Posts by Alex Johnson

The Evolution of Entrepreneurship

In an episode of the Fintech Takes podcast, Frank Rotman (Chief Investment Officer at QED Investors) observed that the stock market has become a game disconnected from reality: When you buy a stock, you are buying ownership in the future cash flows of that business. Companies publicly report their financial performance once a quarter, but…

Read MoreBaaS. So Much BaaS.

3 FINTECH NEWS STORIES #1: BaaS. So Much BaaS. What happened? A lot! So much drama on BaaS Island! Treasury Prime made a strategic pivot (and, unfortunately, laid off roughly 50% of its staff): We are launching a new Bank-Direct product, which will empower banks to support the entire lifecycle of a direct relationship with…

Read MoreCatching Up on Some Fintech Reading

I finally managed to catch up on some overdue fintech reading this week, and, knowing that you (like me) likely have less free time than you’d like, I thought I’d share my CliffsNotes from the two reports I read, in the hopes that I might be able to entice you to carve out some time…

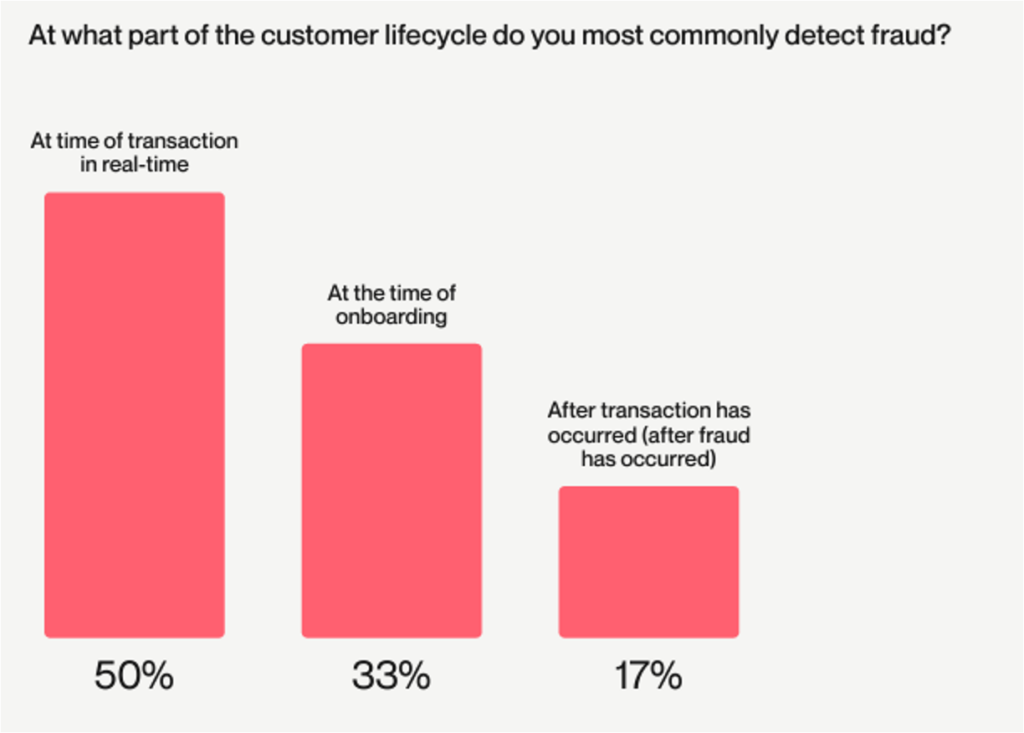

Read MoreIt’s Time to Bring Identity Verification and Fraud Prevention Back Together

My philosophy for personal security is centered around access control. If I keep my doors and windows locked, especially when I’m not at home, I generally feel like all of my stuff will be safe. My sons, who are five and three, have a very different philosophy. They watch their stuff. They watch it very,…

Read MorePremium Neobank. Discount AmEx.

3 FINTECH NEWS STORIES #1: Premium Neobank. Discount AmEx. What happened? As you may have heard, Capital One is buying Discover: Capital One’s recently announced $35.3 billion acquisition of Discover Financial isn’t just about getting bigger — gaining “scale” in Wall Street-speak — it’s a bid to protect itself against a rising tide of fintech…

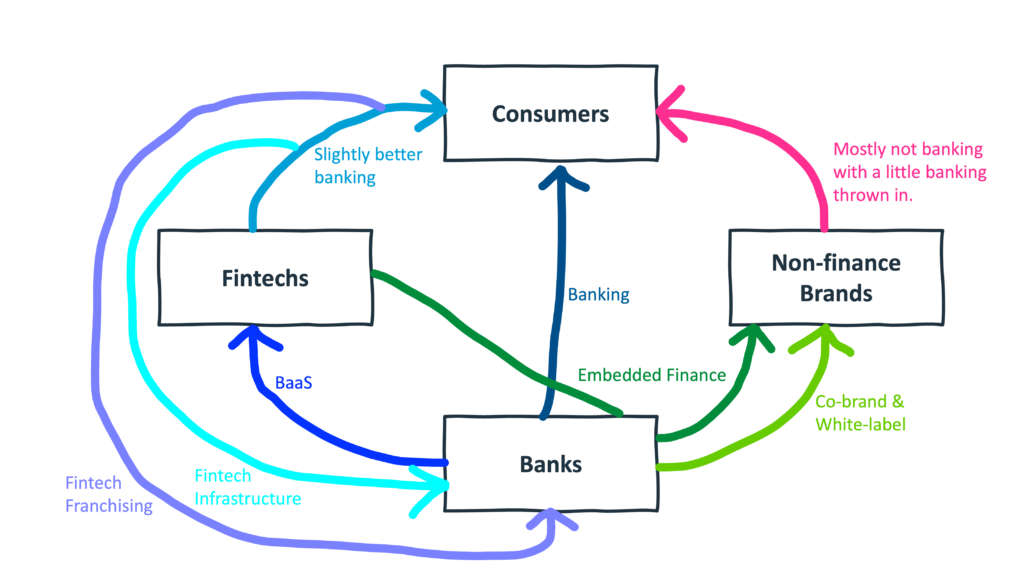

Read MoreFintech Franchises

Here’s a very rough model for how B2C financial services works today: Banks provide banking products and services to consumers. A small (but growing) portion of banks provide banking-as-a-service capabilities to fintech companies. Fintech companies provide slightly better banking products and services to consumers. Banks provide co-brand and white-label banking products and services to non-finance…

Read More