Today we’re diving into the major themes and trends from the first half of 2023. If you missed my Q1 2023 write-up, you can read it here to get caught up to speed. (Hospitalogy Q1 2023 Roundup).

What are you noticing in healthcare so far in 2023? Feel free to respond to this email with anything I might’ve missed.

Secondly, I’d appreciate it if you signed up for my upcoming virtual event! We’ll chat with investors and experts on healthcare AI – talking about what’s practical in healthcare along with interesting startups reducing administrative bloat and solving problems for players in healthcare.

- Register here – even if you can’t make it.

Finally, these pieces take a long time to put together and I really do pour my heart & soul into writing Hospitalogy. I’d appreciate it if you forwarded along my newsletter to friends and colleagues to support me! Subscribe here.

Healthcare First Half 2023 in Review

For the skimmers (yes I am one of you), here’s your TL;DR:

- Vertical Integration Dominates Payor Strategy: CVS buys Oak Street Health, Optum outbids Option Health Care for Amedisys, continues tuck-ins.

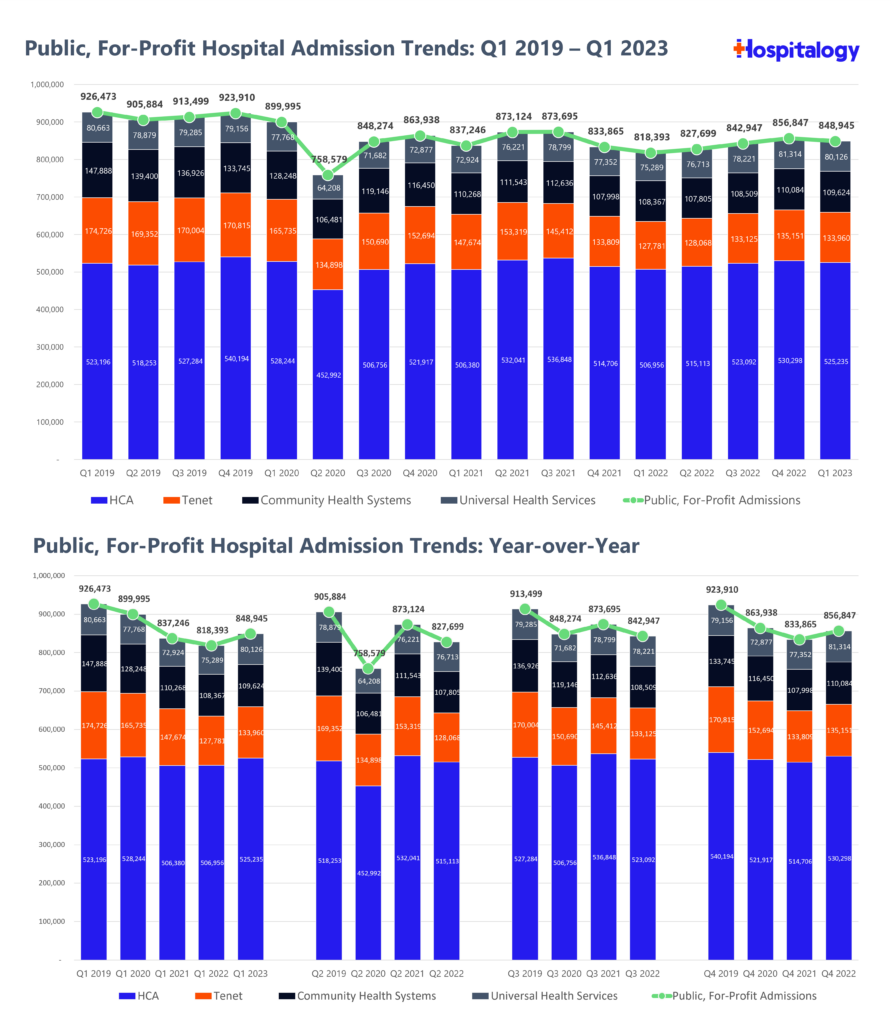

- The Return of Utilization: United & Humana noted higher than expected utilization trends entering the back half of the year. Hospitals and well-positioned services organizations are poised to capitalize on the returning patient volumes.

