23 September 2023 | Healthcare

Semaglutide: A Medical Marvel or an Economic Enigma?

By workweek

Novo Nordisk’s semaglutide added another win to its books, this time showing significant reductions in symptoms in patients with heart failure with preserved ejection fraction (HFpEF).

Are you asking yourself, “Geez, what can’t this drug do?”

You’re not alone.

In this article, I’ll summarize the latest STEP-HFpEF clinical trial, highlight semaglutide’s history thus far, and tie it all together with business and patient implications.

The Deets

In the STEP-HFpEF trial, researchers assessed whether injectable semaglutide could reduce heart failure-related symptoms and physical limitations in patients with HFpEF and obesity, which frequently occur together.

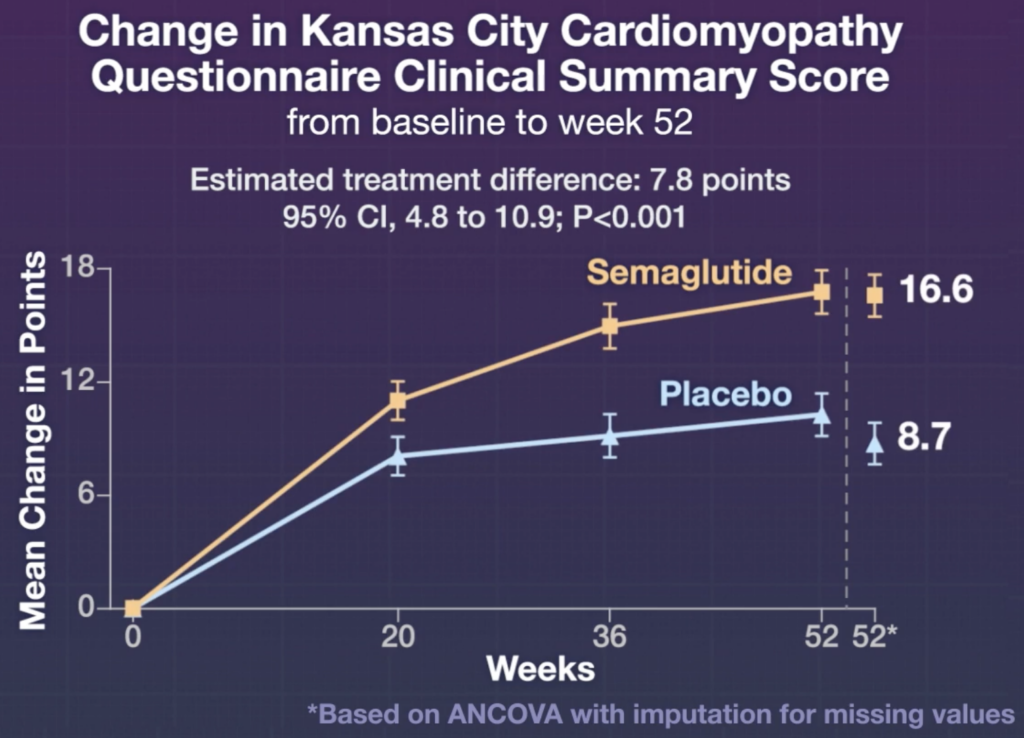

In this multinational study, around 500 participants were randomized to take semaglutide or placebo for one year. Below are the primary endpoints:

- Change in heart failure symptoms and physical limitations.

- Percentage change in body weight.

The average change in points (using a validated questionnaire to assess heart failure symptoms and physical limitations) was 16.6 in the semaglutide group and 8.7 in the placebo group, while the mean percentage change in bodyweight was -13.3% in the semaglutide group vs. -2.6% in the placebo group.

Notably, there were also fewer cardiac disorders in the semaglutide group (2.7% of participants in semaglutide group vs. 11.3% in control group). These “cardiac disorders” include atrial fibrillation, cardiac failure, atrial flutter, and congestive cardiac failure.

Key limitations in the study included (severe) lack of diversity and insufficient power to assess clinical outcomes. First, 96% of the participants were white, hence my use of the word “severe.” Second, there weren’t enough participants enrolled in the trial to assess the impact of semaglutide vs. placebo on clinical events like hospitalizations, meaning the study was “underpowered.”

A Jack of All Trades

Here’s what we know from the current clinical trial data for semaglutide: it’s a wonder drug that has profound effects on different organ systems.

