Good morning,

If you’re in the Austin area for SXSW, join us at our event on 3/12! Space at the event is limited, so please go ahead and register for the waitlist here. We’ll review registrations on a rolling basis as we figure out venue capacity and prioritize folks in healthcare!

Join 18,000+ executives and investors from leading healthcare organizations including Privia, ApolloMed, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

Humana Irish exits the commercial market

Alright so it’s not really an Irish exit…but over the next 18 to 24 months, Humana will call it quits on the employer group insurance business altogether. The segment includes all “fully insured, self funded, and Federal Employee Health Benefit Medical plans.”

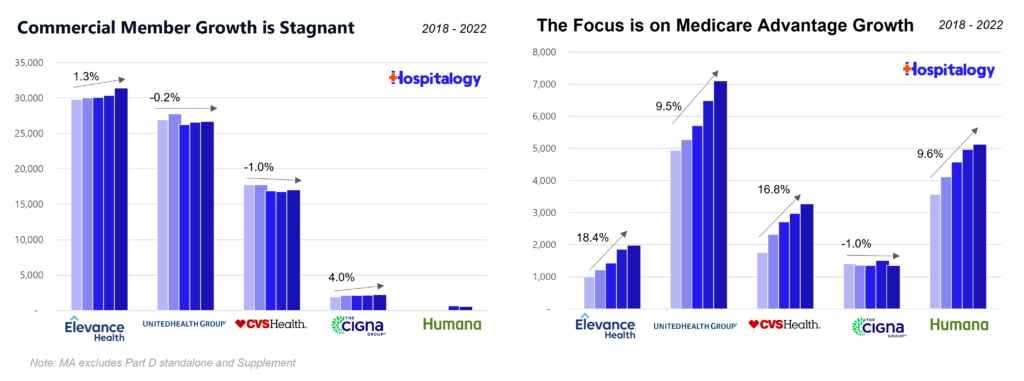

Context: Medicare Advantage (and services) are the main engines of growth for the managed care titans these days. The commercial segment is flat to stagnant as the secular shift of healthcare occurs and the population continues to age into Medicare. One in 5 U.S. residents will reach 65 by 2030. To that end, Humana has decided to go all in on MA and the most recent decision to exit commercial altogether makes sense.

Take a look at Humana’s investor decks and recent activity. It’s all flying into Medicare Advantage.

