16 June 2022 | FinTech

State of the Union: The Credit Bureaus

By Alex Johnson

There is a widespread sentiment in fintech that the primary U.S. credit bureaus — Experian, Equifax, and TransUnion — are terrible at what they do and need to be replaced.

There is also a simple economic reason why fintech companies are likely to believe this — the bureaus are massive.

Here’s a quick example — Plaid is, perhaps, the largest and most successful fintech company operating in the same general problem space as the credit bureaus. While Plaid has, historically, tried to stay away from credit decisioning (because it doesn’t want to be regulated as a Consumer Reporting Agency under FCRA), it is one of the largest providers of consumer financial data in fintech and it is constantly expanding into new use cases (just as a certain card network executive predicted):

Last year, Plaid raised a $425 million Series D funding round, which valued the company at $13.4 billion. Remember — that’s a private market valuation, determined by investors that were (at the time) highly motivated to project their most optimistic predictions on to the company.

Experian, Equifax, and TransUnion collectively generated $13.3 billion in revenue last year.

The credit bureaus are really freaking big.

The credit bureaus also, in spite of what fintech companies and consumer advocates tend to argue, work pretty well.

[I know, I know … the bureaus have lots of problems … we’ll get there, I promise!]

Still, this is a point that is worth making clearly — the United States has a relatively efficient, comprehensive infrastructure in place that enables lenders to make quick and accurate credit risk decisions, based on highly regulated data that consumers can access, monitor, and modify. The credit bureaus are the primary pillars upon which this infrastructure rests.

Compare this credit granting infrastructure to almost any other country in the world and you will come away from your analysis with an appreciation for the grass on this side of the hill. We don’t have a social credit system, like the one that they are trying to build in China. And we don’t allow banks to only report negative repayment data or factor attributes like income into credit scores, like they do in a bunch of different countries around the world.

The U.S. credit bureaus remind me of that Winston Churchill quote, “democracy is the worst form of government, except for all the others that have been tried from time to time.”

However, this shouldn’t cause us to cease in our analysis and criticism of Experian, Equifax, and TransUnion. We deserve a more perfect union and we need to do the work necessary to get it.

And so, in that spirit, I present Fintech Takes’ ‘State of the Union’ on the U.S. credit bureaus. We’ll start with a quick overview on each of the bureaus and then wrap up with a discussion on the macro trends impacting the entire industry.

TransUnion

What They’ve Been Up To

TransUnion had a good start to 2022. The company reported $921 million in revenue, up 32% year over year and putting it on track to hit more than $3.8 billion in revenue this year.

TransUnion has also made three significant acquisitions within the last 6 months — Verisk Financial Services (a provider of competitive intelligence and consumer behavior data) for $515 million, Sontiq (a provider of digital identity protection and security services for consumers) for $638 million, and Neustar (a provider of identity resolution solutions) for a whopping $3.1 billion (the largest acquisition in the company’s history).

The company also sold off its healthcare data and analytics business for $1.7 billion.

Where They’re Going

TransUnion is, to quote Brad Pitt in Moneyball, the last dog at the bowl. They are the smallest of the three U.S. credit bureaus. As such, they have to be creative to win marketshare from the other two.

