02 September 2023 | Healthcare

CMS Takes the Reins: The Big Shake-Up in Medicare Drug Pricing

By workweek

CMS announced the 10 Medicare Part D medications slated for pricing negotiations next year, on which Medicare enrollees spent a staggering $3.4 billion in out-of-pocket expenses in 2022.

CMS has not been able to negotiate drug prices as other countries do, thanks to the Medicare Modernization Act of 2003. Now, the recently signed Inflation Reduction Act (2022) allows CMS to negotiate drug prices—and the ball is finally starting to roll.

In this article, I’ll share details on the 10 drugs that made CMS’s list, catch you up on why CMS is finally able to negotiate drug prices, and give my take on the impact of such negotiations on the system and patients.

The Deets

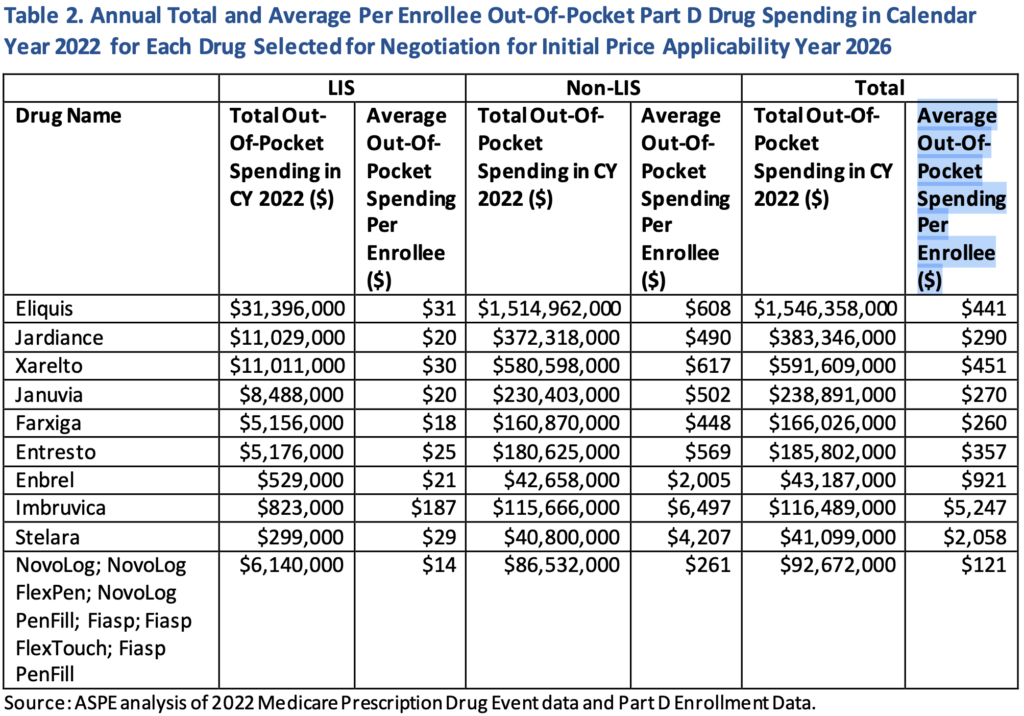

Below is the list of the 10 drugs selected for negotiation along with the total out-of-pocket spending and average per capita spending in 2022. Note, these are common drugs used to treat diabetes, heart failure, autoimmune disease, blood cancers, and clotting disorders.

CMS selected these drugs for negotiation based on their high total Medicare gross expenditures (around $50 billion before rebates) and the fact that millions of Medicare enrollees take one or more of these drugs.

From now until the end of 2024, CMS and manufacturers will be negotiating on the maximum fair price for the drug (more info in the next section). These prices will be finalized in March 2025 and enacted in January 2026.

What to Know: Inflation Reduction Act

The Inflation Reduction Act, signed in 2022, included drug provisions expected to save the government over $200 billion over a decade. One of the drug provisions gives authority to Medicare (CMS) to negotiate prescription drug prices on selected high-cost drugs: “Medicare Drug Price Negotiation Program.”

CMS will negotiate the “maximum fair price” for a drug, which is set based on the lower value of data like the average sales price for a Medicare Part B drug or the average price of a Medicare Part D drug weighted for the number of people taking it and discounts received.

Drug manufacturers will face hefty penalties if they don’t comply with the negotiation process. These penalties include a 65% excise tax on the drug’s revenue in the U.S., which will increase by 10% quarterly to a max of 95%. If drug manufacturers don’t want to pay the tax, they can withdraw their drug from Medicare and Medicaid formularies. Further, if drug manufacturers charge patients more than the negotiated price, they’ll pay a penalty equal to 10x the difference between the price charged and the maximum fair price.

As you’d imagine, drug manufacturers haven’t responded well to the Inflation Reduction Act. Several of them are now suing the government, arguing the program violates the 1st, 5th, and 8th Amendments of the Constitution. You can read more from my article here.

Opponents of the Inflation Reduction Act raise an additional argument, emphasizing the potential stifling of innovation. They caution that implementing price control measures could have adverse effects on drug research and development, thereby posing a threat to future medical breakthroughs. Consequently, they’ve aptly nicknamed the Inflation Reduction Act as the “Innovation Reduction Act.”

Dash’s Dissection

There’s a lot of nuance to the Inflation Reduction Act as it pertains to drug pricing negotiations and the economic impact. However, viewing the economic impact from a systems and patient perspective has helped me better understand it all.

