06 June 2022 | FinTech

Open Banking Bipartisanship

By Alex Johnson

3 Fintech News Stories

#1: Open Banking Bipartisanship

What happened?

Truework added Plaid to its income verification flow:

Truework Credentials empowers applicants to securely, instantly, and easily share their income and employment information directly within online loan applications. The addition of Plaid Income provides lenders with broader coverage through additional user-permissioned data.

So what?

“Wait” I hear you saying, “isn’t Plaid a competitor to Truework?”

Yes. Yes they are. However, in the nascent world of payroll-API-powered income verification, Truework and Plaid and all the other startups out there have a bigger fish to fry — Equifax.

In Q1 of 2022, one business line — Workforce Solutions — delivered nearly half of the $1.4 billion in revenue generated by Equifax. Workforce Solutions provides income and employment verification services to various companies, with income verification for mortgage lenders being one of the most popular use cases.

Truework and Plaid and all the other fintech infrastructure providers in the open banking/payroll API space want that revenue and are, in at least some cases, willing to work together in order to get it.

In this specific case, it appears that Truework is integrating Plaid further down in its income verification waterfall; if Truework’s direct integrations with payroll systems can’t get the needed income data, Plaid (and a number of other providers built into Truework’s Credentials product) can leverage their screen scrapers to try and get it.

#2: How Exactly Are You Going to Fix This?

What happened?

Edge, a provider of payments processing services, raised a pre-seed round:

Edge shines a light on the archaic practices companies are forced to settle for by offering a modern, unbiased solution for all companies. The stigmas associated with these industries are outdated and too broad. We evaluate businesses individually rather than grouping them into whole categories. Edge is building a payments platform that has transparent pricing, is simple to use, and has best-in-class support so you can finally focus on running your business.

Today we are excited to announce our $2.4M pre-seed led by Long Journey Ventures.

And, in related news, Merge — a fintech company focused on bringing banking and payment services to web3 companies — raised a seed round:

The company, which aims to provide banking and payment infrastructure for Web3 companies, has just raised a $9.5m seed round.

Merge operates an API-based banking and payments platform, bridging the gap between fiat and crypto ecosystems.

“As the crypto economy moves further into the mainstream, it’s increasingly clear that the current financial infrastructure isn’t fit to serve the rapid expansion of crypto-native businesses and many providers aren’t specialised enough to gauge risk, said Zihao Xu, investor at Octopus Ventures.

“Merge’s vision is to build the infrastructure necessary to allow crypto businesses to operate without fear of shutdown by regulators or third-party risk teams,” he added.

So what?

Both Edge and Merge were founded with the intent to bring better banking and payments services to high-risk businesses that are often underserved by traditional providers. Merge is focused on web3 companies and Edge is focused, more generically, on being “unbaised” in whom they serve.

This sounds great, but I have a question — what is it, exactly, that Edge and Merge are going to do to level the playing field and ensure that these underserved businesses get access to these services?

The problem is that Edge and Merge are platforms. They’re not replacing banks or the payment networks (as far as I can tell). They’re sitting on top of them. And, as such, they are subject to their partners’ rules … the same rules that often inhibit high-risk businesses from being served in the first place.

Every platform provider wants to work with the maximum number of customers possible. And every platform provider lobbies their financial services partners to loosen restrictions and let them serve more customers. Here’s Stripe:

We want to grow global online commerce and support as many businesses as possible—especially those based on new business models or founded by first-time entrepreneurs. Wherever possible, we eschew risk assessments based purely on categorical labels. Instead, we use a combination of transaction history, machine learning, supplemental business information, and common sense. We want to understand the actual risks posed by a specific business, with the fundamental goal to support as many businesses as possible, rather than just looking at the industry or category. We work with our financial partners to relax restrictions or remove prohibitions wherever possible.

I love what Edge and Merge are trying to do. I’m just a bit unclear as to how they’re going to be any more successful at doing it than Stripe.