- Artificial Intelligence Begins its Hype Cycle: Hippocratic AI, Nuance-Microsoft partnerships with Epic, ambient documentation pilots, reinvigoration of legacy companies enabled by GPT-4, and more.

- Hospitals Respond with more Cross-Market Mergers: Kaiser and Geisinger form Risant Health, Intermountain-UC Health, BJC Healthcare and Saint Luke’s

- Things Fall Apart: Pear Therapeutics, Babylon, Bright Health, Envision Healthcare, GenesisCare, Friday Health Plans, and rumors of more.

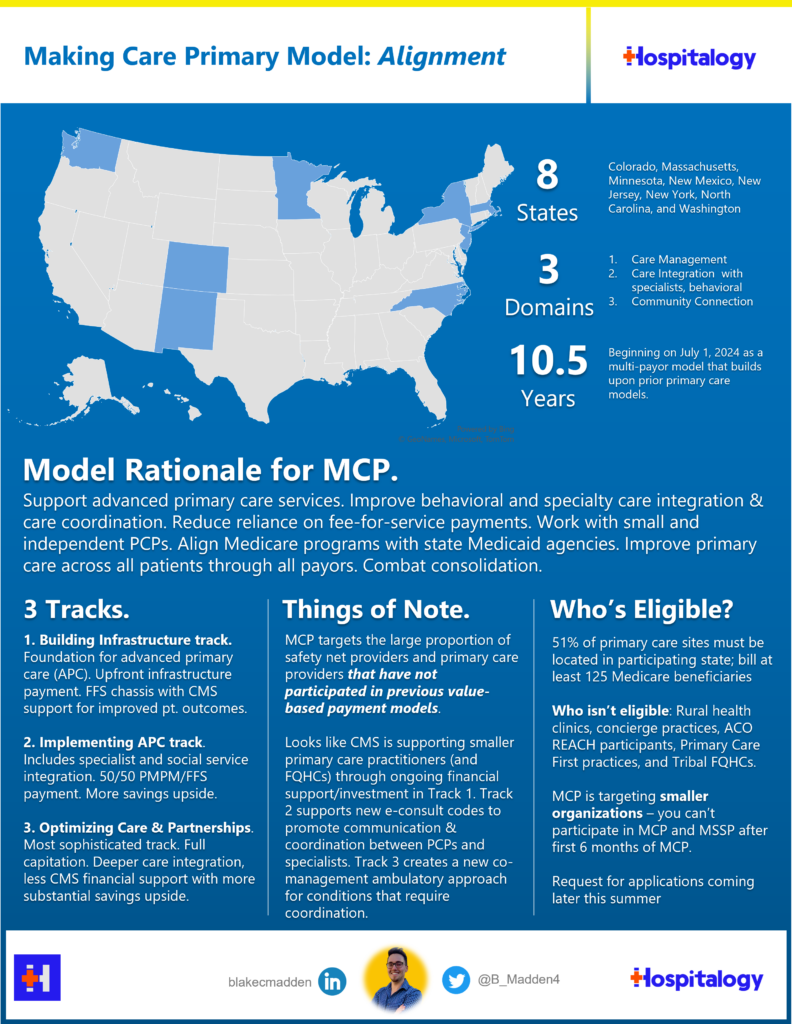

- Policy Updates: Medicare Advantage as a percentage of Medicare plans overall hits 50%, healthcare spending projected to hit 19.6% of GDP by 2030, states scramble to facilitate Medicaid Redeterminations, CMMI unveils Making Care Primary.

- Advanced Primary Care Stays Hot: Aledade’s $260M raise and recent funding activity in enablement names across the primary care space keeps the sector going strong.

