Posts by Alex Johnson

New York Fintech Week Reflections

Let’s start with a theory – there is an ideal size for everything. A class of 15-20 students works great; a class of 40 is a mess. A software company with 400 employees is a dream to work for; a software company with 4,000 is a bureaucratic nightmare. An industry event with 1,000 attendees is…

Read MoreChase Jumps Into Advertising

3 FINTECH NEWS STORIES #1: The Subscription Problem Is Worse Than We Think What happened? Visa launched a new tool for issuers to help their customers manage their subscriptions: In the era of subscription overload, consumers are grappling with the complexities of managing multiple subscriptions across a web of apps. Navigating through each platform’s unique…

Read MoreThe Fintech Takes Advocacy Awards

A lot of my recent writing and podcasting has been focused on regulation. It’s easy to understand why. Whether it’s the prudential regulators’ crackdown on BaaS, the CFPB’s war on junk fees, or Senator Durbin’s relentless assault on interchange, the laws and regulations that govern the financial services industry play an enormous role in shaping…

Read MoreWho Is BaaS For?

You might have noticed that there’s been a bit of drama in banking-as-a-service (BaaS) lately. That’s obviously a significant understatement. It’s also, from my perspective, a good thing. BaaS – the technical, legal, and operational integration between chartered banks and non-bank companies – is important. While it has existed in its modern form for the…

Read MoreThe Credit Card for Greedy, Lazy Transactors

3 Fintech News Stories #1: The Credit Card for Greedy, Lazy Transactors What happened? Following its acquisition of X1, Robinhood announced a credit card: The investing app Robinhood is making headlines with the announcement of the Robinhood Gold Card. This credit card features a minimum of 3% cash back on all purchases and there’s even…

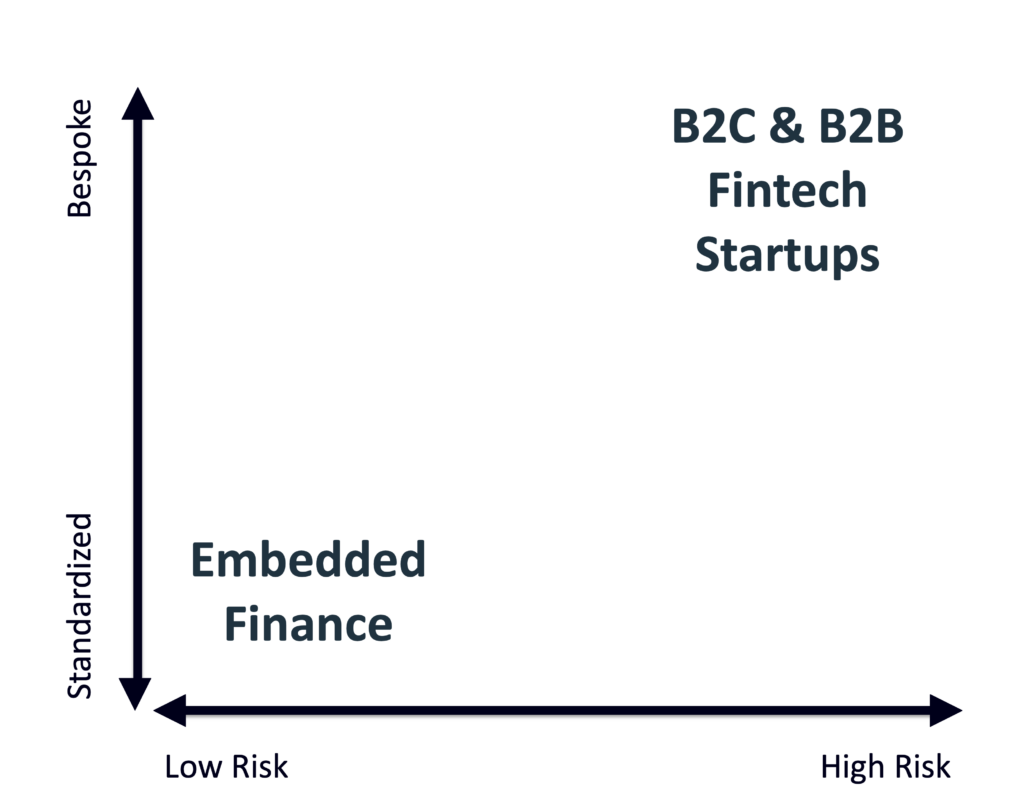

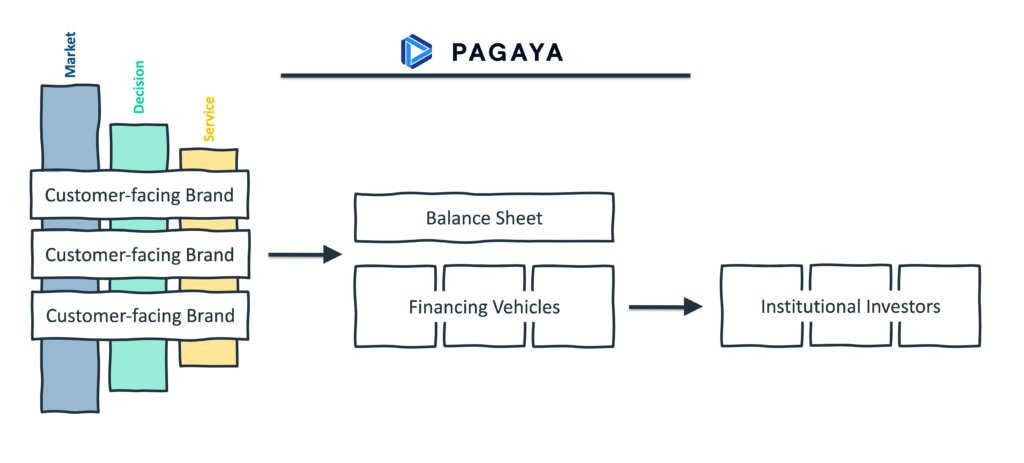

Read MoreThe Risky End State for Consumer Lending

Let’s talk about the mechanics of how digital consumer lending has evolved over the last couple of decades. Twenty-ish years ago, Renaud LaPlanche and a few other clever folks figured out how to use the internet to facilitate a highly scalable and capital-light approach to lending by directly connecting borrowers and investors. Person-to-person (P2P) lending…

Read More