17 September 2022 | Healthcare

Why Millions Are Expected to Lose Health Insurance

By workweek

I have good news and bad news. The good news is the uninsured rate hit one of its lowest points in the past decade at 8.3%. The bad news is that between 5.3 million and 14 million Americans are estimated to lose insurance once the public health emergency ends—which may be soon.

Despite the uninsured rate hitting all-time lows, it’s destined to see its steepest inflection point soon.

How Did Millions Gain Insurance Coverage?

Insurance coverage spiked because of two key pieces of legislation:

The ARPA expanded access to the Affordable Care Act’s insurance marketplace by enhancing tax credits, essentially eliminating the subsidy cliff. Before the ARPA, tax credits for marketplace insurance were capped at 400% of the federal poverty level (FPL). So, if you made more than 400% FPL—the cliff—you were on your own for insurance. However, the ARPA removed that subsidy limit (the cliff) and capped marketplace insurance premiums at 8.5% of household income. This means if you make more than 400% FPL, you won’t pay more than 8.5% of your income in premiums.

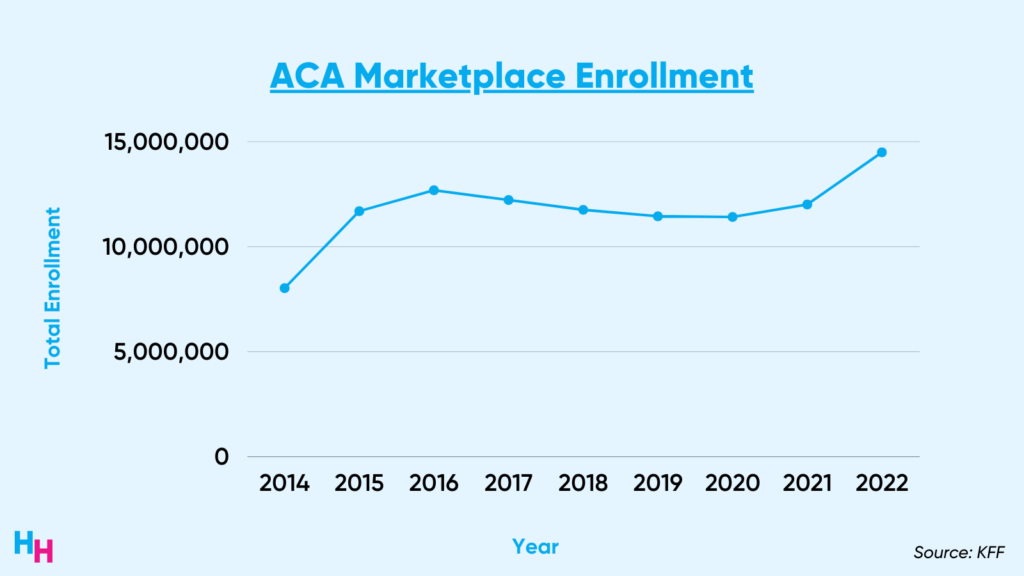

The ARPA was quite successful and led to 14.5 million Americans signing up for health insurance during open enrollment this year, a 21% increase from 2021.

While the ARPA focused on expanding access to the ACA insurance marketplace, the FFCRA focused on increasing access to Medicaid/CHIP. Part of the legislation gave states a 6.2% increase in the federal share of Medicaid spending (remember, Medicaid is jointly funded by federal and state governments) with an important condition:

- states must provide continuous insurance enrollment for Medicaid enrollees, even if enrollees start to make too much income, which would otherwise disqualify them from Medicaid.

Continuous enrollment prevents churn, which occurs when individuals temporarily lose Medicaid coverage due to making too much income. They disenroll and then re-enroll when they make just enough income to qualify them again for Medicaid. Continuous enrollment is, therefore, key to sustaining coverage. The key thing to understand is that the renewal process for Medicaid is a significant barrier to gaining Medicaid coverage. The process requires time off work, qualification criteria papers and month-long wait times for approval, forcing Americans to abandon the Medicaid enrollment process.