(BTW – I’d love to learn more about how Edge and Merge are going to tackle this problem, if anyone can help elucidate me)

#3: Living Paycheck To Paycheck

What happened?

PYMNTS and LendingClub did a survey:

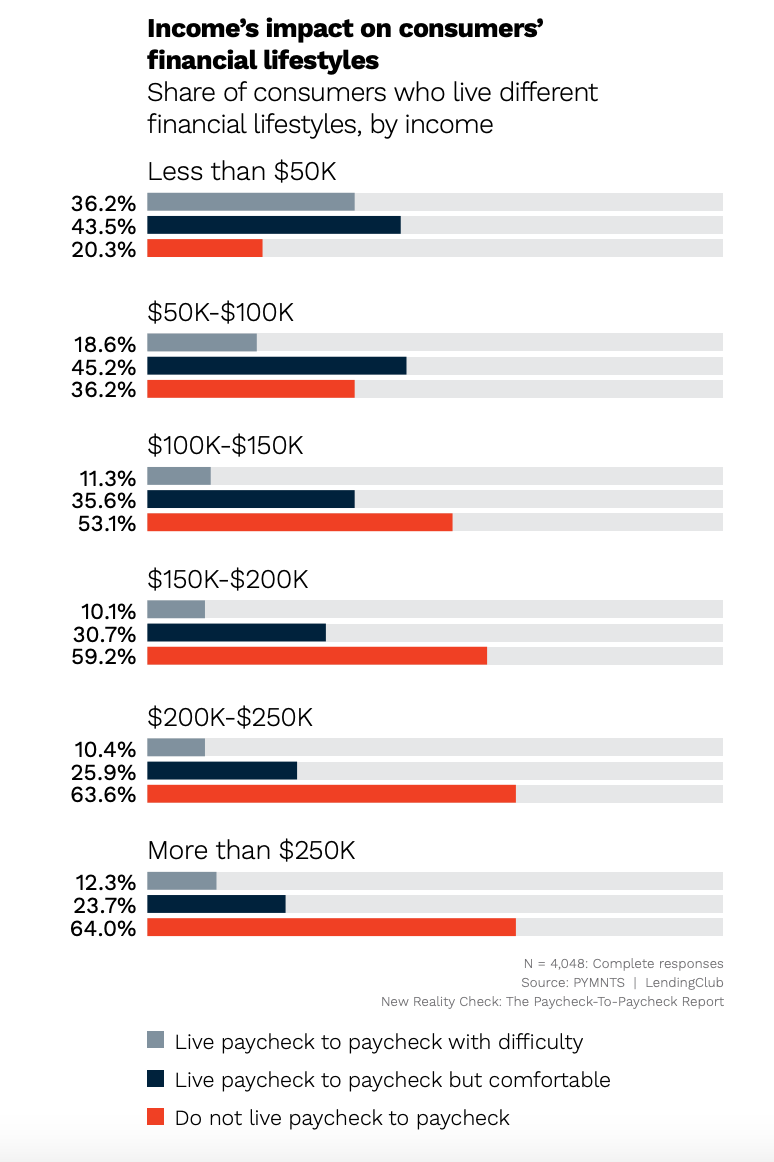

With inflation driving up costs everywhere, consumers in all income brackets — including those who make more than $250,000 annually — live paycheck to paycheck. PYMNTS’ research finds that 61% of U.S. consumers lived paycheck to paycheck in April 2022, a nine percentage-point increase from 52% in April 2021. This increase means approximately three in five U.S. consumers devote nearly all their salaries to expenses with little to nothing left over at the end of the month.

Our data also reveals that slightly more than one in three consumers annually earning $250,000 or more currently live paycheck to paycheck.

So what?

This survey earned itself a decent amount of mockery on Twitter, which I get. Break out the world’s tiniest violin for those making more than $250,000 and still having a hard time making ends meet.