Vertical Integration Dominates Payor Strategy

Optum wins again, snatches Amedisys away for $3.3B

On Monday, June 26, national home health and hospice player Amedisys announced plans for Optum to acquire the firm at $101 per share, or over $3.3 billion. If you recall, Amedisys had previously announced its intention to merge with Option Health Care to create a $10 billion enterprise at the time. I broke that merger down here – and the TL;DR is that both analysts and those on the outside looking in felt dubious about the deal prospects.

Smelling a weakness, the Optum empire stepped in, offering Amedisys a much more shareholder friendly all-cash deal in the following weeks. Looks like the deal was preferable for all parties. And if you’re a longtime reader of Hospitalogy, you know that UnitedHealth Group rarely – if ever – loses. Between LHC Group and now Amedisys (with the assumption that the deal goes through), Optum likely holds around 10% market share in home health and tacks on another potential growth funnel in high acuity at home programs, Contessa, on its growing list of post acute services.

Optum also continued its tuck-in streak, acquiring Crystal Run but also notching several health system partnerships in the first half of the year.

In January, I also covered CVS’ acquisition of Oak Street Health, still the marquee acquisition of the year. Will we see a splashy acquisition in the back half of the year as the market settles down? My vote is yes.

The Return of Utilization = Good Sign for Services Organizations

Utilization is on the rise, and the outpatient book of business is surging for provider organizations.

The question at hand now is whether the growth in outpatient volumes is a short-term release of backlogged surgeries – or, if a new paradigm is emerging in healthcare utilization with sustained, heightened surgical volumes unlocked as labor problems mitigate.

To that end, Bank of America published a great, recent note covering utilization trends. 50% of the care delivery organizations surveyed signaled that strong volumes are here to stay – at least in 2023 – with 10% of respondents also noting an improving labor environment:

In its note, BofA concludes: “In general, Q1 feels like peak growth, but strong demand should continue.” In my mind, volumes will continue to grow as provider organizations get their respective labor shortages in check – if ever.

Meanwhile, inpatient growth has returned, but sits at, or below pre-pandemic levels. This is net positive for payors – in general, from a medical cost standpoint, they are much more concerned about inpatient utilization trends than outpatient growth:

Who’s positioned to win?

The care delivery organizations with aligned physicians and the facilities to boot are poised to succeed long-term.

