Christina Farr brought up an interesting question wondering why insurtechs have struggled so much lately, so I’m here to explain a viewpoint on why the health insurance business kinda sucks for new entrants.

Is that popcorn I smell?

Join 10,400+ thoughtful healthcare professionals, investors, and consultants and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Key Takeaways: Insurtechs vs. Incumbents

Health insurance by default is a horrible business to challenge incumbents. Your profits are capped, you need size to succeed in negotiations, you have heavy capital requirements, you need deep understanding of risk adjustment, and the general public hates your guts for the most part.

Our healthcare system favors incumbents with massive scale in general. This dynamic is the most pronounced in health insurance. The Lindy Effect is real here.

Tech is a tool to be used in healthcare, but can’t change the insurance model or take down incumbents on its own. You still need a good network of docs, people on the ground in every market, top notch risk adjustment, and more to be successful.

Insurance is a horrible business to challenge incumbents

Health insurance is a terrible business to start but a well-oiled machine when you’re big. There are heavy incumbent advantages for a variety of reasons, below being an non-exhaustive list:

Size is the Biggest Factor: There are SO many benefits to being big and established in health insurance:

- Better negotiating leverage with providers and pre-existing relationships / contracts with providers and employers

- Incumbent insurers have built out (and are building out) large services footprints

- Presence in more markets is better for diversifying risk. For an insurer, one or two counties might drive your entire outperformance, but a geographically concentrated plan like Bright in Florida will lead to major losses. Incumbents can also spread out corporate overhead and organizational costs over a wider membership base

- The insurance market is mature and there’s limited ability to compete on price

Capped Profits: Prices are capped at a max of 20% after medical spend. In a good year, health insurers might make 5% in net income. This sucks unless you’re sitting on a massive revenue pool.

Risk Pools are Wonky: The individual and family market is a game of roulette – if you’re not good at risk adjustment, then things like risk adjustment transfers in the individual market (AKA, less risky insurance pools paying $$ to more risky insurance pools) will kill you, which is a big part of what went wrong with Bright.

Tons of Regulation: Insurers have a ton of regs to deal with both at a national and state level like needing capital reserves or the Model Audit rule in addition to existing ACA and CMS guidelines on stuff that insurers have to cover. Medicare Advantage plans are subject to yearly CMS star ratings reviews with constant changes to weightings for various metrics. Bottom line – insurers have to deal with a lot, which makes for heavy upfront admin costs.

Public Perception: Let’s be honest – the general public hates insurers for not covering stuff, prior authorizations and denials of lifesaving medications, etc. This perception isn’t an advantage for incumbents. It works against all insurers in general. You’re fighting a losing battle against Dr. Sally who stitched up your kid’s forehead.

