Welcome back to another edition of Hospitalogy, where I break down the business of healthcare for busy healthcare executives and professionals. Subscribe here to join 20,000 other healthcare folks. As always, there’s plenty happening across the healthcare ecosystem. If you’ve got anything interesting you think would be worth covering, feel free to shoot me an email or DM. I’m not a journalist by trade; just a wannabe over here.

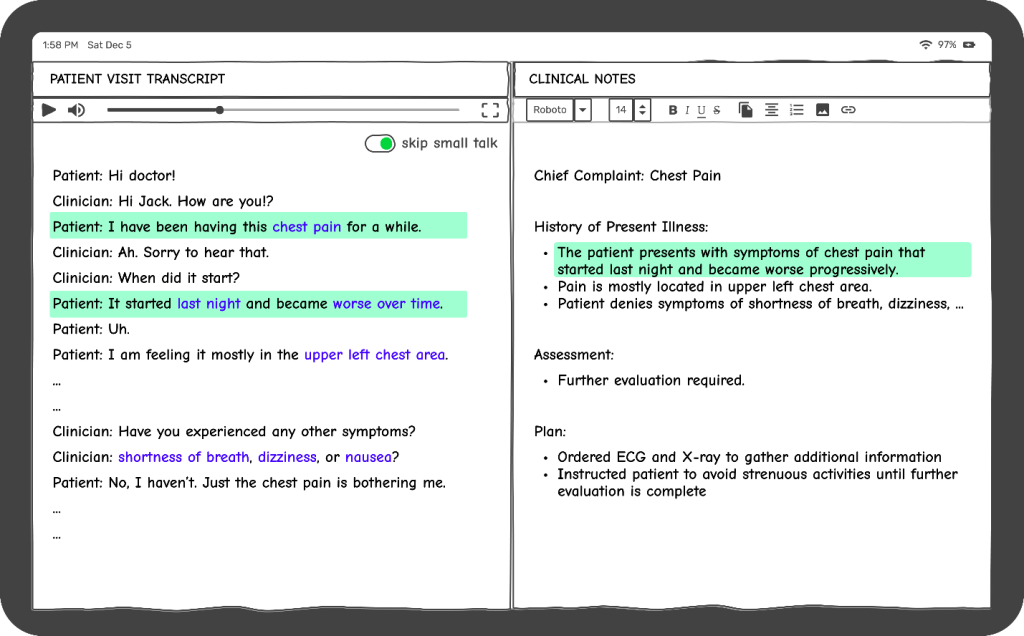

SPONSORED BY NABLA

Is pajama time familiar to you?

Meet Nabla Copilot, an AI medical scribe helping clinicians enjoy care again.

Nabla Copilot generates clinical notes in real time, reducing stress and improving patient care.

“I think I’ve struck gold finding this product. This is incredible. I didn’t use my computer to take notes today. I had faith that Nabla would take care of everything for me so I was able to concentrate solely on the patient”, Doctor Matthew Ortega said…

You can try Nabla Copilot for free, on any device, and by yourself (without having to talk to a sales team!).

Amazon Launches AWS HealthScribe to power Documentation, Imaging Players

Anytime Amazon announces anything in healthcare, it’s a guaranteed headline breaker, and this time was no different – especially since artificial intelligence was involved. Were you surprised at all?

As it turns out, Amazon Web Services (AWS) announced the launch of a new HIPAA-eligible service called HealthScribe that healthcare software providers can use to build their own generative AI documentation & other solutions. HealthScribe is launching in general medicine and orthopedics first, and those building in the space can leverage AWS to manage the underlying infrastructure and healthcare-specific LLMs rather than needing to do so on their own. Stated differently, the AWS offering is a lego set for AI offerings. It’s enabling healthcare software providers to build solutions across generative AI use cases in healthcare.

What’s weird to me are the partners and brands that Amazon launched HealthScribe with. 3M’s M*Modal, ScribeEMR, and …Babylon. Yes, that Babylon. And…we already knew that Amazon was working with 3M in the ambient space months prior in April. Pretty weak sauce for a seemingly major launch like this.

Here’s my biggest question: why buy One Medical for almost $4 billion and then not even leverage the care delivery platform for an announcement like this? It seems ‘easy’ (relatively) enough given that Carbon spun up AI-assisted charting in June. Maybe we’ll see a notable development in the coming months with One Medical.