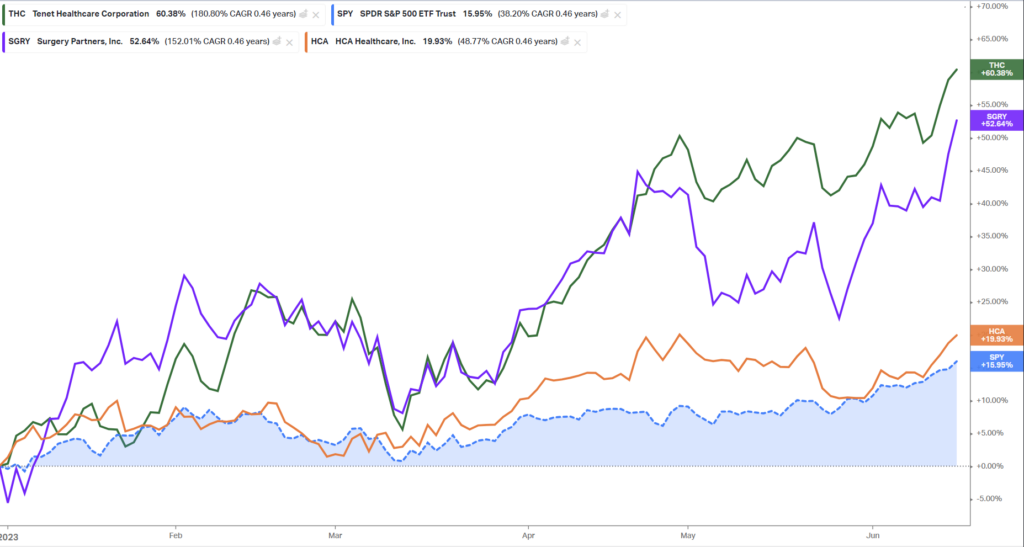

Consequently, look for names like Surgery Partners and Tenet’s USPI to enjoy nice volume growth while doubling down investment in orthopedic and cardiology service lines, two of the highest-margin, juggernaut specialties.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Notice the June spike in these operators:

And as the outmigration continues and surgical innovation moves complex cases into outpatient settings, acuity will continue to rise in the those settings, benefiting those with the facilities and highly specialized physician alignment to meet that growing demand:

The signal here is clear: those investing and operating in outpatient surgical growth will ride the secular tailwinds for the foreseeable future.

Nonprofit health systems are taking note, too. From a recent ModernHealthcare article:

- Other health systems are plotting their own expansions. Sacramento, California-based Sutter Health plans to add more than two dozen ambulatory care centers in the next four years, in addition to dozens of primary and multispecialty care sites. Henry Ford Health is investing $2.2 billion to expand its main campus in Detroit — the largest investment in its 108-year history. AdventHealth’s growth strategy includes expanding its outpatient operations, with plans to double its number of urgent care centers to more than 100, he said.

Look to commentary from health systems and payors headed into Q3 and beyond for the latest on utilization trends – this is something top of mind for services operators nationwide as they’ve been plagued with labor shortages and a tight monetary environment over the past year.

Artificial Intelligence Reaches Peak Hype Cycle – But it’s Warranted

AI has taken the world by storm in 2023, leading to a flurry of conversations (I’m hosting a webinar on 7/20 talking about everything AI!) and investment flooding the space.

To that end, I collaborated with fellow healthcare creators Ben Lee (who did the bulk of this piece) and Paulius Mui to cover the following topics:

- Context on what’s led up to the current AI zeitgeist

- Opportunity spaces for AI applications in clinical workflow where players are converging, and why

- Segmenting the current space and the competition dynamics between players

- Anticipating how new players can make space for themselves in the space

- A clinician’s perspective on these happenings

- A look at the recent financial and commercial activity in the space

Beyond this essay (which is a must read), we’ve seen quite a bit of activity in the space, and startups are now pivoting to include AI in every press release known to mankind. It’s table stakes now for any perceived innovative company to mention AI at some point, and what they’re doing in healthcare with the powerful tool.

As Parth mentioned in the most recent newsletter, companies focused artificial intelligence are receiving the latest ‘healthcare hype cycle’ valuation premiums. We’ve seen several moonshot fundraising announcements in the space (e.g., Hippocratic AI) and expect for this exuberance to continue as it’s an exciting time to witness in healthcare.

