All I have to say today is…

HOW BOUT THEM LONGHORNS?!

Alright enough of that (maybe). Let’s dive in to this week’s healthcare news.

Join 10,300+ thoughtful healthcare professionals, investors, and consultants and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

| SPONSORED BY MAINSTREET |

| In 2022 it’s more important than ever for health tech founders to make the most of every dollar. Small businesses can take advantage of tax credits, but it’s difficult to know what might apply to you. Luckily, MainStreet offers a great solution to ensure you’re taking advantage of everything available to your organization. MainStreet plugs directly into your payroll system and uses their expert tax specialists with over 50 years combined experience to find every tax credit your business qualifies for. The average venture-backed startup saves $50,000+ in its first year alone. MainStreet is providing Hospitalogy readers with a limited time offer – Sign Up Today and Don’t Pay anything until January 2023. Plus you’ll get $500 off your first bill. Both of these offers are only available through October 15th, 2022! Sign up today! |

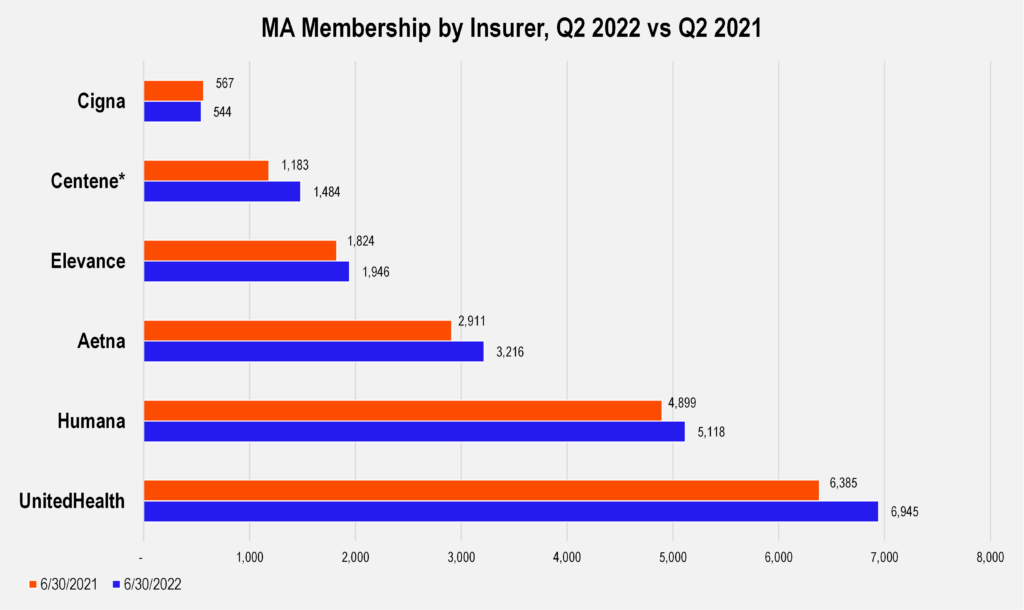

Medicare Advantage plans get major downgrades

Every year, CMS releases star ratings (AKA the Google Reviews of health insurance plans for seniors). The star ratings are based on a variety of inputs that are supposed to reflect the experiences of the consumers that had those plans in the past. It’s a big deal for plans to get a 4-star or higher plan, since CMS issues a 5% quality bonus for plans above that threshold. Given how much revenue is at stake in MA coverage, a 5% drop is a BFD. 2023 star ratings will affect 2024 revenue.

For 2023, a significant number of plans received downgrades for two main reasons.

- One – CMS removed ‘guardrails’ in effect from the public health emergency that prevented major national performance downgrades caused by pandemic-era conditions. Because of this temporary relief, star ratings rose to an all-time high of 4.37 in 2022. That dropped to 4.15

- Two – CMS increased the weighting of patient experience, complaint, and access measures for 2023 (CAHPS). CVS in particular griped about weighting CAHPS so heavily, claiming in its 8-k filing that just 976 members, or less than 1/10 of 1% in its largest plan, were surveyed, leading to the hit to revenue in ‘24.

