04 February 2023 | Healthcare

Looking Back, Looking Ahead: Mark Cuban’s Cost Plus Drugs Company

By workweek

A version of this story was published first on MedPage Today

Just over a year since its launch, Mark Cuban’s Cost Plus Drug Company (Cost Plus Drugs) has appeared to reap nothing but success.

I’m not at all surprised.

As soon as I clicked “publish” on the first article I wrote about Cost Plus Drugs in January 2022, I knew the company would gain tremendous traction: its innovative yet simple, low-cost generic drugs model is disruptive.

Since I published that first article, Cost Plus Drugs has surpassed 1 million accounts, added over 1,000 low-cost generic drugs to its platform, and formed several strategic partnerships. So, as the company commences its second year of operations on a high note, it’s only fitting to reflect on the progress made and predict what’s in store for the upcoming year.

Cost Plus Drugs: Behind the Scenes

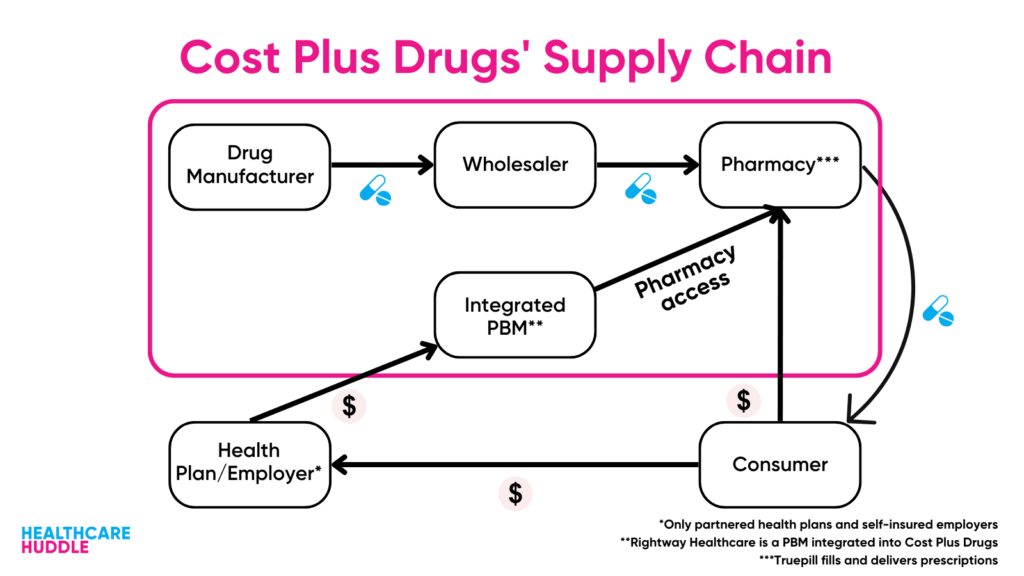

Cost Plus Drugs puts the whole drug supply chain under one roof, allowing it to control costs by removing the traditional players.

