19 August 2023 | Healthcare

The Wild West of Digital Health

By workweek

The digital health space has become the “Wild West”: thousands of digital health companies have launched during the pandemic, with many touting improved healthcare outcomes and increased return on investment without sufficient evidence.

Who knows which solutions actually work and which ones don’t?

As we enter the post-pandemic era, purchasers will need to reevaluate their digital health contracts made during the height of the pandemic. The question is, how can purchasers effectively evaluate these digital health companies? What can digital health companies do to ensure a proper evaluation?

In this article, I’ll highlight the issues with digital health companies’ claims, introduce the newest Peterson Health Technology Institute, and provide insight into digital health churn.

Are digital health solutions actually solutions?

While the growth of digital health is clear, the actual impact is less so.

For example, a cross-sectional observational analysis of the 20 digital health companies with the most funding in 2017 found these companies had not yet “demonstrated substantial impact on disease burden or cost in the US health care system.” Most studies published by these companies only evaluated their digital health solution in healthy patients, and a lack of published studies evaluated clinical outcomes for these companies’ digital health solutions.

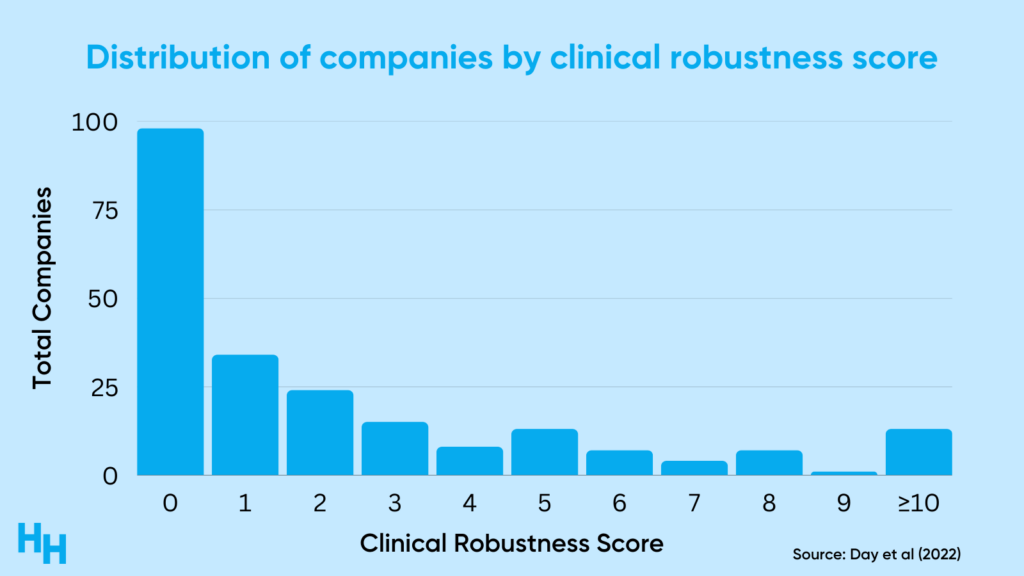

Furthermore, researchers found that many digital health companies lack clinical robustness in RockHealth’s cross-sectional observational study assessing the clinical robustness of digital health startups. The researchers analyzed 200+ digital health companies across different clinical domains (prevention, diagnosing, treatment) and assigned a “clinical robustness score” based on the sum of clinical trials and regulatory filings (510(k), De Novo, premarket approval).

Here’s the distribution of results:

So, around 60% of the companies analyzed had a clinical robustness score of 1 or less (the median score was 1). There was, however, variation across clinical areas like cardiology and oncology, which highlights the maturity of digital health solutions in those areas.

