If you’re reading this, it means that Hogwarts Legacy just released, and there’s a high likelihood I’ll be ignoring all personal and professional obligations today in order to play it. In fact, I’m probably playing it right now.

Maybe.

Actually strike that, I’m definitely still asleep considering that more CVS-Oak Street acquisition rumors released late yesterday. Keeping my nose to the grindstone!

If you want to sponsor Hospitalogy, e-mail me directly at [email protected].

Join 17,700+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Join the Hospitalogy event on February 16

I’m excited to announce the first Hospitalogy virtual panel of 2023!

Join me alongside Herd Midkiff and Kyle Kirkpatrick, healthcare experts and partners at one of the leading healthcare consulting firms, JTaylor.

The virtual event will cover interesting topics like:

- Why the payvider space will continue to dominate strategy in 2023

- Hospital and provider organization labor dynamics, from nurses to physician employment

- Primary care M&A

- and more!

It’ll be a fun, engaging time to discuss the latest trends in healthcare, and I hope you guys will join us on February 16th at 11am CT.

Rumor: CVS nears deal to buy Oak Street Health for $10.5B

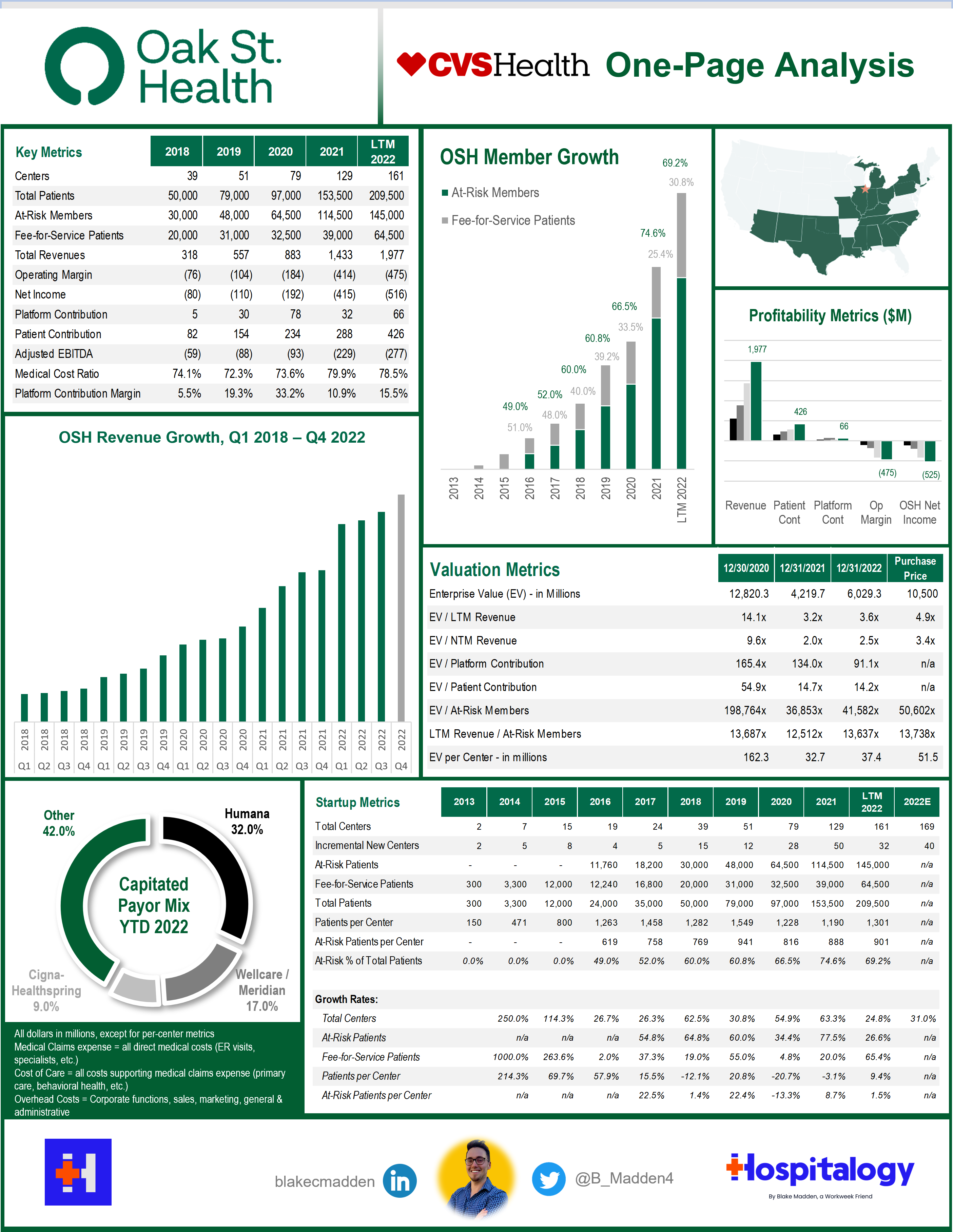

About 4 weeks after Bloomberg reported that CVS was rumored to be nearing a $10B deal to acquire Oak Street Health, the Wall Street Journal reported late last night (Aha! Hospitalogy wins again) that CVS is close to buying the value-based care clinic operator for $10.5B including debt, or $39/share. That’s a ~50% premium to its closing price yesterday of $25.96 and a helluva deal for Oak Street shareholders if you ask me.

Based on Oak Street’s revenue guidance of ~$3.1B and 2022 expected revenue of ~$2.15B, the purchase price provides an implied revenue multiple of 3.4x and 4.9x, respectively. Woof.

