04 March 2023 | Healthcare

Are Digital Health Solutions Actually Solutions?

By workweek

The digital health space is crowded with thousands of digital health companies vying for the attention of consumers, physicians, employers, and insurers. While it was relatively “easy” to capture the attention of consumers and businesses before 2022 (the market was very hot), today’s economic environment is making it more difficult.

Now, customers—especially employers—are asking the one question they should’ve been asking all along: are these digital health solutions a worthwhile investment?

In this article, I’ll quickly highlight the current state of digital health, discuss the lack of clinical validation of digital health solutions, and describe a framework for how stakeholders may evaluate digital health solutions.

The Current State of Digital Health

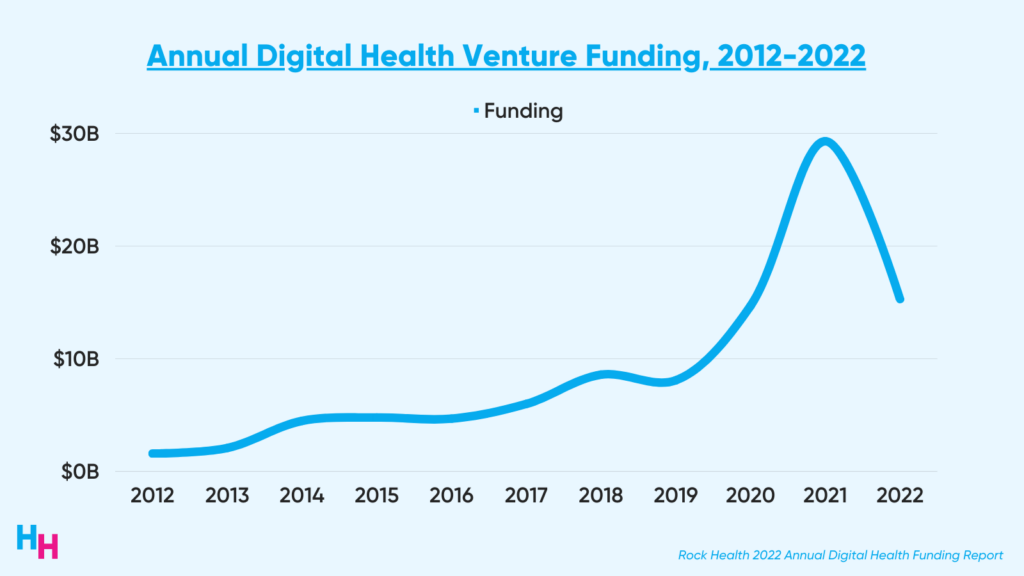

2022’s digital health funding was underwhelming, with startups raising just over half of 2021’s $29.3 billion and barely surpassing 2020’s $14.7 billion.

Despite funding declines, consumer digital health adoption remains strong. Rock Health released its latest digital health consumer adoption survey with some of the key findings:

- Telemedicine reached 80% adoption, primarily for prescription and minor illnesses.

- Audio-only and asynchronous telemedicine beat out video visits.

- Most wearable tech remains primarily consumer-based, meaning employer- or provider-based wearables have much room for adoption (which I discussed in my previous newsletter).

The end of the public health emergency and looming recession, however, will affect consumer adoption of digital health. According to Rock Health, the companies that will continue to have momentum will focus on accessibility, affordability, and trustworthiness.

Trustworthiness means making sure the digital health solution is delivering on its marketed promises: a workflow company actually improves clinical efficiency and reduces costs; a mental health therapy app actually improves PHQ-9 scores; a metabolic health company actually leads to sustainable weight loss.

Do Digital Health Solutions Actually Work?

While the growth of digital health is clear, the actual impact is less so.

For example, a cross-sectional observational analysis of the 20 digital health companies with the most funding in 2017 found these companies had not yet “demonstrated substantial impact on disease burden or cost in the US health care system.” Most studies published by these companies only evaluated their digital health solution in healthy patients, and a paucity of published studies evaluated clinical outcomes for these companies’ digital health solutions.

