29 March 2022 | Healthcare

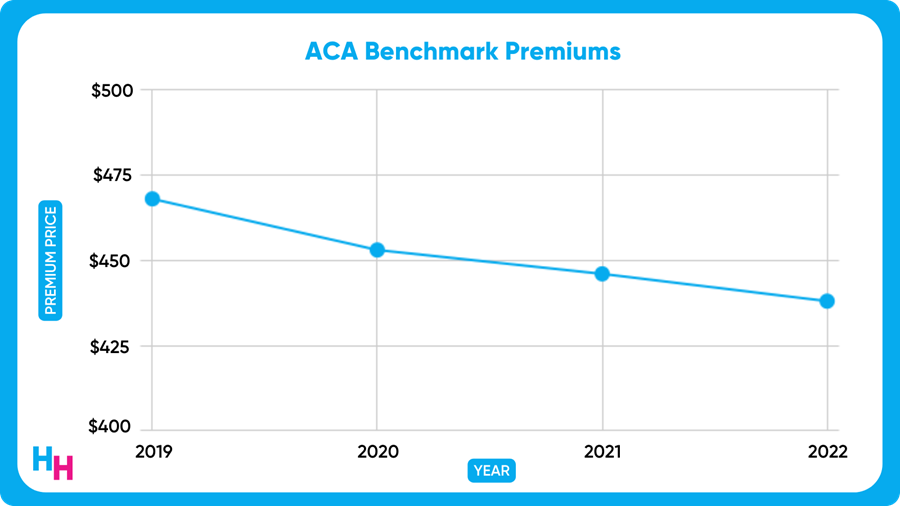

Marketplace Premiums Decrease, Third Year in a Row

By workweek

ACA Marketplace insurance premiums decreased for the third year in a row. Trending in the opposite direction are employer-sponsored insurance premiums, which have been continuously increasing. Either way, the question on everyone’s mind (or my mind, at least) is how inflation will influence insurance premiums.

The Deets

Researchers at the Robert Wood Johnson Foundation analyzed Marketplace insurance premiums across 500 regions. They found that this year’s premiums for benchmark plans declined 1.8%, on average, from $446/mo to $438/mo.

It’s not like healthcare has become less expensive. So what’s going on?

- 1️⃣ Competition: competition in the Marketplace is increasing. Compared to a Marketplace with at least five insurers, premiums on average for a Marketplace with just one insurer were $189.50/mo higher. This number decreased with each new insurer added to the Marketplace.

- 2️⃣ American Rescue Plan Act (ARPA): the ARPA expanded Marketplace subsidies greater than baseline ACA subsidies, driving down premiums. And, since the ARPA essentially made Marketplace insurance more affordable, a record-breaking 14.5M people enrolled in Marketplace insurance this year, a 21% increase from 2021.

- 3️⃣ Continuous Medicaid Enrollment: Marketplace insurers also had to consider the impending end of the continuous enrollment requirement when setting their 2022 premiums. Around one-third of the 14M people who’ll lose insurance will be eligible for subsidies for Marketplace insurance, which would drive down premiums.

Yes, But…

Inflation rose 8.5% over the last 12 months. However, inflation for medical services only rose 2.4%. As Blake Madden explained, the lower inflation rate for medical services is because healthcare always lags behind other industries. Provider reimbursement prices and premiums for an upcoming year are typically set six months in advance. So, prices are basically locked in going into the new year, which is why medical services weren’t really touched by inflation… yet.

Once these reimbursement contracts end between payer and provider next year or years later, providers and hospitals will inevitably negotiate higher prices to compensate for the higher cost of the medical goods needed for operations and patient care. As a result, insurers will likely jack up premiums, which fall on employers and beneficiaries.

So, will ACA Marketplace premiums continue to decline? My prediction right now is no.