Based on a ModernHealthcare analysis, the biggest losers include Aetna (CVS) and Centene.

- CVS had to issue an 8-k related to its Aetna plan downgrades. While 87% of CVS MA plans were 4-stars or higher in 2021, just 21% will be above 4-stars in 2023 including its biggest plan, Aetna National PPO (1.9M members), affecting revenue payouts in 2024. It’s a big hit to profitability – likely around 4% to 5% of earnings in 2024. CVS stock dropped around 7% at the time of announcement.

- Centene lost the most stars among major insurers according to the MH analysis. 1.8% of Centene’s MA plans received a 4-star or higher rating, down from 32.6% (!!!) in 2022. Centene dropped about 5% on the news.

Among the winners included Kaiser, SCAN Health in California, and Humana.

Madden’s Musing: While the star rating declines were expected and an industry-wide event, this news is still a huge hit both monetarily for insurers but also politically. Medicare Advantage is wildly unpopular among progressives who are against the privatization of MA. Insurers get constant heat from all sides related to controversial risk adjustment practices in MA – including this frontpage NY Times article published this week (v timely). MedPAC and other government officials estimate MA overpayments between $12B and 25B. At the same time, seniors love their MA plans and MA enrollment will overtake traditional Medicare in number of beneficiaries in 2023.

Also, don’t forget about CMMI’s also-politically-unpopular programs – direct contracting (DCE) and ACO REACH – which are also tied to the whole ‘Medicare privatization’ thing but have led to investments in the value-based care space. MA controversy will continue and balances should be added, but the machine rolls on. Just like Texas and Alabama, the focus will be on getting those elusive 4-and-5-stars.

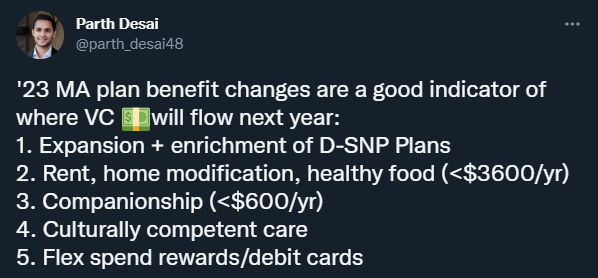

Final tidbit: As Parth Desai notes, MA plan benefit changes and policy from CMS tend to dictate where investment dollars flow:

Resources:

- ModernHealthcare: Nearly 20% of MA plans lose star revenue for 2023

- Part C and Part D Performance Data from CMS

- McKinsey – MA star ratings may decline with new methodology

- The 57 plans that earned 5-star ratings for 2023 – Intermountain’s SelectHealth, UPMC’s Health Plan, Kaiser’s Foundation plans, BHSH’s Priority Health, and Baylor’s MA plan all earned 5 stars for 2023 among other notables.

