18 February 2023 | Healthcare

Do Weight-management Startups Have a Future?

By workweek

A version of this story was published first on MedPage Today

The effectiveness of GLP-1 agonists—e.g., semaglutide (Wegovy)—in reducing weight has caught nationwide attention, causing a frenzy among celebrities and the wealthy to get their hands on the drug. It has also prompted startups to launch new weight management programs.

The weight-management space is the next “big” space. In my opinion, the weight-management space may follow the same path the mental health space experienced over the past couple of years.

Given the increasing popularity of the weight-management space and the inevitable flow of funding, it’s critical to understand the area’s moving parts. In this article, I’ll highlight novel anti-obesity medication and obesity data, discuss the current state of the weight-management space, and predict whether weight-management startups have a future.

The Deets

2022 was an inflection point for obesity treatment.

Novo Nordisk, Eli Lilly, and Amgen’s novel obesity medications demonstrated impressive results in clinical trials (which I’ve summarized here). These anti-obesity medications target three types of receptors throughout the body: GLP1R, GIPR, and glucagon-R.

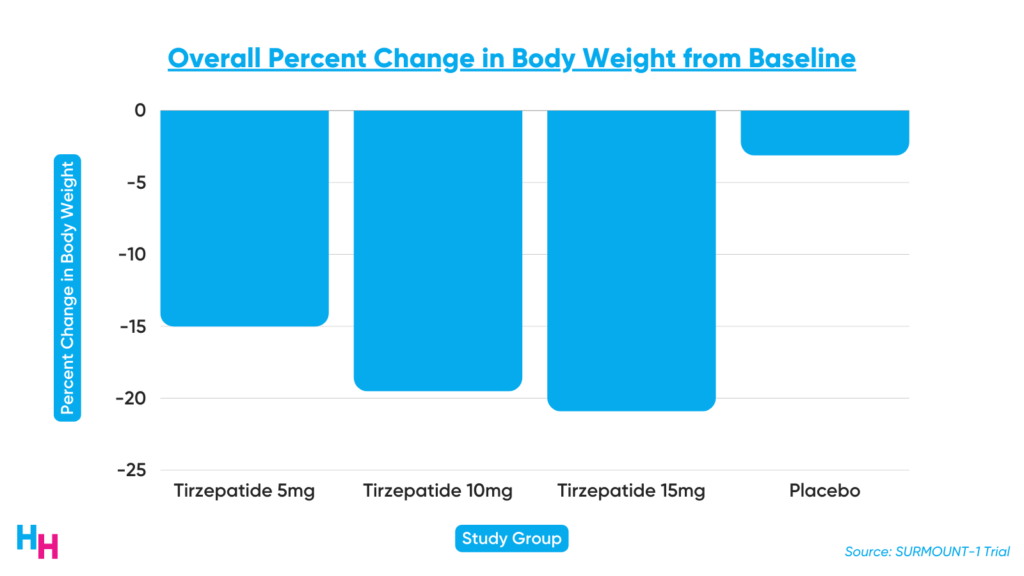

There’s still a lot of unknown regarding how manipulating GLP1, GIP, and glucagon receptors induce weight-loss effects. However, we do know that activating or blocking some of these receptors increases insulin secretion, decreases blood glucose, and suppresses appetite. Consequently, weight loss and improvement in cardiometabolic health are achieved. Take a look at Eli Lilly’s tirzepatide data from the SURMOUNT-1 trial, which led to the FDA granting it fast-track designation.

The effectiveness of these anti-obesity medications has caused much excitement in the medical community. We finally have effective medication to treat a disease whose prevalence continues to increase at a dangerous rate among all age groups.

However, physicians aren’t the only ones who are excited about the new tool in their toolkit to treat obesity and improve patient care: startups are also excited. I’d say thrilled, actually.

The Current State of Obesity Care

Startups are thrilled about these novel anti-obesity medications for one other reason besides improving obesity care—the money.

The total addressable market for obesity care is vast:

- 42% of adults have obesity, up from 30.5% two decades ago.

- 9.2% of adults have severe obesity (up from 4.7% two decades ago).

- 20% of children (2 to 19 years old) have obesity.

The prevalence of obesity is a bit more nuanced as you break it down further into race/ethnicity and income:

- 50% of non-Hispanic Black adults have obesity (Hispanic: 46%; non-Hispanic white: 41.4%, Asian: 16%).

