25 March 2023 | FinTech

The Most Interesting Conversations From Fintech Meetup

By Alex Johnson

Organized chaos.

That’s how one attendee described the experience of attending Fintech Meetup, and, after reflecting on my own experience, I think it’s apt.

On the surface, you might have mistaken Fintech Meetup for a miniature Money2020. Fewer attendees (about 3,000), but the same general mix of institutions. Different hotel, but actually the same one that Money2020 started at. A different team behind the event, but made up of many of the folks that initially dreamed up and built Money2020.

Dig a little deeper, though, and you’d notice some important differences.

For example, Money2020 doesn’t have fintech speed dating.

Fintech Meetup does. In fact, it pioneered the platform to facilitate double opt-in 1:1 meetings, at scale, when it was initially created during the early days of the pandemic and Fintech Meetup was a digital-only event.

Seeing those meetings happen IRL was quite something.

There were two ballrooms this size. Each facilitating back-to-back 15-minute meetings, with everyone changing tables at the end of each meeting.

Just the sound of it was … well, it’s difficult to describe. Approaching the ballrooms kinda felt like walking up to a packed college football stadium. There was this low rumble that you could feel as much as you could hear. As soon as you entered, it resolved into a thousand quietly intense conversations … all happening simultaneously. It wasn’t loud so much as it was palpable. You could feel the energy in the room.

It was exquisitely organized chaos.

And it was, for me, equal parts exhausting and productive.

Here’s my personal accounting from the conference:

- 33,000 Steps (the Aria is very walkable)

- 26 Meetings (apologies to those I was unable to meet with!)

- 3 Live Podcast Recordings (featuring Jason Mikula, Ahon Sarkar, and a nearly-hoarse Simon Taylor)

- 2 panels (in which I got to learn from super smart folks like Cristina Ciaravalli, Marcel van Oost, Aditi Maliwal, and Jonathan Pomeranz)

- 1 main stage interview (I was thrilled to get a chance to interview Jim Magats, CEO of MX)

But, as is usually the case with great events, the most valuable parts were all the random conversations that happened in the in-between moments – the impromptu hallway meetings and off-the-record chats over dinner.

I wanted to summarize 10 of the most interesting topics, ideas, and observations that I encountered in these in-between moments.

#1: Money attracts attention, and attention creates an opportunity to earn loyalty.

This was a direct quote from a conversation I had with an executive in the banking-as-a-service space, and it immediately lodged itself in my brain.

Embedded finance was, as you might expect, a big theme at the event, and the point this person made is that we tend to take how engaging money is for granted. I mean, we deal with money every day in our industry, but, for non-finance brands, one outcome of embedding a financial services product (particularly deposits or wealth management) is a significant boost in user engagement.

For brands that have strong affinity (I like this company) but low engagement (I rarely interact with this brand’s products/channels), embedded finance can essentially provide a big push to their strategic flywheel, opening up opportunities for cross-sell and improving retention rates.

I hadn’t been thinking of embedded finance in exactly these terms before.

#2: Putting humans at the center of your product.

There is a strange reluctance in tech to build products that depend on humans. Instead of simply asking consumers what their goals are, we build algorithms to try and guess them. Instead of embedding customer service agents at a critical point in a complex workflow, we try to build completely self-service systems.

I understand this preference for automation, but it can be self-defeating if our desire to excise humans entirely from our software undermines the ability of that software to completely solve our customers’ problems.

Lately, I’ve observed a few examples of fintech companies bucking this preference and building software products that are, to some degree, dependent on humans. One, which I mentioned on a recent episode of Not Fintech Investment Advice, is Capitalize. They leverage a combination of software and human agents to help customers roll over and consolidate their old 401K accounts.

Another example, which I was introduced to at Fintech Meetup, is SpyCloud, which is a cybercrime analytics provider. Their product provides companies with automated insights that prevent cyberattacks and protect against fraud. These insights are sourced from breach and malware data, gathered by a specialized team of humans experienced at navigating the darknet and interacting with hackers and criminals.

