona, and now RSV is straining pediatric hospitals.

- Both UMass and UW Medicine are giving significant raises to nurses.

- An estimated 333,942 healthcare providers dropped out of the workforce in 2021, according to an Oct. 20 report from Definitive Healthcare. That includes 117k physicians, which would amount to around 10% of all active physicians. Many more are approaching retirement and this is an alarming trend.

- OneOncology’s physician oncology communications platform has moved to Slack.

Miscellaneous Maddenings

- New season of Apex is here! Call of Duty is about to drop! I’ll just be inside for the next couple of months, you guys are gonna have to get healthcare news somewhere else.

- “Did you know that the ‘club’ in club sandwich stands for ‘chicken and lettuce under bacon? That’s lame as hell” – my wife

- So funny story – I interned at a company called RealPage, which provides rental property management software in Dallas back in the day. Well it turns out they were accused of colluding for setting rent prices in multiple markets through their pricing algorithm!! Wild times fam. I guess health insurers aren’t the only ones forming cartels!! If only I had known back in 2015…

Hospitalogy Top Reads

- Turquoise Health published a super interesting study on the state of price transparency in healthcare. Read it here!

- An interesting essay on how Digital health is just e-commerce

- Trilliant Health published its latest report on trends shaping the health economy in 2022.