- Around 25% of Hispanic and non-Hispanic Black children have obesity (non-Hispanic white: 17% and Asian 9%)

- 20% of children in low- and middle-income families have obesity compared to 11% in high-income families.

Caring for children and adults with obesity costs the health system $173 billion (as of 2019), with medical costs nearly $2,000 more for patients with obesity compared to patients without it.

Suffice it to say obesity is an area that requires significant innovation to improve the health of Americans. Cue the startups.

Startups tackling obesity fall into several areas, including weight-loss coaching, nutrition counseling, “dieting,” medical or surgical therapies, and fitness. Some startups tap into all of these different areas, while others focus just on one.

I use the term “weight management” to classify companies that focus on weight-loss and obesity care. The two share similarities but are quite distinct. Weight loss companies are for anyone who wants to lose weight while obesity care is for those who have overweight or obesity (recall the demographic data from above). The markets and approaches are different, which I’ll describe in a future article.

Dash’s Dissection

Here’s what I predict will happen to startups offering new weight-management programs with anti-obesity medication.

Established virtual care startups will start launching new weight-management services, and new virtual care startups will follow suit. These startups’ business models will likely be primarily direct-to-consumer, meaning they’ll target you, me, and our patients through social media advertisements, drawing us to their website. We’ll insert our health data (weight, height, medical history) to see if we qualify for their weight management program, through which we can gain access to semaglutide.

The onboarding process for these startups’ weight management programs will be remarkably frictionless. On certain startups’ websites, you’ll see some already have a dedicated team to work with insurance companies to cover medical treatment. This is critical since it’s really the medication treatments, like semaglutide, that are driving the weight loss in the short-term, not so much the coaching and dieting programs.

As startups increase access to semaglutide (whether truly indicated or not), insurance companies will become more stringent with approvals through prior authorization requirements and other barriers. They have already become stricter.

So, what happens now if patients can’t get insurance coverage?

Consumers will have to pay out of pocket. But it will be the wealthy demographic uniquely able to afford out-of-pocket costs. This will widen the socio-economic disparities seen in patients with overweight and obesity. In fact, this is already happening, especially among patients of color and Medicare-covered populations.

As the total addressable overweight and obesity market becomes restricted to wealthy consumers, startups will likely add a business-to-business (B2B) approach to their business model. This means they’ll target employers, payers, or even health systems. They’ll partner with these stakeholders to provide overweight and obesity care to their employees or beneficiaries, taking control of the entire care episode. The B2B approach will almost certainly drive more revenue than the direct-to-consumer approach since businesses have more capital than consumers.

Investors will flock to the weight management area, pumping money into these startups like they pumped money into digital mental health startups in 2021. Similar to digital mental health startups, this weight management space will become oversaturated.

How will startups differentiate themselves?

I believe startups will differentiate themselves by offering integrated, sustainable care targeted at the populations who need it most (again, recall the demographic data from above!). These startups will engage with payers, health systems, and employers to take full ownership of managing care for patients with overweight or obesity. They’ll offer nutritional counseling, behavioral therapy, lifestyle coaching, medical treatment, and surgical treatment. Some startups may even be open to risk-based contracting to take on all the risk in caring for these patients. In my opinion, startups taking the integrated and sustainable approach to overweight and obesity treatment are the most financially and morally valuable.

Those not taking the B2B, integrated, and sustainable approach may find themselves in a situation like digital mental health company Cerebral. In brief, according to a reported memo written by three Cerebral board members, the market perception was that Cerebral ran an Adderall pill mill. The company targeted consumers on social media, drawing them to its website. There, consumers could quickly fill out some medical and psych details, speak with a provider, get diagnosed with ADHD, and get a prescription. That easy. But Cerebral was investigated for its prescribing practices and its path forward is unclear as the company works to restructure.

This is all to say, the direct-to-consumer startups offering weight-loss programs with these anti-obesity medications will likely be investigated for inappropriately prescribing semaglutide to patients who aren’t indicated (not overweight or obese).

In summary, novel anti-obesity medication like semaglutide remarkably reduces weight, making the weight management space attractive for investors and entrepreneurs. Even more attractive is the total addressable market of patients with overweight or obesity. However, it will only be those startups delivering integrated and sustainable care to the populations who need it most that will perform well in the long run.

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.