26 August 2023 | Healthcare

The Unbundling: Is Blue Shield’s Big Move a PBM Game-Changer?

By workweek

Blue Shield of California announced a new cost-saving drug prescription model that involves cutting ties with CVS Health’s Caremark pharmacy benefit manager—one of the largest PBMs in the U.S.

This news received a lot of attention, specifically around the “disruption” of PBMs. CVS’s stock subsequently plummeted, prompting the question: Is this the beginning of the end for PBMs?

No, likely not.

In this article, I’ll dive into Blue Shield of California’s new model, highlight the controversies around PBMs, and share my thoughts on the “unbundling” of PBM services inherent in the new model.

The Deets

Blue Shield of California’s Pharmacy Care Reimagined initiative, set to launch in 2025, is anticipated to offer its approximately 5 million members annual medication cost savings of up to $500 million. The initiative is designed to enhance transparency in the drug supply chain, increase the convenience of accessing medications, and reduce costs.

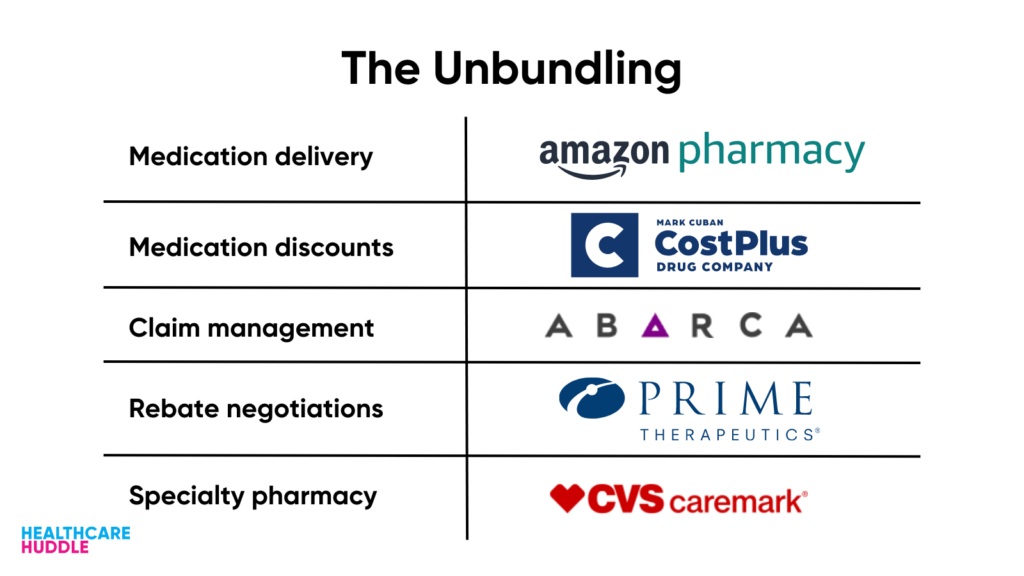

Blue Shield’s initiative works by unbundling the functions of Caremark—the PBM middleman (I explain more in the next section). Blue Shield has chosen five companies that align with the initiative’s “philosophical and technology standards” to replace the functions of Caremark. Here are the companies:

- Amazon Pharmacy: convenient, transparent, and free delivery of non-specialty medications (read Blake’s article here).

- Mark Cuban Cost Plus Drug Company: transparent and affordable drug pricing at the pick-up counter via Cost Plus Drug’s Team Cuban Savings Card. As of now, only a few thousand independent pharmacies and all of Kroger’s pharmacies accept the Team Cuban Savings Card (read my article here).

- Abarca: payment of prescription drug claims via its PBM platform, Darwin.

- Prime Therapeutics: rebate negotiation with drug manufacturers, with the goal of moving toward a value-based pricing model.

- CVS Caremark: specialty pharmacy services. “But I thought Blue Shield cut ties with Caremark?” Yes, they did—but only for their non-specialty pharmacy services.

So, Caremark’s functions have technically split into the five entities listed above—an “unbundling” of services.

Why Target PBMs?

PBMs function in shady, mysterious ways. It’s hard—dare I say, impossible—to know how much money is flowing back and forth, which is why medications are so expensive. PBMs have therefore been under the magnifying glass for their opaque tactics that have been driving up medication costs.

