Today we’re diving a bit deeper into Amazon’s healthcare strategy given recent announcements by the ecommerce giant in healthcare.

I hope you enjoy the visuals, and if so – would love for you to pass along the newsletter to a colleague. These take me a while to put together and I invest a number of hours and energy to make sure Hospitalogy is as valuable and high quality as possible for subscribers! If you’re new here, subscribe to Hospitalogy along with 20,000+ others here.

Executive Summary: Amazon in Healthcare

- Amazon’s AWS for Health is developing picks and shovels for builders in healthcare to bolster its enterprise cloud offerings (HealthScribe, HealthImaging)

- On the care delivery side, Amazon is building a consumer-centric healthcare platform between Amazon Clinic, RxPass, Pharmacy, and One Medical

- Platforms take a long time to build, but if anyone can do it, it’s Amazon

Amazon’s Healthcare Strategy is Taking Shape

Amazon’s activity and movement toward critical mass in healthcare is picking up steam. The retail ecommerce giant has made a number of plays across AWS and cloud, but also interestingly, in care delivery (both virtual and in-person) and pharmacy.

If they’re not already, Amazon is headed toward being a consumer-focused healthcare platform, making long-term investments and product launches into the space (Clinic, PillPack → Pharmacy, One Medical). On the other side of the coin, AWS for Health, Amazon’s enterprise cloud play, has been increasingly focused on providing the picks, shovels, and lego bricks for healthcare software developers to build new tools as of late which I wrote about on Tuesday (HealthScribe, HealthImaging) with the ultimate goal of creating a more compelling offering for its enterprise cloud healthcare customers.

Take a look at Amazon’s current healthcare footprint as of August 2023 and you can see the strategy slowly taking form:

The healthcare strategy is taking shape in a number of interesting platform plays:

- Amazon Clinic: Amazon Clinic acts as a supply and demand platform for low-acuity virtual care and rather than directly providing care themselves, Clinic aggregates existing supply of virtual care providers (Wheel, SteadyMD, Curai, HelloAlpha)

- Pharmacy ↔ Care Delivery Flywheel: Similarly to CVS-Caremark-Aetna-Oak Street or Walgreens-pharmacy-co-located VillageMD, patients are more likely to fill their prescriptions on-site, or in this case, on-platform with Amazon. The effect is probably exacerbated online given that Amazon’s RxPass is $5 and circumvents insurance along with Clinic.

Amazon’s Platform Advantage in Healthcare

What affords Amazon the ability to create these platforms in healthcare over time? First of all, they’re already giant, so stomaching losses on platform developing are a blip on the radar. Secondly, and more importantly, Amazon Prime is an incredibly sticky user base and allows Amazon to acquire customers for a long-term healthcare platform vision on the cheap. At the end of the day, it all boils down to CAC, and Prime is the CACiest of them all with 150 million active prime users in the US.

Source: Healthcare Platform Blog – Amazon is Uniquely Positioned to Deploy Platform Envelopment Strategies in Healthcare: 7 Leverage Points (Part I) (Part 2)

The Healthcare Platform Blog had a great 2-part series on Amazon where they outlined the following competitive advantages and Amazon’s distinct ability to build platform businesses in healthcare:

- A Huge User Base

- A Loyal User Base

- Provision of Hybrid Clinical Care

- Deep Pockets

- A National and International Footprint

- One-Stop-Shopping for Employers

- Digital Front Door for Healthcare

To this end, Amazon can offer consumer-centric healthcare services to Prime members at scale and continues to push the healthcare needle forward from a consumerism standpoint, offering, for instance, a 28% discount on yearly One Medical memberships $144 / year during Amazon Prime Day, wait times along with telehealth messaging services thru Clinic, and of course the aforementioned RxPass for $5 / month no matter how many eligible generics you need filled.

My biggest question, and one that remains unanswered, is why Amazon bought One Medical – a brick and mortar player – at all when it can act as this great aggregator of virtual care delivery. I was skeptical of the acquisition (and purchase price) back in July 2022, and I’m still wondering what Amazon is planning to do with clinic expansion + Iora today. Is the pharmacy and Prime → One Medical flywheel enough? My working thesis is no…and that more is coming over the next several years.

