Compliance is Difficult to Scale

#1: Morgan Stanley Has it Backward What happened? Morgan Stanley is testing out GPT-4 to help its human financial advisors: The experiment is aimed at “helping investment professionals parse through thousands of pages of our in-depth intellectual capital, analyst commentary, and market research in seconds – a process that typically could take more than half…

Read MoreThe Most Interesting Conversations From Fintech Meetup

Organized chaos. That’s how one attendee described the experience of attending Fintech Meetup, and, after reflecting on my own experience, I think it’s apt. On the surface, you might have mistaken Fintech Meetup for a miniature Money2020. Fewer attendees (about 3,000), but the same general mix of institutions. Different hotel, but actually the same one…

Read MoreShould You Protect Customers From Themselves?

3 Fintech News Stories #1: Should You Protect Customers From Themselves? What happened? NatWest is the latest big UK bank to introduce limits on its customers’ ability to purchase crypto: The bank is putting a daily limit of £1000 and a 30-day payment limit of £5000 to crypto exchanges “to help protect customers from losing…

Read MoreCould BaaS Prevent The Next SVB?

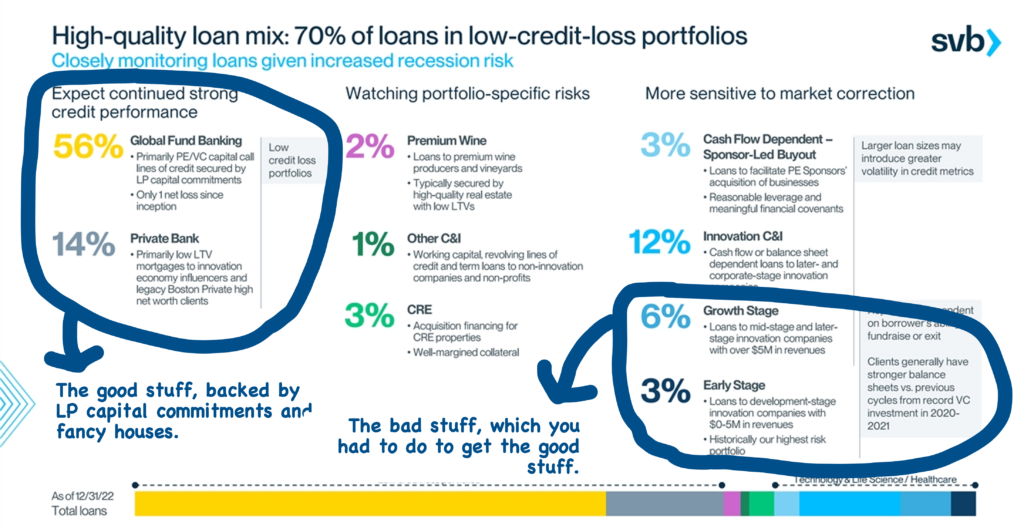

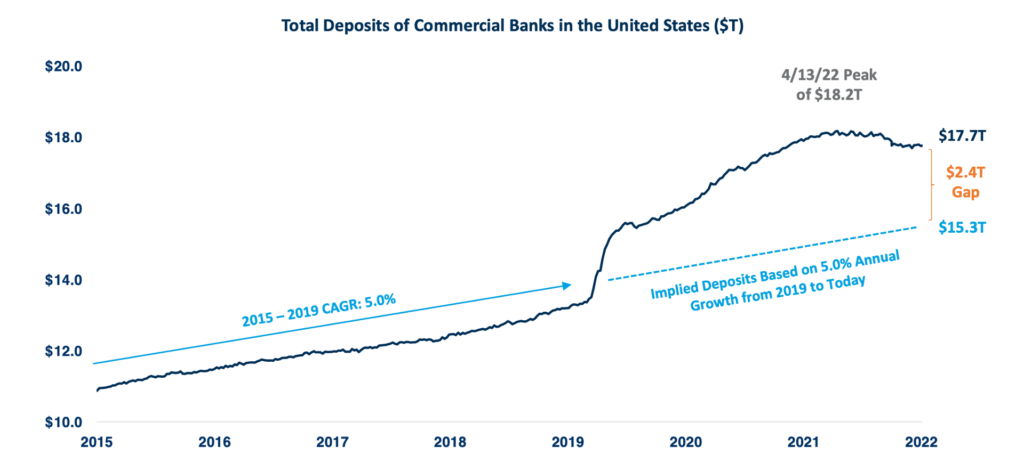

The conversation around SVB – which I have found to be both exhausting and enlightening, in very unequal measures – has shifted from diagnosing what happened to prescribing what should happen next in order to prevent more Twitter-fueled bank runs. These prescriptions range from absurd (bitcoin does not fix this, and a de-evolution away from…

Read MoreWAGMI

What happened? Janet Yellen, Jerome Powell, and Martin Gruenberg shared an update: After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects…

Read MoreNGMI

I was planning to write about something else this week, but then this happened: Silicon Valley Bank, Santa Clara, California, was closed today by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect insured depositors, the FDIC created the Deposit Insurance National Bank of…

Read More