Blake’s Take: Alright, I’ll eat crow on this one. I admit defeat. When the initial news of this potential deal came out, I shot it down hard and fast, saying the deal didn’t make sense for a number of reasons. Although I still think my logic was pretty sound, it looks like the CVS team wanted to make this deal happen no matter what. Here’s some fun speculation:

- CVS overplayed its hand, stating its intentions way too loudly and resulting in a frenzy of primary care speculation. VillageMD is already light years ahead with its recent Summit deal, with Walgreens blundering along for the ride. Amazon got its hand in the cookie jar with One Medical – well, assuming the deal goes through that is; apparently the FTC’s new head is obsessed with taking down Amazon, once even called the ‘Amazon Antitrust Antagonist’ while Optum takes down physician after physician group, private equity rolls up every specialist in sight, and CVS buys Signify, let’s pay attention to things actually moving the needle Lina Khan, but I digress – and so, as a result of all the activity, CVS maybe…panicked a bit and snatched up the last major VBC clinic player on the block, Oak Street Health.

Here’s the thing, though. CVS is still dealing with all of those headwinds I mentioned in my last writeup. How will this deal affect its finances? Its use of capital, since Oak will need heavy investment? Its previously disclosed ability to buy back shares or pump out its dividend? Will this deal not dilute earnings? In the short term, CVS will be facing some notable headwinds. All eyes will be on CVS’ earnings call Wednesday.

All of that being said, an acquisition of Oak Street Health, if done right, is a long-term investment in the right direction for CVS. It finally has its long-awaited primary care platform. Maybe we’ll look back in 5-10 years and see one of the most successful health tech related M&A deals of all time. Or maybe we’ll see another goodwill impairment (looking at you, Livongo).

