This week, the Wall Street Journal reported that Envision Healthcare, after a long and beleaguered battle, is expected to file for chapter 11 bankruptcy. Given Envision’s history, I thought it’d be interesting for subscribers to dive into a ‘post-mortem’ of sorts on what went wrong in the case of Envision Healthcare.

| SPONSORED BY ABRIDGE |

| Ambient documentation is one of the best current use cases for AI in healthcare. There’s a reason why I’ve written about it several times in the past month with its potential to impact patient care and physician burnout. At a recent conference, Abridge’s founder Shiv Rao demoed the product for me. In the dummy patient visit, he told me to “come in for an EKG and an echocardiogram” and prescribed me medication for my high blood pressure. Within 30 seconds, the app had provided a summary of the note for Dr. Rao to easily configure and edit for his use. It was seriously impressive. If you want to see the product for yourself and its impact on clinicians, patients, and margins, schedule a demo today. |

Upcoming Hospitalogy events:

- Jared and I are talking about retail health on the 17th! Save your seat.

- The Yuvo Health team is joining me on May 24 to discuss innovation in Medicaid, and the Medicaid enablement space! RSVP here.

- Networking Opportunity: Dallasites! I’m hosting a healthcare happy hour and networking event at Community Brewery on Thursday, June 8. Join me!

The Envision Healthcare Post-Mortem: Key Takeaways

- Envision Healthcare operates two primary segments: physician practice management (EmCare), and ASC management (AmSurg).

- Envision staffs a huge proportion of emergency room departments. Its massive footprint here caused major exposure to the No Surprises Act.

- Envision actively pursued an aggressive out of network and surprise billing pricing strategy.

- The No Surprises Act banned surprise billing, which, coupled with existing market dynamics, created severe cash flow and margin pressures on Envision’s staffing operation.

- Envision is now expected to declare chapter 11 bankruptcy and is a classic case study as a bad actor in healthcare pursuing financial engineering and exploitation of market inefficiencies as a core business strategy, ultimately proven unsustainable.

Envision Healthcare’s Beginnings and Rise to Public Company

The story of Envision is filled with mergers, acquisitions, and all-too common drama of payor disputes and surprise billing. Buckle up as we embark on this rollercoaster journey of one of the most unfortunately notorious healthcare corporations in recent history.

Envision Healthcare was founded in 1992 with an initial focus on providing outsourced medical services to hospitals, such as emergency department staffing, anesthesia services, and radiology as a physician practice management company (PPM). With major private investor backing throughout its history (CD&R, Onex Capital, and now KKR), Envision grew quickly through rolling up emergency physician, radiology, and anesthesia groups.

PPMs like Envision sought to streamline and consolidate the business side of medical practices, allowing physicians to focus on patient care. This approach gained traction throughout the 1990s and early 2000s as healthcare costs continued to rise, and hospitals looked for ways to optimize their operations. Envision’s rapid growth attracted the attention of investors including CD&R, which bought Envision for $3.2B in 2011 then subsequently, took Envision public via IPO in 2013, which resulted in a nice chunk of change while also providing the PPM with additional capital for further expansion.

Envision’s activity as a public company was marked by aggressive acquisition and growth strategies. One of its most significant – and best – moves was its 2016 merger with AmSurg, a leading ASC management company. The merger created one of the largest healthcare service providers in the United States, boasting a combined market capitalization of around $10 billion and total enterprise value around $15B. Envision managed to buy up AmSurg after the ASC company’s two failed attempts to merge with fellow PPM player TeamHealth (acquired by Blackstone in 2016).