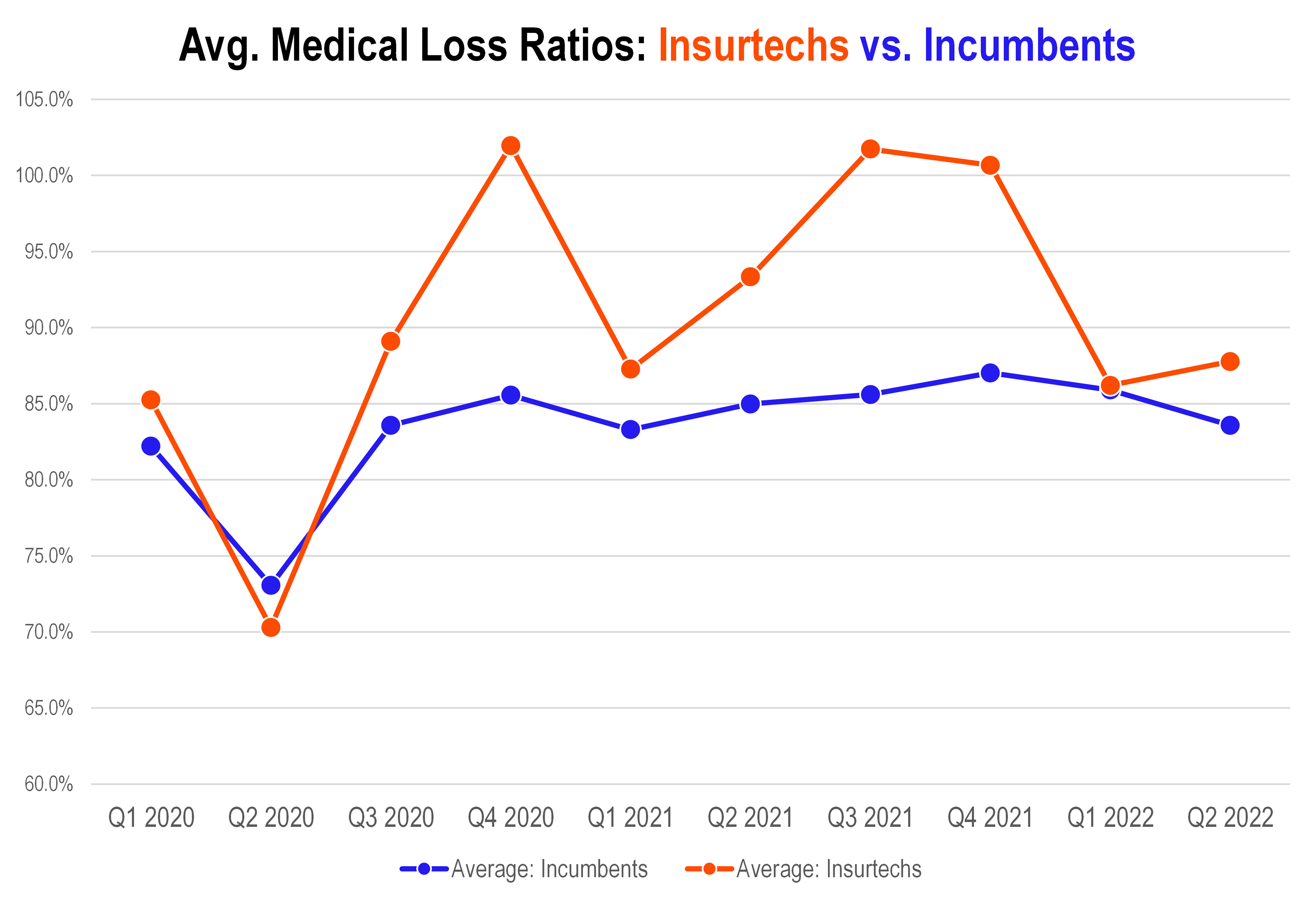

Current Operating Environment Favors Insurers, yet Insurtechs bleed cash

Let’s be real. This is a great operating environment for health insurers and mostly has been for the past decade:

- Hospital admissions are declining and overall utilization is still suppressed from 2019 levels as patients defer care = good for insurers (in the short term; long term effects acuity-wise are unknown but the point is that utilization IN 2022 is down)

- Biden has expanded and is supporting ACA subsidies. In general the ACA has been a boon to health insurers since I see that chart of UnitedHealth’s stock price since 2012 at least once a week on Twitter. Free money from the government!