Final point – this deal and the One Medical deal provide recent precedent transactions and valuation multiples for scaled risk-based providers. Because of the hyper activity of strategic buyers, these players continue to have a clear floor value which will boost the industry forward.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Payors react to Medicare Advantage Developments

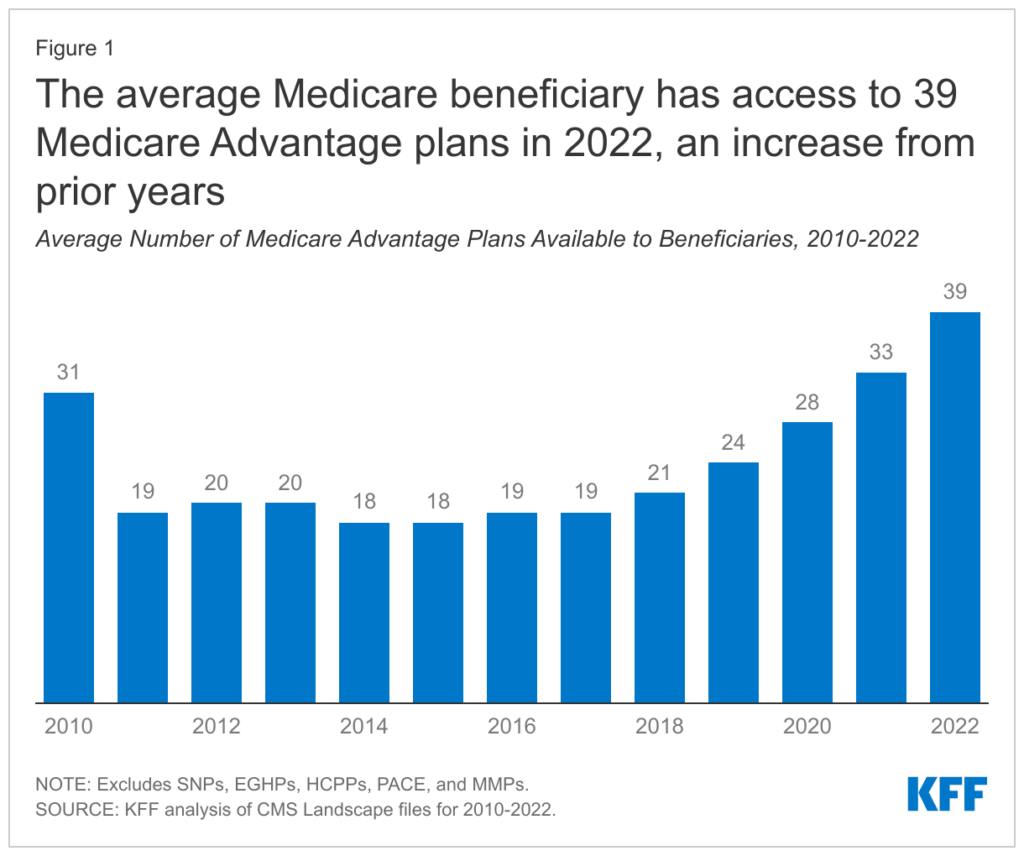

Lots of action in Medicare Advantage this week between payor full-year earnings and policy decisions coming in from CMS. Here’s what you need to know:

Advance Notice: CMS released its ‘proposed rule’ for Medicare Advantage and Part D payments. Overall, it’s expecting plan payments to increase by 1.03% in 2024.

RADV Audits: CMS has been checking a sample number of Medicare Advantage beneficiary medical records against their diagnoses to audit MA billing practices. In doing so, CMS found that the sample of records reviewed didn’t match up, leading to the conclusion that MA plans overbilled Medicare as far back as 2011. So, based the error rate generated by the sample, CMS is applying that same rate to all MA plans. In the final RADV rule, CMS is only recouping plan overpayments from 2018 and onward, excluding the first seven years of overpayments. For 2011-2017, CMS will only recoup non-extrapolated payments. So instead of CMS recouping all payments back to 2011 (a $2.4B impact), the non-extrapolated, actual audits amount to…$41M.

On the flip side, the 2018-onward claw back will amount to around $4.7B. For the years 2025-2032, CMS is estimating that RADV payments will hit $468M, ramping up to $702M by 2032 and is docking payor MA reimbursement by those amounts over the 7 years.

