FedNow Notes

If you haven’t listened to this podcast that Jason Mikula and I did with Mark Gould, the Chief Payments Executive at the Federal Reserve, I would highly encourage you to do so. It was fascinating. We recorded it shortly before the July 20th launch of FedNow and, as you might imagine, faster payments was a…

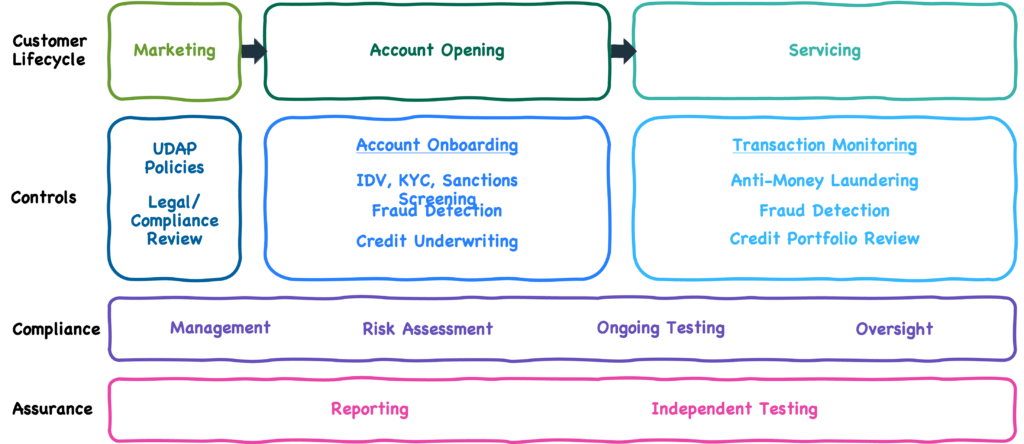

Read MoreBaaS, Compliance, and the Path Forward for Community Banks

Banks have always been highly reliant on third parties. Whether it’s for technology or staff augmentation or importing critical subject matter expertise that they don’t have in-house, third parties have played a critical (and often under-discussed) role in the growth and success of banks. This is especially true for community banks, which are at a…

Read MoreHas Plaid Lost The Payroll Race?

#1: Has Plaid Lost The Payroll Race? What happened? Pinwheel, a data aggregator focused on the payroll space, announced a new partnership with Plaid: Today Pinwheel … partners with Plaid, the leading open finance network, to provide complementary payroll data services for its Income product. In addition, Pinwheel will become a Preferred Provider for direct…

