11 March 2023 |

Is the Future of U.S. Healthcare UnitedHealth Group?

By workweek

Key healthcare stakeholders like payers, providers, and pharmaceutical services continue to battle harsh economic conditions caused by labor shortages and inflation. As these stakeholders adapt to such conditions, we’re seeing a shift in profit pools. This shift, highlighted by McKinsey’s recent report on the future of U.S. healthcare, speaks to critical profit trends in healthcare.

In this article, I’ll describe the current state of U.S. healthcare, discuss key findings from McKinsey’s future of healthcare report, and try to convince you the future of healthcare is UnitedHealth Group (as first suggested by Dr. Eric Bricker).

The Current State of U.S. Healthcare

U.S. healthcare is still much the same as a decade ago, characterized by its high spending, egregious uninsured rate, and razor-thin hospital operating margins.

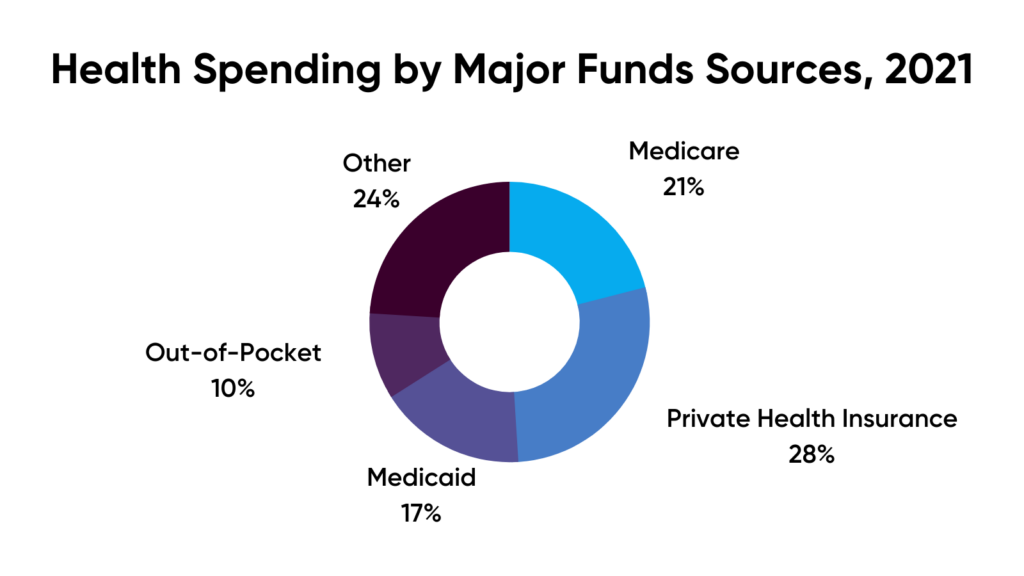

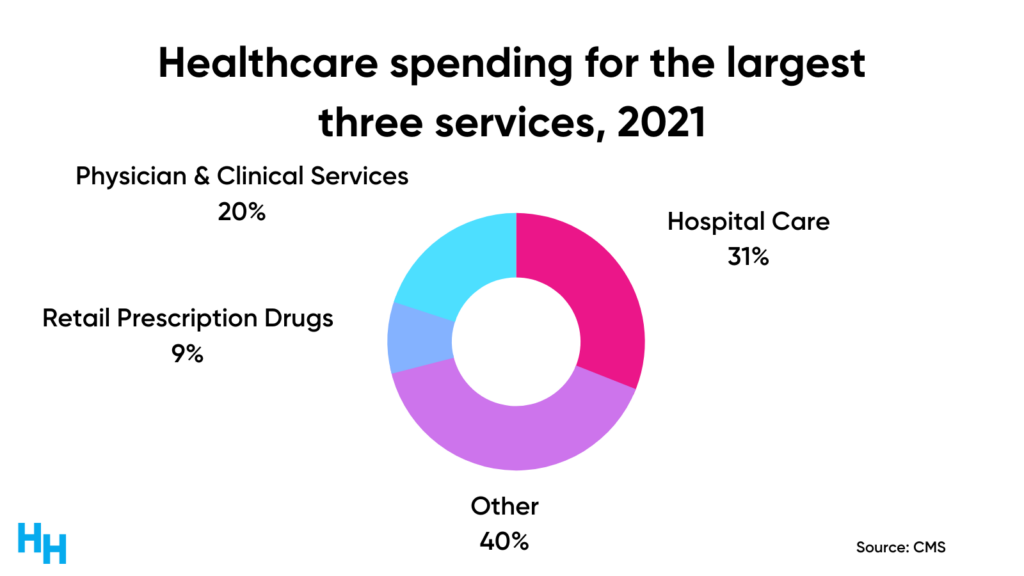

National Healthcare Expenditures (NHE) in 2021 grew 2.7%, reaching $4.30 trillion. I can’t even explain that number because it’s unfathomable. While NHE in 2021 slowed compared to 2020 (which saw a 10.3% increase), it still made up 18.3% of gross domestic product. Below demonstrates where the money is coming from.