Hospital M&A and the Rise of Risant Health

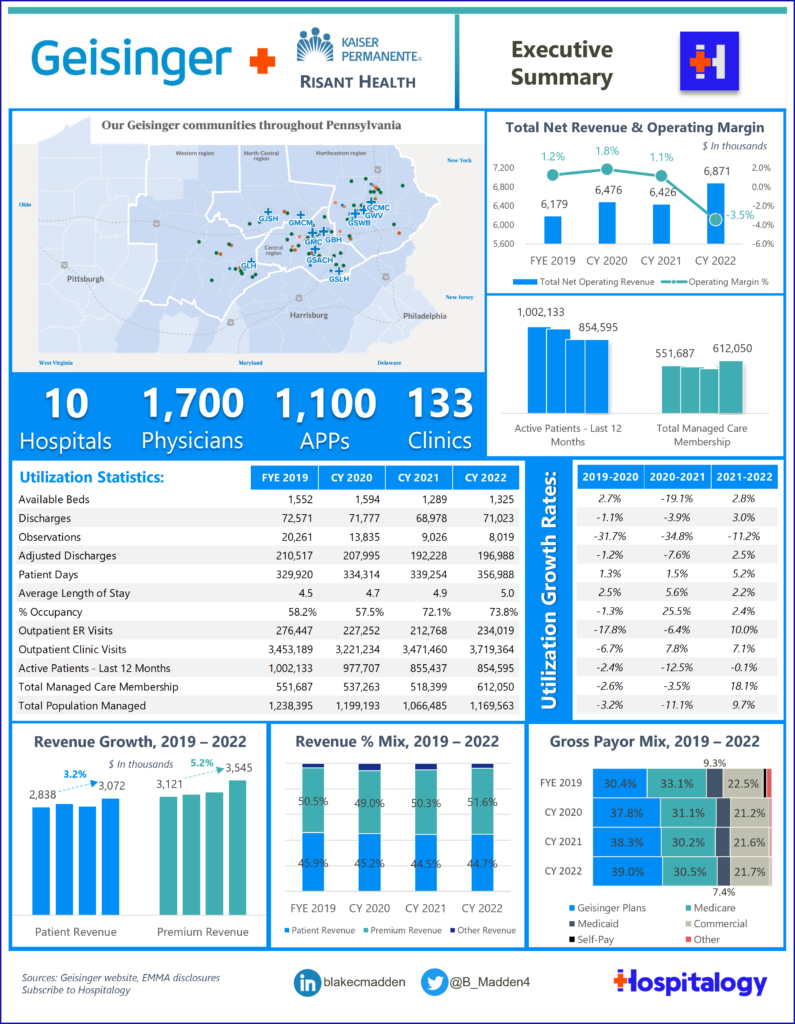

Kaiser Permanente and Geisinger form Risant Health

Kaiser Permanente formed a new nonprofit health system called Risant Health. Risant Health will have significant financial backing as a subsidiary of Kaiser. The system’s inaugural member is Geisinger, based in Pennsylvania. Geisinger’s CEO Jaewon Ryu will lead Risant. Over the next 5 years, Risant will target smaller integrated care delivery organizations (e.g., nonprofit health systems with a health insurance offering) with the goal of hitting $35 billion in system revenue. The nonprofit health system members will operate independently but hold affiliation with Risant. Risant provides a potential lifeline for health systems struggling in the 2023 operating environment to provide population health expertise, capital needs, and capability-based scale.

Read my full write-up on Risant Health, including my take on the deal, the broader trends at play, and the hospital value proposition that likely enticed Geisinger to join. (Read More)

BJC HealthCare, Saint Luke’s Health System plan to merge, forming $10B system

On May 31, St. Louis-based BJC Healthcare and Kansas City-based Saint Luke’s Health System announced their intent to merge into what would create an $8.7B, 24-hospital system. Some more info on the merger details:

Between Risant, Advocate-Atrium, Intermountain-SCL, and Unitypoint-Presbyterian, the bigger story unfolding in hospital M&A here is yet another ‘cross market’ merger between two non-profit health systems. Under these mergers, both systems maintain their own headquarters and operate independently, yet try to realize some expense/capability-based synergy. BJC and Saint Luke’s makes a bit more sense than those, though. Both of these health systems have been a part of the BJC Collaborative – a multi-system alliance – since 2012. And the merger paints an even clearer if we take a peek at BJC’s impressive facility base and academic medical center footprint. BJC holds a 40+% market share in its core market and generates 54% of its revenue from its formidable academic medical center footprint.