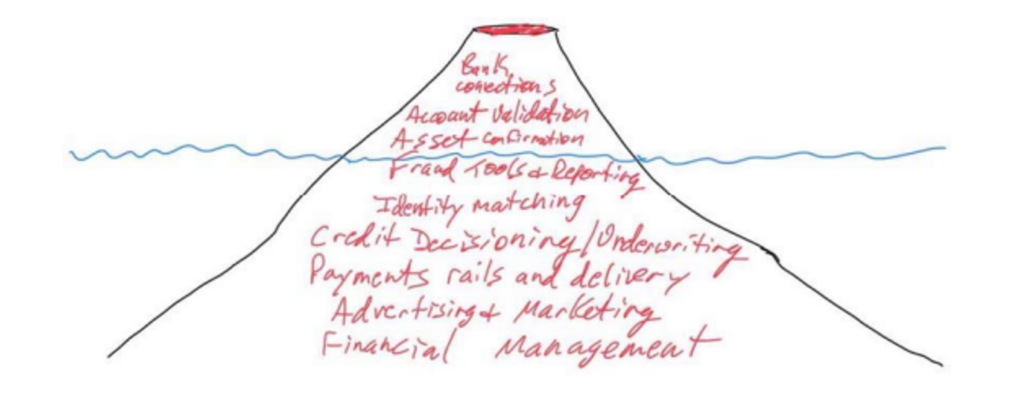

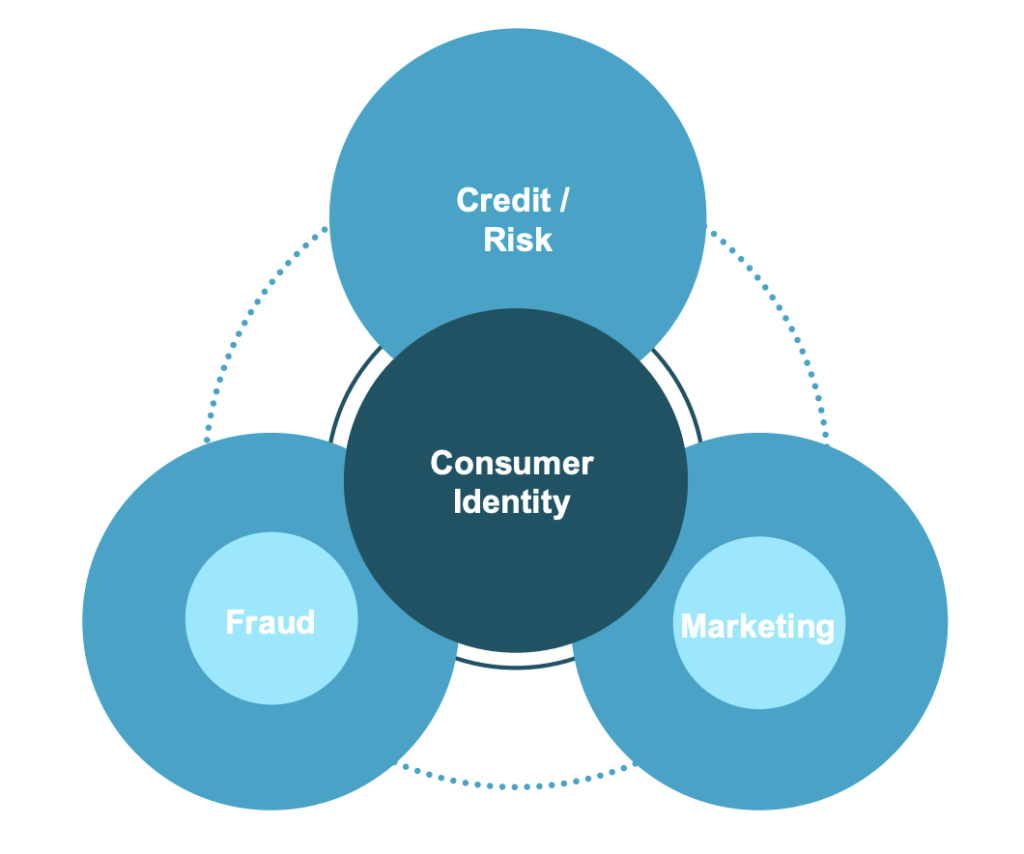

The company’s strategy, which the Verisk and Neustar acquisitions clearly emphasize, is to focus on creating a virtuous cycle across three areas — credit, fraud, and marketing. Here’s how they visualized it in their most recent investor update:

The basic idea is that the more identity, risk, and behavioral data elements they can connect together for each consumer in their database, the more value a call to TransUnion can be for a financial institution. More calls means more pricing power for TransUnion, which is the thing that each of the bureaus (which are, at their core, commodity data businesses) most desire.

The Sontiq acquisition supports a slightly different goal. Each of the credit bureaus has a B2C business, which sells data and services directly to consumers. Credit monitoring is the most established and well-known example of these B2C services, but the Sontiq acquisition positions TransUnion to move its B2C business towards a greater focus on identity protection and digital security (competing with the likes of NortonLifeLock).

Fintech Takes’ Take

The Neustar acquisition is a massive bet (even after you recoup some of the cost by selling your healthcare business). Reading between the lines a bit, it seems that TransUnion is hoping that Neustar’s identity resolution platform (OneID) will help bring all of the company’s scattered identity and fraud management products together into a unified offering. Having witnessed a few acquisitions and technology integrations up close at prior jobs, this strikes me as perhaps a bit too optimistic.

TransUnion turning its B2C offering towards identity and fraud protection through the acquisition of Sontiq is smart given the dominance of Experian in the B2C credit monitoring market.

Equifax

What They’ve Been Up To

Q1 of 2022 was Equifax’s highest revenue quarter ever, pulling in $1.3 billion. However, despite this strong start, Equifax reduced its guidance for the full year by approximately $100 million.

Why?

