17 December 2022 | Healthcare

The Future of Obesity Care

By workweek

2022 was an inflection point for obesity treatment. Novo Nordisk, Eli Lilly, and Amgen’s novel obesity medications demonstrated impressive results in clinical trials. These medications not only reduced weight but improved overall cardiometabolic health.

So, is the end of the obesity epidemic near? Not quite. But we’ll soon have a remarkable pipeline of obesity medications at our disposal that function as Swiss Army knives.

In this article, I’ll highlight the clinical trial results for some obesity medications in 2022, discuss the future of obesity management, and dive into the challenges to ending the obesity epidemic.

The Swiss Army Knives

Novo Nordisk, Eli Lilly, and Amgen all announced stellar—and I don’t use that word lightly—results from their clinical trials of novel obesity medications. I’ve highlighted some of these trials throughout 2022, including Novo Nordisk’s semaglutide, Eli Lilly’s tirzepatide and retatrutide, and Amgen’s AMG133. I’ll summarize them later below.

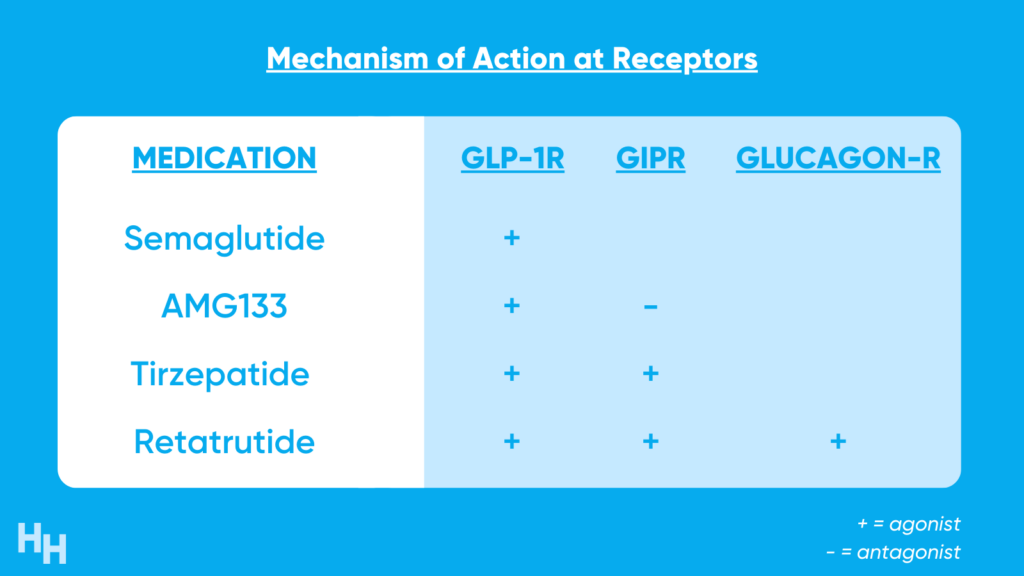

Before touching on the clinical trial results, it’s essential to understand each of these medications acts on one, some, or all of the following receptors: GLP1R, GIPR, and glucagon-R. These receptors are located throughout the body and have neuro-cardio-metabolic effects, hence why I call them Swiss army knives.

There’s still a lot of unknown regarding how manipulating GLP1, GIP, and glucagon receptors induce weight-loss effects. However, we do know that activating or blocking some of these receptors increases insulin secretion, decreases blood glucose, and suppresses appetite. Consequently, weight-loss and improvement in cardiometabolic health are achieved.

Medications targeting GLP1 and GIP receptors were initially purposed to manage type 2 diabetes. However, patients on these medications exhibited profound weight-loss, prompting Novo, Lilly, Amgen, and other pharma companies to investigate how these drugs can be used specifically to treat obesity. I highlight some of 2022’s clinical trials below.