BJC needed an expansion story, and the merger with Saint Luke’s grants that. According to credit agency reports, about a quarter of BJC’s admissions come from outside of its 11-county primary service area. To me, the signal here is that BJC can leverage Saint Luke’s operating footprint to push more patients to its facilities outside of the core market. BJC was already in a healthy financial position, expecting margin recovery this year and holding a nice credit rating from the agencies. If anything, this merger will continue to push that margin further upward after a bad 2022 stemming from labor and inflation issues for hospitals. The merger also opens the door to potential population health initiatives. The BJC Collaborative combined touches around 11 million residents in the Midwest. You have to think that operating some of the premier institutions across that population as well as leading market share puts Saint Luke’s and BJC NewCo in the driver’s seat.

Chinks in the Armor: Things Fall Apart for Babylon, Bright, Friday, Envision, GenesisCare, and Others

Babylon’s Exodus

Babylon declared de-facto bankruptcy on May 10th, although the press release doesn’t really tell you that in a straightforward fashion. Under the “take private” transaction, which Babylon was somehow “pleased to announce” despite quite literally destroying all shareholder value, Babylon’s largest lender AlbaCore injected another $34.5 million of capital into the cash-bleeding operation and restructure some lending terms.

In a more recent update, Babylon disclosed that MindMaze group would acquire Babylon assets in July 2023 and Babylon would cease trading on the public markets. From $4B in company value to…a rounding error is a hell of a ride.

I wrote a deeper dive on Babylon’s fall from grace here.

KKR-backed Oncology Player GenesisCare files for Bankruptcy

The second KKR-backed healthcare name in about as many weeks – GenesisCare – is preparing to file for bankruptcy, per the Wall Street Journal.

GenesisCare, based in Australia, holds a sizable footprint of radiation oncology and medical oncology operations in the U.S. Normally, radiation oncology is fairly profitable and a stable book of business since, as you can imagine, cancer is such a large industry.

But the post-Covid drop in utilization for healthcare services combined with not-so-great tuck-in acquisitions of medical oncologists led to financial deterioration for the cancer care business.

Then in 2019, KKR combined forces with GenesisCare to buy a distressed cancer care operator, 21s Century Oncology in a $1.1B deal according to PE Hub.

That deal was likely a big contributor to the collapse – 21st Century Oncology (21C), its legacy operating struggles, and of course, debt problems. Agencies cut GenesisCare’s credit rating twice in the past 6 months and its liquidity deteriorated over time.

But here’s the big picture happening right now: debt-saddled, highly levered players are going belly-up in current capital environment, with high interest rates and jumpy banks. Major fat is getting trimmed in healthcare right now, and more is yet to come.

Friday Health Plans Shuts Down

Several states have shut down Friday Health Plans, a VC-backed firm that has fallen the way of Clover and Bright Health – expanding too quickly with too many members and lacking the infrastructure on the back end to support responsible growth.

On its website, Friday leaves a somber note, disclosing that it had “grown incredibly quickly,” but had been “unable to scale our financial infrastructure to match the pace of our growth and secure the additional capital required to run our business.”

As states wind down Friday’s operations and members hop onto new plans, it’s yet another valuable lesson learned from a well-intentioned firm working in a cutthroat segment of healthcare – health insurance.

KKR-backed Envision Healthcare Files for Bankruptcy

On May 15, 2023, Envision Healthcare, after a long and beleaguered battle, filed for chapter 11 bankruptcy protection.

In case you missed it, I wrote a full piece about the rise and fall of Envision healthcare, which you can read here. In summary – it was a mistake for Envision to play hardball with UnitedHealthcare, but also upset multiple stakeholders through surprise billing tactics.

I have a few more updates on Envision after poking around, including an internal memo from Envision to their employees on its chapter 11 filing and FAQs. Bottom line – everything will be business as usual while existing lenders take over Envision and AMSURG. KKR is out of the business completely, but the failure raises questions around other highly levered names in the physician practice management space, including BlackRock’s TeamHealth, RadPartners, and I’m sure others.

Pear Therapeutics files for bankruptcy

On April 7, digital therapeutics firm Pear Therapeutics filed for Chapter 11 bankruptcy. After I touched on Pear considering strategic alternatives last week, it turns out that the best path forward was to file for bankruptcy protection, lay off most of the staff, and identify buyers that might want to pay for specific assets or pipelines.