Amazon’s Future in Healthcare

Amazon is building its version of consumer-centric healthcare. Will consumers continue to come? How will we look back upon the platforms and shovels being built today in 10 years? Things are picking up speed, and yet…healthcare is notoriously slow.

Platform thinking and ROI is long-term, and healthcare is default long-term. Eventually these platforms and flywheels will emerge, but we have a long time to go. But if anyone can succeed, it’s Amazon.

Resources & Further Reading Material:

- Amazon is Uniquely Positioned to Deploy Platform Envelopment Strategies in Healthcare: 7 Leverage Points (Part I) (Part 2)

- The New Rules of Healthcare Platforms (Link)

- Summit Health Advisor’s State of Healthcare Platforms report (Link)

- Amazon and One Medical: Are we There, Yet? (Link)

Links for Amazon Healthcare timeline:

2018:

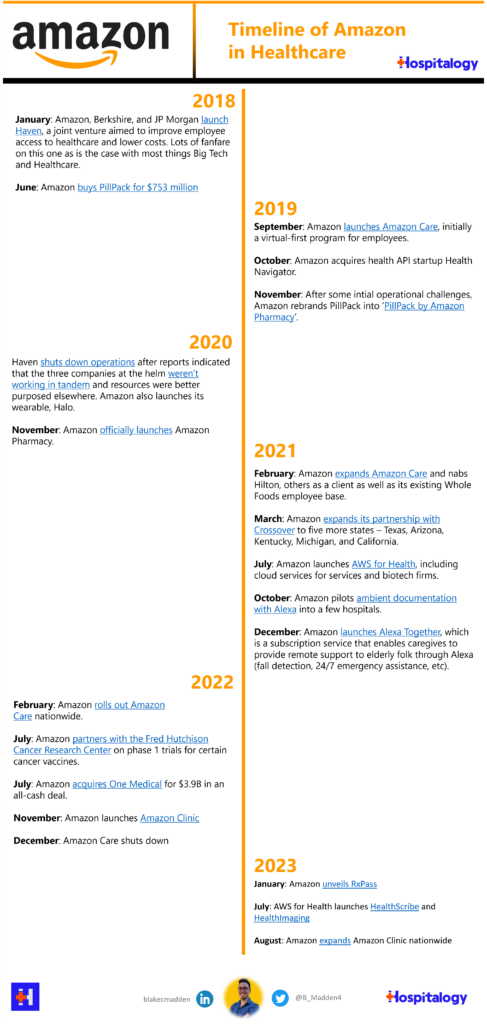

- January: Amazon, Berkshire, and JP Morgan launch Haven, a joint venture aimed to improve employee access to healthcare and lower costs. Lotsa fanfare on this one as is the case with most things Big Tech and Healthcare.

- June: Amazon buys PillPack for $753 million

2019:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- September: Amazon launches Amazon Care, initially a virtual-first program for employees.

- October: Amazon acquires health API startup Health Navigator.

- November: After some intial operational challenges, Amazon rebrands PillPack into ‘PillPack by Amazon Pharmacy’.

2020:

- Haven shuts down operations after reports indicated that the three companies at the helm weren’t working in tandem and resources were better purposed elsewhere.

- Amazon also launches its wearable, Halo.

- November: Amazon officially launches Amazon Pharmacy.

2021:

- February: Amazon expands Amazon Care and nabs Hilton, others as a client as well as its existing Whole Foods employee base.

- March: Amazon expands its partnership with Crossover to five more states – Texas, Arizona, Kentucky, Michigan, and California.

- July: Amazon launches AWS for Health, including cloud services for services and biotech firms.

- October: Amazon pilots ambient documentation with Alexa into a few hospitals.

- December: Amazon launches Alexa Together, which is a subscription service that enables caregives to provide remote support to elderly folk through Alexa (fall detection, 24/7 emergency assistance, etc).

2022:

- February: Amazon rolls out Amazon Care nationwide.

- July: Amazon partners with the Fred Hutchison Cancer Research Center on phase 1 trials for certain cancer vaccines.

- July: Amazon acquires One Medical for $3.9B in an all-cash deal.

- November: Amazon launches Amazon Clinic

- December: Amazon Care shuts down

2023:

- January: Amazon unveils RxPass

- July: AWS for Health launches HealthScribe and HealthImaging

- August: Amazon expands Amazon Clinic nationwide