Tirzepatide (Eli Lilly)

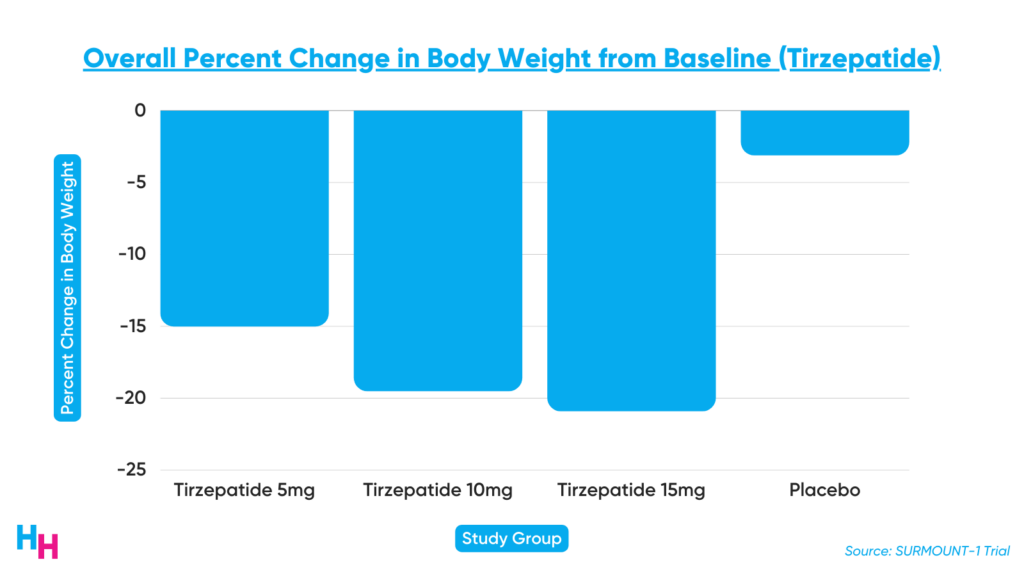

SURMOUNT-1 was a 72-week-long Phase III, double-blind, randomized control trial, including 2,500 participants with a BMI over 30, or 27 with more than one weight-related comorbidity that’s not type 2 diabetes. At the end of the 72-week study period, participants’ body weight decreased by 16% in the low-dose group, 21% in the medium-dose group, and 23% in the high-dose group. Those in the placebo group only lost 2% of their body weight.

Additionally, metabolic health indicators improved in the tirzepatide groups. For example, participants receiving the drug saw a 20% decrease in triglycerides, a 7.5% decrease in non-HDL lipids, and a 39% decrease in fasting insulin (this drug is also an anti-diabetic drug). Also, HDL levels improved by 9% in the tirzepatide groups.

The FDA granted tirzepatide fast-track designation based on these promising results. However, before the FDA approves tirzepatide, Lilly must complete its SURMOUNT-2 clinical trial (Summer 2023), which will include patients with type 2 diabetes.

Retatrutide (Eli Lilly)

Lilly announced their Phase II clinical trial of retatrutide showed participants with obesity receiving the drug had a 24% decrease in weight after 48 weeks. Official results have yet to be published in a peer-reviewed journal. Lilly will move to Phase III trials.

Semaglutide (Novo Nordisk)