Pear went public via SPAC at a $1.6B valuation in December 2021, and just 16 months later, is selling off for scraps. Regardless, despite the challenges related to distribution difficulty, mindset shift involved with a cutting edge product, and reimbursement challenges, Pear as a whole pushed the envelope forward.

- Chris Hogg shared a fantastic post-mortem on Twitter related to digital therapeutics as a whole in a thread linked here.

Policy Updates: MA Penetration, CMS Payment Updates, Healthcare Spending Projections, and Medicaid Redeterminations.

- Healthcare Spending: CMS released its annual projection of national health expenditures, containing historical data through 2021. Driven by strong 65+ demographics growth, healthcare spending will outstrip broader GDP growth. government agencies expect GDP to grow at a 4.6% compound annual growth rate from 2022-2031, though much of that is frontloaded in 2022 (9.2% growth expected). Annual growth in 2022 is expected to be 9.2% on the back of strong government spending and …ahem…inflation. After 2022, GDP will bounce around 4.0% growth thru 2031. Current levels of government (and healthcare) spending are unsustainable, a core reason why CMS is pushing risk-bearing arrangements in healthcare to address total cost of care. As a percentage, spending is projected to rise from 18.3% in 2021 to 19.6% by 2031. Healthcare Spending is projected to hit 19.6% of GDP by 2031. Full analysis here.

- New APM just dropped: CMS unveiled its latest alternative payment model – Making Care Primary. I briefed subscribers on it in early June here.

- Medicaid Redeterminations: The Biden Admin is alarmed by the rate of folks getting booted off Medicaid, although most individuals should be able to find insurance again. States are scrambling to reach patients as patient visits get canceled amid administrative slowdowns. “About 4 in 5 people dropped so far either never returned the paperwork or omitted required documents, federal and state data show.” (Link)

- MA Penetration: Based on the latest numbers, Medicare Advantage as a percentage of all Medicare plans hit 50% – and is expected to grow from here as more seniors age into the program.

The Advanced Primary Care Space stays red hot

Along with enablement platform Aledade raising another $260M, announced on June 21, we’ve seen an influx of activity in the advanced primary care space throughout 2023. The fundraising announcement also bucks the macro trends as enablement firms and value-based care players continue to see funding and growth spurred by Medicare Advantage, ACO REACH, and MSSP tailwinds – though Aledade did mention some dilution in that tweet above.

Take note the recent slew of advanced primary care activity, for example:

- CVS-Oak Street deal ($10.6B)

- Humana-Welsh Carson – Centerwell developments

- Amazon-One Medical deal ($3.9B)

- VillageMD-Summit ($8.9B) and VillageMD-Starling Physicians

- CVS-led Carbon Health deal $100M fundraise (and led the Monogram Health fundraise)

- Pearl Health fundraise $75M

- Vytalize Health fundraise $100M

- Wellvana fundraise $84M

- Humana-ChenMed partnership extension

And plenty more that is missing from this list.

Conclusion: Get your popcorn ready for the rest of 2023.

Healthcare never stands still, and there’s always something happening – whether it’s a company declaring bankruptcy, an innovative new buzzy AI startup, or a 1,000 pound gorilla payor asserting its dominance on a market. I’ll be keenly watching the trends and whether the bounce-back story happens in care delivery organizations.

Over the past few months, we’ve launched a healthcare executive community called the Board Room to leaders in healthcare who want to stay ahead, be better informed, and network with others across healthcare silos.

Now we’re up to 35+ thoughtful healthcare professionals and have discussed pressing topics including what’s actually going on with AI in healthcare and emerging investment themes in value-based care.

Stay ahead with monthly executive briefings, expand your network, and get an extra e-mail send on Sundays from me chock full of resources I don’t share with the wider audience by joining the Board Room.