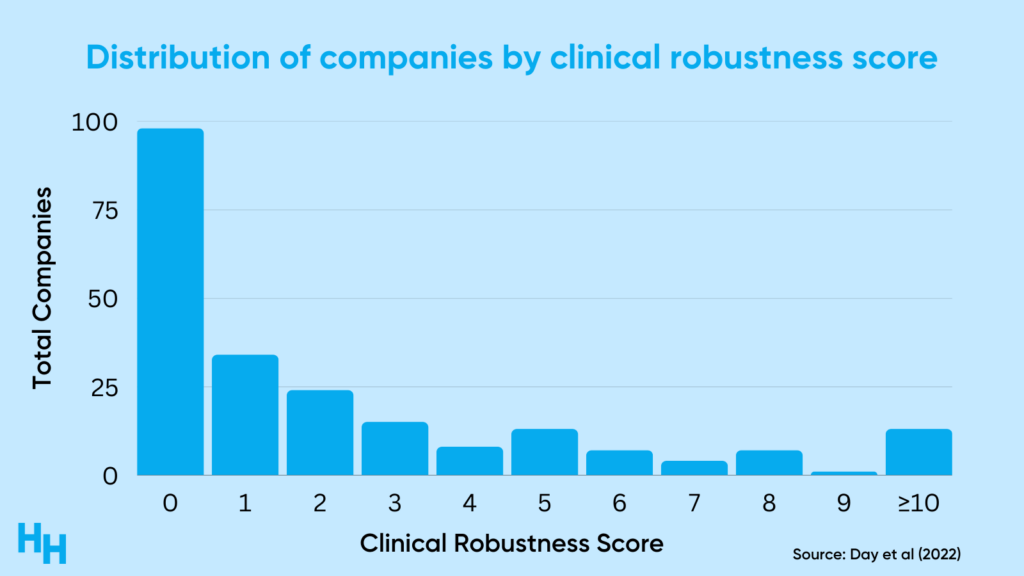

Furthermore, in Rock Health’s cross-sectional observational study assessing the clinical robustness of digital health startups, researchers found that many digital health companies lack clinical robustness. The researchers analyzed 200+ digital health companies across different clinical domains (prevention, diagnosing, treatment) and assigned a “clinical robustness score” based on the sum of clinical trials and regulatory filings (510(k), De Novo, pre-market approval).

Here’s the distribution of results:

So, around 60% of the companies analyzed had a clinical robustness score of 1 or less (the median score was 1). There was, however, variation across clinical areas like cardiology and oncology, which highlights the maturity of digital health solutions in those areas.

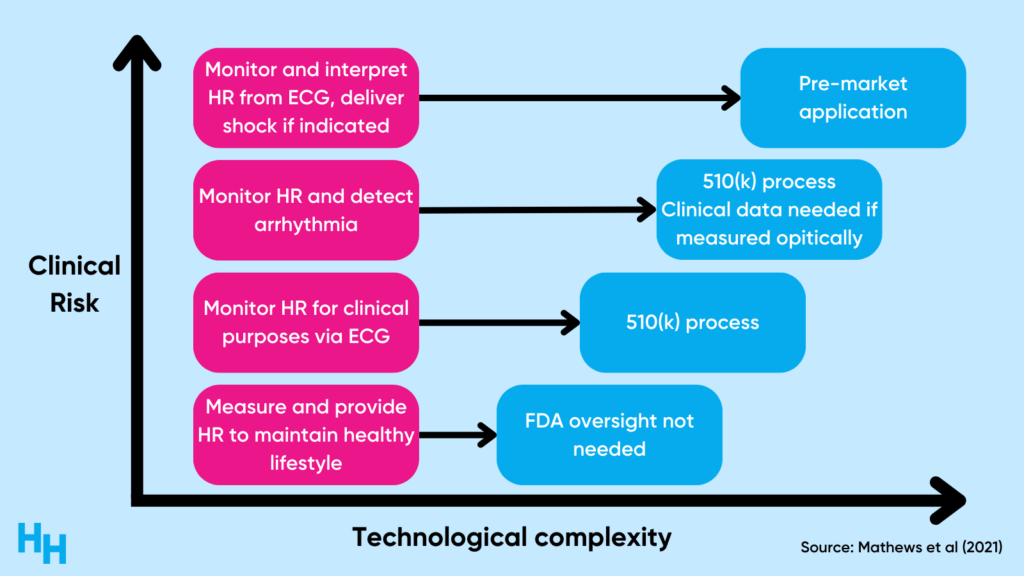

As clinical risk increases, so does the necessity of clinical validation studies. For example, a wearable that measures heart rate for lifestyle purposes isn’t subject to any FDA oversight. However, a wearable that monitors heart rate and detects arrhythmia needs to go through the 510(k) process—a premarket submission that shows the wearable is “substantially equivalent to a legally marketed device” in both safety and efficacy. So, the riskier—or more “clinical”—the solution, the more government oversight there is.

The validation process can be expensive, likely a challenge many digital health companies need to grapple with. And, if these companies’ solutions aren’t “clinically risky,” why try to validate them?

Dash’s Dissection

The digital health space is rapidly growing, outpacing robust regulatory measures or frameworks to ensure digital health solutions are valid from technical, clinical, and system areas. The fail fast, fail often mantra that startups follow is key to digital health’s expansive growth. But we must remember the most important tenant of medical ethics: first, do no harm.

Hence, there needs to be a balance between the speed at which digital health solutions are hitting the market and the technical, clinical, and system utility of such solutions.