#3: Can midsize banks survive?

As I mentioned above, I had the opportunity to interview Jim Magats, CEO of MX, on the main stage at Fintech Meetup.

We talked about a lot of topics, but the big one, as you can probably guess, was Silicon Valley Bank.

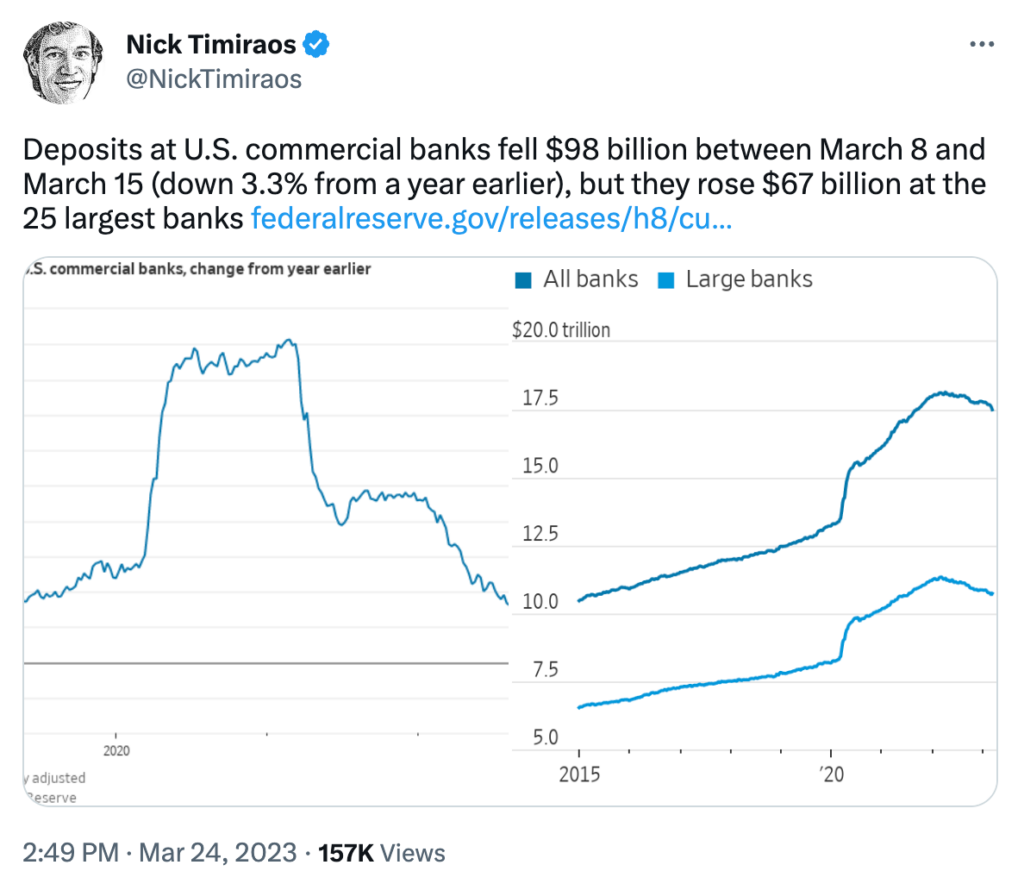

Jim’s commentary focused on the importance of trust, particularly among midsize banks, in the wake of SVB. He correctly noted that we have seen a flight of deposits out of these institutions, which have mostly landed at the biggest banks. The most recent reporting I’ve seen on this shift comes from Nick Timiraos at the Wall Street Journal:

The concern, which was echoed in a lot of the private conversations I had at the conference, is over midsize banks’ long-term competitive prospects in an environment in which customer trust has been badly shaken.

My perspective on this topic is that it’s not really about trust, it’s about utility. Many (not all!) midsize banks in the U.S. have spent the last 40 years honing skills (branch-based distribution) to compete in a world that no longer exists. The largest banks have begun adapting to the new world (product/price/brand differentiation), and the smallest banks are somewhat immune from it.