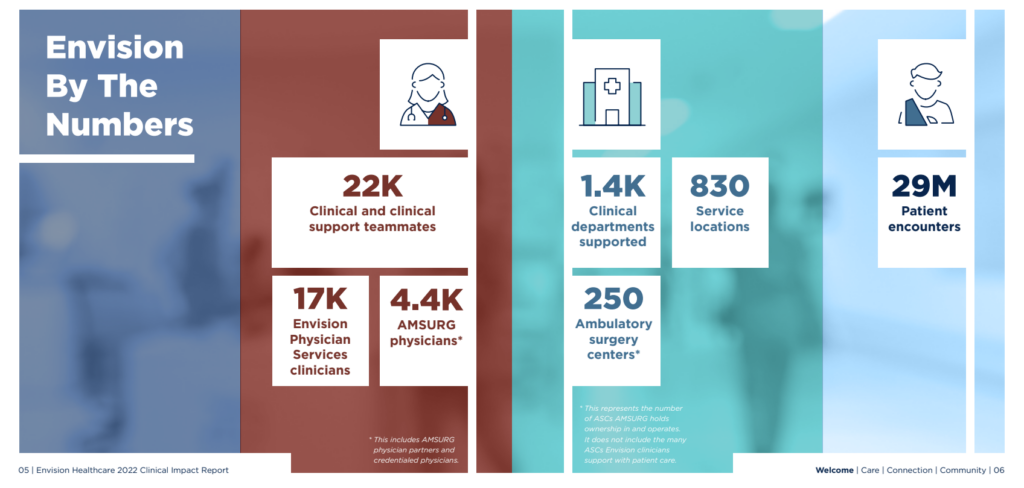

Between AmSurg and physician staffing operations, Envision still boasts an impressive footprint of services today:

Envision Healthcare’s Downfall Begins

In 2018, private equity firm KKR made the bold decision to take Envision Healthcare private after some choppy operating performance post-AmSurg. KKR acquired the company for a staggering $9.9 billion, including a resounding $7 billion in debt financing – one of the largest leveraged buyouts at the time. The deal was completed in October 2018, but this transaction was an inflection point in the story, and where Envision’s story took a darker turn.

As it turns out, even prior to KKR’s investment Envision Healthcare had pursued an aggressive pricing strategy with payors, asking for exorbitantly high rates to contract for physician services. When payors refused to foot the entire bill, Envision would pass along any leftover service bills to the patient, a practice known as balance billing. If payors refused to accept Envision’s contract terms, Envision would simply go out of network with them, leading to surprise bills for unknowing patients who were quite literally going to the ED for emergency services and then were treated by out of network Envision physicians staffed at those hospitals.

Since Envision held a sizable footprint in EDs nationwide, the impact of its pricing tactics were widespread. By 2017, 18% of all emergency room visits had at least one out of network charge associated with services rendered (note that Envision wasn’t the only one doing this, just the most public one).

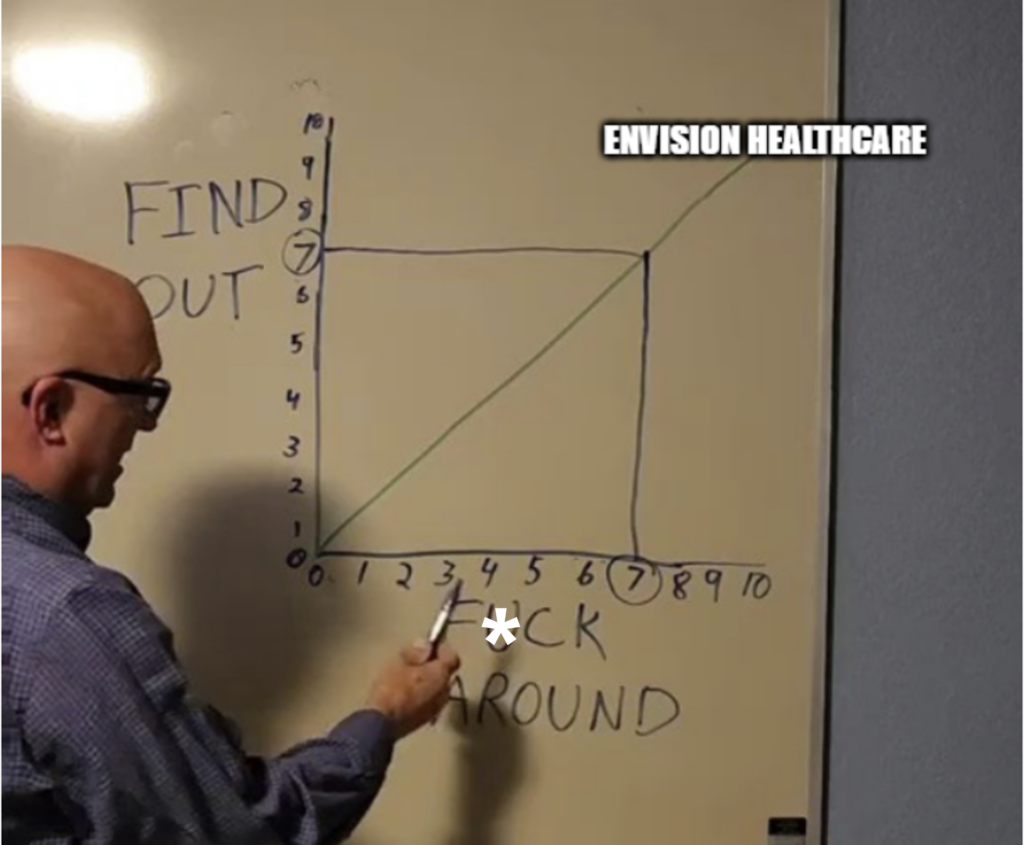

These tactics pissed off payors, patients, the media, and eventually…the government.