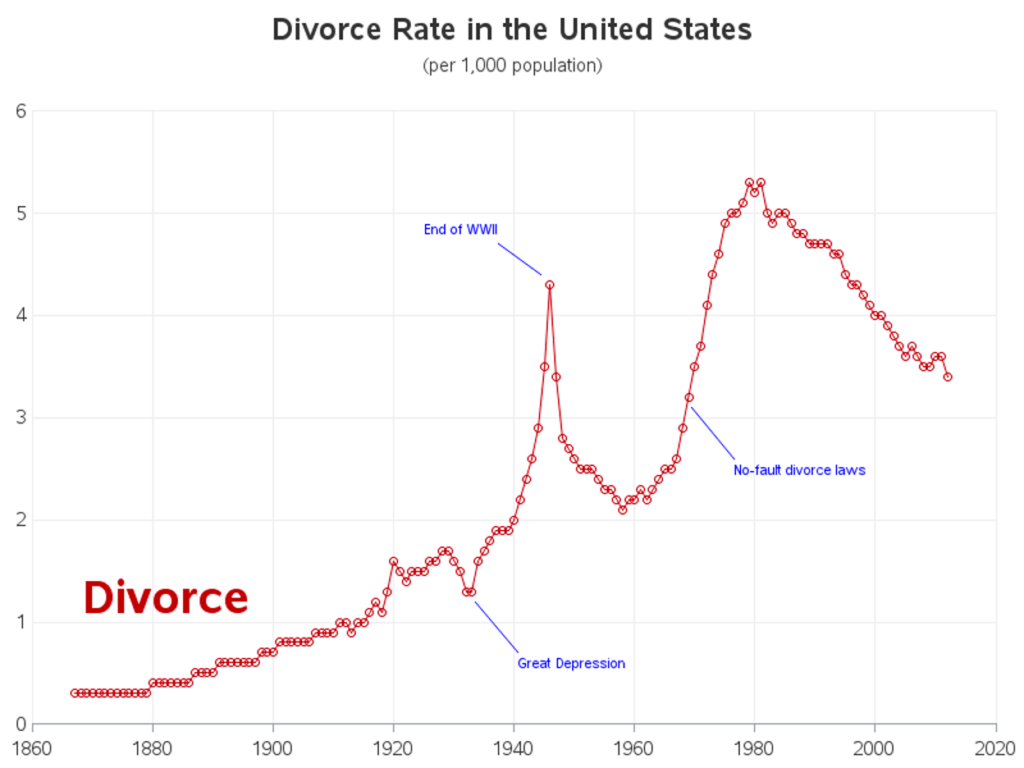

Read MoreYou Gotta Date Your Wife

The first law allowing no-fault divorces in the U.S. was passed in California in 1969. Before the passage of this law, if you wanted a divorce in California, you had to be able to demonstrate that your spouse was “at fault”, meaning that they had committed an act incompatible with the marriage (adultery, abandonment, etc.)…

Read MoreWhat Witchcraft Is This?

#1: Roger What happened? Roger, a digital bank for military service members, is officially launching tomorrow. Roger was built by Citizens Bank of Edmond after they were approached by Nymbus with the idea to start a standalone digital bank. Here’s an excerpt from a podcast that Citizens Bank CEO Jill Castilla did with Penny Crosman…

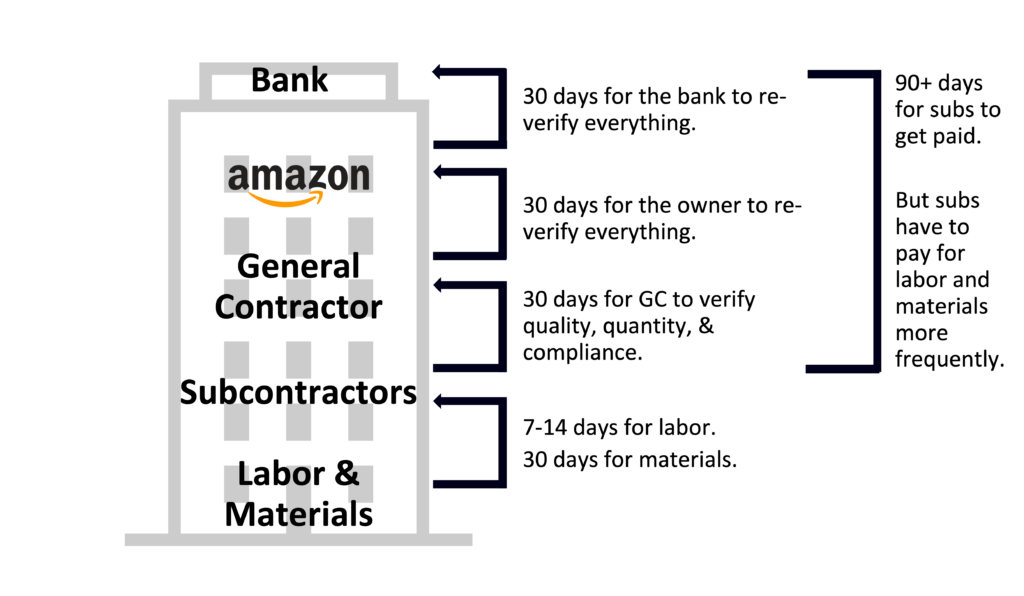

Read MoreWhen Banking Problems Don’t Look Like Banking Problems

Banks are pretty good at finding and solving banking problems that look like banking problems. There’s obviously still room to innovate and improve things on the margins, but, by and large, there aren’t a lot of true greenfield opportunities in financial services. Banks have already identified them all. Unless they don’t look like banking problems. …

Read More