Midsize banks are caught in the middle. And in an environment where the status quo feels suddenly uncertain, I’m not sure they are offering sufficient utility to retain their customers.

#4: Will multi-bank relationships become the norm?

Another ripple effect of SVB, which was a point of discussion this week, can be summed up by this question – will customers keep all their deposits with one bank from now on?

Many banks and neobanks have been scrambling over the last two weeks to come up with solutions to solve the uninsured deposits problem for their customers, by spreading out deposits over $250,000 across multiple FDIC-insured bank accounts (this is one of the main services provided by deposit networks like IntraFi).

This, in theory, eliminates the primary incentive for customers to open multiple accounts at different banks, which is an outcome that their existing banking providers would prefer to avoid.

Still, I wonder if the toothpaste is out of the tube.

After all, there are other benefits to maintaining accounts at multiple banks, most notably the ability to optimize yield as banks compete with each other for deposits. The primary thing that has held consumers and businesses back from doing this is that it has historically been extremely inconvenient to manage. However, that’s a problem we can solve with software, and I have to imagine there are fintech companies working to build multi-bank deposit optimization solutions as we speak.

#5: Redundancy in fintech infrastructure.

Related to the point above, the topic of redundancy in fintech infrastructure was a very popular backroom topic at Fintech meetup.

Several fintech executives I spoke with told me that they are frantically revisiting every architectural decision they have made in their software to better understand any hidden dependencies on specified third-party service providers (banks in particular). These dependencies are often unseen by a company’s developers because the third-party infrastructure providers that they utilize (think Stripe) focus specifically on abstracting away all of those complexities.

This is no longer acceptable. SVB’s demise illustrated how alarmingly interconnected a lot of financial infrastructure tends to be, as Patrick McKenzie recently wrote about in his newsletter:

When Rippling’s bank recently went under, there was substantial risk that paychecks would not arrive at the employees of Rippling’s customers. Rippling wrote a press release whose title mostly contains the content: “Rippling calls on FDIC to release payments due to hundreds of thousands of everyday Americans.”

Every regulator sees the world through a lens that was painstakingly crafted over decades. The FDIC institutionally looks at this fact pattern and sees this as a single depositor over the insured deposit limit. It does not see 300,000 bounced paychecks.

#6: Needed: real-time, 24/7 settlement networks.

Silvergate and Signature Bank were less popular discussion topics at Fintech meetup, but one interesting thing that I heard from a few folks in regard to the demise of those institutions, was interest in their 24/7 settlement networks, which were called SEN and Signet, respectively.

These networks enabled the banks’ customers (crypto exchanges and their institutional clients) to instantly send funds to each other in order to settle the fiat side of any transactions they executed. Because these were private networks operated by the banks solely for the use of their customers, they could run 24/7, which was a key value proposition for crypto exchanges, which were facilitating the crypto side of these transactions at all hours of the day and night.

With Silvergate and Signature going under, these networks are no longer available for use by the crypto industry, which (depending on your feelings about crypto) might not seem like such a bad thing. However, I was recently reminded by a certain banking crisis that having a real-time, 24/7 institutional settlement network might not be a bad idea:

That is when SVB, at the time controlled by SVB Financial Group, started looking for help, only to run into the U.S.’s bank-funding system, which wasn’t built for speed. First it turned to the San Francisco Federal Home Loan Bank, asking for a $20 billion loan. The FHLB system is a nearly 100-year-old network of privately capitalized, government-sponsored banks meant to support mortgage lending.

It was already midday in California, and SVB’s unusually large request came too late for the San Francisco FHLB to process that day, people familiar with the matter said.

SVB also tried to get $20 billion in assets to the Fed through Bank of New York Mellon Corp., one of its custodial banks. SVB was too late—it had missed BNY Mellon’s daily cutoff for instructions for Fed transfers from custodial accounts.

The Fed needed a test trade to be run before the actual transfer could occur. That took time and the Fed didn’t extend its own daily deadline of 4 p.m. PT for collateral transfers to help SVB. Time ran out on the bankers and SVB couldn’t get the money that day.