- MA star ratings sat at all-time high’s in 2022 = more quality payouts

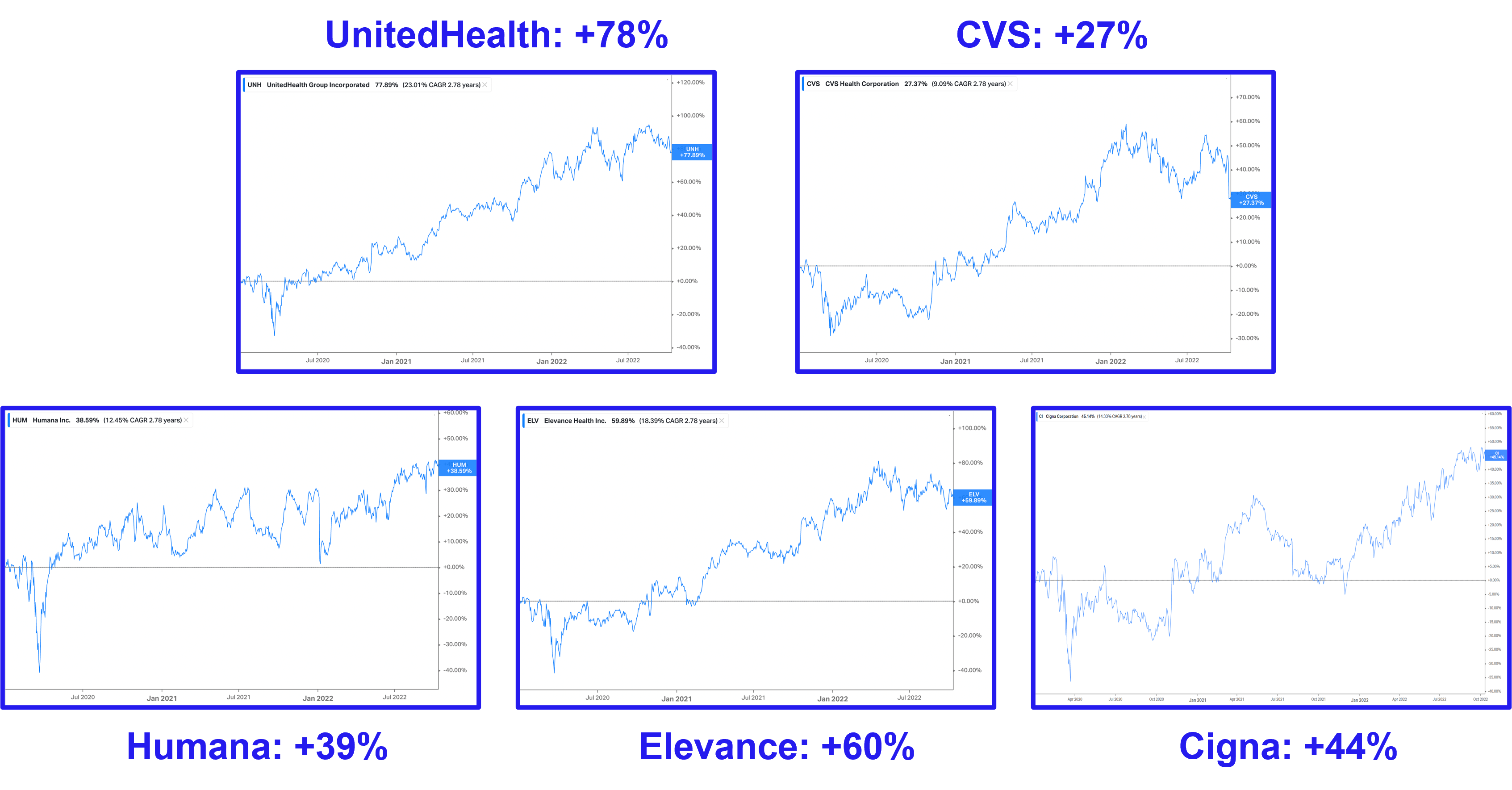

For the reasons listed above and I’m sure many others I’m missing, traditional insurers are hitting all-time high’s in the markets.

