22 October 2022 | Healthcare

Apple Care (for Humans)

By workweek

Apple plans to enter the health insurance industry by 2024, according to CCS Insights’ Chief Analyst Ben Wood. Many of you have followed the decade-long saga of big tech attempting to enter the healthcare space to compete with incumbents, only to fail.

Healthcare verticals, like insurance, are tough to enter and disrupt. Apple certainly has the money, power, and resources to enter and change the health insurance industry—but this doesn’t mean the company will succeed. It would be better for Apple to double down on its current healthcare efforts, which will significantly impact medicine more than involve itself in the insurance space.

The Deets

Apple will take “tentative first steps” into the insurance market by partnering with a major insurer in 2024. According to Wood, Apple is well-equipped to enter the insurance market because of its troves of consumer health data, including daily heart rates, weight, sleep duration, and daily activities.

They are in such a strong position to do this. They’ve got a wealth of personal health data through Apple Watch. If they join some of the dots together they can become a very competitive health insurance player and that potentially is going to have quite an impact on the structure of the healthcare market in the U.S.

Ben Wood, CCS Insights’ Chief Analyst

Apple is unlikely to start its own health insurance company. History has shown that the Davids who try to compete with the Goliaths of health insurers end up struggling. Insurance is a tough industry to disrupt when incumbents run the show. Instead, Apple is likely to form a partnership with one of the incumbent insurers, much like what Walmart has done with UnitedHealthcare. Apple has already partnered with insurers like UnitedHealthcare, Devoted Health, and John Hancock’s Vitality program to offer Apple Watches as a fitness benefit.

What Happens to New Players in the Insurance Market?

Insuretech companies (Oscar, Bright Health, Clover Health), Amazon, Berkshire Hathaway, JP Morgan, and Walmart have all made efforts to enter the health insurance market with variable success. But, again, health insurance is a challenging industry to enter. Blake summed it up nicely in a recent newsletter:

Health insurance, by default is a horrible business to challenge incumbents. Your profits are capped, you need size to succeed in negotiations, you have heavy capital requirements, you need deep understanding of risk adjustment, and the general public hates your guts for the most part.