That said, the data in the actual PYMNTS research report was quite interesting to me. This graphic, which shows the distribution of consumers by income and financial status, was especially so:

The distinction here that is interesting is between ‘live paycheck to paycheck with difficulty’ and ‘live paycheck to paycheck but comfortable’. It’s interesting because it indicates that there are distinct differences in the financial product and service needs of consumers living paycheck to paycheck.

The first group (with difficulty) has a cashflow problem. They need financial services solutions that help them earn more money and/or better manage their expenses. These consumers also benefit enormously from solutions that speed up time to money (like 2-day early access to direct deposits) and short-term liquidity solutions that bridge cashflow imbalances (like overdraft protection).

The second group (comfortable) has a savings problem. They’re not struggling to pay bills, but they’re also not meaningfully building wealth. They need financial services solutions that automate saving, encourage investment, and start inspire some long-term financial planning.

2 Things to Read and/or Listen To

#1: A Lesson on Accountability (by Blake Madden) 📚

Here’s a story about a startup, founded at the same time as the start of the COVID-19 pandemic, which set out to broaden access to a critical service that consumers had, historically, only been able to get in person. This startup attracted a ton of investment from VCs, which saw the pandemic as the perfect opportunity to jumpstart a nascent industry and exploit some regulatory arbitrage. The pressure to grow was immense and led the company to make some very poor choices in regards to its business model and products, which ultimately led to a pending investigation by the DOJ and the CEO stepping down.

This is not a fintech story.

This is a healthcare story, written by my brilliant Workweek colleague Blake Madden. It’s about a virtual mental health startup called Cerebral, which has gotten itself into deep trouble due to reported abuse of controlled substance prescriptions. It’s also a story about the VCs that poured money (and pressure to grow) into Cerebral and have, since this trouble began, been very quiet.

This is not a fintech story, but you should read it (and subscribe to Blake’s excellent newsletter) because the parallels between healthcare and financial services are deep and there are a lot of critical lessons to be drawn from them.

#2: The Pivot to Web3 Is Going to Get People Hurt (by Maxwell Strachan) 📚

Continuing with the theme of investors quietly profiting from morally ambiguous businesses, I found this Vice article on web3 to be rather troubling.

The part I didn’t really understand, until reading the article, is how investors (which put $2 billion into early- and seed-stage Web3 companies in Q1 of 2022 … more than double what the next-highest sector, biotechnology, received, and triple what traditional fintech got) benefit from acquiring tokens (as well as more traditional equity stakes) from the web3 businesses they invest in:

Traditionally, venture capitalists have had to wait years before they can receive a payout for their investments, usually during an initial public offering. Since tokens could be sold at any time, Tunguz [a web3-focused investor at Redpoint Ventures] realized Web3 investors in them had access to an asset with “immediate liquidity” instead, which can lead to a return even if the company never goes public. If they do, all the better: the equity investor can then cash out twice.

The risk inherent in such a system became clear, though, soon after we spoke. In May, the $40 billion Terra-Luna ecosystem collapsed. A major factor had been that an affiliated lending protocol, Anchor, had promised a 20 percent staking yield. Once people started to lose confidence in the sustainability of that yield, they rushed to pull their money out, leading to Terra’s algorithmic stablecoin, UST, losing its peg to the U.S. dollar and a dramatic crash in its sister cryptocurrency, Luna.

Within days, it was reported that one of Terraform Labs’ early and biggest investors, the crypto-focused hedge fund Pantera Capital, had quietly cashed out “roughly” four-fifths of its investment ahead of UST’s collapse, a little under $170 million on a $1.7 million investment. The news infuriated many retail investors, who saw it as proof of what many in crypto suspected: professional investors gaining an early edge, loudly pumping up the project, quietly cashing out—the dump—and then moving on to the next token.

1 Question to Ponder

How will a rising rate environment (which we seem destined to be in for a while) impact consumer demand for traditional savings products vs. riskier investment products (including crypto)?

DM me on Twitter or LinkedIn if you have any thoughts on this question.