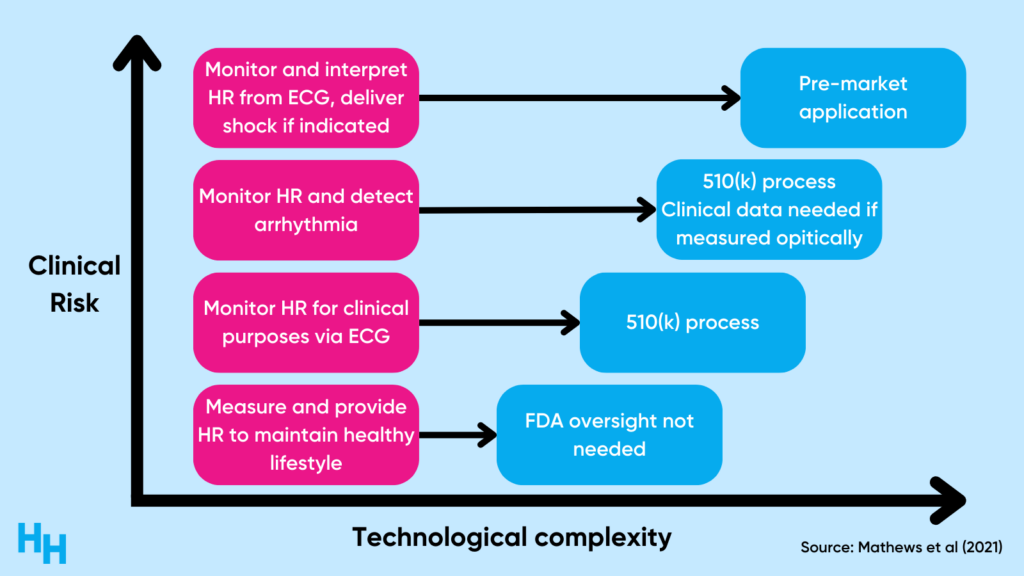

As clinical risk increases, so does the necessity of clinical validation studies. For example, a wearable that measures heart rate for lifestyle purposes isn’t subject to any FDA oversight. However, a wearable that monitors heart rate and detects arrhythmia must go through the 510(k) process—a premarket submission showing the wearable is “substantially equivalent to a legally marketed device” in safety and efficacy. So, the riskier—or more “clinical”—the solution, the more government oversight there is.

The validation process can be expensive, likely a challenge many digital health companies need to grapple with. And, if these companies’ solutions aren’t “clinically risky,” why try to validate them?

How to comb through the thousands of digital health solutions

The Peterson Health Technology Institute is a newly launched organization that will provide an independent evaluation of the clinical effectiveness and economic impact of digital health solutions. Until now, researchers have published frameworks for the evaluation of digital health solutions (see my piece here), but nobody—as far as I know—has actually taken a framework and put it to use.

According to the website, the Peterson Health Technology Institute will analyze the following of digital health companies:

- clinical benefits

- economic impact

- health equity

- privacy and security

- user experience

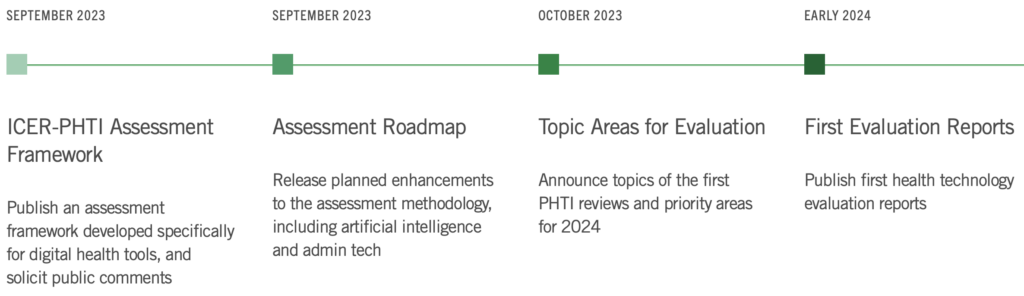

The Institute will use public and private data to assess the above-mentioned points, using a framework that will be announced in September.

The Peterson Health Technology Institute will likely benefit both builders and purchasers.

- Builders are trying to establish themselves among thousands of digital health solutions all vying for purchasers’ attention.

- Purchasers are trying to evaluate which of these thousands of digital health companies will provide the greatest clinical and economic impact—this has been challenging given the lack of tools for such evaluations.

Therefore, the Peterson Health Technology Institute’s framework (once released) may help guide digital health companies on important, measurable, areas to focus on while the Institute’s evaluation of the digital health solution will help purchasers find the most valuable digital health solution.

Here’s what Caroline Pearson, director of the Institute, had to say about all of this:

What we want to do is make it so everyone who’s buying digital health tools understands what good looks like and what evidence they should be looking for to support those decisions. And in turn, investors and digital health developers will know what evidence folks want and begin to generate that evidence to really support their value proposition.

FYI: I’ll be chatting with Peterson Health Technology Institute’s Lindsey Schapiro about all of this on Tuesday the 22nd, save your spot here.

Dash’s Dissection

The Peterson Health Technology Institute launched at the perfect time.

As we enter the post-pandemic era, purchasers like hospitals are reevaluating the digital health contracts they signed at the height of the pandemic, asking themselves “Did we get a good return on investment?” If yes, these purchasers will renew their contracts, if no, they’ll need to find another digital health solution.