Bigger picture – the clinical documentation space will only continue to heat up from this point. Winners with the best distribution, enterprise cloud alignment, and breadth of offerings will win while others will fall by the wayside and consolidate.

Related to the above was Amazon’s announcement in the imaging space, launching AWS HealthImaging. From the press release, HealthImaging will serve a similar function as HealthScribe in supporting the infrastructure and providing lego bricks needed to store, analyze, and share mass amounts of medical imaging data.

I will maintain that the best form of Amazon’s healthcare strategy revolves around consumer-centric, platform plays in healthcare including RxPass, Amazon Clinic, and now AWS offerings like HealthScribe…assuming they can attract the right clientele.

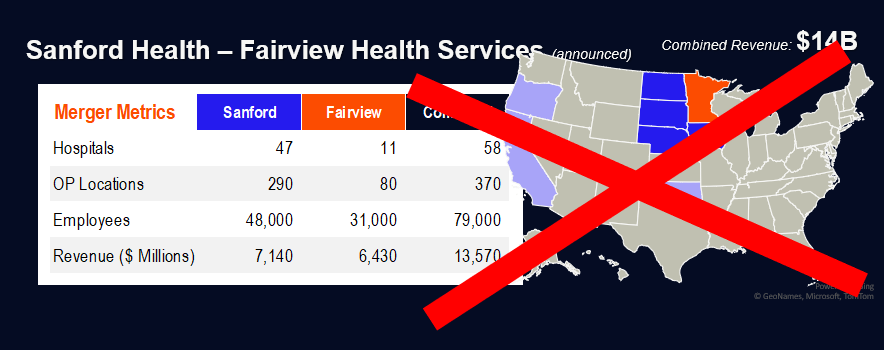

Sanford, Fairview Health Services Call Off $14B Megamerger

Sanford-Fairview…Donezo: After a drawn out process, in which even Fairview’s associated academic medical center at the University of Minnesota opposed (even going as far as to request funds from the state to acquire its affiliated hospitals), the Sanford-Fairview Health Services merger has been called off. The merger would have created a giant in the Midwest at over 50 hospitals

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Don’t forget that Sanford has failed at least 3 merger attempts in recent memory, the first one being Fairview a decade ago, then Intermountain Healthcare and UnityPoint Health more recently.

Partnerships and Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

Managed Care Monopoly: The Justice Department launched a monopoly investigation into the managed care industry after reading my Hospitalogy reports on vertical integration (kidding).

Medicaid Disenrollments: CMS has released April Medicaid unwinding data, with total disenrollments surpassing 3.8 million. (Link)

Surescripts Monopoly Settlement: The FTC reached proposed settlement in the Surescripts illegal monopolization case dating back from a few years, which seems to make Surescripts’ market power a little less dominant to give competitors some leeway. (Link)

Prior Auth Reform: The AHA and BCBSA are urging CMS to abandon ‘conflicting’ requirements in their prior authorization reform proposal. (Link)

Layoffs at CVS: CVS is cutting 5,000 jobs mostly in corporate and administrative roles, which is hilariously less than 2% of its workforce. From the linked paywalled WSJ article, the firm is all-in on its healthcare transformation according to an internal staff memo from CEO Karen Lynch. Gotta cut costs somewhere to make room for that Oak Street Health acquisition! (Link)

Cigna’s Algorithmic Blunder: Health giant Cigna is being accused of improperly rejecting thousands of patient claims using an algorithm. The firm has since refuted allegations, saying that the tool is meant to streamline decision making processes. (Link)

Birthing Centers: The state of Connecticut is set to license freestanding birth centers. (Link)

Partnership Announcements:

- Apollo Medical Holdings announced a partnership with IntraCare to advance value-based care in Texas and Oklahoma through its aligned network of 425 providers and 40,000 members. As part of the partnership, ApolloMed will work with IntraCare’s PCPs in conjunction with the ACO REACH program and will lend IntraCare $25M. (Link)

- The Oncology Institute partnered with House Rx to integrate House Rx’s specialty medication dispensing model within TOI’s clinic and pharmacy locations in several markets. (Link)

- Bon Secours Mercy Health is piloting virtual nursing at three sites and looking at ways to expend virtual nursing to its 48 hospitals. Current vendors involved include Banyan Medical, Nurse Disrupted, and its own internal program employing its own nurses. (Link)

- Microsoft and Blue Shield of California are partnering to create an integrated data hub. (Link)

- Quantum Health is expanding its family-building offering with the addition of Kindbody. (Link)

- Duo Health and National Kidney Partners are launching a statewide value-based care model in Florida. (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

Several rapid fire quick hits related to earnings season and recent M&A. I’ll likely be doing a deeper dive on HCA, UHS, and Tenet Q2 results on Thursday’s send.