- MA star ratings: basics and best practices

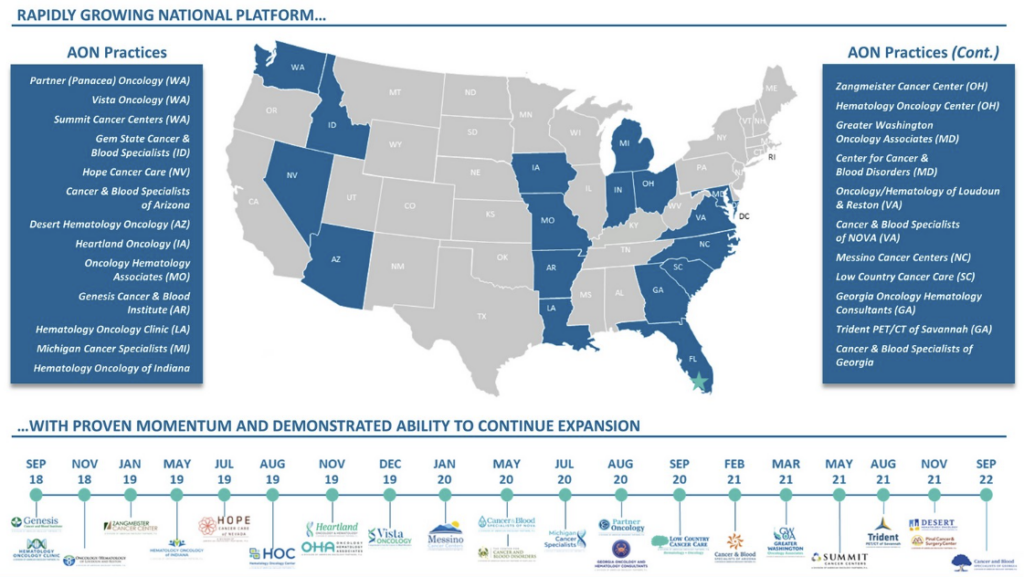

American Oncology Network to go public via SPAC

Defying the odds of the times, oncology practice management platform American Oncology Network (AON) is combining with the Digital Transformation Opportunities Corp SPAC at a $500 million enterprise value. It’ll join its peer, The Oncology Institute, as one of two oncology-focused physician practice management organizations in the public markets at a time when basically nobody is going public.

About AON: the platform has a 24-practice, 71-clinic, 107-physician footprint across 18 states since starting in 2018. Financially speaking, AON is operating at a $1.16B revenue run-rate for 2022 with slightly above breakeven adjusted EBITDA. The firm seems to deploy the roll-up playbook similar to PE-backed or other practice management platforms in the sense that its growth comes through affiliating with oncologists with the add-on play of transitioning these physicians and practices to value-based care arrangements given its participation in the Oncology Care Model and I imagine the coming Enhanced Oncology model similar to OneOncology.

Madden’s Musing: Economics of the business aside, is anyone touching a healthcare-related SPAC in 2022?

Resources:

- Investor prospectus SEC Filing – pretty decent presentation in there

- AON Press release

Market Movers

Business and Strategy:

- ApolloMed announced the purchase of Valley Oaks Medical Group, a practice operating in Las Vegas, Houston, and Fort Worth with a 20k patient panel including 6k Medicare patients, allowing ApolloMed and the physicians to dive deeper into risk.

- Publicly traded post-acute operator Brookdale Senior Living is reportedly exploring a sale.

- Yale New Haven Health is acquiring 3 hospitals in the CT area which also includes a couple medical groups and other post-acute related assets.

- Dialysis player Fresenius is expanding into early-stage kidney disease treatment and drug development to prevent and slow chronic kidney disease.

- CVS is apparently in exclusive talks to buy Cano, but things seem to be on shakier ground. The deal could fall apart, which would leave Cano in a state of capital disarray.

- HCA is selling 3 Tulane-based hospitals to New Orleans-based LCMC Health for $150M plus a $220M capital commitment. The article notes that this sale creates a duopoly for hospital operators (Ochsner and LCMC) in the Tulane market. We’ve seen this play out before, fam. I wouldn’t be surprised if this attracts some antitrust attention from the Louisiana AG.

- Memora Health announced a partnership with Luma Health to streamline care coordination and management at health systems.

- 7-hospital system Pipeline Health filed for Chapter 11 bankruptcy, citing “skyrocketing labor and supply costs, decreased ability to generate revenue and delayed payments from various insurance plans for critical patient care services already delivered.”

- Kansas Health System is acquiring 2-hospital system Olathe Health.

- Galileo partnered with Elation Health, giving Galileo-affiliated physicians access to Elation’s API at the point of care.

- Staffing firm ShiftMed partnered with Uber Health to remove transportation barriers for healthcare professionals.

- Priority Health partnered with Kroger to launch two co-branded Medicare Advantage plans – PriorityMedicare + Kroger and PriorityMedicare D-SNP + Kroger. Creative.

- PointClickCare launched Virtual Health, a telehealth service for SNFs.