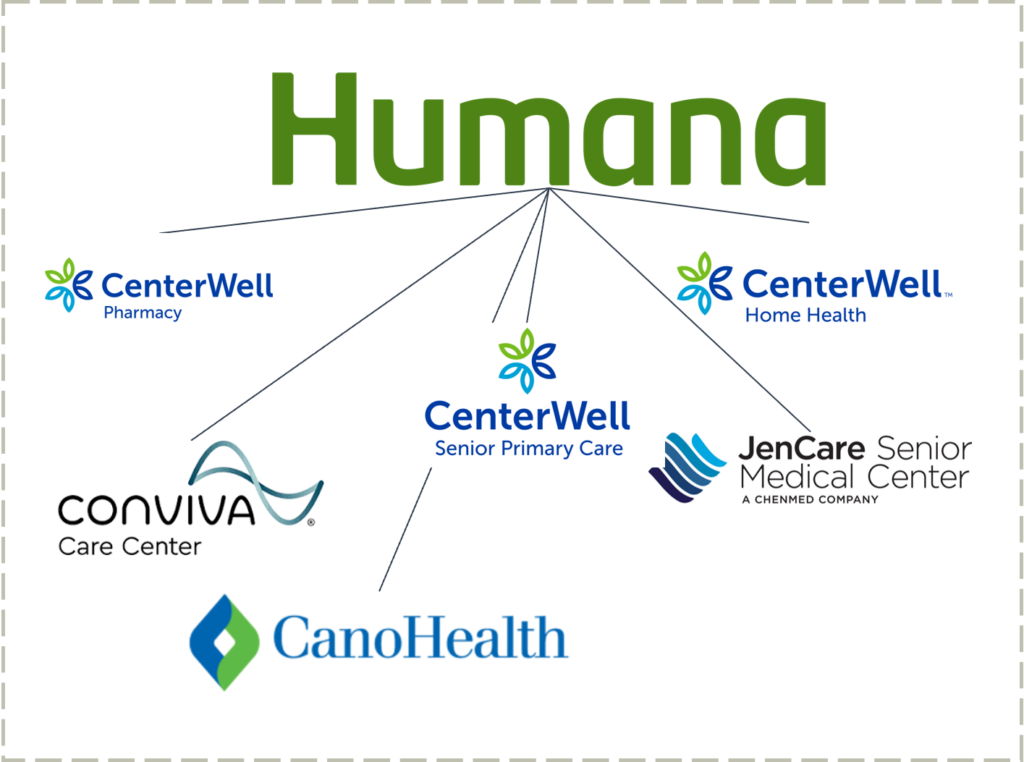

In 2015, it partnered with Oak Street Health (and comprises around 30% of OSH revenue as of 2022).

In late 2017, Humana purchased post-acute provider Kindred Healthcare alongside financial backers WCAS and TPG. Shortly thereafter Humana combined Kindred’s home health and hospice segment with its $1.4B acquisition of Curo Health Services to create one of the country’s largest home health and hospice operators. (Also, don’t forget that in 2018 Walmart tried to buy Humana when it was valued around $37B.) Later in 2021, Humana purchased the remaining 60% interest in Kindred at Home.

In 2018, Humana partnered with Walgreens on its Partners in Primary Care venture to open senior MA clinics in the Midwest. It also rebranded its clinical footprint at the time into Conviva and exited the ACA exchange biz.

In February 2020, Humana announced the first of two joint ventures with WCAS to scale and expand the Partners in Primary Care platform (now known as CenterWell), taking an off-balance sheet approach to growth where WCAS committed $600M and Humana held a minority stake in the clinics with I assume a call option to buy eventual control.

In early 2021 Humana expanded Conviva by acquiring 12 clinics and 49 affiliated practices in Florida. It also introduced CenterWell as its rebranded payor-agnostic services offering.

Then, in 2022, Humana really dug in on the MA front. Starting in January, Humana announced expansion of CenterWell’s senior primary care footprint into several new markets and 26 new centers. Following that, Humana doubled down on CenterWell with WCAS by forming a second joint venture with double the capital contribution. The new JV is deploying $1.2B in capital (see you thought I was being dramatic – it’s quite literally double) to develop 100 new CenterWell centers between 2023 and 2025. Humana also developed senior clinics with Cano Health as well and was rumored to be interested in buying the senior clinic operator late in 2022.

On the insurance side, Humana partnered with the USAA in October 2022 for a co-branded MA plan for vets and has achieved stellar star ratings results. Along with United, Humana achieved the highest median MA star ratings.

Humana also holds an existing joint venture with well-known primary care player ChenMed called JenCare. In August 2022, this JV was rumored to be up for sale by ChenMed. More recently in 2023, Humana extended existing network agreements with ChenMed through 2028 which included JenCare.

Blake’s Take: So where does this bring us today? Piecing it all together, it’s clear why Humana is tripling down on MA.

Humana now holds the largest operation for senior-focused primary care services in the country – at a time when Medicare Advantage plans require patient engagement and satisfaction more than ever to move the needle financially. With a payor agnostic strategy, CenterWell is incredibly well positioned to provide senior services segment to the long-tail of MA plans not named UnitedHealthcare or otherwise, a similar strategy to what Walgreens and VillageMD are cooking up.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

And it’s also the exact strategy that CVS pursued with Oak Street Health (at a much lower cost). So while these clinics are breakeven to losing money today in their initial cohorts, Humana has a fantastic capital partner in WCAS and is well ahead of the curve for the future of healthcare services demand (AKA, senior-focused Medicare clinics) by 2030 – which, if you recall, is when a fifth of the country will be 65+. At that point, the 300+ clinics will have reached financial and operational maturity with nice platform contribution.

Long term, Humana is poised to win – and win big – in Medicare Advantage. Now the only question mark is whether major policy or funding changes hit the program – something I’m sure the insurance lobby is more than equipped to handle.

Teladoc loses $13.7B in 2022

In perhaps the worst M&A move in digital health history (or maybe even ever in healthcare), Teladoc posted a $13.7B loss in 2022 after reporting several quarters of goodwill impairment related to recent acquisitions – most notably, Livongo.