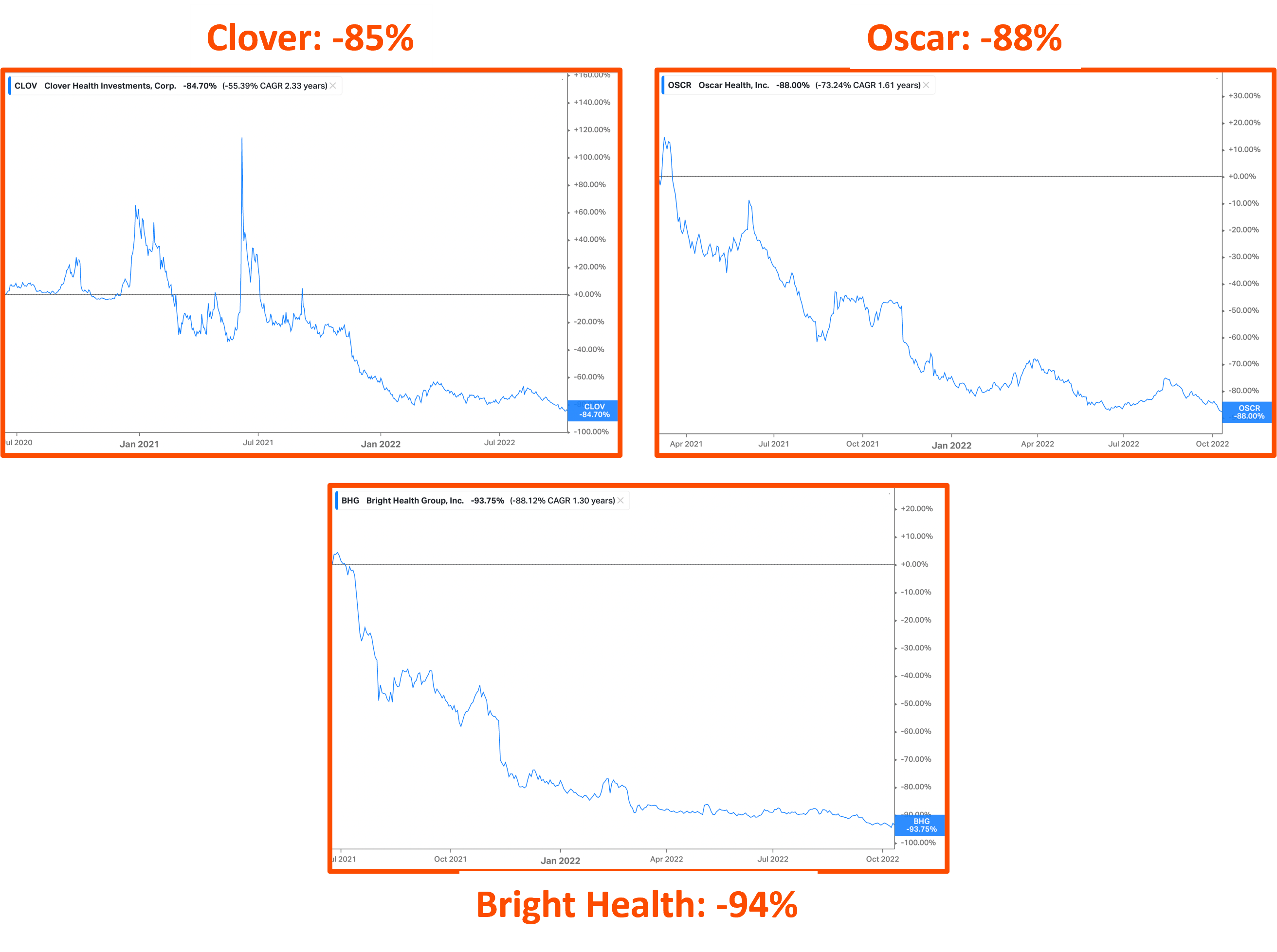

Still, despite the easy operating environment, it’s been an absolute travesty for insurtechs. Losses are piling up. Medical spending is out of control, Oscar is jumping from strategy to strategy like Mario on a Super Mario 64 speedrun, and Bright bit off more than it could chew. More on that below.

You know it’s bad when Clover is throwing out made-up operating stats like ‘normalized medical cost ratio’ and ‘adjusted operating expenses’ and NORMALIZED adjusted EBITDA. At least they were a meme stock for a minute.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Bright Health’s Failure & Pivot

The rise, fall, and then pivot? of Bright Health will be an interesting case study for years to come.