Metabolic System

Semaglutide significantly reduces body weight in patients with obesity/overweight with and without a coexisting condition, including diabetes. It also leads to better glycemic control in patients with type II diabetes—which was the original indication of the drug. We’re now awaiting the STEP-10 trial, which is investigating whether semaglutide is effective in patients with obesity and pre-diabetes.

Cardiac

Semaglutide lowers rates of cardiovascular death, nonfatal heart attacks, and nonfatal strokes in patients with type 2 diabetes at high cardiovascular risk. As per above, semaglutide also improves symptoms and physical limitations in patients with HFpEF.

Pending is the official data from the SELECT trial, which is evaluating semaglutide effects on heart disease and stroke in patients with cardiovascular disease and overweight/obesity, but without type two diabetes. However, a preliminary announcement from Novo Nordisk shows that semaglutide reduced major adverse cardiovascular events by 20% compared to a placebo group over a period of up to five years. That data point is absolutely bonkers: 20%!

Liver

Semaglutide can resolve non-alcoholic steatohepatitis, a common metabolic disease associated with increased morbidity and mortality.

Musculoskeletal

The STEP 9 trial is currently assessing changes in pain scores in patients with obesity and pain due to knee osteoarthrities taking semaglutide vs placebo. TBD. But I expect it to be a successful clinical trial, given weight loss is the first “prescription” for patients with osteoarthritic pain and overweight/obesity.

Psych

Anecdotally, patients on Ozempic have reported reduced cravings for food, nicotine, alcohol, gambling, and other compulsive behaviors. The START-T trial is just getting started to evaluate semaglutide therapy for alcohol reduction.

Personally, I’ve chatted with another physician who said one of their patients is paying out of pocket for semaglutide to reduce their alcohol cravings.

Dash’s Dissection

Study after study shows semaglutide and other similar medications are effective at treating a range of metabolic-related disorders like obesity, diabetes, NASH, and cardiovascular disease.

So, shouldn’t health plans cover these medications for the above conditions if it makes their beneficiaries healthier and reduces health expenditures?

It depends on which health plan we’re talking about.

Medicare may benefit from covering semaglutide for the above conditions, given beneficiaries are stuck on Medicare for the long run, and the long-term health benefits may be realized. One analysis predicts coverage of drugs like semaglutide would save Medicare $175 billion to $245 billion over a decade. These long-term health benefits would show in reduced Medicare Part A spending from decreased hospital inpatient care and skilled nursing care. It would also show in reduced Medicare Part B spending from decreasing the incidence of obesity-related conditions like heart disease and diabetes, which would drive up spending.

Medicare Advantage, Medicaid, and other private health plans may or may not benefit from covering semaglutide for the above conditions given churn rates, removing the long-term benefits of coverage. In fact, between 15% to 20% of beneficiaries enrolled in private or public health plans experience some sort of disruption in coverage each year. Below are some data from individual studies:

- Medicare Advantage: around 13% of beneficiaries left their plan within one year and nearly 50% within five years.

- Medicaid: the average duration of Medicaid enrollment is around 10 months, with significant disenrollment and reenrollment rates.

- Private Health Plans: around 20% of beneficiaries disenrolled from a commercial insurer each year (between 2006 and 2018).

Given high churn rates and disruption in coverage, why would a health plan spend thousands of dollars on semaglutide coverage if they may not reap the full cost-saving benefits in the long run?

From an economic standpoint, it doesn’t make sense for an individual insurer (other than Medicare) to cover semaglutide for the above conditions. An analysis by Reuters found the annual cost of overall care for patients prior to Wegovy (semaglutide for obesity without diabetes) was around $12,000 vs nearly $20,000 after taking Wegovy—a 60% increase.

I’m a physician, not an economist, so my math will end here. But the point is: if a beneficiary isn’t going to stick with the same health plan for the long-run, a health plan wouldn’t benefit from covering semaglutide for obesity, since they’ll never realize the long-term cost savings of preventing further morbidity.

But of course, the patient would undoubtedly benefit from semaglutide coverage.

In summary, the latest clinical trials demonstrate semaglutide’s substantial potential in managing various conditions, notably heart failure with preserved ejection fraction. However, the economic feasibility of providing this drug is contentious, with Medicare possibly benefiting due to its long-term structure, while the benefits for other, more transient health plans remain unclear. The inherent conflict between its proven health benefits and the economic and policy challenges surrounding its provision highlights a pressing need for balanced healthcare policies to allow broader, equitable access to such promising treatments.

Stay ahead in healthcare with my weekly Healthcare Huddle newsletter, covering digital health, policy, and business trends for 30,000+ professionals. Share with colleagues and subscribe here.