15 October 2022 | Healthcare

Why Walmart Created a Clinical Trials Vertical

By workweek

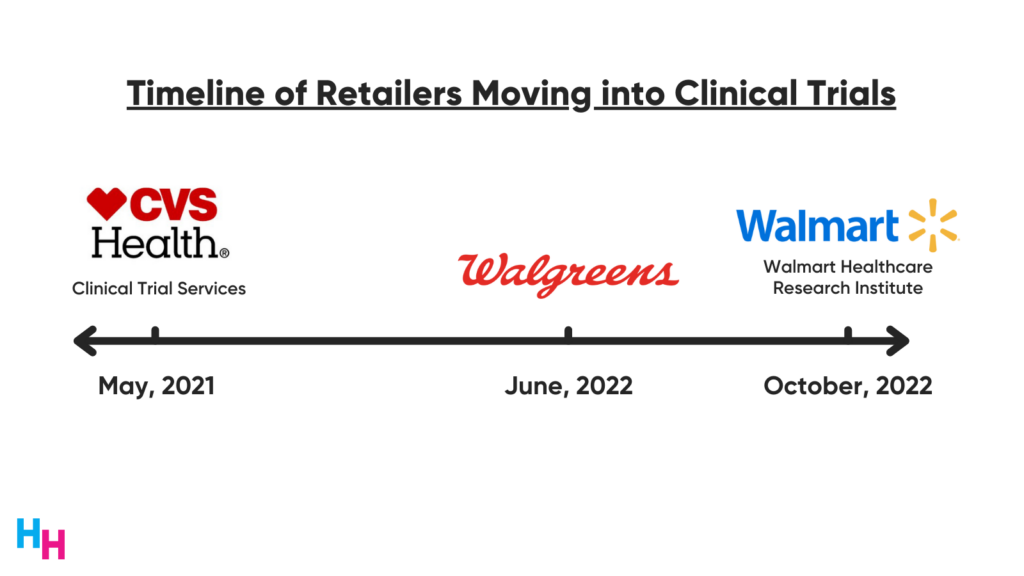

Walmart launched the Walmart Healthcare Research Institute, aiming to increase community access to clinical trials. The clinical trials space has received more attention lately: CVS Health and Walgreens announced earlier this year that they’ve created new verticals focusing on clinical trials.

All three companies are targeting the clinical trials space intending to make clinical trials safer, higher quality and more equitable. While their strategy to enter the clinical trials space is well-intentioned, likely benefiting the medical field and patient care in the long term, these companies are also following the money.

The Deets

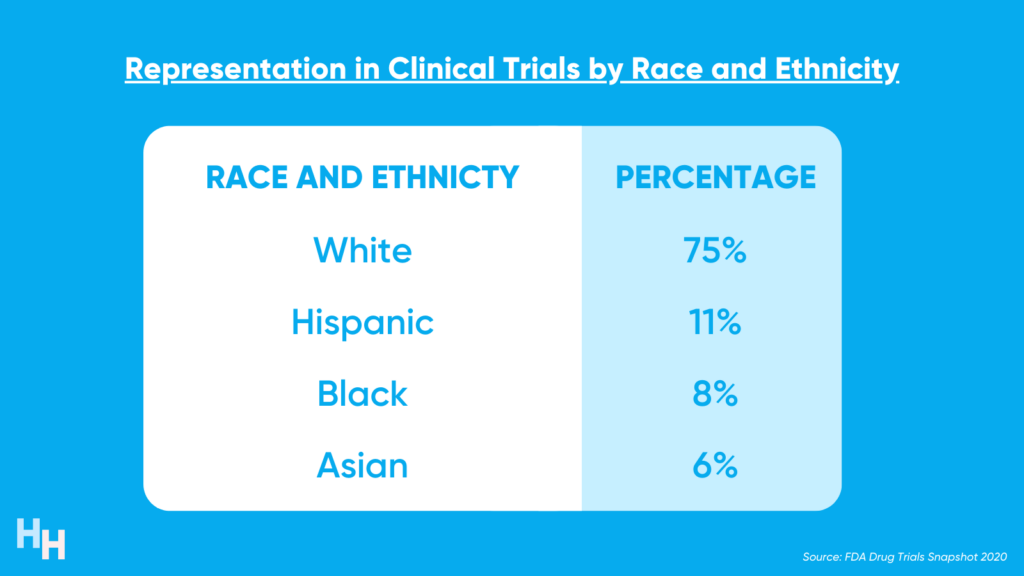

The Walmart Healthcare Research Institute will focus on clinical trials investigating treatments for chronic conditions (diabetes, cardiovascular disease, Covid-19 and asthma) in populations that are historically underrepresented in clinical trials. These include older adults, rural residents, women and minority populations.