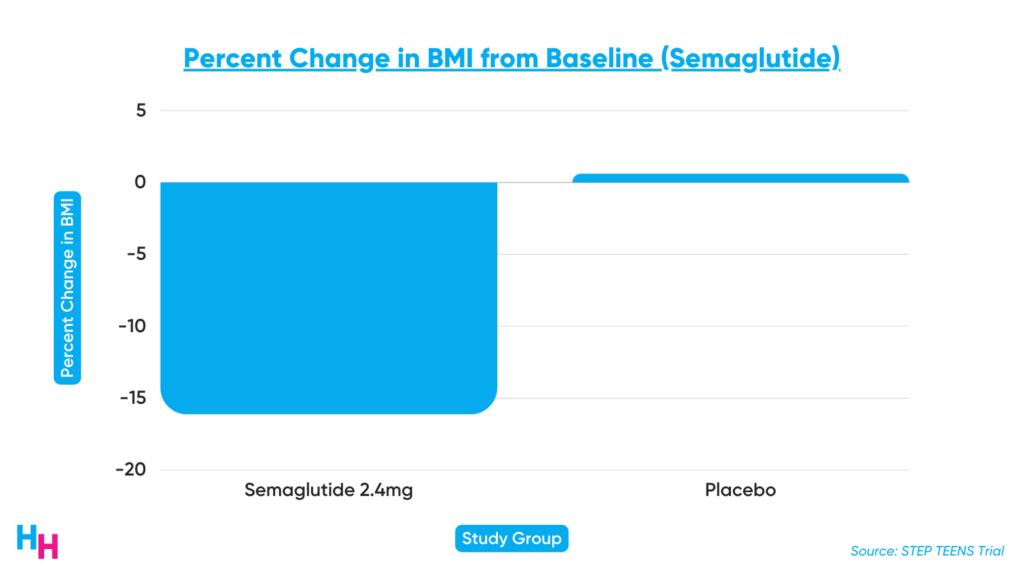

STEP TEENS was a 68-week-long Phase III, double-blind, randomized control trial, including 201 adolescents with a BMI greater than or equal to the 95th percentile or 85th percentile with at least one weight-related comorbidity. Those receiving semaglutide had a significant 16% decrease in BMI compared to baseline, while those on placebo had a 0.6% increase. Additionally, 73% of those receiving semaglutide lost 5% or more of body weight compared to 18% of those in the placebo group.

Semaglutide is already FDA-approved to treat obesity in adults after Novo’s Phase III trial showed an average 15% decrease in body weight for those taking semaglutide. This is the drug that the news continues to chat about because celebrities have taken it for weight-loss. Novo’s semaglutide has faced disruptive supply chain issues, causing shortages in the drug (this is not due to celebrities taking the medicine… they make up 0.000001% of the population).

AMG133 (Amgen)

Amgen announced their Phase I clinical trial of AMG133 resulted in significant weight-loss compared to placebo participants. The trial enrolled 110 participants to test the safety and optimal dosage of the drug. After 85 days, those in the high-dose group lost 15% of their body weight, those in the low-dose group lost 7%, and those in the placebo group gained 1%. Amgen will start Phase II trials as soon as possible. We’re still waiting for official results in a peer-reviewed journal.

The Future of Obesity Care

With highly-effective anti-obesity medications available or in the pipeline, what does the future of obesity management look like? I have three predictions:

- Direct-to-consumer (D2C) and business-to-business (B2B) obesity management startups will launch and transform the weight-loss marketplace.

- Anti-obesity medications will serve as adjuvant therapy in those with severe obesity needing bariatric surgery.

- Early intervention obesity treatment programs will pop up targeting adolescents with obesity.

The Rise of D2C and B2B Weight-loss Startups

D2C weight-loss startups will continue to pop up, offering medical weight-loss treatment with drugs like semaglutide. As more startups launch, existing companies will remain competitive by finding ways to lower the cost of semaglutide, which is quite unaffordable, especially if insurance doesn’t cover it. The most successful companies will offer comprehensive weight-loss management, including medical treatment, nutritional coaching, psychological coaching, and fitness coaching. While taking semaglutide alone works wonders, a more holistic approach to weight-loss management will likely be more sustainable.

Since semaglutide is largely unaffordable, the total addressable market will hit a ceiling if D2C startups can’t sustainably lower the drug’s cost for consumers, prompting the rise of B2B companies. These B2B weight-loss startups will target employers and payers, promoting healthier employees and beneficiaries, resulting in decreased medical spending. Employers and payers will take on more cost-sharing to make drugs like semaglutide affordable. I believe B2B is the way to go instead of D2C, especially since we’re seeing a growing trend in the mental health space (e.g., Calm) of originally D2C companies shifting to B2B.

Bariatric Surgery Adjuvant Treatment

Novel anti-obesity medications like semaglutide will become an adjuvant treatment for bariatric surgery. This isn’t my prediction, but Dr. John Morton’s, a bariatric surgeon and obesity expert at Yale. Earlier this year, I said bariatric surgery would die out with the advent of these medications. But opinions can change, right? So, I agree with Dr. Morton in that bariatric surgery plus semaglutide can serve in much the same way as those undergoing a CABG procedure remain on statins. Therefore, I predict bariatric surgery may become even more popular as patients recognize the benefits of the potential combination of the surgery with an effective anti-obesity medication like semaglutide.

Early Obesity Intervention Programs for Adolescents

Early obesity intervention programs will become more prevalent as clinical trials support anti-obesity medications’ efficacy in adolescents. Obesity has compounding effects on the body, leading to a five to 20-year decrease in life expectancy. Early intervention is critical.

While these early intervention programs will leverage medical treatment, they’ll also incorporate digital health to engage the younger generation better. This will include wearable technology to monitor vitals, machine learning technology to track progress and monitor treatment response, and social media tools for motivation (e.g., features that show what you may look like if you lose 10 pounds).

