Tipping in Fintech is Complete Bullshit

Bulls Fighting (1786) painting by George Stubbs. 3 FINTECH NEWS STORIES #1: Tipping in Fintech is Complete Bullshit What happened? Earned wage access (EWA) is the focus of a new bill in Congress: The U.S. House Financial Services Committee (HSFC) advanced “Earned Wage Access Consumer Protection Act,” a bill that aims to provide a regulatory…

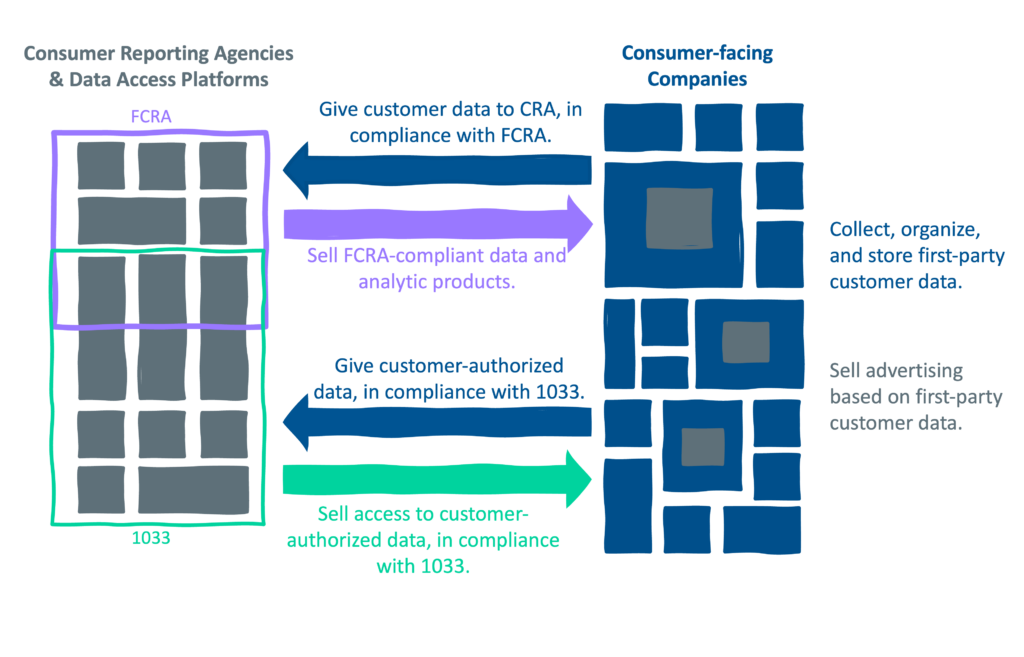

Read MoreThe CFPB’s Vision for the Data Economy

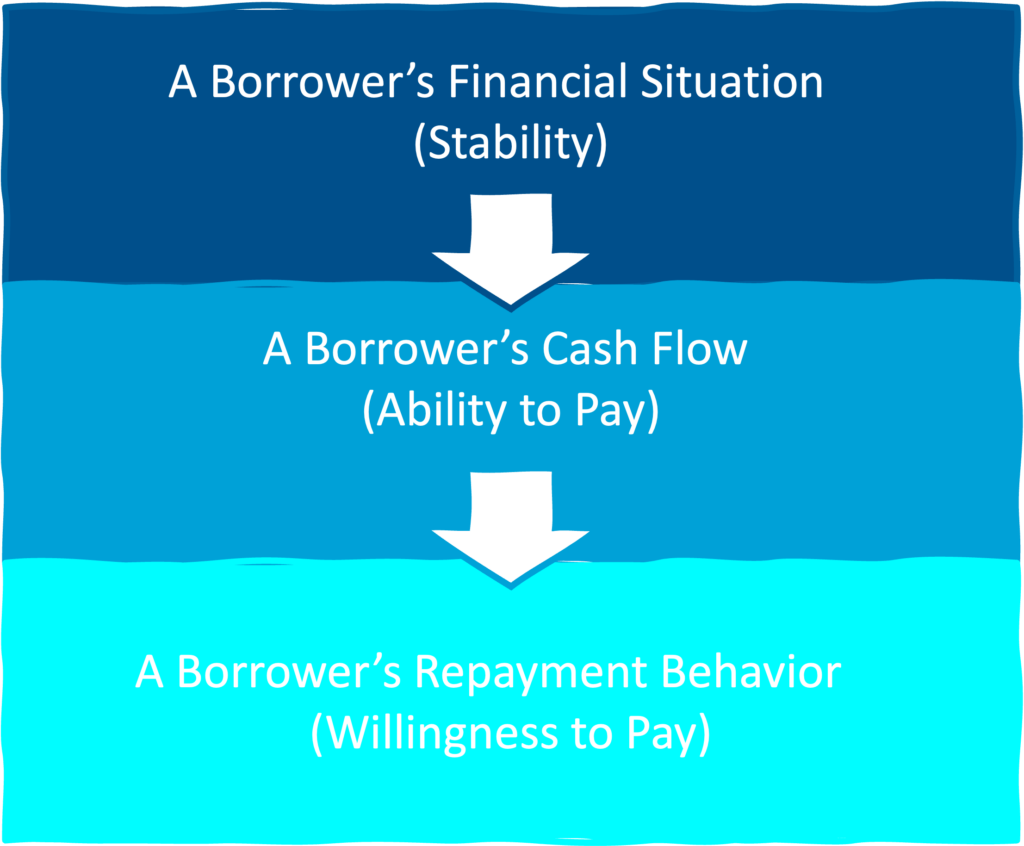

Let’s start with a couple of recent news stories. The first is the story of a man named Romeo Chicco. At the end of last year, Mr. Chicco attempted, unsuccessfully, to get auto insurance from seven different providers. When he finally succeeded on the eighth attempt, he ended up paying nearly double the price that…

Read MoreNubank’s New Move

3 Fintech News Stories #1: Nubank’s New Move What happened? Nubank is creating a mobile virtual network operator (MVNO) so that it can (presumably) offer mobile service to its customers: Nubank wants to venture beyond banking services and is preparing to launch its own cell phone company. Anatel approved an accreditation contract signed between the…

Read MoreThe Tortured Fintech Analysts Department

#1: My Boy Only Breaks His Favorite Toys What happened? Klarna is launching a new card product in the U.S.: The new Klarna Card, which the Sweden-based firm announced Wednesday, will offer users various interest-based repayment options for individual purchases, including paying in three- or six-month installments or moving the payment due date for a…

Read MoreLearning How to Play a New Game

Imagine that you learned how to play chess at a young age and became good at it — like obsessively good. And you never really bothered to wonder why there was that empty space on the board, right next to the king. It was always just there. Then you hear about a different version of…

Read MoreCredit Cards are a Poor Wedge Product

3 FINTECH NEWS STORIES #1: Credit Cards Are a Poor Wedge Product What happened? Petal, the fintech credit card company, is being acquired: Empower has entered into a definitive agreement to acquire Petal and expects the acquisition to close by the end of the second quarter Its planned acquisition of Petal, a New York-headquartered consumer…

Read More