Because mortgage interest rates are up and mortgage origination volumes are, correspondingly, plummeting. This hits Equifax especially hard because the biggest revenue contributor at Equifax isn’t its consumer and business credit data. The biggest line of business at Equifax is Workforce Solutions, a collection of data and services products that help businesses and government entities with employment and income verification. 40% of the revenue from Workforce Solutions comes from employment and income verification for mortgage lending.

The only significant, non-Workforce Solutions news at Equifax recently was the acquisition of Data-Crédito, the largest consumer credit reporting agency in the Dominican Republic.

Where They’re Going

Equifax predicts that in 2022, more than 50% of its revenue will come from outside its traditional consumer and commercial credit bureau market segments.

Workforce Solutions is going to be the big driver of that shift and the company is investing aggressively in it, acquiring Efficient Hire (an HR management software company), rolling out a manual verification service for self-employed consumers, and building out a whole host of new integrations and partnerships.

Overall, the company wants to capture and retain as much of the employment/employer data and services market as it can.

Fintech Takes’ Take

The single mindedness with which Equifax is attacking the employment/employer data and services market is honestly a bit startling. They dominate that market today and they are pressing the gas pedal all the way down to the floor.

It’s a smart strategy. As I’ve written about before, employment data sits at the top of the consumer data waterfall. Creating programatic access to it is a huge unlock for a whole host of use cases.

The concern for Equifax is that every fintech company in the open finance/payroll API space is 100% focused on competing with them. They are unified in their desire to beat Equifax, even to the point of forging alliances where necessary. It’ll be fascinating to see what comes out of this competition.

Experian

What They’ve Been Up To

Experian, headquartered in Ireland, operates on a slightly different financial schedule from Equifax and TransUnion, which makes comparing first quarters difficult. However, looking at their annual report, it’s clear they had a good year.

In their last fiscal year, Experian reported $6.2 billion in revenue, up 17% year over year.

Experian is the most credit bureau-y of the three credit bureaus. A majority of its revenue comes from the credit data that it sells to financial institutions around the world (Experian has, by far, the biggest international footprint of the three bureaus), the analytics and decisioning technology that it built to leverage that data (Equifax and TransUnion have mostly gotten out of the business of selling credit lifecycle management software to banks), and credit monitoring/building/shopping and identity protection services for consumers.

Where They’re Going

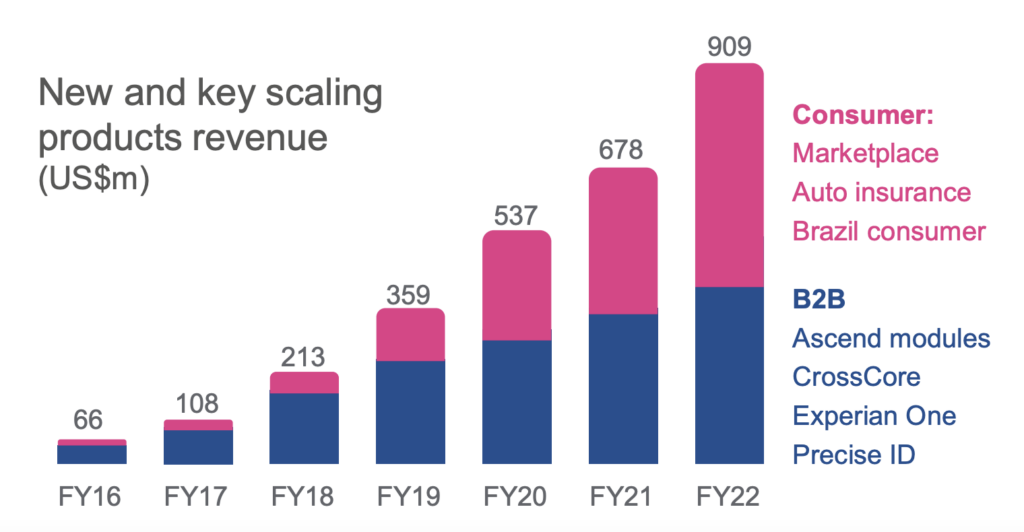

It’s all about B2C.