Blake Madden, Hospitalogy

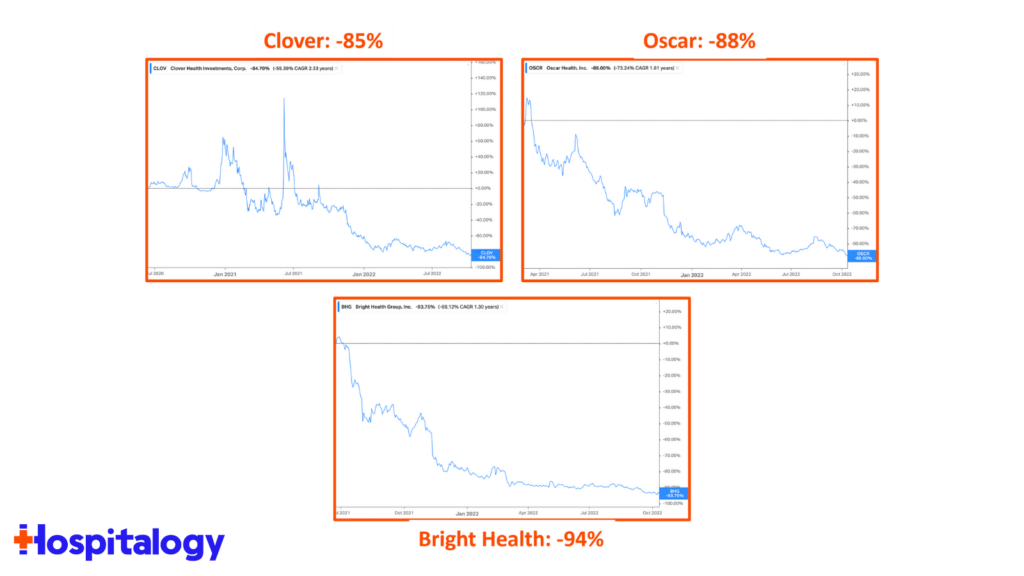

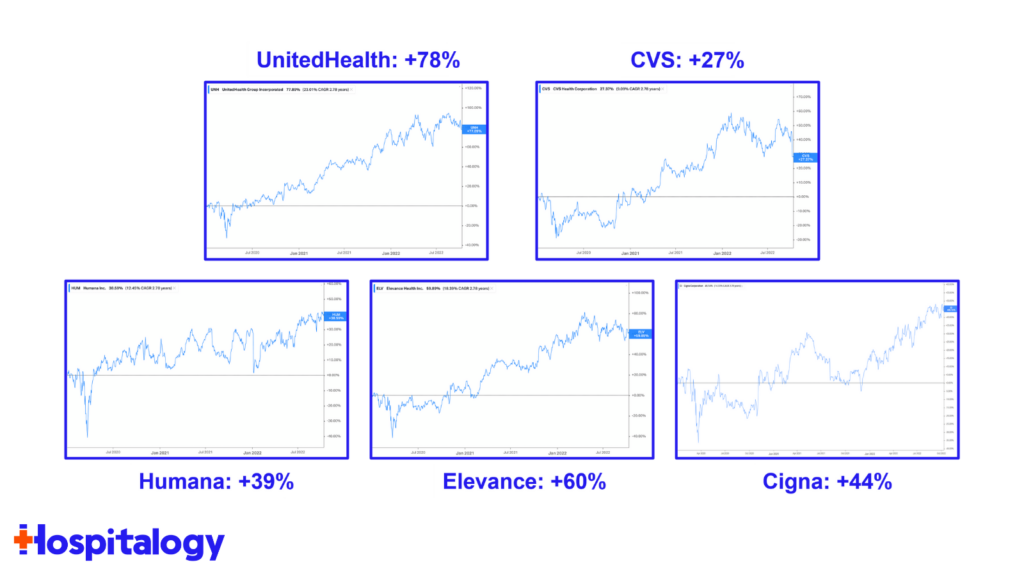

Insuretech companies have struggled to perform at the same level as incumbent insurers like UnitedHealthcare. For example, their medical loss ratios remain well above incumbents’, and their stocks have been trending downwards (a valid market response to their performance) while incumbents’ have been trending upwards. No matter how advanced the technology insuretech companies leverage is, it “can’t change the insurance model or take down incumbents on its own.” Well-established networks, wide market penetration, and robust risk adjustment are the ingredients to success.

Amazon, Berkshire Hathaway, and JP Morgan Chase bonded to form Haven in 2018, only to flop a couple of years later. Haven’s mission was to “provide U.S. employees and their families with simplified, high-quality, and transparent health care at a reasonable cost.” While Haven wasn’t an “insurance” company per se, it did try to disrupt the insurance market. Unfortunately, Haven failed to achieve its mission. Insurers make big profits and have zero incentive to change, even with the leverage Amazon, Berkshire Hathaway, and JP Morgan Chase have.

Walmart has increased its healthcare footprint over the past two decades, from generic prescription meds to Walmart Health clinics and now, insurance. Walmart is a self-insured company that innovated in-house to improve insurance/healthcare costs with its Center of Excellence programs. However, instead of starting an independent commercial insurance company, Walmart chose to form a ten-year partnership with UnitedHealthcare. How Walmart succeeds in the insurance market through this partnership is TBD.

Overall, the main issue is this: incumbents have a stranglehold on the health insurance market, and anyone trying to play with them is destined to struggle—even Apple.

Apple’s Healthcare Success

Apple’s strong healthcare vision has guided Apple on a prosperous path to empowering people to live healthier days.

Our vision for the future is to continue to create science-based technology that equips people with even more information and acts as an intelligent guardian for their health, so they’re no longer passengers on their own health journey.

Jeff Williams, Chief Operating Officer, Apple

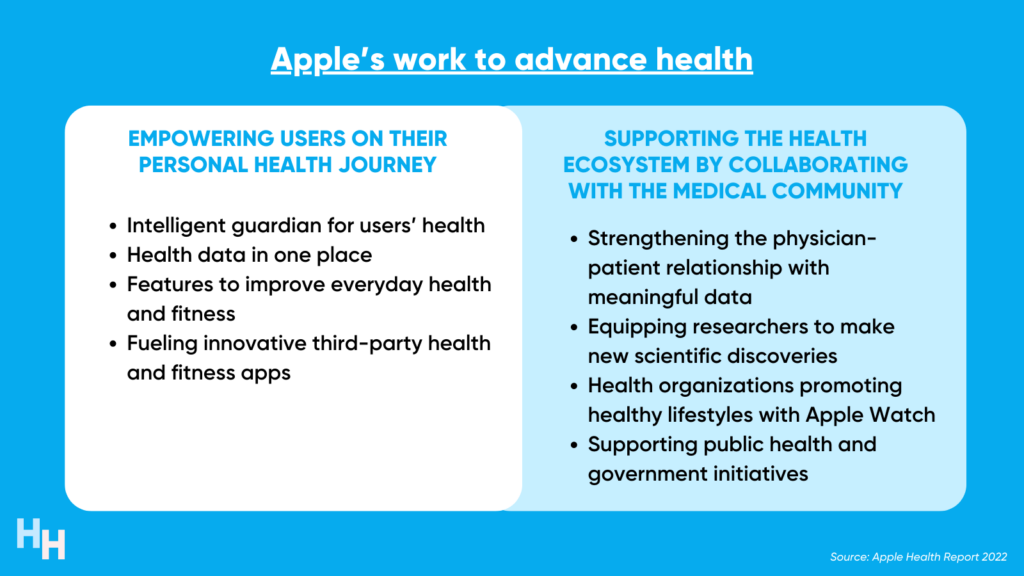

Apple’s healthcare stack relies on its core products, Apple Watch and iPhone, and falls into two categories: personal health and research/care within the medical community.