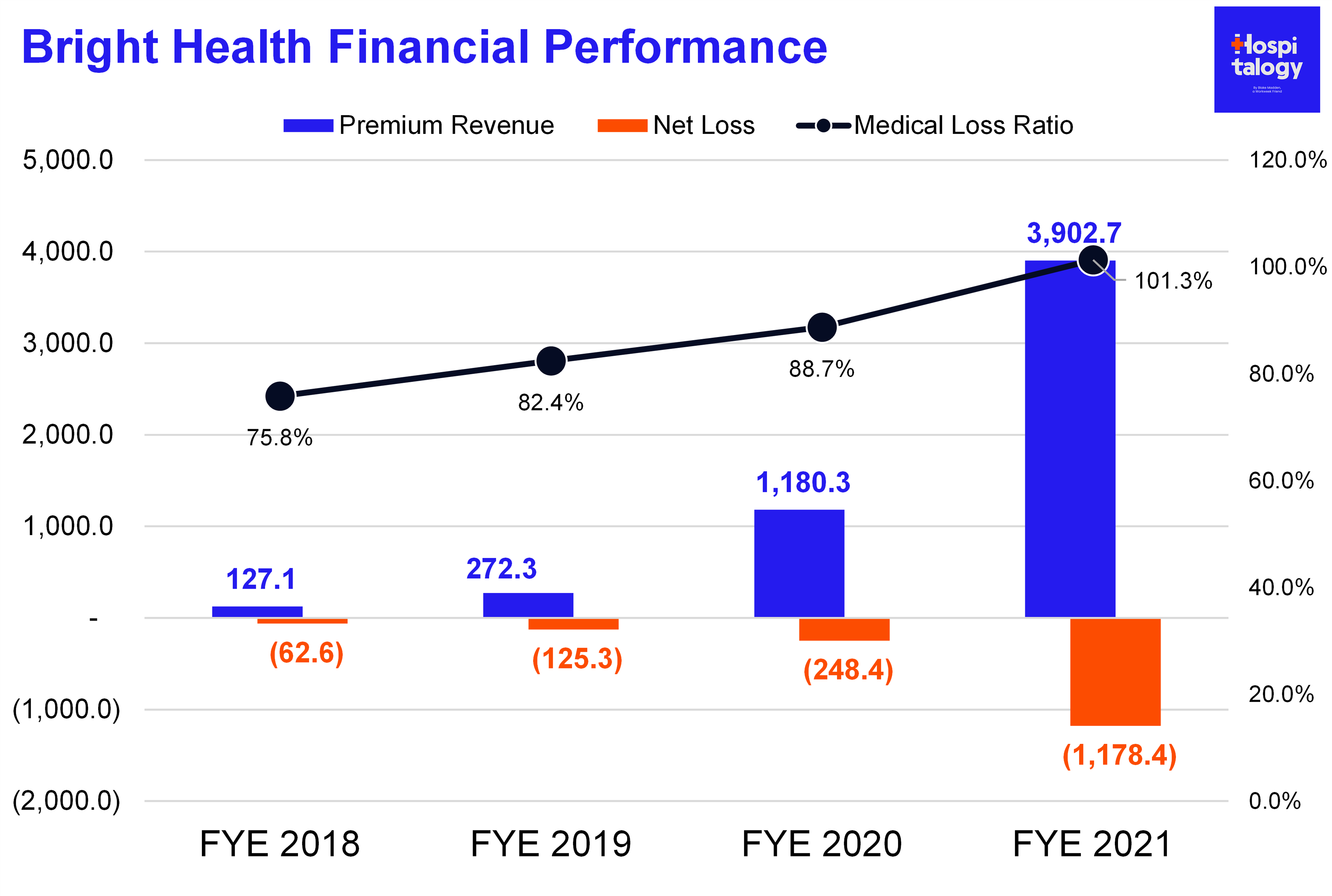

Bright IPO’d in June 2021, raising $924 million. The mark valued Bright at $11 billion, making it the largest digital health IPO ever. It had passable operating performance in 2018 and 2019 with sub-85% medical spend.

Then in 2021, Bright proceeded to lose $1.2B to the horror of bright-eyed investors. In Q4 2021 alone, the insurtech lost $800M. Bright underperformed expectations so badly that Cigna and New Enterprise Associates (its VC backer) had to throw it a $750M lifeline, massacring its stock price.

Fast forward six months later – Bright found itself in a similar position, needing another large influx of capital or risk shutting down operations. Rather than continuing to foot the bill for markets hemorrhaging losses, Bright decided to shut off the insurance valve.

