03 September 2023 | Climate Tech

Manufacturing myopia?

By

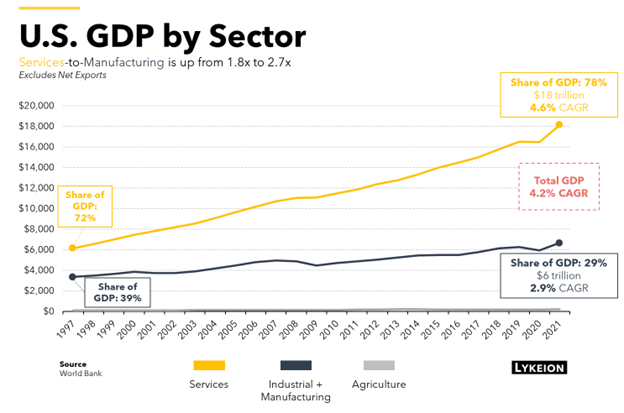

For years, the West imagined that nurturing more of a services-based economy and outsourcing manufacturing was a tenable, long-term proposition. U.S. manufacturing and industry, as visualized below, has grown significantly more slowly in recent decades than services-based components of the economy.

There were some oversights in this economic reorganization. Two good examples are the challenges of climate change and decarbonization. To accelerate the energy transition, net new manufacturing development is required to develop clean industry and technology. And that work can’t just happen the developing world; it needs to be incubated in developed countries.

Fortunately, many greenshoots signal that a shift towards focusing on clean industry and manufacturing is happening in the U.S. and Europe.

Financial capital flows and government support are among the strongest signals. For example, in the past two weeks alone, we’ve seen major financing announcements across the public and private sectors for battery supply chains and EV manufacturing in the U.S. and Europe:

- Last week, Northvolt, based out of Stockholm, raised an additional $1.

2B in convertible notes to build a battery supply chain in Europe. - This week, Redwood Materials, based out of Carson City, NV, raised more than $1B in Series D funding to expand its battery recycling and refining business in the U.S.

- Also this week, Eos Energy Enterprises, based out of Edison, NJ, raised $398.6M in conditional loan guarantees from the DOE to build four production lines in Turtle Creek, Pennsylvania for its “Eos Z3™” product, an industrial-scale zinc-bromine battery energy storage system.

- Finally, late this week, the U.S. government (via the DOE) announced an additional $15B+ in new funding to accelerate domestic EV production, including $10 billion in new loan funding, $2B in grant funding to help convert existing factories for EV and hybrid production, and $3.

5B for domestic battery manufacturing and source raw materials.

While the latest bit of news from the DOE is “vague on the details” and doesn’t represent net new funding (the funds will come from the IRA and bipartisan infrastructure law), it cements just how much focus there is on EV manufacturing and batteries in the U.S. right now.

Within the headline funding numbers there’s some compelling highlights for us to pull out, too. For one, the fact that Eos is working on a novel battery chemistry (zinc-bromine) is noteworthy. Both zinc and bromine are relatively abundant compared to lithium or the copper needed for ‘traditional’ batteries.

Similarly, Redwood Materials’ approach to battery supply chain onshoring is as much about circular economics as it is about building new supply chains from scratch. Their planned facilities, including one in South Carolina, focus on battery and material recycling from used EVs and other tech.

Still, beyond all this focus on batteries, there’s a separate question at foot for me here. Namely, is the current wave of onshoring investments too narrow?

Manufacturing myopia?

The short answer to my above question is no. The investments catalyzing EV supply chains and battery manufacturing in the U.S. will bring jobs to local communities, stimulate economic growth, and reduce dependencies on China as the U.S. and other Western countries decarbonize transport.

There are, of course, many unknowns surrounding how many of the announced battery factories get built. And of those that do get built, how many will produce at full capacity? And of those that do, how long will they produce at full capacity for? In short, how good will the government’s ROI be on these investments?

Further, the dizzying political dance that will occupy much of our attention (in the U.S., at least) for the next year could throw a wrench in plans come 2024.

But let’s not sweat that too much right now. Seeing how much progress the U.S. has made on batteries in a few years has been highly encouraging.

Beyond that, I do wonder whether and when we’ll see a similar surge in green manufacturing investment and activity outside EVs and batteries. There have been several factory investment announcements for technologies like solar panel components. But on the whole, between solar panels and EVs, the U.S. green manufacturing boom feels a touch myopic.

One reason for this myopia? Competing with China. China makes 60% of the world’s EV batteries and wind turbines and 80% of its solar panels and solar panel components. Hence why batteries and panels are intuitive places to start if you’re trying to compete with China and reduce dependence on them.

Still, batteries, panels, and even turbines are just small slices of the industrial tech needed for decarbonization. Countless other manufacturing sectors and technologies – e.g., thermal solutions for industrial heat, electrolyzers, electric arc furnaces, green hydrogen for fertilizer – will require the same levels of investments we’re seeing in batteries. Shouldn’t we hope for, nay, demand billion-dollar production commitments for those areas, too?

It’s true, stimulating new supply chains in these areas will be less simple than EVs and batteries. The technologies are often less mature, more expensive, and more specialized. Still, and perhaps because of that reality, it’s work the public and private sectors need to take on. These are areas the U.S. and the West in general should lead in – it can’t all be left up to India and China.

The net-net

Even after decades of slow growth, if U.S. manufacturing today alone constituted a global economy, it’d still be the 7th largest worldwide. Which means we’re still playing from a position of strength.

It’s decidedly not time to take our foot off the pedal on EVs and batteries. But it is time to catalyze the same level of growth in other manufacturing areas.

The battery boom should offer a blueprint, or a roadmap if you will, for seeding domestic manufacturing in other industrial applications and areas. It’s worked once so far. Let’s do it again.