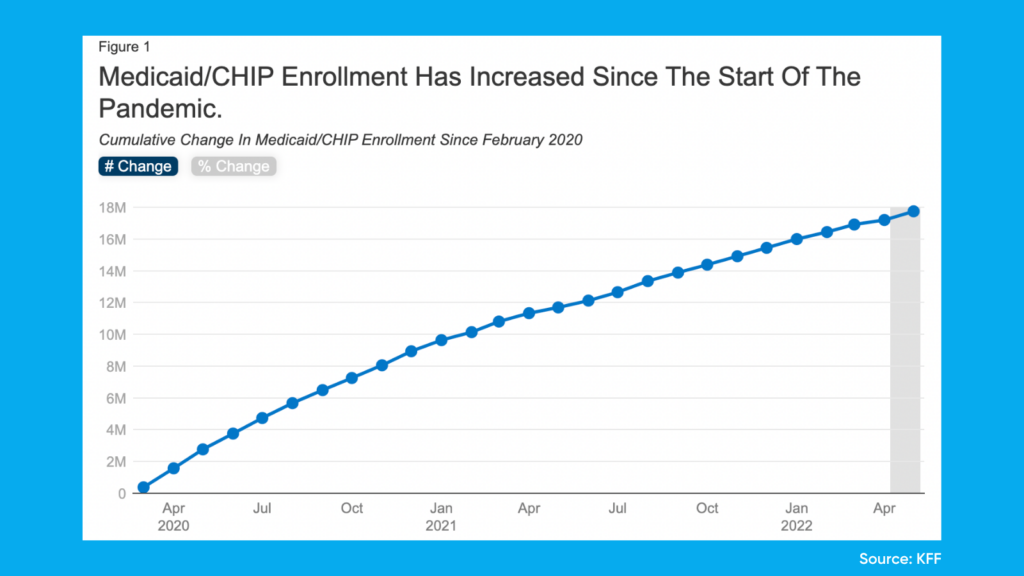

Medicaid/CHIP enrollment has increased 25% since pre-pandemic, providing 17 million eligible adults and children with insurance coverage.

The Cliff

There are two impending insurance cliffs. One cliff has been temporarily averted while the other is approaching us head-on and fast.

The first cliff involved the ARPA’s enhanced government premium subsidies for the ACA marketplace. While not tied to the public health emergency, these subsidies were set to expire by the end of this year. However, the recent Inflation Reduction Act will add $64 billion for a three-year extension of enhanced premium assistance for ACA insurance plans. So, those on marketplace plans will have these tax credits through 2025—cliff one averted.

The second cliff involves the FFCRA’s Medicaid funding to provide continuous Medicaid. This continuous enrollment coverage is contingent on the public health emergency status, which will inevitably expire soon. The government has renewed the nation’s “public health emergency” status several times and is set to renew it (or not) this fall.

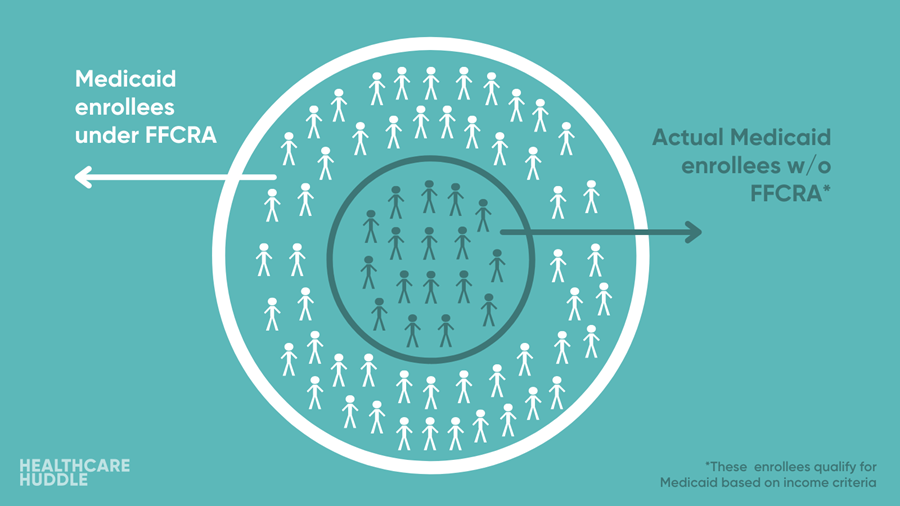

Without any solution to providing continuous enrollment coverage when the public health emergency ends means millions of Medicaid’s 76.7 million enrollees will inevitably lose insurance. The Kaiser Family Foundation surveyed state Medicaid officials and estimated that Medicaid may lose between 5% and 13% of its enrollees. That’s 5.3 million to 14.2 million people.

Essentially, once the public health emergency ends, the federal government will leave it up to the states to determine how they want to wean people off of the continuous enrollment coverage. For example, 40% of Colorado’s 500,000 Medicaid enrollees aren’t currently qualified for Medicaid coverage based on income but have coverage because of the FFCRA. What will Colorado do with this 40%?

There are 49 other states where a significant proportion of Medicaid enrollees wouldn’t actually qualify for Medicaid coverage if there were no continuous enrollment. As such, there will be significant variation in how states choose to address continuous enrollment once the public health emergency ends. I predict progressive states like New York and California will work to sustain continuous enrollment while conservative states like Texas will rid of it instantly.