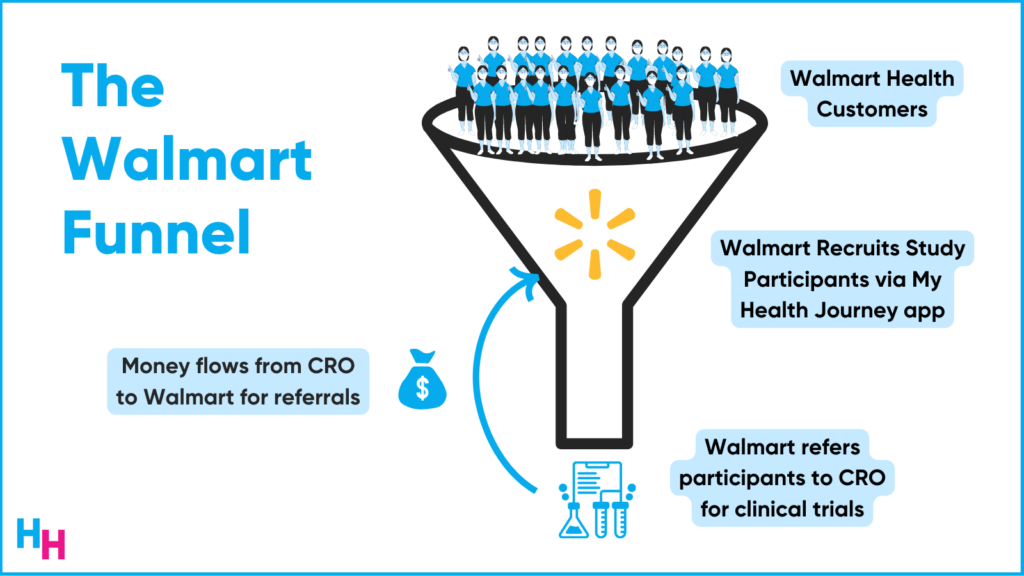

Walmart won’t be running the actual clinical trials but rather will serve as a source of referrals to academic centers and contract research organizations that are running the trials. Think of Walmart acting as a funnel for diverse research participants, which are in low supply but in high demand in the clinical trials world. Diverse participants make clinical trial data more generalizable to larger populations. Walmart has since formed contracts with several strategic partners:

- Laina Enterprises — virtual clinical trial company

- CTI Clinical Trial & Consulting Services — a contract research organization

- Pharmaceutical companies

- Leading academic medical centers

According to Walmart, the research institute is already demonstrating strong results, with a referral rate 3x the industry benchmark. Walmart has quick and easy access to their customer base—90% of Americans live within 10 miles of a Walmart and almost 4,000 of their 10,500 stores are in underserved areas.

Walmart is streamlining their clinical trial referrals through their new My Health Journey app. Through the app, the research institute provides customers with info regarding clinical trials and participation. Customers can also track their own health data and obtain their insurance info.

CVS Health and Walgreens’ Clinical Trial Strategy

CVS Health and Walgreens have also moved into the clinical trial space.

CVS Health

CVS Health launched their clinical trial services in 2021 to increase community access to trials with a focus on improving the effectiveness of trials. According to their announcement, CVS’s clinical trial services entail the following:

- Precision patient recruitment: Leveraging analytics, national reach and local community connections to engage individuals by helping them learn about clinical trial opportunities that may be appropriate for them

- Real-world evidence generation and studies: Retrospective and prospective studies that measure the impact of novel devices and therapeutics in real-world settings

- Clinical trial delivery: Innovative, decentralized options for the delivery of Phase III/IV clinical trials and real-world evidence studies at CVS locations, at home or virtually

Like Walmart and Walgreens (see below), CVS stores are everywhere. Their omnipresence gives them the power to increase access to trials if they’re taking place at a CVS Health facility. In fact, 85% of Americans live within 10 miles of a CVS retail health.

Since the inception of their clinical trial services, CVS has delivered over 200 in-home clinical trials by Coram (home infusion and tube feeding therapy), engaged and pre-screened hundreds of thousands of study participants, and conducted studies on the emergence of new coronavirus variants, the flu, and long-covid.

Walgreens

Walgreens launched their clinical trial vertical back in June, aiming to increase patient access and retention in clinical trials by redefining the patient experience (I wrote about it here). Walgreens will form partnerships with pharma companies to create patient-centered clinical trial experiences. The plan is to make clinical trial enrollment and future participation as convenient as possible and ensure the trial population is ethnically and racially diverse.

Walgreens will use its clinical data (remember, they own VillageMD) and match its patient population to suitable clinical trials. Participants won’t have to travel too far for the clinical trials, which is one of the most significant reasons people don’t participate in clinical trials. Around 75% of Americans live within five miles of a Walgreens, which has 9,000 locations in all 50 states.

The Money Maker

While clinical trials benefit the greater good, they are by no means cheap for pharmaceutical companies and other sponsors. Trials are perhaps the most expensive part of drug R&D. Pharmaceutical companies spend an average of $19.0 million (with wide ranges) for one drug’s clinical trials. The next obvious question is where is the money going?

At a high level, clinical trial funding flows from the sponsor (pharmaceutical company, NIH, academic center) to the organization or researchers running the clinical trial. In a majority of instances, sponsors pay a contract research organization (CRO) to manage the entirety of the clinical trial since managing it themselves would be too complex, time-consuming and expensive.