- Mark Cuban Cost Plus Drugs Company partnered with Capital Blue Cross to offer members access to MCCPDC drugs.

- Aetna Better Health of Florida partnered with value-based home care group Emcara Health to bring its primary care comprehensive model to members.

- Augmedix partnered with Kirby Medical Center to offer its ambient documentation solution to physicians at the health system.

- CVS hired former Optum exec Amar Desai to run its healthcare services division. CVS is quickly developing its services offerings to catch up to the other managed care players and bolster its offerings.

- Encompass Healthcare announced a JV with Piedmont to build a 40-bed IRF facility in Athens, Georgia

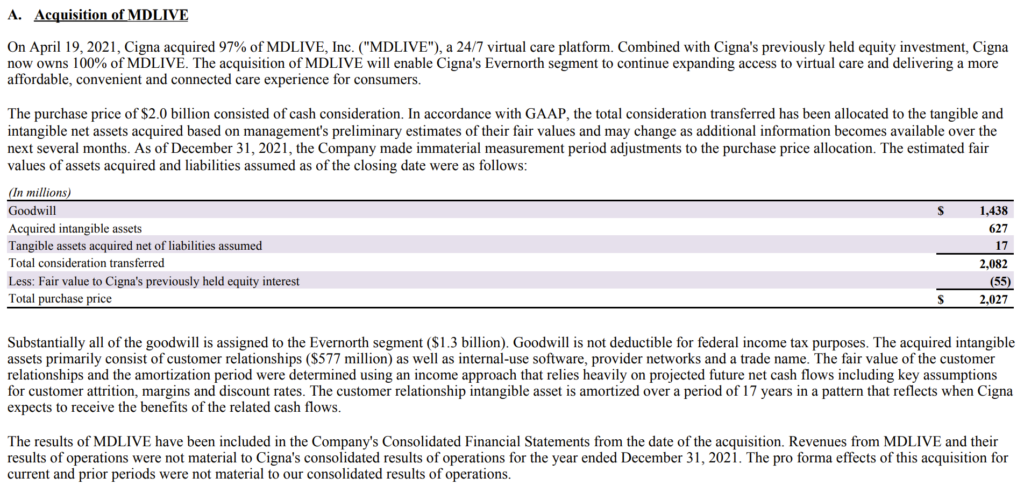

- Interesting little tidbit I found while poking around Cigna SEC filings – the managed care player disclosed in its 10K that it bought MDLive in April 2021 for just north of $2B, yet another player who timed the top pretty nicely.

Regulations and Rates:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- A Health Affairs essay estimates that around 15% of total U.S. medical spending is administrative waste, AKA, a smooth $570B.

- The FTC is investigating (WSJ paywall) PE-backed US Anesthesia Partners, one of the largest providers of anesthesia services, to determine whether it’s amassed too much market power via tuck-in acquisitions.

- Providence provided a response to the NY Times article shared last week – read it here.

- Home health & nursing home players are asking for more relief in the year-end spending bill.

Other:

- CommonSpirit Health is still dealing with a huge IT security breach that apparently started on October 3rd.

- CMS is asking for commentary related to a national provider directory

- Synapse Medicine launched a multi-site clinical study with multiple hospitals to measure its clinical support and medication reconciliation software in hospital settings.

- Ro is partnering with the National Institute on Aging for Alzheimer’s research.

Miscellaneous Maddenings

Hospitalogy Top Reads

- This was a nice piece from Sapphire Ventures on the rise of the digital health enablement stack – dynamics pushing the trend forward and major players emerging within each component of the stack itself.

- Pretty interesting dialogue between several pharmacy and PBM execs discussing the industry & regulations here.

- I covered the 19 biggest stories in healthcare during Q3 – check them all out here.

- Jared wrote a fascinating piece about Eli Lilly’s new blockbuster drug candidate, tirzepatide, and why he thinks it’s a game changer for obesity care.

Join 10,300+ thoughtful healthcare professionals, investors, and consultants and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!