So What?

While the uninsured rate hit all-time lows, there are still 27 million Americans without health insurance. This number could be greater than 30 million uninsured Americans post-public health emergency.

The loss of insurance has serious health and economic consequences. Foremost, those without insurance are in poorer health and don’t have easy access to healthcare services. This means no regular source of care (preventative care) and late detection of conditions like cancer that will have a toll on health and economic productivity. Additionally, when those without insurance use healthcare services, the care is often uncompensated at first. Therefore, the government must spend around $33.6B annually to pay providers for uncompensated care.

What’s Next?

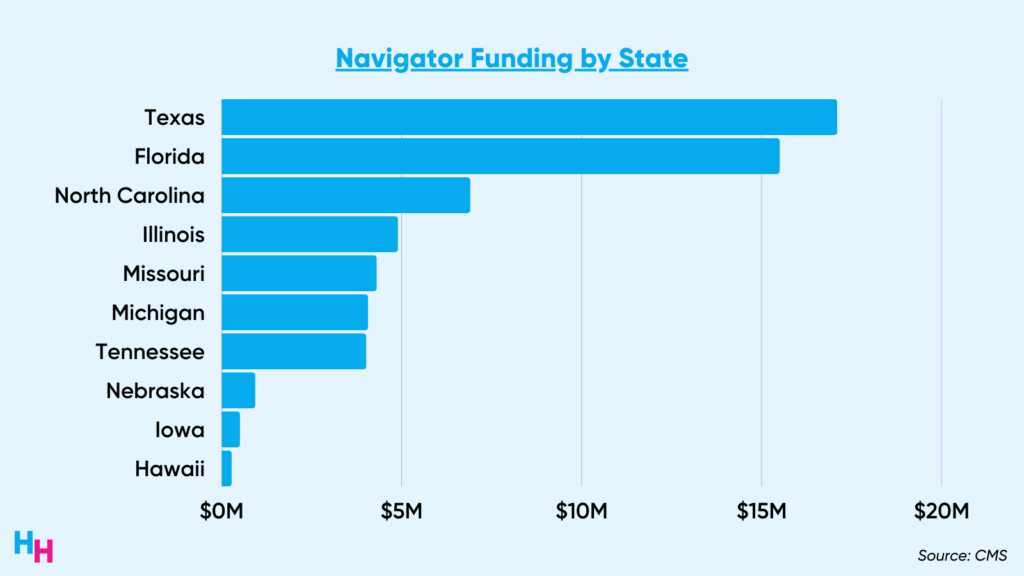

The Biden administration is preempting the efflux of Medicaid enrollees by investing heavily into ACA marketplace navigators, as I discussed in last week’s newsletter. Navigators are organizations trained to help consumers, small businesses and their employees navigate insurance options through the ACA marketplace. This includes outreach and hosting local community events to educate people on their insurance options. The Biden admin’s $100 million investment into ACA marketplace navigators will focus on two areas:

- Improving outreach to underserved communities.

- Helping eligible Medicaid beneficiaries transition to ACA marketplace plans, given the impending end of the public health emergency.

These two areas target the populations most affected by the public health emergency’s end, which would lead to this insurance coverage cliff.

As I mentioned above, there will be extensive variation in how states choose to address continuous enrollment. The Biden administration knows this, so the $100 million won’t be disbursed equally to states. Texas—which I predicted would boot every non-qualifying individual off of its Medicaid plans—will receive the most funding, thereby preparing individuals to regain insurance through the ACA marketplace.

Dash’s Dissection

I’ll share an anecdote regarding the importance of insurance coverage. Several months ago, I cared for a young patient with multiple previous admissions for non-fatal drug overdoses, presenting with yet another non-fatal drug overdose. After discussing treatment options, she was highly amenable to opioid use disorder treatment and highly motivated to improve. But, she had one request: the treatment needed to be at an inpatient rehab center so she’d be far away from opioids.

Despite extensive coordination between the psychiatry team and social workers, we reached a dead end. Since she didn’t have insurance, no inpatient rehabilitation facility would accept her. We were left with the one thing she insisted she didn’t want: outpatient rehab treatment.

Once she was medically stable and her follow-up appointments confirmed, we discharged her. While we did the most we could do within the confines of this broken insurance system, everyone on the team had an eerie feeling she’d be back.

A week later, I ran through my list of old and new patients on Epic. I saw the patient’s name, who now had an assigned bed in the ICU. There she was, back in the hospital for a non-fatal overdose. The system failed her—insurance status matters.