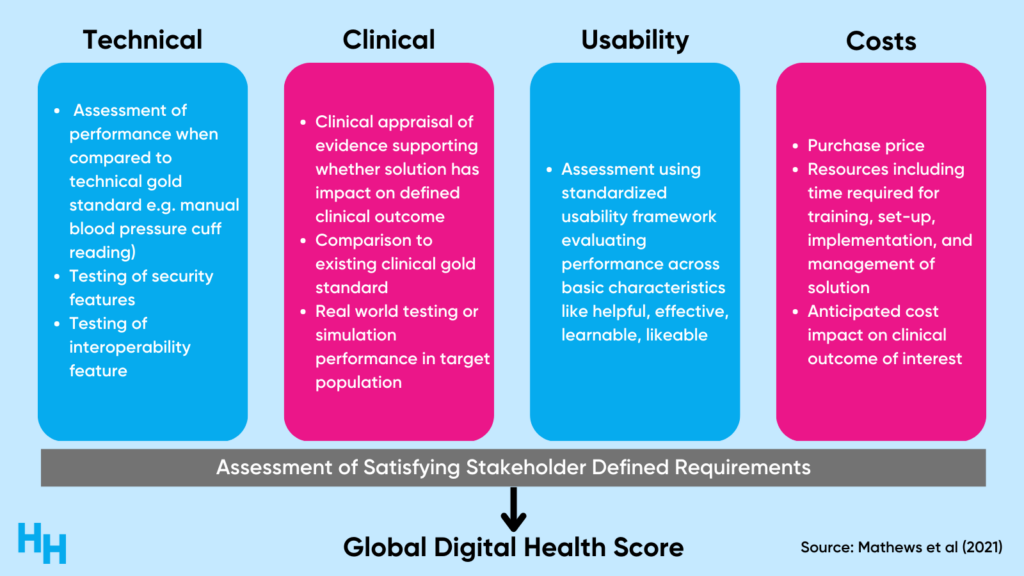

A potential framework healthcare stakeholders can use to evaluate the robustness of digital health solutions is the Digital Health Score Card, developed by Mathews et al. (2019). This framework is an objective, transparent, and standards-based evaluation of digital health solutions.

In this framework, an independent evaluator would review the digital health solution, both pre- and post-market, across four domains: technical, clinical, usability, and cost. The evaluator would then aggregate scores within each domain to create a global composite score (much like a FICO credit score).

Patients, physicians, employers, and payers could use the Digital Health Score Card to evaluate and compare digital health solutions before purchasing and realizing that a digital health solution is quite useless. For example, researchers used the Digital Health Score Card to evaluate popular mobile health oncology apps. Using the framework, the researchers found that the apps being assessed didn’t meet high-quality standards across multiple domains and end-user requirements. Such results would make employers question subscribing to one of the apps as an employee health benefit, for example.

Employers have begun to question the digital health solutions they’ve been providing as an employee benefit. Healthcare costs are rising, meaning employers need to rethink the money they’ve invested into digital health solutions for their employees. Employers are expected to increase focus on a critical area:

- Return on investment: for the past couple of years, employers’ mindset was to increase employees’ access to healthcare by subscribing to several digital health solutions. However, now with increased employer benefit costs, employers are focusing on which digital health solution will offer the best bang for their buck.

So, digital health startups need to prove their solution is robust. This is why in the article Common pitfalls of digital health startups & advice on how to avoid them, investor Betty Chang emphasizes digital health founders must deliver and track the right clinical outcomes.

When you’re starting out, your dataset may be limited, but you can point to compelling qualitative customer testimonials or references. Over time, you’ll rely on more and more quantitative data like readmission, mortality, safety of care, and NPS scores. And getting FDA clearance or approval on your device and therapeutics, running clinical trials, and publishing results in academic journals can establish your clinical IP and moat.

Gastroenterology startup Oshi Health is a prime example of a digital health company gathering evidence their solutions are clinically effective. They performed a prospective clinical trial to evaluate the effectiveness of Oshi’s 9-month multidisciplinary GI care program. 332 participants with IBD, IBS, and FGID enrolled. The study found significantly higher levels of patient engagement, satisfaction, and symptom control, while also significant reductions in GI-related costs per patient. Note, however, that this wasn’t a randomized clinical control trial—the highest standard of clinical evidence. But it was a clinical trial showing statistically significant results in a relatively large sample size.

As healthcare costs continue to skyrocket and the digital health space becomes saturated, digital health startups must appropriately test their solutions to show they are a worthwhile investment to patients, physicians, employers, payers, and investors.

In summary, digital health funding has spiked over the decade, with thousands of digital health startups hitting the market. This market, however, is now saturated, and the clinical robustness of digital health solutions within the market needs to be clarified. The Digital Health Score Card is an objective, transparent, and standards-based evaluation of digital health solutions’ “robustness” that computes a global score, much like a FICO credit score. Customers can then use this score to ensure they’re making a sound investment in a digital health solution with the greatest return on investment.

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.