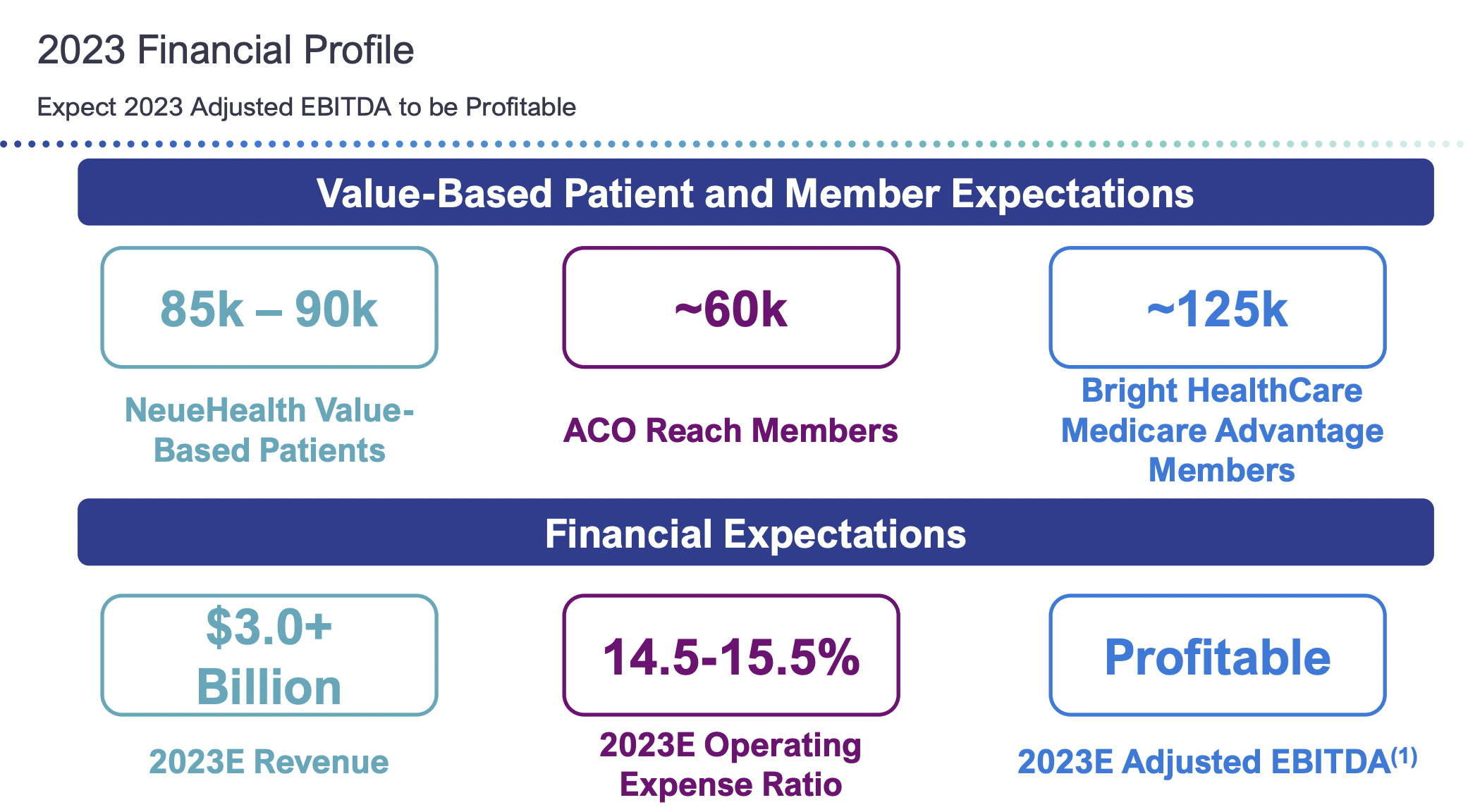

It withdrew from ALL individual and family plan products and ALL Medicare Advantage products outside of Florida and California. In its strategic update, Bright now wants to focus on a fully aligned care model in Texas, California, and Florida. The move will release around $250M in insurance capital reserves while Bright also receives another $175M preferred equity pipeline from investors. In other words, Bright is biting the bullet and tightening focus around core markets with NeueHealth presence. It expects adjusted EBITDA profitability in 2023 but the big question from here is whether Bright is able to continue to grow in the senior care market across its risk-based, direct contracting (ACO REACH) and MA membership.