Selling credit data to financial institutions (B2B) is still the biggest revenue driver for Experian, but all the growth is in B2C:

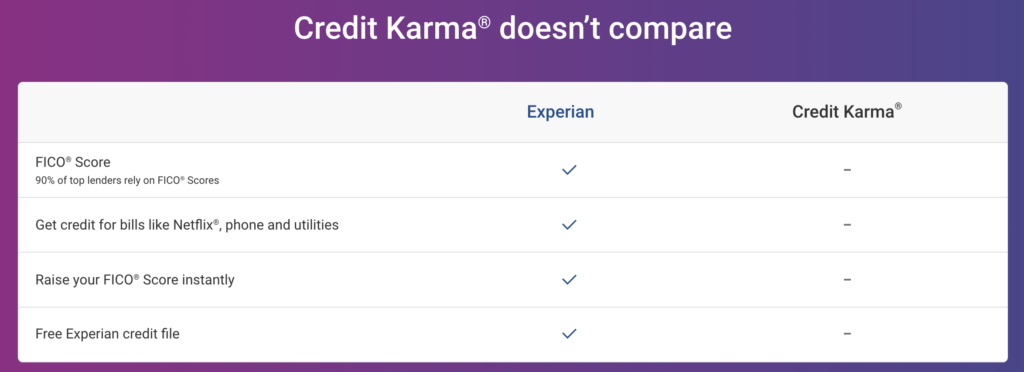

Experian’s B2C offering is comprised of credit monitoring, credit building (Experian Boost & Experian Go), lead aggregation (Experian Marketplace), and identity theft protection. Put simply, it’s Credit Karma (a comparison Experian openly invites consumers to make):

Experian is investing aggressively in this area, expanding its marketplace to cover new product categories like insurance and adding new consumer-facing tools like bill negotiation.

Fintech Takes’ Take

As the biggest credit bureau, Experian has the resources to play a lot of hands at the Blackjack table simultaneously. It can continue to expand internationally (Brazil is a big focus for the company). It can continue to invest in selling Ascend (its credit lifecycle management software) and CrossCore (its fraud management platform) to financial institutions. It can even dabble in competing with Equifax in employment and income verification.

However, it’s clear that Experian’s biggest bet is on becoming the consumer-facing credit bureau and monetizing the opportunities that come out of that (directly and indirectly).

The other bureaus have largely left this business to Experian, which is a big competitive advantage. The B2C business also provides Experian with a new mechanism to differentiate the data and services they provide on the B2B side (consumer-contributed data from Experian Boost makes their core credit files thicker).

That said, this strategy also comes with risks. Experian’s B2C offerings are built around the FICO Score (see the anti-Credit Karma messaging above), which is obviously bad for VantageScore (the credit bureaus’ joint alternative to FICO). Experian positioning itself as the most consumer-facing of the three bureaus also seems likely to invite greater scrutiny from regulators like the CFPB.

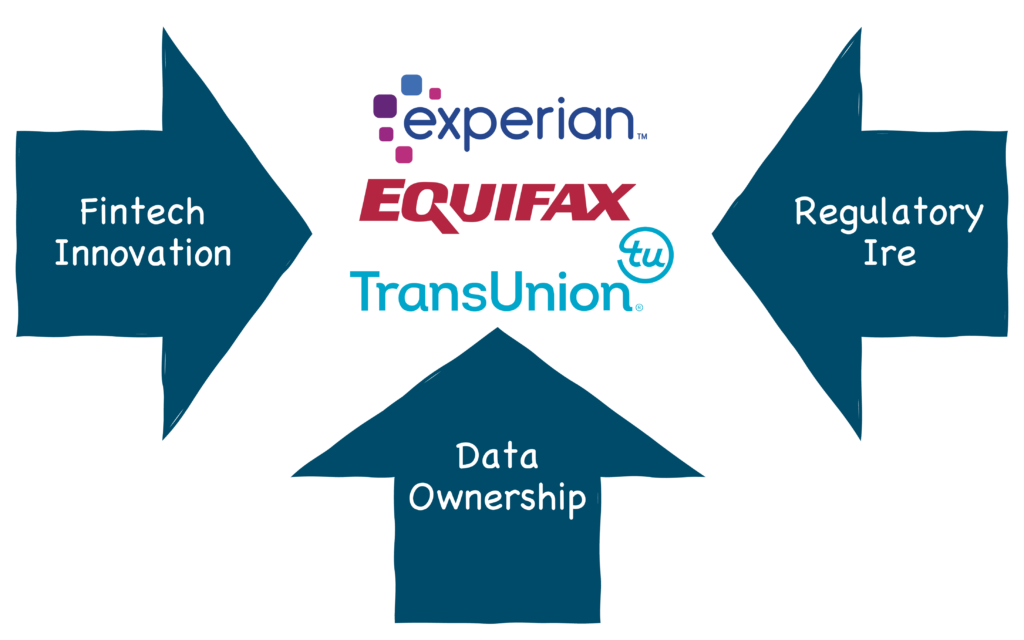

Where is the Industry Going?