When you play stupid games, you win stupid prizes. In this case, Envision was dealing with some powerful healthcare stakeholders.

A Perfect Storm of Regulation and Macro Events Crushes Envision

As a result of patient issues in the ED, new surprise billing legislation was introduced first by several states, then at the federal level. The No Surprises Act (NSA), passed in 2020 and in effect as of 2022, aimed to protect patients from surprise medical bills resulting from out-of-network care.

As the law went into effect, healthcare providers found themselves facing increased scrutiny and challenges in navigating the new billing landscape. So as you can imagine, Envision, with its extensive network of providers and services and ludicrous pricing strategy, was particularly susceptible to the fallout from this legislation.

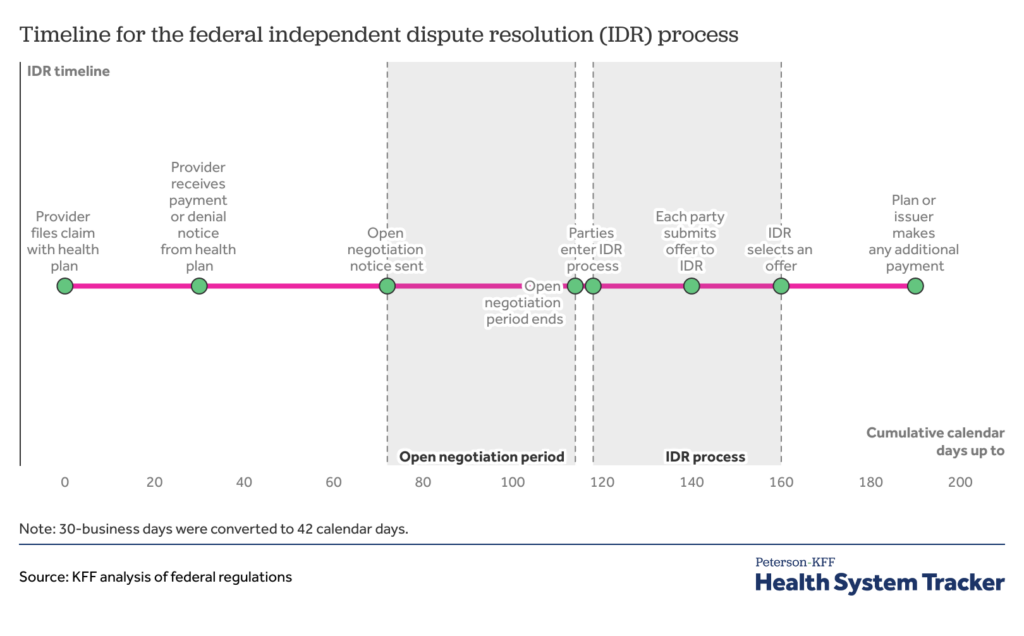

Physician groups like Envision and radiology providers felt significant ramifications from the NSA. The policy gave payors like UnitedHealth Group the undeniable upper hand in contract negotiation and pricing. Whenever payors and providers couldn’t agree on payment for services rendered, the NSA called for the groups to enter arbitration – independent dispute resolution (IDR). Note that there are still plenty of issues with this process from the provider perspective (delays, payor exploitation of IDR, cash flow issues for providers), but that’s for another newsletter. It still protects patients while the squabbling happens in the background.

For an overview of the entire NSA process, here’s a good explainer.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Initially, the arbiter involved in IDR was required to use median in-network rates for services as a starting point for determining reimbursement. This guidance has since changed, but providers still feel payors have the upper hand in the battle for reimbursement. So, payors started (and still are) using IDR to dispute payment and win lower rates in arbitration. And this dynamic has been particularly bad for Envision.

You see, since Envision’s rates were orders of magnitude higher than other comparable market rates for physician services, payors started playing hardball with Envision. UnitedHealth refused to negotiate with Envision, going out of network and not paying for services, leading to several ugly lawsuits. Meanwhile, those billed amounts sat in A/R for Envision and started stacking up. This dispute, combined with other similar conflicts, contributed to Envision’s deteriorating financial position. As a result of the NSA and fallout, Envision was forced to pivot from an out-of-network pricing strategy into lower in-network rates with payors.

