29 October 2022 | Healthcare

2023 Marketplace Open Enrollment Will Be Record-Breaking

By workweek

My second-favorite holiday* is on November 1st: the start of open enrollment for the Affordable Care Act Marketplace. Why is it one of my favorite “holidays”? Because the government (taxpayers, really) will gift millions of qualified Americans affordable health insurance—a rarity in America.

The ACA Marketplace has provided affordable health insurance to millions of Americans since its inception in 2014. Therefore, it’s essential to know about the ACA Marketplace! So, in this article, I’ll discuss the pandemic-related legislation that increased access to the insurance Marketplace and why I think 2023 enrollment will surpass the record-breaking 2022 enrollment.

2022 Was A Record-Breaking Year

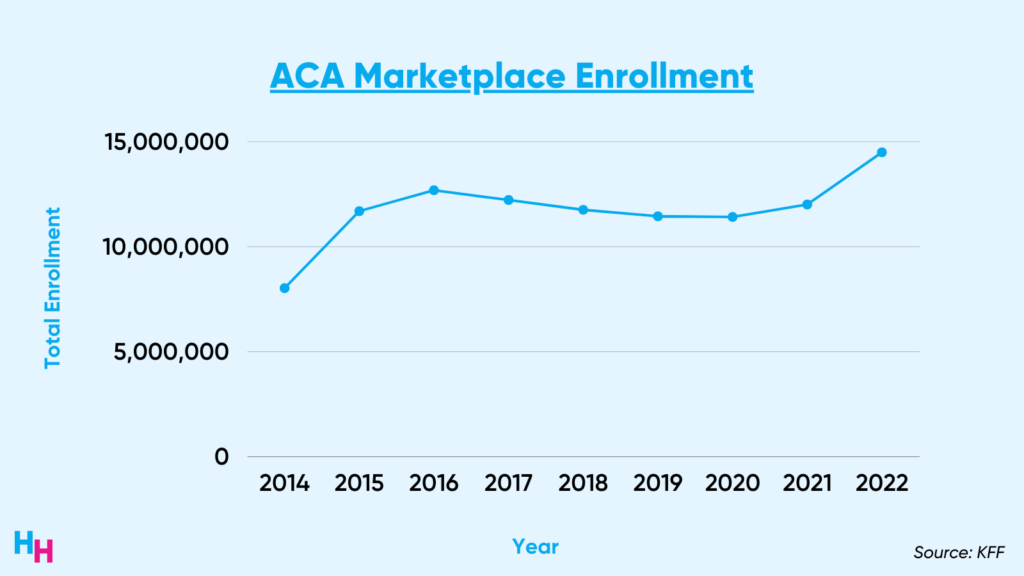

ACA Marketplace enrollment in 2022 reached record-breaking numbers:

- 14.5 million Americans signed up for Marketplace insurance, a 21% increase from 2021.

- 3 million out of the 14.5 million enrollees were newly insured, up 17% from 2021.

Enhanced tax credits (thanks to the pandemic) and improvements in Marketplace navigators are the reason for the 2022 Marketplace enrollment spike.

The American Rescue Plan Act (2021) expanded access to Marketplace insurance by enhancing tax credits, essentially eliminating what’s known as the subsidy cliff. This means if you made more than 400% of the federal poverty level, you wouldn’t pay more than 8.5% of your income in premiums. Consequently, 14.5 million Americans—and 3 million previously uninsured Americans—enrolled in the Marketplace in 2022.

Additionally, the Biden Administration invested $80 million into Marketplace navigators in 2021, increasing awareness of the Marketplace and streamlining the enrollment process.

- Navigators are organizations trained to help consumers, small businesses and their employees navigate insurance options through the Marketplace.

For example, with $80 million in funding, care navigators added significantly more tools to the Marketplace navigator, increased the use of unconventional media to target underinsured communities, and hosted in-person outreaches at local libraries, Covid-19 clinics, and job fairs.

Also noteworthy is the 1.8% decrease in Marketplace place premiums from $446/mo in 2021 to $438/mo in 2022. This was the third year in a row that premiums declined.

2023 Will Be Another Record-Breaking Year

2023 is destined to be another record-breaking year for ACA Marketplace enrollment due to renewed legislation extending premium subsidies, new legislation fixing the family glitch, and increased funding for Marketplace navigators.