TL;DR – this result is much better than expected for insurers. To put this cut into perspective, based on a few analyses I’ve seen, the expected impact to the five biggest insurers’ medical loss ratios over those years is 10 basis points. For the non finance folks, that is a tenth of a percent. 0.1%.

- Payor reactions: So far, the payor and investment reaction to RADV stuff is “we’re glad they didn’t go back further than 2018, which is a net win, but we disagree with the exclusion of the fee for service adjustment. We also want to learn more about CMS’ methodology for the audits, which are a black box to us. We’re gonna sue the crap out of ‘em and delay this as long as possible.”

Moving forward, CMS will look to audit ~5% of MA plans, or 30 contracts per year. That could reach a more significant percentage if consolidation happens in the MA space, which I perceive as likely given that there is a plethora of plan access right now and MA plans are increasingly commoditized. As such, it’s possible that the prospective overpayments (that $468M-$702M) increases.

TL;DR: Big payors win. Litigation will happen. Big payors win. Lower revenue likely in 2024. Big payors win.

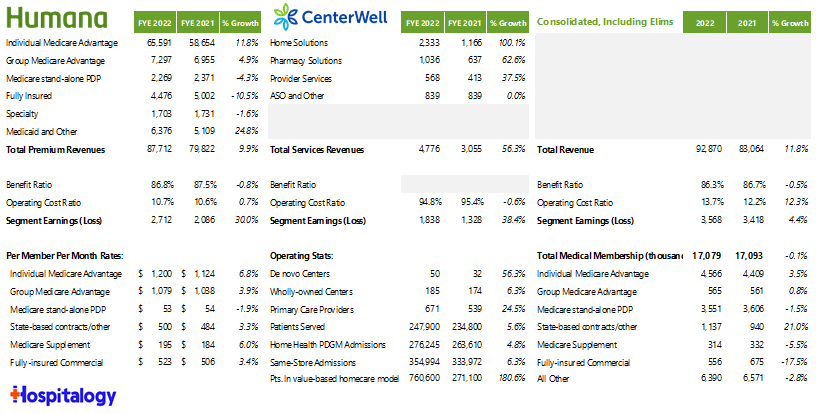

Humana commentary, which has significant exposure to MA:

On the RADV rule: “While we’re still reviewing the final rule and considering its impact, I will share some of our initial observations. First, we support CMS’ decision not to extrapolate the result of any audit payments for the years prior to 2018. As CMS acknowledged auditing such as time periods represent a unique challenge that may produce results that are not truly reflective of the plans compliance or coding accuracy. Important part of RADV ruling is the audit methodology. Therefore, we look forward to working with CMS to learn more about the methodology, including contract selection, sampling and extrapolation as a rule did not provide the details needed to fully understand the potential impact of the future audience.” Bruce Boussard, Humana Q4 2022

Cigna commentary , whose biz is ~5% MA:

On the advance notice: “…The initial rate letter that came out does have lower or somewhat anemic revenue, we’ll await the final rate letter that comes forward relative to that. Having said that, I think it’s a little bit early to presuppose what 2024 growth outlook may look like because you compete on a relative basis. Having said that, this will create, if it stays in the range of what the rate letter looks like. It will create some revenue dislocation. So the sophistication of benefit management that’s going to be necessary market by market. The leverage of value-based care relationships, which, as I noted earlier, about 75% of our MA lives are in a value-based care relationship will all come into play. I reinforce the fact that the 10% to 15% is our objective to have 10% to 15% customer growth over time on average. We’re stepping into this year with a very good customer growth outlook already that we feel good about. And as a final note, I would remind you that while an attractive long-term growth opportunity for us, today, this represents or MA represents less than 5% of the enterprise portfolio. So any dislocation in 2024, we deem to be manageable with the strong performing portfolio that we have in front of us.” – David Cordani, Cigna Q4 2022 earnings call