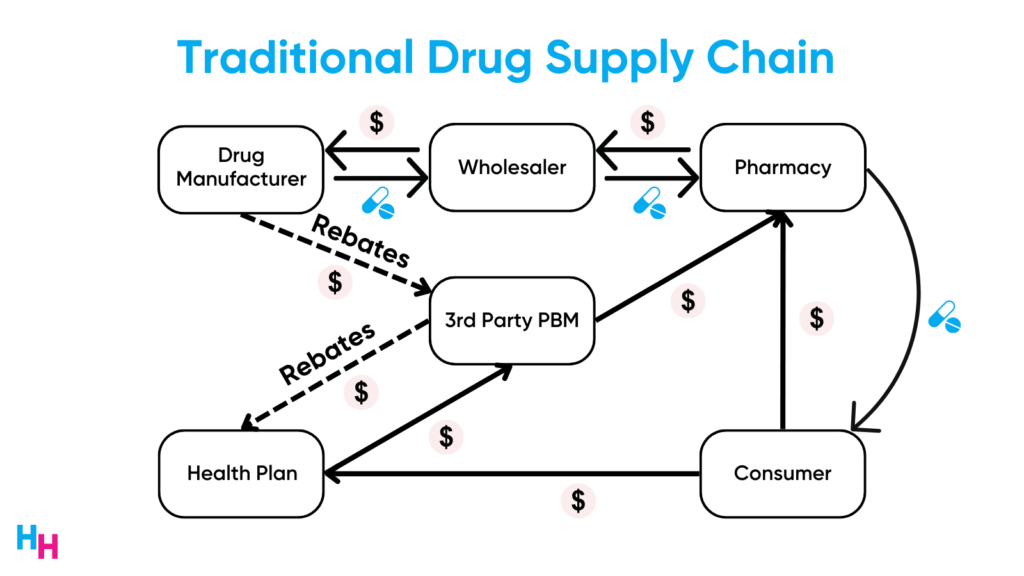

To understand PBMs’ role in the drug supply chain, you need to know the main players (boxed below in the graphic).

In the drug supply chain, wholesalers buy drugs from manufacturers and sell them to pharmacies. Drug manufacturers negotiate with pharmacy benefit managers (PBMs) to get their drugs on insurance companies’ formularies. Since the decision rests with PBMs, they negotiate both with insurers, to ensure the manufacturer’s drugs are covered, and with pharmacies, to ensure those drugs are dispensed. This intricate web involves numerous financial exchanges, often obscured, driving up drug prices.

Rebates play a pivotal role in this chain, primarily benefiting PBMs. Manufacturers give rebates—based on a percentage of the drug’s list price—to PBMs. In turn, PBMs share some of these rebates with insurers, who then pass a fraction to employers. Due to the significant revenue from rebates, for drugs like the Humira biosimilars to compete with Humira, their list prices must align closely with Humira’s, ensuring sizable rebates for PBMs (this is the whole issue with rebates).

Three PBMs own 80% of the market (Caremark, OptumRx, Express Scripts), which makes it extremely difficult for smaller PBMs to gain entry, giving these three PBMs immense negotiating power.

For all the above, Blue Shield decided to ax Caremark.

Dash’s Dissection

While Blue Shield’s initiative is novel, it won’t be disruptive. I hope I’m wrong.

The novelty comes from unbundling the PBM function by eliminating Caremark’s non-specialty PBM services and replacing them with the five other companies I previously mentioned.

But, I have some questions.

First, some of the core functions of the PBM include formulary development and management, utilization management, and retail pharmacy contracting. Of those companies listed above, none of them will explicitly be serving these functions. Will Blue Shield be taking these PBM functions in-house?

Second, if Blue Shield’s goal is to replace Caremark with companies that better align with its values, including transparency, convenience, and low costs, why not just replace Caremark with a smaller PBM that aligns with those values? Not all PBMs are “bad.” For this reason, we saw Cost Plus Drugs forgo building their own, in-house PBM services, instead partnering with Rightway Healthcare (no rebates or cost spreading) and RxPreferred Benefits—two PBMs that value transparency. This is to say, Blue Shield could’ve just partnered with Rightway Healthcare (which already partners with Cost Plus Drugs), saving the headaches of working with five other companies that all have their own interests.

Lastly, Blue Shield’s move won’t be disruptive to the PBM industry or CVS Health. In fact, CVS Health isn’t concerned about the loss of business, as Blake mentioned in his newsletter. CVS Health makes a majority of its money from its specialty drug services—which Blue Shield is still using! CVS Health also owns the largest share (28%) of the specialty pharmacy market. Here’s what pharmaceutical industry expert Adam Fein had to say:

Despite firing CVS Health’s Caremark business, Blue Shield will still utilize the most profitable and opaque part of CVS Health’s PBM operations.

There is a chance Blue Shield of California truly realizes the $500 million in savings. That’d be great. But at the end of the day, CVS is still driving its revenue from its specialty pharmacy services, which Blue Shield is still using. In my opinion, the only way to “disrupt” the middlemen is through effective policy measures, which are TBD.

In summary, Blue Shield of California’s new initiative aims to reconfigure the drug prescription model by cutting ties with CVS Health’s Caremark and unbundling PBM services. The change promises enhanced transparency and savings, yet raises questions regarding the real impact on the PBM industry and CVS Health’s continued relevance. While the move is novel, its ability to truly disrupt the existing system may hinge on more profound changes, possibly through policy measures, indicating that the traditional PBM landscape may remain largely intact.

Stay ahead in healthcare with my weekly Healthcare Huddle newsletter, covering digital health, policy, and business trends for 30,000+ professionals. Share with colleagues and subscribe here.