Medicare NHE grew 8.4% in 2021, representing 21% of NHE by major funding source, with Medicare Advantage spending driving the growth (14.1% in 2021). MA is expected to make up 50% of all Medicare beneficiaries. Recall the MA market has been quite lucrative, making it an attractive area for providers, payers, and payviders (we’ll get to this soon).

While Medicare enrollment is growing with the aging population, Medicaid enrollment is about to decrease significantly, with the formidable Medicaid redeterminations starting in April. I covered the Medicaid cliff here, describing how the end of continuous enrollment may lead to millions uninsured. Currently, 8% of all Americans are uninsured.

Lastly, hospitals experienced their most challenging year financially in 2022 due to high inflation rates and increased labor expenses. Nearly half of all U.S. hospitals ended 2022 with negative margins. However, revenue-driving areas in the outpatient setting increased, like surgical centers.

So, given the current state of U.S. healthcare, what can we expect over the next couple of years?

The Future State of U.S. Healthcare Profits

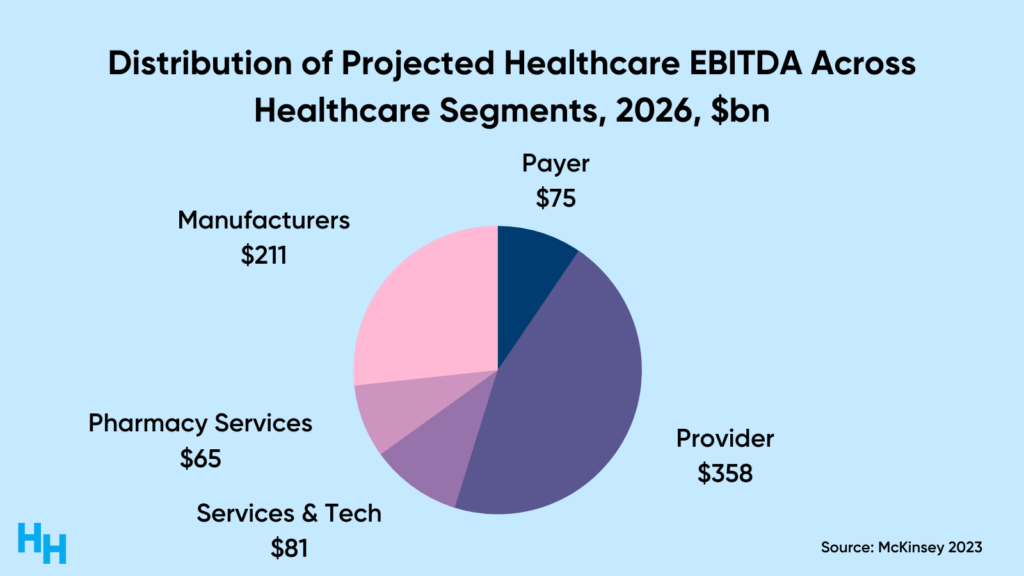

McKinsey researchers predict healthcare profit pools will grow at a 4% CAGR from $654 billion in 2021 to $790 billion in 2026. They break down profit pools into five different areas:

Many profit pools are experiencing growth within each category, but I’ll highlight the fastest-growing ones, especially as they relate to trends I’ve discussed in previous newsletters.

Payers

The payer profit pool is predicted to grow at an 11% CAGR, from $40 billion in 2021 to $75 billion in 2026. MA growth is driving these profit pools. Again, MA is a lucrative market since it allows payviders (UnitedHealth Group), for example, to take on high-risk (and highly reimbursed) patients while controlling costs to maximize profit. The government segment of the payer profit pool, which includes MA and Medicaid, is expected to be 50% greater than the commercial segment by 2026. Yes, the moneymaker will be government-funded (taxpayers, really) insurance—not private insurance.

Providers

The provider profit pools are estimated to grow at a 3% CAGR from 2021 to 2026, much lower than that of payers. But, the provider profit pool, which includes hospitals, office-based physicians, and post-acute care, will reach $358 billion by 2026—the largest of all profit pool segments.

The fastest growth within the provider profit pools comes from the office-based physicians, virtual healthcare, and pre-acute/non-acute segments.

- Office-based physicians: Value-based care models’ profit pools are projected to grow at a CAGR greater than 10% between 2021 to 2026.

- Virtual Care: Home health profit pools are expected to grow at a CAGR greater than 10% until 2026. I recently discussed the power of the home health movement here.

- Pre-actue/non-acute: ambulatory surgical centers and retail clinics’ profit pools are expected to grow at a CAGR between 5 and 10% until 2026. Care in these non-acute settings has significantly higher margins (two to three times higher) than the acute setting. Hospitals and PE firms will continue to shift focus to these non-acute settings.

Services and Technology

Health services and technology profit pools are expected to have a 10% CAGR between 2021 and 2026, to $81 billion by 2026. Software (13% CAGR) and data & analytics (19%) drive this growth. These profit segments focus on patient engagement, clinical decision support, and workflow capabilities. I’ve discussed in previous newsletters that I’m bullish on digital health technology that focuses on improving clinical and non-clinical workflows. Bureaucracy is killing healthcare and the delivery of medicine. Health services and technology is an important sector that can improve efficiency in healthcare.