On the RADV rule: “…Now specific to the RADV actions, we’re pleased, the CMS concluded that they’re not going to extrapolate their actions prior to 2018. We’re concerned that we continue to question a couple of decisions. For example, the elimination of the fee-for-service adjuster that we deemed to be foundational to the program. And we await specifics relative to the methodology that is going to be used in some aspects of the extrapolation and work as we have in the past and as we always will, we will work closely with CMS to seek to get further clarity relative to the open items that are here. So a bit of a fluid environment but we see progress relative to the lack of extrapolation beyond 2018, and we see some open questions for the industry at large. So remain, and we will collaborate with CMS to get more visibility on that over the near term.” – David Cordani, Cigna Q4 2022 earnings call

Partnerships and Strategy Updates:

April Anthony, once the CEO of Encompass Healthcare’s home health division, is back at it again with her new home health co VitalCare. It’s already up to 74 locations throughout the Southeast. (HHCN)

BCBS California partnered with Accolade to launch a new virtual-first plan in the state. It’ll be available April 1st. Accolade bought 2nd.md in early 2021 for $460M and PlushCare shortly thereafter for $450M. (Fierce)

Cigna’s Q4 and full-year 2022 earnings. (HCD)

Humana’s Q4 and full-year 2022 earnings. (HCD). Humana also named former Steward Health Care President Sanjay Shetty, MD to lead its healthcare services biz, CenterWell. Speaking of CenterWell, they’re on a clinic spree – opening 10 more in DFW this year. And just because I can’t help myself, a quick summary: and I know it’s tiny – here’s the excel/google sheet

Providence is unrolling a virtual nursing unit, resulting in higher nurse and patient satisfaction. (HITN)

Contessa, an Amedisys company, rolled out its hospital at home JV with Virginia Mason Franciscan Health. Contessa was a nice little acquisition for Amedisys. (HHCN)

This article covered an interesting pilot HCA ****worked on with Azra AI to decrease time from cancer diagnosis to first treatment by 6 days, also increasing patient retention by 50% and other positive results. (HITN)

Nursing home staffing levels haven’t reached a level this low since 1994. (HLM)

CVS launched the Community Equity Alliance, aimed at addressing barriers to care in underserved communities. (Fierce)

Finance and M&A Updates:

Kaufman Hall’s January 2023 hospital flash report notes a return to positive operating margins for hospitals, although the year as a whole was one of the worst for hospitals in recent memory. (KH)

CommonSpirit Health bought a minority stake in the UAE – RAK Hospital, ‘one of the UAE’s most acclaimed private hospitals’ – what the heck? Don’t forget that a UAE-based healthcare firm Pure Health invested $500M into Ardent Health in September 2022, one of the biggest for-profit private health systems in the country. (BK)

In a move that surprises absolutely nobody, the Minnesota AG has asked Sanford Health and Fairview to postpone its March 31 closing date of its 58-hospital merger. (Fierce)

Flagler Health+ is joining the University of Florida’s Health System UF Health. (BK)

Ascend Capital Partners announced investments into Allied Physicians Group – New York’s largest independent provider of pediatric care – and Adjuvant Health. (PRN)

Digital Health and Startup Updates:

Palantir partnered with Cardinal Health to provide live purchasing decision support of pharmaceuticals by combining and analyzing datasets. (PRN)

Beacon Health System partnered with Biofourmis to help launch its hospital-at-home program and reduce readmissions throughout its system. (PRN)

Canvas Medical and Zus announced a partnership in which Canvas will integrate Zus’ Aggregated Profile (ZAP) into Canvas through the Canvas Contributor Program, which enables authorized 3rd parties to develop new features, functionality, integrations, and/or extend the Canvas platform for all users and customers. (PRN)

Paradigm, a new clinical trials startup, launched with $203M in Series A (!!!) funding from the likes of General Catalyst and ARCH Venture Partners (MedCity)

Yet another staffing agency scored yet another vast sum of money. ShiftMed raised $200M. But please don’t confuse ShiftMed with ShiftKey, which raised $300M at a $2B valuation! (Mobi)