Hopefully, the idea of a real-time, 24/7 institutional settlement network – ideally one that can work across multiple banks – doesn’t die with Silvergate and Signature.

(Tassat is one company I know that is trying to keep the dream alive).

#7: BaaS for Square?

I, unfortunately, didn’t get to see Samantha Ku’s fireside chat on the main stage at Fintech Meetup. However, I heard from multiple folks who saw Square Financial Services’ Chief Operating Officer, that it was really interesting.

Of particular note was the suggestion that Square might eventually get into the world of banking-as-a-service.

Square is already well down the path of becoming a regulated bank. It has a Utah ILC bank charter. And although I’m not sure how much an ILC charter allows when it comes to BaaS, one could certainly see Square taking the additional steps necessary to make BaaS a viable business opportunity.

It’s also not difficult to see the strategic appeal of such a move. If embedded finance really is the future, it would make all the sense in the world for Square to be the enabler of embedded finance for all of its merchants.

After all, Stripe already provides BaaS (through third-party bank partners). Why not Square?

#8: How would continuous underwriting change lending product design?

Fintech Meetup had a very strong lending and credit track, which I was fortunate enough to spend some time in.

One discussion that I heard in this track’s session (and during the breaks between the sessions) was the inevitability of new credit data infrastructure (lots of fintech companies are trying to seed new data into the credit bureaus or compete with them directly) and the impact of that infrastructure on the design of new lending products.

Here’s an interesting hypothetical that I discussed with someone – imagine that we have a real-time credit bureau, which is constantly being updated, and is able to facilitate the continuous underwriting of consumers for credit. Rather than applying for a specific lending product at a specific time, consumers are continuously and passively underwritten and approved for credit based on real-time changes in their cash flow and repayment behavior.

What would this hypothetical world look like? How would such infrastructure impact banks’ risk-based pricing decisions? How would it impact consumers’ borrowing behavior?

Lots of fascinating threads to pull on here.

#9: Generative AI will be a godsend for fraudsters.

There was also a lot of great content on fraud prevention at the event.

My favorite quote came from Soups Ranjan, CEO of Sardine, who said on a panel, “AI will be a key enabler for financial crime. It scales up scam creation like phishing 1000x”.

This is a scary thought. One of the key factors that constrain fraudsters is time management. There is an ROI in fraud (just like in everything), which means that if you are a clever fraudster, you will optimize your resources to get the maximum return. That might look like a three-month-long romance scam targeting a wealthy older woman. Or it may look like a hastily written, generic phishing email targeting 100 million consumers whose emails you bought for $100.

Generative AI has the potential to negate the need for these tradeoffs. Instead of a poorly written and generic phishing email, how about a flawlessly written and deeply persuasive phishing email that is personalized to each consumer based on data that is easily available on the darknet?

Banks and fintech companies are not prepared for this type of mass-market sophistication in scams, but they better start getting ready.

#10: This is a relationships business.

Sarah Hinkfuss, a partner at Bain Capital Ventures, moderated a panel that I was on titled “How to Sharpen Your Message and Cut Through the Noise.”

The purpose of the panel was to help fintech founders figure out how best to pitch their company to investors and journalists.

The key takeaway from the panel?

Don’t pitch.

One of my fellow panelists mentioned that a frequent mistake he sees founders make when talking to investors is slipping into “pitch mode” and forgetting to have a conversation with the investor. His point was that conversations foster relationships, and relationships are always, in the long run, more valuable than any specific transaction.

Personally, I have found the same thing to be true in working with the media. The best interactions I have with founders are all relationship first.

Or, as Sarah nicely summed up:

Focus on relationships. Your network is built of those people who say “yes” to you, as well as those who say “no.” What impression do you leave in every interaction? What do you take away? Focus on the relationship, not the transaction.

I’m grateful to have had the chance to build new relationships and strengthen existing ones this week. I look forward to doing it again next year!