Apple has had remarkable success in each of these categories, benefiting medicine and population health.

Personal health and fitness features

Apple Watch and iPhone have several fitness features that empower users.

Data from all of these features, including users’ medical records, are all in one place, making personal health and fitness data easily accessible and visually understandable.

The intelligent guardian is users’ favorite aspect of Apple’s health kit. As an intelligent guardian, Apple Watch communicates with iPhone every second, monitoring for arrhythmias, falls, crashes, and ear-damaging noise. The user doesn’t need to do any work to “monitor” their health. Apple does it for them.

Research and care within the medical community

Apple has been advancing medical research by facilitating researchers’ creation of studies using Apple’s products and increasing users’ access to medical research. Apple has two “research” features.

- ResearchKit: allows researchers worldwide to build apps for innovative studies at an unprecedented scale.

- Apple Research App: allows Apple’s diverse and large user base to participate in landmark studies.

Apple also works to augment physician and patient experience by improving communication between care teams and streamlining workflows. For example, Apple created EHR apps that allow providers to read and write patient records on the go or to receive urgent lab results on the apple Watch. Apple is also a platform for innovative medical technology, like the portable ultrasound Butterfly IQ.

Dash’s Dissection

New players in the insurance industry struggle to stay alive. Therefore, companies strategizing to enter the insurance space will likely partner with an incumbent, as evidenced by Walmart’s partnership with UnitedHealthcare.

If Apple does enter the market, I imagine the insurance model will be a hybrid between what insuretech and Walmart are doing. Apple will blend beautifully designed technology with a strategic partnership in the lucrative Medicare Advantage space. Since Apple already partners with insurance plans to offer Apple Watch as a fitness benefit, it’s unlikely Apple’s move into the insurance industry will be an iteration of that fitness benefit.

It’s also unlikely that Apple will start its own insurance plan. Wood said that the “health data Apple is already collecting will give a competitive edge over rivals,” which insinuates Apple will be starting a solo insurance company. Sure, Apple has “a lot of data.” But this data includes heart rate, rhythms, blood pressure, and fitness activities, which are not high-value data to underwrite populations and make you competitive with incumbents like UnitedHealthcare.

Since the insurance market is notoriously difficult to penetrate and disrupt, Apple should instead double down on its current health technology to tackle the low-hanging fruit in healthcare, which will have profound impacts:

- Research Study Diversity and Participation: Diversity and ample participation in research studies to advance medicine are constant challenges in the medical field. One-sixth of the U.S. population owns an Apple Watch, meaning 50 million people have their heart rate, rhythms, respiratory rate, O2 saturation, gait, and activity levels constantly monitored. Iterating and improving Apple’s Research app could drive study participation and diversity, advancing medicine. For example, researchers used Apple Watch to monitor AFib in 400,000 participants (published in NEJM!). In addition, CVS Health, Walgreens, and Walmart have all moved into the clinical trials space—Apple should, too.

- Preventative Care: The intelligent guardian constantly monitors users’ vitals, gait, and environmental noise to ensure there are no scary deviations from users’ baseline. And if there is a deviation from baseline, whether an irregular rhythm or a fall, the patient, loved ones, or EMS will automatically be notified. Apple has an opportunity to advance the intelligent guardian area to turn data into actionable insights. For example, suppose a user’s gait is off. In that case, Apple can notify them of it and provide exercises (or app!) to strengthen muscles or refer them to a local physician/physical therapist for an evaluation. The downstream effect is preventing dangerous—or deadly—falls.

- Workflow: Apple has tried improving hospital workflows by streamlining patient data to physicians and enhancing team communication. The workflow value proposition will be the next “big” area to tackle in healthcare, as evidenced by the increased funding the area has received throughout the year. Given Apple is all about elegance and efficiency, they have the opportunity to leverage their technology to streamline workflows in the healthcare setting. For example, this could be a tap-in check-in for patients with Apple Watch or iPhone, monitoring physician idle time in the clinic, or visualizing patients’ Apple Watch data through the EHR.

In summary, Apple is rumored to enter the health insurance space in 2024. Possibilities include Apple creating its own insurance company or partnering with an incumbent insurer (likely in the MA space). While the prospect of Apple entering the insurance space is exciting, it doesn’t beat the excitement of imagining how Apple can leverage its technology and market penetration to tackle the low-hanging fruit in healthcare. Whether it’s insurance or advancing its tech, Apple will continue empowering people to live healthier days.

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.