There Are Still a Few Pirates Left in Fintech

3 FINTECH NEWS STORIES #1: 1033 What happened? It! It happened! It finally happened! The Consumer Financial Protection Bureau (CFPB) proposed a rule that would accelerate a shift toward open banking, where consumers would have control over data about their financial lives and would gain new protections against companies misusing their data. “With the right…

Read MoreThe Generative AI Revolution in Banking is Perfectly Timed

Our premise for today is simple – Disruption in financial services tends to occur when technology innovation intersects with a significant regulatory shift. The last time this happened was in 2010, when this: Gave us this: As many others have written, it was the combination of smartphones and the Durbin Amendment that led to the…

Read MoreThat’s More Like It

3 FINTECH NEWS STORIES #1: I Don’t Get It What happened? A London-based fintech infrastructure company raised a seed round: Kennek has raised $12.5 million in a seed funding round led by HV Capital and supported by Dutch Founders Fund, AlbionVC, FFVC, Plug & Play Ventures and Syndicate One. The company has developed an end-to-end…

Read MoreFintech Hangover Cures

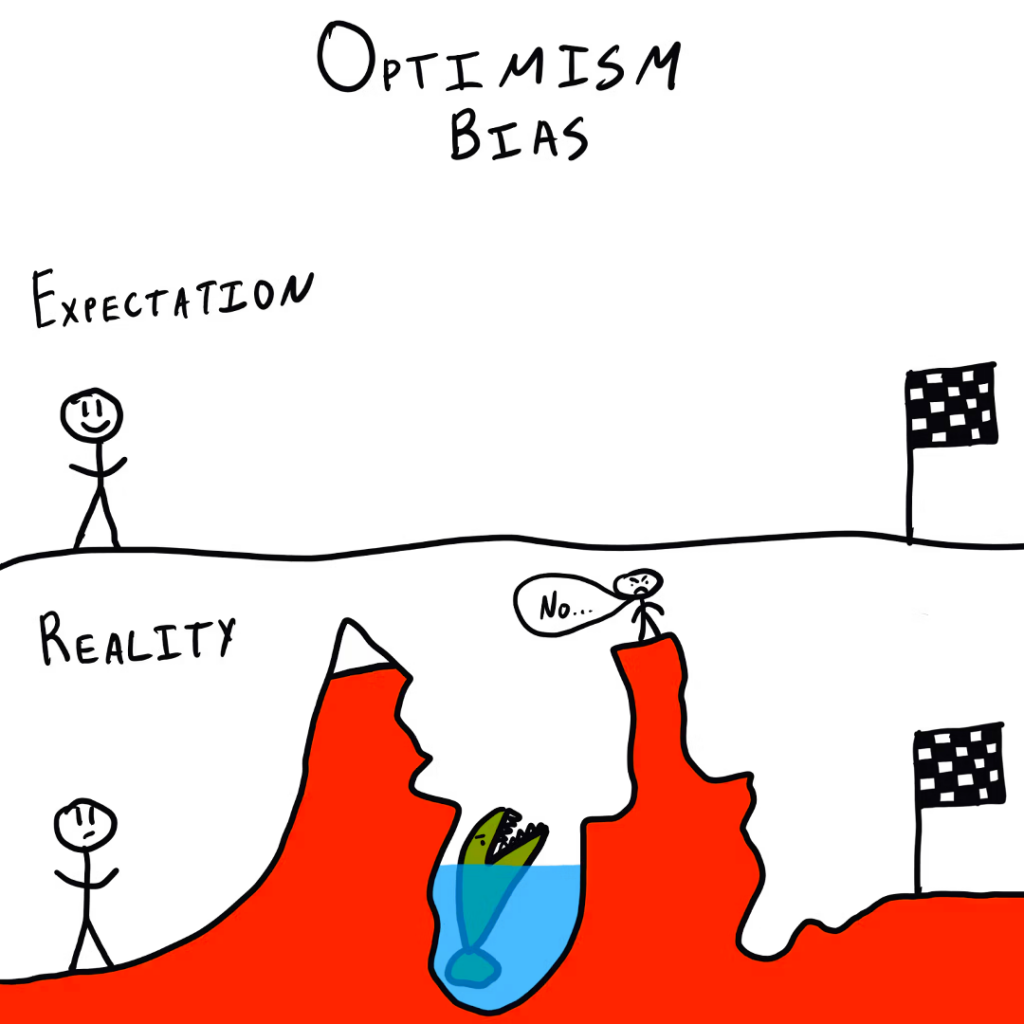

One of my favorite cognitive biases (yes, I have favorites, I’m a social studies teacher by training) is the optimism bias – the tendency for a person to believe that they are more likely than the average person to experience positive outcomes and less likely to experience negative ones. The reason that it’s one of…

Read MoreExperian Goes All In

3 FINTECH NEWS STORIES #1: Experian Goes All In What happened? Experian now offers a bank account: Experian has launched the Experian Smart Money Digital Checking Account and Debit Card, featuring FICO score-boosting Experian Boost. The Experian Smart Money Digital Checking Account allows consumers to pay eligible bills, such as utilities, rent and telecom, and…

Read More8 Questions About the Future of Open Banking

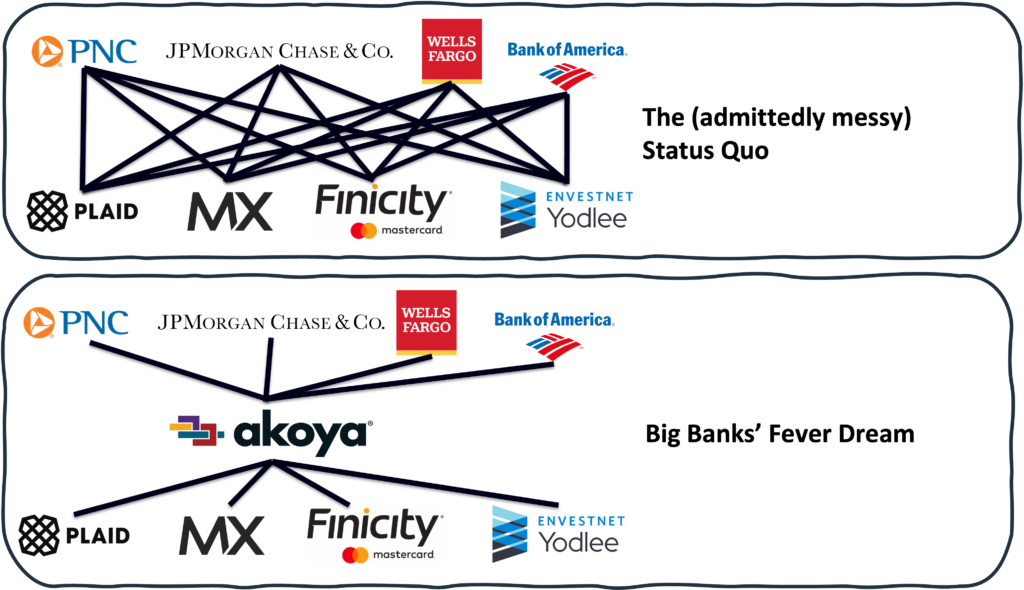

You likely saw the news, first reported by my friend Jason Mikula over at Fintech Business Weekly, that Akoya (an open banking platform) and a few of the financial services companies that own it are making a rather aggressive move: Fidelity, where Akoya was incubated, has taken by far the most aggressive steps to limit…

Read More