Pharmacy

Pharmacy services profit pools are expected to grow at a 3% CAGR from 2021 to 2026, reaching $65 billion. Leading the growth are the specialty pharmacy and infusion services profit pools. Physician office and ambulatory site infusion profit pools are predicted to grow 11% CAGR until 2026. Home infusion is also expected to increase between 5 and 10% CAGR. As medicine shifts to more patient-centered care (convenience), care will shift into the home and more convenient outpatient settings compared to the inpatient setting.

The McKinsey report provides a deeper analysis, but the trends I reported above will be the trends I’m following over the next couple of years and will continue to write about.

Dash’s Dissection

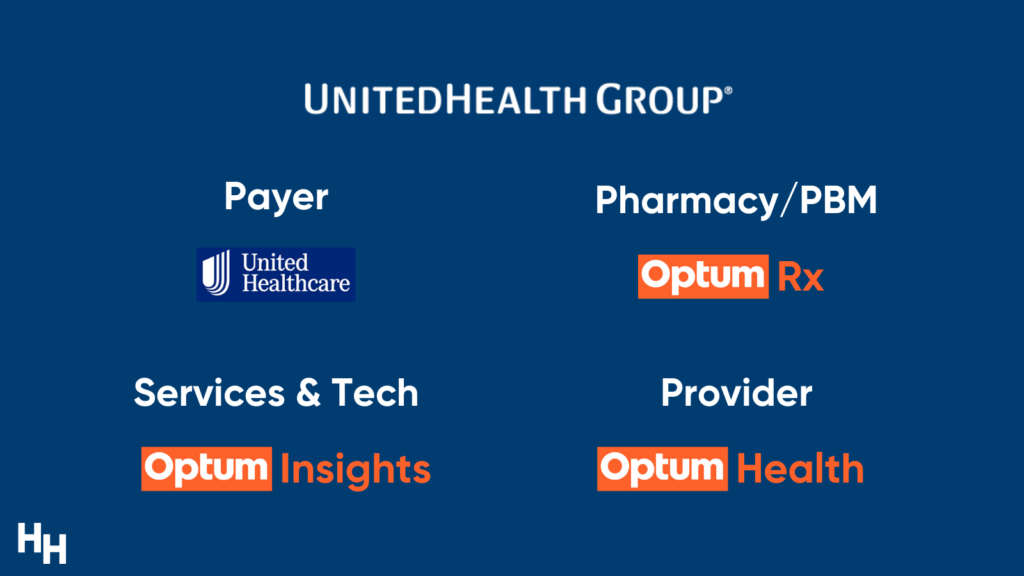

The future of U.S. healthcare is UnitedHealth Group (UHG). Or, at least, every large health insurer’s business models will mirror UHG’s.

UHG has already tapped into all of the critical profit pools I discussed. As Dr. Eric Bricker said in his video about the report: it’s as if McKinsey made the report for UHG.

UHG has consistently squashed its competitors regarding profits, raking in $20.6 billion in profit last year. Its biggest competitor, Cigna, posted $6.7 billion. UHG isn’t just a “payer.” Far from it. UHG is a payer and provider and offers health services & technology and pharmacy services.

The graphic below shows how UHG’s different verticals align with nearly each profit pool category the McKinsey report focused on. Note UHG owns the largest share of PBM and Medicare markets (Medicare Advantage!) among its competitors.

So, if McKinsey is saying government insurance segments, specialty pharmacies, virtual healthcare, and software & data profit pools will grow the quickest over the next few years, and UHG is already heavily invested in these areas, you’d think others should follow suit.

And that they are.

CVS is following UHGs playbook; CVS has Aetna (payer), Caremark (PBM), CVSspecialty (specialty pharmacy), CVS pharmacy (regular pharmacy), Oak Street Health (health provider, recently acquired), Signify Health (home health). All CVS needs data solutions like Optum Insight, and then CVS will have completed the UHG Playbook.

Humana is another company following the playbook, as discussed by Blake here. What’s interesting about Humana is that the company is exiting the commercial insurance market. That’s just not where the money is at. But, as McKinsey reported, the government segment of the payer profit pool, which includes MA and Medicaid, is expected to be 50% greater than the commercial segment (e.g., private insurance) by 2026.

Follow the money.

In summary, as healthcare stakeholders adapt to harsh economic conditions, we’re seeing a shift in profit pools. McKinsey researchers predict healthcare profit pools will grow at a 4% CAGR from $654 billion in 2021 to $790 billion in 2026. Health services and technology and payer profit pools are predicted to grow the fastest at over a 10% CAGR until 2026. Interestingly enough, all of the fast-growth profit pools reported by McKinsey are the profit pools UnitedHealth Group has already tapped into. It’s as if the McKinsey report is a report on UnitedHealth Group. Given these trends, other large payers will follow UHG’s playbook.

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.