Spotify’s founder Daniel Ek is launching a healthcare startup called Neko Health. (Sifted)

Beckers provided a nice overview of health tech investment activity in January. (BK)

Angle Health raised $58M in a Series A led by Portage. (Angle)

Spatially Health partnered with ACO Health Partners to provide the ACO with analytics around social aspects of healthcare and increased patient engagement. (Fierce)

Mark Cuban’s Cost Plus Drugs partnered with cancer care support company OncoPower. (Mobi)

Alpine Health Systems has officially launched as an AI-enabled length of stay management tool for hospitals in partnership with OSF HealthCare. (PRN)

NOCD raised $34M focused on OCD. (BHB)

Policy and Payment Updates:

Lexology published a comprehensive look at policy updates and trends to watch in private equity and digital health. (Lexology)

A Bipartisan House Bill put forward a bill outlining permanent telehealth benefits, called the Telehealth Benefit Expansion for Workers Act. (HITN)

KFF published a paper on the end of the public health emergency including details on health coverage and access. (KFF)

Healthcare trade groups are clashing over the scope of CMS’ review of the ACA’s essential health benefits (Fierce)

The Texas Medical Association filed its 4th lawsuit against the No Surprises act, this time lamenting the $300 increase in the independent dispute resolution / arbitration fee. Sheeeesh. (HCD)

CMS is looking to create universal quality measures across all programs. (BK)

Costs, Data, and Other Updates:

The FTC fined GoodRx $1.5M for sharing health information with advertisers. (HCD) It’s the first fine related to enforcement of the Health Breach Notification Rule.

Two Congress people are trying to end the Oracle Cerner VA implementation, calling for the department to revert back to its internally-developed EHR. I can’t imagine that’d be a better solution right…right? (MedCity)

A recent report indicates that nurse understaffing is becoming more deadly for patients. (MedCity)

The Commonwealth Fund wrote an insightful piece on the Georgia Medicaid work requirements experiment. (TCWF)

Employer benefits growing in popularity include behavioral health services and reproductive health. (MedCity)

Over 35 million prior authorization requests were submitted to MA plans in 2021. (KFF)

Montana pharmacists may get more power to prescribe. (KHN)

Whitepapers and Resources

Pitchbook’s Q4 2022 healthcare services report. (Pitchbook)

A comprehensive list of links from CMS related to public health emergency waivers. (CMS)

The Primary Care Development Corporation published a report on 2022 primary care legislative trends. (PCDC)

Miscellaneous Maddenings

- The Mavs traded for Kyrie and despite the recent upheaval about Kyrie’s beliefs, that vaults the Mavs into becoming a major contender. Huge fan of the trade, let’s get it done Cubes.

- The Pebble Beach Pro Am concluded this week and you have to hand it to Justin Rose. What a player. Fun fact, I played Pebble Beach last year and despite having a case of the hooks, shot a solid 84. The short game was working for me and it was truly a cathartic experience walking along the edge of the ocean and playing golf.

- Meanwhile, back in Dallas golf land, I played at Luna Vista on Saturday in incredibly windy, muddy conditions and shot an 82 which I will absolutely take.

- Calling layoffs ‘refinements’ and then quoting Martin Luther Kind Jr. in the same e-mail where you announce those ‘refinements’ is an all-time bad move by PagerDuty’s CEO. (Gizmodo)

Hospitalogy Top Reads

- Pharmacy benefit managers: the middle men for the middle men. (AHCW)

- Health Affairs wrote a nice overview of workforce composition in private equity affiliated practices versus non PE practices. (HA)

- And finally: a gut-wrenching story. UnitedHealthcare Tried to Deny Coverage to a Chronically Ill Patient. He Fought Back, Exposing the Insurer’s Inner Workings. (ProPublica)

That’s it for this week! Join 17,700+ executives and investors from leading healthcare organizations including Privia, ApolloMed, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!