You can think of CROs like wedding planners: you pay them a flat fee, they take care of everything, and will charge you for the costs of catering, photographer and florist. Like wedding planners, these contract research organizations are paid no matter the study’s (or wedding’s) outcome. Read another way: they’re always winning.

Contract research organizations have many responsibilities, some of which they perform in-house, others of which they outsource to third parties.

If a CRO chooses to outsource certain services, they may pay the third party a flat fee or per-participant rate. Here are some examples:

- CVS Health: CVS partners with drug developers (like Pfizer) and CROs to deliver research solutions, from recruitment to administering study-related tests (at-home, in-house and virtual).

- Walgreens: A CRO is likely paying Walgreens a per-participant trial site fee for running trials at Walgreens’ locations.

- Walmart: One of Walmart’s partners is CTI Clinical Trial & Consulting Services, a CRO. This CRO is likely paying Walmart a lucrative per-participant fee for Walmart’s referral of historically underrepresented clinical trial participants, to which Walmart has access.

The CRO market is growing quickly with a predicted compounded annual growth rate of 12%, reaching 163.50 billion by 2029. As drug sponsors and CROs look to increase participant diversity in and access to their clinical trials, they’ll turn to CVS Health, Walgreens and Walmart’s clinical trial services. Business is just starting.

Dash’s Dissection

Some of the most challenging aspects of running a clinical trial are recruiting diverse participants and ensuring participants can transport to the clinic site. Despite the importance of well-run clinical trials, 80% of clinical trials do not meet patient enrollment deadlines and 30% drop out because of inconvenient trial site locations, complex participation requirements and trial duration.

What CVS Health, Walgreens and, now, Walmart all have in common is their reach: 90% of Americans live within 10 miles of a Walmart, 85% of Americans live within 10 miles of a CVS and 75% of Americans live within five miles of a Walgreens. This reach puts these companies at an advantage in recruiting diverse populations into clinical trials compared to other companies working in recruitment support. Additionally, these three companies all have the resources to run clinical trials, given their provider networks, convenient locations, health clinics, pharmacies and acquisitions ranging from telehealth to home health companies.

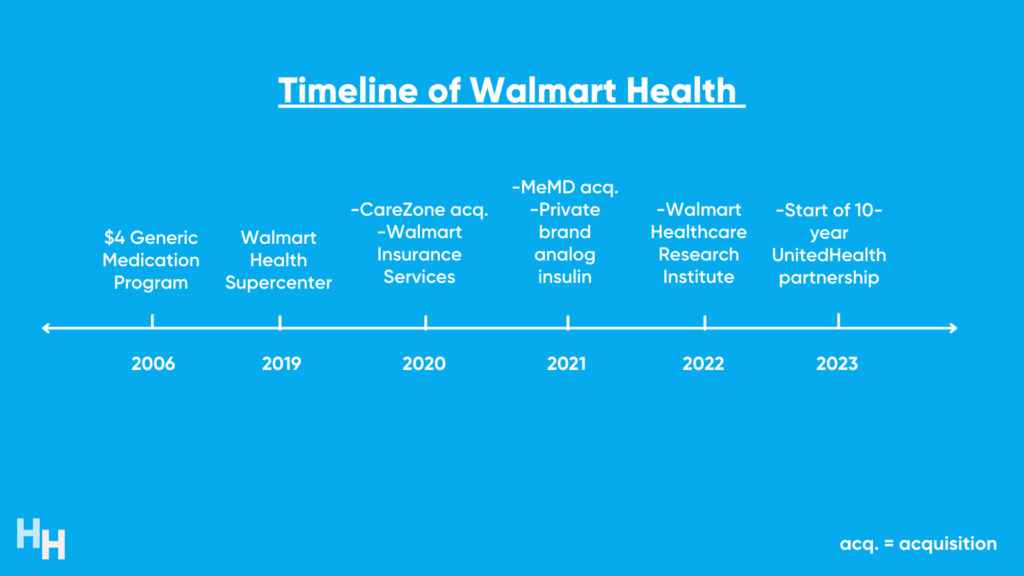

Walmart, in particular, is no stranger to healthcare and has continued to make strategic moves within the space over the years.

This is quite the health stack from Walmart, touching many verticals in healthcare. The clinical trials space is Walmart’s latest move and will certainly be a revenue driver. However, the reason they’re not running the actual trials (e.g., providing the experimental treatments) like CVS Health and Walgreens is likely because Walmart Health’s super clinics have been slow to scale— it’s not clear why.

I do imagine a future when Walmart acts as a clinical trial site once they have the resources. When this happens, Walmart will join the likes of Walgreens and CVS Health in decentralizing clinical trials, which will have profound effects on the medical field. By increasing accessibility to clinical trials, underserved populations historically left out of them will be proportionately represented, increasing the strength of clinical trials.

In summary, CVS Health, Walgreens and Walmart have moved into the clinical trials space for good reason: it’s lucrative, there’s a high demand for the diverse populations these companies have access to, and it’ll benefit the medical field and patient care in the long run.

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.