Now let’s take a step back and look at the macro forces that are impacting the credit reporting industry and make a few educated guesses about how those forces might impact Experian, Equifax, and TransUnion.

I think there are three that we need to talk about.

Regulatory Ire

In 2021, the CFPB received 994,000 consumer complaints. 710,300 of them were about credit reporting. That’s 71% of the total 🤯

If you want to know why the CFPB seems very focused on the credit bureaus, that’s why. Specifically, the CFPB’s recent research and statements about the bureaus indicates two primary areas of concern.

1.) Overall Customer Service — Consumers have a legal right to dispute inaccuracies on their credit reports (roughly one third of U.S. consumers have reported finding errors on their reports according to a study done last year). A lot of those disputes tend to flow through the CFPB (71%!), but according to a recent report from the CFPB, the credit bureaus are increasingly unresponsive to those complaints:

In 2020, Equifax, Experian, and TransUnion changed how they respond to complaints transmitted to them by the CFPB. The CFPB’s analysis reveals that the NCRAs are closing these complaints faster and with fewer instances of relief.In 2021, the NCRAs reported relief in less than 2% of complaints down from nearly 25% complaints in 2019.

2.) Specific Practices & Populations — The CFPB also spends a lot of time looking at the impact that specific practices by the credit bureaus have on consumers, especially vulnerable consumer populations (survivors of human trafficking, military families, etc.) One such practice that they recently flagged as concerning (and the the credit bureaus made changes to in response to the CFPB’s concerns) was medical debts:

People reported that once medical bills were placed in collections and furnished to credit reporting agencies, their credit scores stopped reflecting their ability to repay debts. Their lower credit scores became weapons debt collectors could use against them to force payment. In some instances, individuals reported becoming so frustrated trying to resolve allegedly unpaid bills that they gave in and paid the debt collector. They just wanted to make the collection efforts stop and to increase their credit scores.

Fintech Innovation

The credit bureaus all like to talk about how fintech companies are a growing, strategically important customer segment for them. They also, less publicly, like to gripe about the problems that those fintech companies are causing them.

Two examples:

1.) Credit Builder Products — These have become very popular among B2C fintech companies over the last couple of years (for a full rundown of what kinds of products are out there and how they work, check out this essay). These products are often designed to make it virtually impossible for consumers to misuse them and, thus, generate negative tradeline data for their credit reports. That’s great for consumers, but it has a distorting effect on the data reported to the bureaus and the ‘willingness to pay’ signals that lenders extract from that data. That’s bad for Experian, Equifax, and TransUnion.

2.) BNPL — After significant pressure from the market and from regulators, all three credit bureaus have announced that they will be accepting data furnished by BNPL pay-in-4 providers such as Klarna and Afterpay. Given that none of this data has, historically, been captured by the bureaus, this is a big deal. It’s also a bit controversial. While everyone seems to generally agree that it’s important to capture this data (BNPL is credit after all), there is disagreement about how this data will impact consumers’ credit scores. Experian thinks the impact might be more negative, which is why it created a separate BNPL bureau to capture the data without impacting consumers’ core credit reports. Equifax and TransUnion, on the other hand, appear to view the addition of BNPL repayment data as a net positive and are dropping it into their core credit files (with special tagging).

Data Ownership

The final force exerting an influence on the credit bureaus is shifting consumer and societal attitudes around data ownership. There are two flavors:

1.) Open Finance — It’s hard not to look at the growing support for and adoption of open banking in the U.S. and not wonder about the impact that this trend will have on the credit bureaus. How will the use of open banking data for cashflow underwriting impact the use of traditional credit data in underwriting (see the OCC’s Project REACh and Fannie Mae’s recent announcement about a cashflow underwriting pilot for mortgage lending for two examples)? How will programatic access to payroll systems impact lenders’ ability to approve and/or provide better pricing for borrowers that link their paychecks to their loans? How will consumers’ growing comfort with consumer-permissioned data experiences impact the way that they feel about the comparatively opaque, control-less credit reporting process?

2.) On-chain Reputation — I would be remiss if I didn’t also point out that the development of web3 (which will hopefully slow down a bit and happen more responsibly now that token prices have crashed) will likely bring up some interesting questions about how consumers, in a trustless and fully digital environment, should be able to build and share their reputation with other parties. We’ve recently seen the perils of web3 lending based solely on collateral, so I’m intrigued to see what ways web3 folks dream up as alternatives for creating the trust between counterparties necessary for lending in a decentralized world (TransUnion is apparently intrigued by this question as well).