Systems Impact

The Medicare Drug Price Negotiation Program is expected to save Medicare $96 billion over 10 years. In 2021, Medicare spent around $120 billion on all prescription drugs (not just Part D), accounting for 13% of all Medicare expenditures ($900 billion). Drug pricing negotiations are projected to save Medicare ~$10 billion per year over the next ten years, which would decrease the proportion of Medicare prescription drug spending from 13% to 12%.

Now, if we zoom out and view the drug pricing negotiation savings from the perspective of the entire healthcare system, the program doesn’t seem to make a dent in healthcare spending. Prescription spending totaled $378 billion in 2021, accounting for ~8.89% of total healthcare spending ($4.255 trillion). If you account for the annual $10 billion savings from Medicare drug pricing negotiations, the percentage of health spending on prescription drugs decreases to 8.67%.

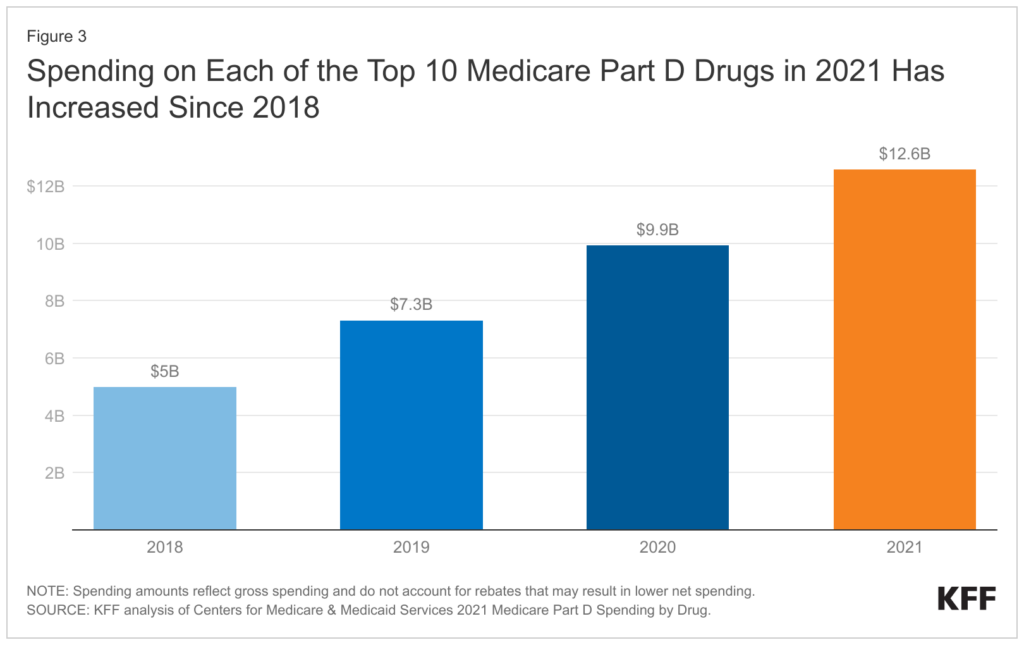

Sure, these small percentage drops seem unremarkable. I’ll just add that these price negotiations may prevent the ever-so-increasing prices of these ten drugs which in total have more than doubled between 2018 to 2021.

We also need to think about the ripple effects of allowing Medicare to negotiate drug prices and publicize them. For example, once leading heart failure medications like Jardiance and Farxiga have a negotiated price, other competitors in the SGLT2 inhibitors class will need to adjust their list prices or increase rebates to remain competitive and get on formularies.

So, pay attention to how competing drug manufacturers respond to CMS’s negotiated prices. The cost savings from drug negotiations may be more profound.

Patient Impact

From the patient perspective, we’re dealing with a more meaningful and understandable impact in regards to out-of-pocket cost savings (primarily because we can understand the impact of $100 in savings vs. $100 billion, which to me is unfathomable).

Look at the graphic above where I show the average out-of-pocket spending per Medicare Part D enrollee in 2022. Any cost savings that patients may reap from drug pricing negotiations is a win. The greatest savings will likely come from the most expensive drugs on the list. The lower-cost drugs will see some savings, but not large. Why? These drugs have been around for some time and are already heavily rebated. Therefore, the negotiated price that CMS lands on may not be less than the price of the drug after rebates.

In fact, one study (bias alert, so take it with a grain of salt) predicts that only four of the 10 drugs on the list will have a negotiated price less than the current net price (after rebates) CMS pays now for the drugs. TBD on how it really results.

In summary, CMS is taking significant strides to negotiate drug prices for Medicare Part D, targeting medications with notable out-of-pocket expenses for enrollees. The Inflation Reduction Act of 2022 grants this negotiation power, aiming for substantial government savings over the next decade. However, these negotiations are not without controversy, as some drug manufacturers argue against its constitutionality and warn of potential stifling of medical innovation. Systemically, the cost savings might appear marginal, but the patient perspective offers a more tangible understanding of the benefits. The true impact of these negotiations will unfold over the coming years, especially as CMS finalizes drug prices and manufacturers respond.

Stay ahead in healthcare with my weekly Healthcare Huddle newsletter, covering digital health, policy, and business trends for 28,000+ professionals. Share with colleagues and subscribe here.