Now really this is sort of a ‘fake’ loss – meaning in the sense that the loss is non cash. I mean, yes, it’s still a loss. But in reality, despite the well-documented, historic losses from a GAAP perspective, Teladoc is generating positive cash flow. The bigger questions facing the company revolve around whether telehealth is a commodity (it is BUT you still need someone to power it right?) and growth/quality of BetterHelp given new market entrants as well as recent regulatory developments on telemental health and new DEA proposed regulation. I’ve discussed before how mental health is a crowded space with many well capitalized players. 2023 is make or break given these regulatory changes post PHE to telehealth and Teladoc’s business model is squarely in the lense from a variety of directions.

I do wonder where Teladoc’s stock would be if they’d never acquired Livongo.

Partnerships and Strategy Updates:

Mark Cuban Cost Plus Drugs announced a partnership with Diathrive Health to provide lower cost medication and (Press Release)

BCBS of Minnesota entered into a full risk relationship with Homeward Health in rural Minnesota. (Mobi)

Aledade announced its progress in 2023, including adding more than 450 primary care practices to its network in 2023 and acquiring Curia, a player in value-based care analytics. (Aledade)

Finance and M&A Updates:

Amazon closed its $3.9B acquisition of One Medical and is offering a discount on annual membership ($144 using code ‘AMAZONONE’ lmao, true consumerization right there). Pretty crazy to see One Medical, Amazon Clinic, and Amazon Pharmacy listed 1, 2, 3 on the Amazon site. (Hospitalogy)

Optum and UnitedHealth Group closed its acquisition of LHC Group for $5.4B excluding debt. (Hospitalogy)

Cano Health, which was in dire liquidity capital straits, just closed a $150M term loan facility with institutional investors. Here’s the kicker – the term loan is a 14% per annum interest rate for the first 2 years!! In addition to those extreme terms, Cano also offered warrants to the lenders up to 29.5M shares of Class A stock or 5.5% of pro forma diluted shares outstanding. From what I’ve seen, it’s about a year or so lifeline for the senior MA clinic player until it manages to turn things around or find a buyer. The management team seems to be hoping and praying that someone swoops in and saves this company. Cano also recognized a $323M goodwill impairment on assets acquired within the past couple of years. (Cano)

MercyOne, now 100% owned by Trinity Health, is closing a deal to acquire Genesis Health System as early as next week. It’s a follow-up to a signed letter of intent from September 2022. (MH)

This edition of Hospitalogy is sponsored by Axios. You guys know I love Axios reporting. Erin Brodwin and the Axios Pro team really have their fingers on the pulse of the health tech space. She and the entire team of seasoned journos just published a great overview on deal sentiment in health tech and other industries of note.

Download the Deals Sentiment Report. It dives into how private equity, venture capital, and M&A reps are feeling about the dealmaking environment in 2023. Recommended for anyone who wants to get up to speed quick on market sentiment.

Digital Health and Startup Updates:

Vytalize Health, an enablement player, raised $100M in what appears to be an increasingly crowded space. It currently partners with PCPs that care for more than 250,000 patients so assuming like 1,500 per panel that’s ~167 providers. (Link)

Ambience Health raised $60M on 2/23 to automate clinical documentation through artificial intelligence & its AI medical scribe, Ambience AutoScribe. Meanwhile, somehow published in the same week, 60% of adults would feel uncomfortable if their healthcare provider relied on AI. I’ll likely be covering the ambient documentation space in the near future, so if there’s anything specific you’d like for me to dive into, let me know.

IncludeHealth raised $11M (Mobi)

Elation Health acquired Lightning MD in an effort to become an all-in-one tech platform for providers (MedCity)

Axena Health raises $25M to support pelvic floor digital therapeutic (Mobi)

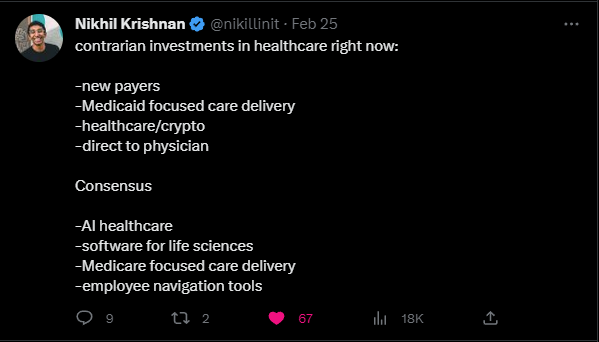

Nikhil’s thoughts on VC investment dollars in healthcare:

Redox and Google Cloud announced a partnership to accelerate data interoperability to speed up data exchange among healthcare organizations. (Press Release)

Bicycle Health partnered with Wellpath to serve individuals living in the Federal Bureau of Prisons’ residential reentry centers. (Press Release)

Policy and Payment Updates:

On February 24, 2023, the Drug Enforcement Agency announced proposed rules for prescribing controlled substances via telemedicine after the COVID-19 Public Health Emergency expires. The proposed rules are open for public comment for only thirty days, after which DEA will issue final regulations. (Foley)

The American Hospital Association released commentary on the FTC’s non-compete proposal, stating that not only does the FTC lack authority to implement this, but also a one-size-fits-all approach to non-competes would result in drastic consequences for physicians and senior healthcare executives. In particular, the current form of the rule would only affect for-profit hospitals. It’s likely that pretty much every trade group and healthcare organization opposes the FTC measures given the current state of physician/exec non-competes and the effects on trade secrets, referral patterns, and investment into healthcare services. I mean, just this week a federal judge blocked a former Cigna exec from joining CVS Health. (AHA)

5 areas of healthcare policy to watch in 2023: Labor dynamics, modifications to alternative payment models, supply chain reform, making prior authorization not suck, and creating sustainable funding for providers. (Health Affairs)

New York state has proposed legislation that would require the New York State Department of Health (Department of Health) to review and approve any material transaction involving physician practices and physician practice management organizations. The proposal takes aim at, among others, investor-backed physician practice management platforms. (Foley)

Lawmakers are repeating history once again by asking why PBMs even exist. Now, cue the PBM defense of ‘well actually, it’s the drugmakers’ faults for high list prices’ and ‘premiums would rise without PBMs – we pass on almost all rebates’. All this being said, PBMs operate with little transparency (case in point – Centene’s PBM is settling with every state under the sun). Reports are out on bipartisan momentum toward PBM regulation – the PBM Transparency Act – hot off Inflation Reduction Act drug reform. But the finger pointing in healthcare persists among all stakeholders, and nobody is innocent. (Fierce)

- Meanwhile, the FTC continues to investigate PBMs and the effect of their vertical integration inside of larger healthcare orgs (CVS, Cigna, United) on patients, access, and affordability. “The FTC’s inquiry will build on the significant public record developed in response to the request for information about pharmacy benefits managers that the agency launched on Feb. 24, 2022. The agency has received more than 24,000 public comments to date.” 24k comments!!

Costs, Data, and Other Updates:

MA plans are more likely to deny inpatient care. Grass is green. (Crowe)

Half of Americans in a new poll say the government should emphasize lowering prescription drug costs and reducing the cost of health care over other public health-related priorities. (Hill)

Stop Soldier Suicide was named a first place winner in a recent Veterans Affairs challenge (Mission Daybreak) and was awarded $3 million in its incredible mission to address soldier suicides alongside its partner Neuroflow. Really awesome stuff here. (SSS)

Nomi Health formed the Nomi Health Charitable Foundation aimed at reducing barriers to care and addressing affordability. (Press Release)

Whitepapers and Resources

Accountable Care In 2023: Evolving Terminology, Current State, And Priorities (Health Affairs)

Miscellaneous Maddenings

- I finally watched Top Gun this weekend and man…instant classic.

- The PGA has had a great stretch of tournaments lately between the Honda Classic and Waste Management. If you missed the final few holes Sunday, it was an entertaining watch and a classic lesson in course management (which I often fail at) where Charles Kirk, in the middle of the fairway on a par 5 on 18, pushed his approach way right into the water. He ended up bogeying and having to sweat out a win in the playoff rather than cruising to an easy victory. It was also great learning about Eric Cole, who had a hell of a final round and is a 34 year old rookie. With all the storylines out here in golf, it makes you wonder why Full Swing hadn’t happened before this year. Probably because of stingy PGA policies.

Hospitalogy Top Reads

- Summit Health Advisors released a great report on healthcare platforms in 2023 and why they’re poised to win long-term. (Summit)

- This Overview of Teladoc and Livongo moving forward past 2023 was a great read. (MedCity)

- Some recent, interesting Twitter threads:

- A market map of psychedelic startups

- Rethinking women’s health

- Medicare Advantage and acute care utilization

That’s it for this week! Join 18,000+ executives and investors from leading healthcare organizations including Privia, ApolloMed, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!