Renewed Legislation

The American Rescue Plan Act—legislation that enhanced government premium subsidies for the Marketplace—was destined to expire by the end of the year. But, the Inflation Reduction Act saved the day by essentially “renewing” the premium subsidies.

The legislation, signed in August, added $64 billion in funding for a three-year extension (until 2025) of the enhanced premium subsidies for Marketplace insurance. So, those currently enrolled in Marketplace plans can renew their insurance, knowing they’ll have these tax credits through 2025. This also means that the 3 million Americans who were previously enrolled in off-Marketplace insurance plans have the opportunity to enroll in government-subsidized insurance, escaping their plans’ ever-so-increasing premiums. Not to mention the millions of Medicaid enrollees who are likely to preemptively enroll in Marketplace insurance, given they’ll lose Medicaid coverage as soon as the public health emergency ends (I talked about it here).

Lastly, I must note that had the premium subsidies not been renewed, Americans would have faced steep premium increases. For example, a married 60-year-old couple making $70,000 annually pays $500/mo ($6,000/yr) for a full-silver benchmark plan with the current premium subsidies. Without the Inflation Reduction Act, this couple would pay $1,860/mo ($22,300/yr)— that’s 32% of their annual income vs. 8.5% of their yearly income with subsidies!

Simply put: had the Inflation Reduction Act never passed, premium subsidies would decrease, driving up premiums in the individual market.

New Legislation

The Biden administration updated a rule to fix the family glitch, an annoying “glitch” in the ACA that affects 5.1 million Americans. To briefly explain this glitch:

- Individuals and families are ineligible for premium subsidies if they have another form of coverage, such as employer-sponsored insurance, that’s affordable and provides minimum value.

- Affordable = the cost of premiums for the individual employer-sponsored insurance plan is less than 9.6% of family income.

- Minimum Value = more than 60% of health expenses are covered by employer-sponsored insurance.

So, say your family income is $50,000/yr, and you want your employer-sponsored insurance to cover your family. Your employer offers insurance with a $6,000/yr premium for the family and a $1,300/yr premium for just you.

Since your individual annual premium is $1,300, that’s less than 9.6% of your family income—or, in other words, “affordable”—you get no subsidies for your $6,000/yr family premiums.

Determining who qualifies for family subsidies depends on the affordability of the annual premium for individual coverage, no matter if you have a family plan. That’s weird.

What did the Biden administration do, then? They fixed this glitch. Now, an “affordable” family insurance plan means the annual premium for a family plan (not an individual plan, as it’s been) must be less than 9.6% of family income. In the above example, the $6,000/yr family premium is more than 9.6% of family income, hence not affordable—they qualify for premium subsidies.

An estimated 710,000 of the 5.1 million Americans affected by the glitch will now enroll in the ACA Marketplace. Since those mainly affected by the family glitch are young and relatively healthy, the Marketplace insurance risk pool would be healthier, and premiums should decrease.

Increased Navigator Funding

The Biden administration invested $100 million into the ACA to increase insurance coverage for underserved communities. The funding will go into care navigators, which is expected to increase enrollment in 2023 as it did in 2022.

The goals of the $100 million investment are two-fold:

- Navigators will improve outreach to underserved communities.

- Navigators will help eligible Medicaid beneficiaries transition to Marketplace plans, given the impending Medicaid Cliff.

The $100 million won’t be disbursed equally to states. While Texas, Florida, and North Carolina will receive the greatest funding, Hawaii, Iowa, and Nebraska will receive the least funding. This makes sense, given Texas, Florida, and North Carolina have some of the highest uninsured rates in the country, while Hawaii, Iowa, and Nebraska have some of the lowest.

Tying it All Together

A record-breaking number of Americans enrolled in Marketplace insurance in 2022. Who’s to thank?

- Premium subsidies from the American Rescue Plan Act

- Increased funding for Marketplace navigators

I predict that 2023 Marketplace enrollment will experience yet another record-breaking year. Why?

- Continued premium subsidies from the American Rescue Plan Act will allow current enrollees to renew their affordable plans.

- Increased funding for Marketplace navigators will help millions of Medicaid enrollees transition to Marketplace insurance before the public health emergency ends.

- The fixed family glitch will influence an estimated 710,000 Americans to enroll in Marketplace insurance.

*My first favorite holiday is Thanksgiving, and my least favorite day of the year is the day after Thanksgiving. I hate having to deal with awful heartburn and stomachache.