Dash’s Dissection

Obesity is a national epidemic, affecting two out of five adults and one out of five children and adolescents. As I said earlier, obesity has compounding effects on the body. Untreated obesity leads to cardiovascular disease, cerebrovascular disease, and type 2 diabetes (which, itself, leads to a range of adverse health effects like renal disease, retinopathy, and microvascular disease). Given these downstream effects, it’s no surprise medical costs for obesity are over $170 billion annually. That’s more than Apple makes in global annual iPhone sales!

I should emphasize that obesity is a chronic, degenerative disease. To say obesity is simply caused by “eating too much” and “lack of physical activity” would be naive and ignorant. Obesity pathophysiology is complex, which is why these novel medications I discussed are true game changers.

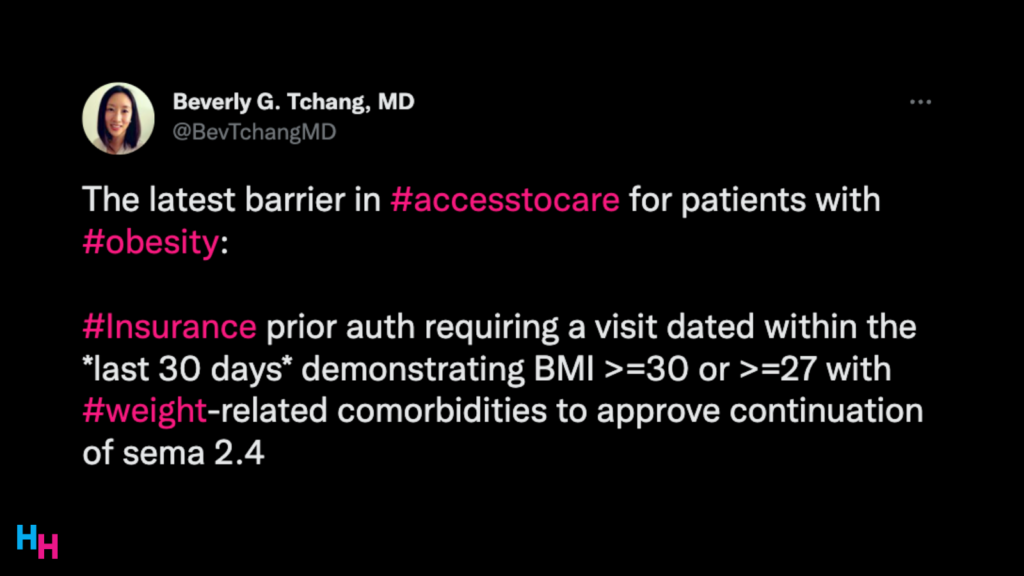

However, there are several challenges to achieving what I envision will be the future of obesity management. Foremost, insurance companies will do what they can to not cover these novel medications like semaglutide, limiting access. They will be stringent with their approvals. Sure, the long-term benefits of covering these medications would be cost-effective, but a patient seldom sticks with the same insurer throughout their lifespan. So, why would one insurer front the costs of an expensive medication if the patient may be off their health plan within a year?

Additionally, I imagine access to these novel anti-obesity medications is not made equitable. In that case, perverse health disparities will continue to permeate society, costing the health system money rather than saving the health system money. For example, the obesity rate for non-Hispanic Black adults is 50%, while it’s 41% for non-Hispanic White adults. If access to these effective anti-obesity medications is not made equitable, then these rates will only move farther apart from each other.

Lastly, these effective anti-obesity drugs will inevitably fall into the wrong hands, leading to stigma around those taking the medication for appropriate indications. Throughout this article, I tried to be careful with my wording when discussing these medications: they’re not weight-loss drugs. They’re anti-obesity drugs. While there is overlap, the indication of these drugs is for those with obesity, not for people who “just want to shed a couple of pounds for a wedding.” Similar to how Adderall has become stigmatized with the advent of pill-mill startups like Cerebral, anti-obesity medications will face a similar fate as more D2C and B2B weight-loss startups pop up.

In summary, 2022 was an inflection point in anti-obesity treatment, following several clinical trials supporting the efficacy of novel anti-obesity medications. The future of obesity management will be exciting with new startups, treatments, and public health programs. 2023 may be just as exciting a year for obesity management as 2022.

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.