William Brady, senior vice president of quality and performance improvement at UnitedHealthCare, said it nicely:

Some of the technology-enabled care modalities that were reimbursed during the public health emergency will “fall off” if they fail to “provide a compelling and data-driven rationale” of their value, Brady declared.

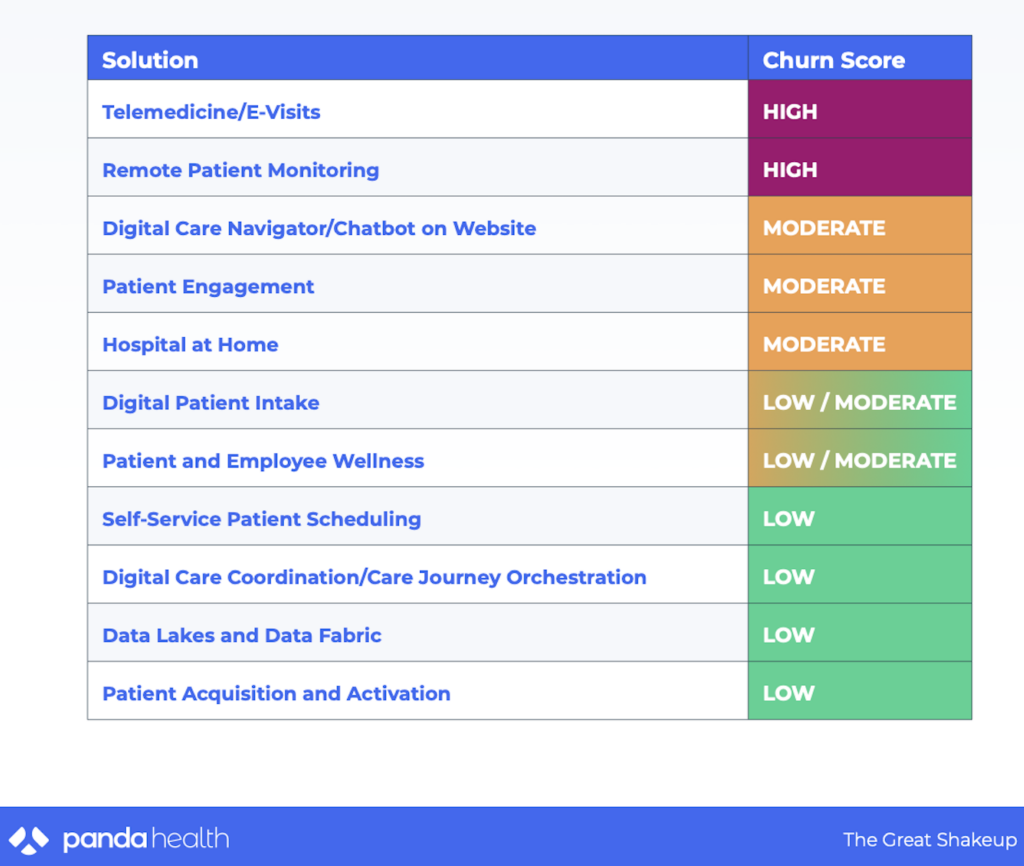

What we’ll likely see over the next couple of years is a significant churn of digital health companies as purchasers reevaluate which solutions led to the best healthcare outcomes and lowered costs. Panda Health published a report on the expected churn, predicting that Telemedicine/E-Visits and Remote Patient Monitoring digital health solutions will have the highest rate of churn over the next three years.

This is all to say that now’s the time for careful evaluation of digital health solutions, which Peterson Health Technology Institute will provide.

In summary, the rapid growth of digital health companies during the pandemic has ushered in an era where claims of improved healthcare outcomes often lack substantial evidence. While some solutions might offer potential, many haven’t yet demonstrated a significant impact on disease burden or cost savings in the healthcare system. The Peterson Health Technology Institute’s timely launch offers hope, providing an independent evaluation framework for these digital health solutions. As the post-pandemic period sees purchasers reevaluating their contracts and investments, tools and organizations like this will be instrumental in ensuring that chosen digital health solutions are both clinically robust and economically sound. The coming years will be pivotal in refining the digital health landscape, with a strong emphasis on validating claims and ensuring patient safety.

Stay ahead in healthcare with my weekly Healthcare Huddle newsletter, covering digital health, policy, and business trends for 30,000+ professionals. Share with colleagues and subscribe here.