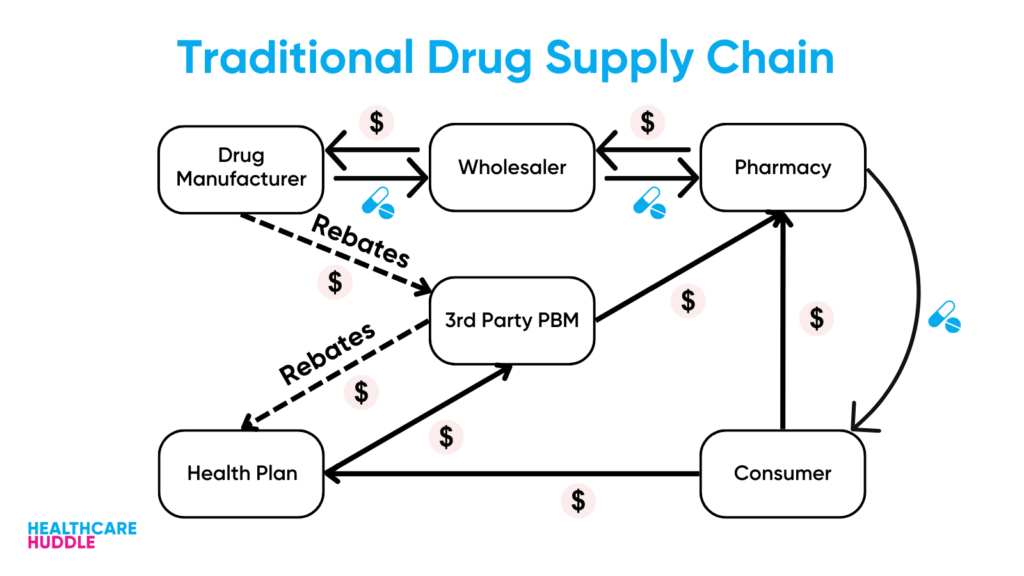

The traditional drug supply chain is unnecessarily complex, with multiple stakeholders negotiating with one another to purchase, sell, and provide rebates for drugs. As seen in the graphic below, there’s a wholesaler that purchases drug supplies from the manufacturer that then sells the drug supplies to pharmacies. The drug manufacturer also negotiates with pharmacy benefit managers (PBM) to place its drugs on insurance companies’ formularies — because what’s the point of manufacturing drugs if no insurance company will cover them? As such, the PBM negotiates with the insurer to fulfill the drug manufacturer’s wishes. The PBM will also negotiate with the pharmacy to dispense the manufacturer’s drugs. Throughout this process, money flows back and forth in opaque ways, raising drug prices.

Cost Plus Drugs places the entire supply chain under one roof. It’s that simple. Yet, no other company has executed such a strategy to lower drug prices at scale for patients. Its radical transparency separates Cost Plus Drugs from every other healthcare company.

Again, since the supply chain is all under one roof, Cost Plus Drugs can control prices. Here’s how the company determines the price of its drugs:

- Manufacturing costs (relatively inexpensive)

- $3 pharmacy labor fee

- 15% markup

- $5 shipping

While Cost Plus Drugs initially intended to place the whole drug supply chain under their own roof — like creating their own PBM — they’ve deviated slightly over the year, allowing them to scale more efficiently and effectively.

A Year in Review

Within its first year of operations, Cost Plus Drugs quickly scaled its customer base through organic growth and strategic partnerships.

In September ‘22, Cost Plus Drugs reportedly surpassed $25 million in sales and 1 million customers (10% week-over-week growth) within the first nine months of operations. Here’s the kicker: customer growth has been largely through word-of-mouth, which Cuban’s massive following has certainly facilitated.

Cost Plus Drugs decided to form strategic partnerships with several PBMs instead of creating their own in-house PBM as initially planned. The in-house PBM would have eliminated the traditional PBM model by essentially integrating its wholesaler and pharmacy so customers would have access to wholesale pricing. But, these partnered PBMs all strictly align with Cost Plus Drugs’ values: no rebates and no cost are spreading, two traditional PBM strategies that raise drug prices and that Cost Plus Drugs aims to avoid. Therefore, these PBMs are the perfect PBM partners to integrate into Cost Plus Drugs’ supply chain, and are a more efficient and effective solution than creating a PBM from scratch.

Here are the PBMs:

- Rightway Healthcare (announcement): This company is a care navigator and PBM. No rebates or cost are spreading involved in their business model. Rightway members have direct access to Cost Plus Drugs from Rightway’s app, maximizing access to low-cost generic drugs.

- EmsanaRx (announcement): The company launched its EmsanaRx Plus platform, which serves as a supplemental drug discount pipeline directly to Cost Plus Drugs. EmsanaRx will collect a 1.5% flat fee for legal, administrative, and data-sharing services, but not charge more than $3 for each insurance claim, and will pass along any rebates collected.

- RxPreferred Benefits (announcement): The company is a transparent PBM. Think of RxPreferred as an employer-sponsored benefit allowing members to access cheap generic meds on Cost Plus Drugs that are covered by their insurance plan.

Cost Plus Drugs also partnered with its first health plan Capital Blue Cross. This partnership will allow Capital’s beneficiaries to use their insurance cards to purchase Cost Plus Drugs’ cheap generic drugs. Again, this is a slight deviation from what appeared to be Cost Plus Drugs’ initial strategy of focusing solely on consumers. This partnership adds payers to Cost Plus Drugs’ customer base.

Lastly, Cost Plus Drugs began its Insulin Test Program to figure out how it can best provide low-cost insulin. For Medicare, monthly out-of-pocket insulin costs are capped at $35 (thanks to the Inflation Reduction Act). The Insulin Test Program includes the following:

- No insurance

- Max 90-day supply of short-acting insulin ($105)

- Shipping & Handling ($65)

The total cost for a 90-day supply is $170, which is more than spending $35/month on out-of-pocket insulin costs for three months (if you’re on Medicare). So, it seems this program is targeted at those on commercial insurance.