HCA raises full-year outlook on strengthening admissions. (Link)

UHS beat Wall Street estimates for Q2 earnings on ‘high demand’ at acute care hospitals. (Link)

Tenet Reports Second Quarter 2023 Results; Raises 2023 Outlook. (Link)

CHS selling 3 Florida hospitals to Tampa General Hospital for $290M. (Link)

Weak hospital margins to persist in 2024: Fitch (side note: pretty insane the dichotomy here against the above, eh?) (Link)

Biogen Bulks Up in Rare Disease With $7.3B Reata Pharmaceuticals Acquisition. (Link)

Talkspace reports increased B2B payor revenue, reaffirms break-even goal. (Link)

London-based Informa plans to buy HIMSS global healthcare conference. (Link)

Teladoc Health stock rises amid increased Q2 earnings driven by BetterHelp. (Link)

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Genie Health notched a partnership win with embattled PT provider ATI Physical Therapy, which is outsourcing its virtual MSK offering to Genie with the intention of creating a hybrid care model scaled across 900 clinics in 24 states. Genie Health expects to add over 2,500 therapists and 400,000 new patients to its platform through the deal. (Link)

Thyme Care is partnering with AON, which will leverage Thyme’s model & stack to participate in the Enhanced Oncology Model. (Link)

- “AON will partner with Thyme Care to reduce the total cost and improve the quality of care for AON patients. Thyme Care is a leading value-based cancer care partner, providing comprehensive cancer care support and navigation beyond the clinic for AON patients. As part of the partnership, Thyme Care will facilitate AON’s cancer clinics located across the country to participate in the EOM.”

GoodRx launched Medicine Cabinet

Hims & Hers is expanding into cardiovascular health with a new product launch called Heart Health by Hims. (Link)

Bicycle Health is literally going the extra mile as part of its Alabama Airdrop initiative. As part of the program, doctors are flying to Alabama to ensure continuity in opioid treatment for patients who might not have access in the state. (Link)

Data breaches continue to be major liabilities for healthcare organizations. The average cost of a healthcare data breach has reached $11M, according to a recent report. (Link)

Dorsata has sued Athenahealth and Unified Women’s Healthcare, alleging deceptive business practices and blatant IP theft including “trade secrets and other confidential information, including financial projections, material contracts, customer pricing, software architecture, designs workflow and dataflow,” according to Fierce. (Link)

Nabla published a nice blog post providing an overview of AI-enabled medical scribes currently available with some market intel on pricing and features. It’s a nice, savvy piece of content marketing from their team. The only player to add to the intel below is Augmedix, which is the only publicly traded ambient documentation player after Microsoft acquired Nuance in 2022. (Link)

The Clinic by Cleveland Clinic is expanding its digital and virtual care strategy. (Link)

RadNet, Inc. has announced the addition of Sham Sokka and Sanjog Misra to drive further growth in its digital health initiatives. (Link)

GoodRx has launched a solution designed to help consumers manage their prescriptions. (Link)

Virtual care provider Hello Alpha has introduced a ‘whole-person’ weight management program for employers. (Link)

A new report suggests it’s time for a billion-dollar Women’s Health Fund. (Link)

Fundraising Announcements:

- Headspace secured $105M in new financing. (Link)

- Halodoc raised $100M in a Series D round led by Astra. (Link)

- Tisento, a bio startup working on a brain-penetrating drug, launched with $81M in funding. (Link)

- RapidAI, a company specializing in stroke imaging, announced a $75M growth investment. (Link)

- Nexo, a bio startup focused on cancer drug R&D, secured $60M in funding. (Link)

- Proprio, a company developing a surgical navigation platform, raised $43M for commercialization. (Link)

- Octave Bioscience, a company offering solutions for neurodegenerative diseases, raised $30M. (Link)

- Hippocratic AI raised $15M, tacking on an extra 15 large ones to its previously raised $50M for its nothing burger product, bringing its total $ raised for doing nothing up to $65M. (KIDDING). (Link)

- GenHealth AI, a company developing large-scale medical models, raised $13M in funding. (Link)

- UpLift, a platform providing access to behavioral health services, secured $10.7M in funding. (Link)

Hospitalogy Top Reads

My favorite healthcare essays from the week