But but…Bright’s executive team has a ton of experience in health insurance. So what went wrong here? Here are some guesses:

- Growth too fast, too soon: Bright struggled to get its operations under control amid too many market expansions. While the firm promised its investors scale and growth into new markets through acquiring members and providers, the firm couldn’t manage that massive growth with existing infrastructure. As a result, it couldn’t appropriately capture risk adjustment for its members.

- Dumb administrative expenses: Similarly to the first bullet, Bright spent a ton on marketing and selling expenses during the special open enrollment period in 2021 and throughout its growth campaigns. And let’s not talk about the exorbitant executive compensation package Bright decided to pay itself out despite its horrid operating results.

- MA and Employer/Commercial market struggles: The individual market contains the lowest barrier to entry and is primarily where we saw Bright and Oscar compete with incumbents. Unfortunately, like I mentioned before, this market is hard to predict from a risk perspective. Bright didn’t have the network to compete with incumbents in more lucrative, stickier markets. Bright’s decision to compete on price in the IFP markets also led to more narrow networks, less patient choice, worse consumer experience, and higher out of network costs for its business.

- Geographic Concentration: Bright held a large market presence in Florida and that concentration risk led to outsized medical costs, which were especially pronounced during the height of the pandemic with regional surges. Incumbents were more insulated from surges given their larger membership bases across diverse geographies and also offset by deferred care from elective procedures.

As a result of its poor business decisions, Bright Health stock saw a washout from $11B+ to under $1B. Whooooosh. What’s that? The sound of investment dollars getting flushed out of Bright Health (mine included).

Mismatch between Insurtech investments and outcomes.

The healthcare – and health insurance – experience needs to improve. But so far, VC-backed upstarts have failed to make a dent because the odds are stacked toward incumbent insurance giants.

This write-up won’t stop investment dollars from flowing into healthcare insurtechs. The TAM is too enticing, and the industry needs obvious improvement. A.I., data, and other tech-enabled offerings will eventually find ways to force incumbents to evolve their business models in order to stave off their VC-backed competitors.

That being said, any belief that a snazzy looking UI with some added tech haphazardly attached to an insurance product can outcompete the titans of an industry filled with execs who have been in the game for decades is naive at best.

For now, creating a tech-enabled operation in health insurance from scratch is extremely difficult. Not impossible, but hard. And investors need to be realistic about returns in this space. There’s a fundamental mismatch between expected returns in healthcare insurtechs (including historical valuations) and insurance regulations that mandate fixed margins and low-single digit net income.

P.S. – plz stop valuing insurance & risk-based businesses on multiples of revenue.

Final Thoughts.

I’m not saying it’s impossible for Bright, Clover, Oscar, Devoted, Alignment, and others to break up the health insurance industrial complex with a ton of regulatory capture, but maybe there’s a better option.

Instead of focusing on building large-scale insurance products to compete directly with incumbents, perhaps there’s a better path forward:

- Dare I say it…work with the United’s and Humana’s of the world to help them transform patient experience and create a better product from the inside out. Understand key, nuanced pain points for these organizations and build them.

- Build offerings that make them more $$$ (ahem…Signify and in-home evaluations)

- Develop smaller-scale MA plans (like Alignment) that focus on member experience, a key factor in quality payouts (MA star ratings).

Finally, another interesting, potentially-emerging option for insurance startups…partner with health systems and providers to help them transition to risk-based models (physician enablement, ACOs, MA plans). Create new insurance products that will ultimately compete with insurers in the employer and self-insured markets.

Thanks for reading! If you enjoyed the essay, join 10,400+ thoughtful healthcare professionals, investors, and consultants and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!