The Outlook for Year Two

Coming off a successful first year of operations, Cost Plus Drugs appears destined to experience rapid customer and revenue growth through new strategic partnerships and more cheap generic medications.

The year 2022 showed us that Cost Plus Drugs is expanding its direct-to-consumer strategy by focusing on business-to-business partnerships with health plans and self-insured employers. I envision large payers, even as large as Medicare, engaging in partnership discussions with Cost Plus Drugs. After all, a study in the Annals of Internal Medicine demonstrated significant cost savings ($3.3 billion) for Medicare Part D if beneficiaries were to have used Cost Plus Drugs to purchase their medications.

Additionally, with the opening of a new manufacturing facility, the company can offer drugs like injectables that experience frequent shortages. Offering such drugs, including insulin, will attract even more customers.

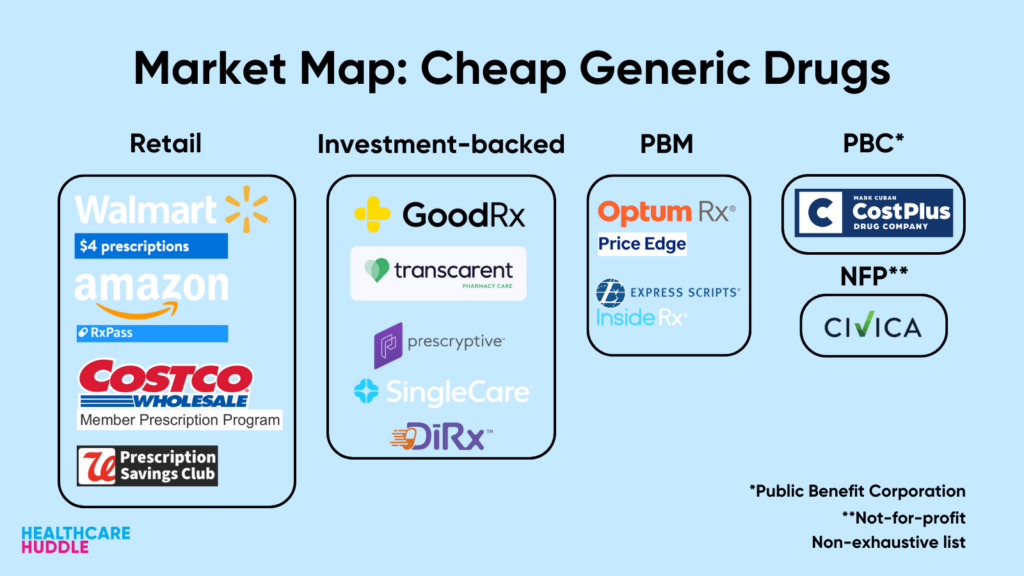

Lastly, increased competition from old and new players may further expedite the pace at which Cost Plus Drugs scales.

This increased pace may come from adding a marketing budget (again, until now, Cost Plus Drugs’ growth has mainly been word-of-mouth), forming more partnerships with health plans and insurers, and working to lower drug prices even further to remain competitive. Within its first year, 130+ of the generic meds on Cost Plus Drugs experienced price drops.

On a personal note, I’m eager to integrate my healthcare knowledge of the generic drug market with clinical care as soon as I start residency. Knowing where patients may find the most affordable medications is invaluable. Unfortunately, a minority of prescribers know about such cheap generic drug options.

As a medical student, I got a taste of this “knowledge integration” when I suggested to my senior resident that we send my patient’s oral vancomycin prescription to Cost Plus Drugs. Medicare didn’t cover oral vancomycin, leaving my patient to pay $500 out of pocket vs. $70 with Cost Plus Drugs. The look on my patient’s face when I told them I found an option that was hundreds of dollars cheaper…

In summary, Cost Plus Drugs has experienced significant success within its first year of operations, as evidenced by its customer and revenue growth and strategic partnerships. Cost Plus Drugs will face increased competition from old and new players (see RxPass and Price Edge), forcing Cost Plus Drugs to innovate, supplying cheaper generic drugs—and more of them. For Cost Plus Drugs, 2023 is destined to be as exciting a year as 2022, especially with the expectations to turn a profit.

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.