In 2020, Envision generated as much as $1 billion in EBITDA. Two years later, that number dropped 75% to $250 million. Ratings agencies downgraded Envision debt to junk levels, trading for pennies on the dollar. Things were so bad that KKR and Envision restructured AmSurg debt in May 2022, moving AmSurg a degree of separation away from (now pissed off) lenders. It’s now unclear as to whether AmSurg, which is fine operationally (its debt was trading at 98 cents on the dollar as late as November 2022), would also file for bankruptcy.

In summary, the perfect storm of events unfolded in almost storybook fashion, resulting in an impending Envision bankruptcy:

- Labor challenges post-pandemic

- Low ED, elective surgery utilization

- Passage of the No Surprises Act = reimbursement and cash flow issues

- Tight monetary environment and rising interest rates on a debt-saddled entity

- Terrible public image (negative externalities)

As the company’s growth and profitability faltered, Envision found itself struggling under the weight of its massive debt burden. Despite numerous efforts to restructure and improve its financial outlook, Envision ultimately could not overcome the operating challenges it faced in the new normal presented post-pandemic with decreased ED utilization and fewer expense/growth levers to counteract the problems. Per the Wall Street Journal, which has documented this journey well, Envision is now expected to file for chapter 11 bankruptcy, serving as a cautionary tale for healthcare professionals and investors alike.

Post-Mortem: Can Envision Reinvent Itself?

The rise and fall of Envision Healthcare is a fascinating study in ambition, growth, and the complex realities of the healthcare industry. From its meteoric rise as a public company to its dramatic collapse, Envision’s downfall offers invaluable lessons and insights for all healthcare professionals, investors, and stakeholders.

Envision is the classic example of a bad PE-backed apple trying to exploit emergency care for financial gain – the story I hate seeing in healthcare despite all of the needed capital investment in healthcare that PE provides.

It levered itself up like crazy and knowingly pursued an out of network staffing strategy in ERs to push up margins and drive investment returns in an area of healthcare with extreme, uncontrollable, inelastic demand. In this case, Envision created costs without adding any sort of incremental value in healthcare. At the end of the day, the strategy on the staffing book of business was pure and simple financial engineering. Bad financial decisions compounding on bad financial decisions.

Like a whipped dog, Envision is now scrambling to restructure and reinvent itself with payors. Private equity already gets a bad rap in healthcare in the media, and Envision is one of the worst outwardly perceived offenders, seen as exploiting emergency services (largely out of the patients’ control) for financial gain.

Envision’s physician staffing operation is now at an inflection point, and we should all take the story of Envision as a lesson in healthcare. Pigs get slaughtered, and any patient exploitation for pure financial motive will eventually be found out and rectified. To that end, if a business in healthcare seems to be wildly outperforming its peers or taking advantage of some form of arbitrage, I would encourage investors to take a closer look at the sustainability of those margins or that growth/performance.

Because oftentimes…it’s too good to be true.

As for KKR? They’ll be just fine, as one of the savviest healthcare investors in the space. From the WSJ, KKR’s Americas Fund XII has already written off the $10B investment, and still holds a 19% net annualized return. But they deserve significant criticism for piledriving Envision with $7 billion + in debt at utterly absurd leverage ratios for a staffing business that should be a low-margin, commoditized operation. Envision is KKR’s black sheep, and we should not soon forget what happened – and what they did – to sentiment of physicians toward emergency care, driving up healthcare costs, and exploiting patients for financial gain while contributing to the rampant medical debt problem in the U.S.

And UnitedHealth Group? Despite the recent $91M settlement the firm had to pay Envision in early May, it’s a small price to pay to see the downfall of a competitor. Recall that United’s Optum holds ownership in Sound Physicians and isn’t afraid to play hardball. I imagine their team is quite content with how things have played out.

Finally – is the writing on the wall for other highly levered PE-backed rollups? What happened to Envision likely isn’t an isolated event.

Commentary from Subscribers on Envision Healthcare:

“Envision failed because physician staffing is a terrible business… and they levered it to the moon because that is the only way you can generate double digit return on a low single digit margin business. All of these specialties are also price takers. End users could care less who their physician is when they visit these facilities. Therefore, payers are focused on price and price alone. Race to the bottom.” – health system administrator

“The reason why Envision sank is UHC has complete unfair market advantage and has lobbied their way to max regulatory capture. How do they have Optum to deliver care and compete against independent physicians and hospitals and then also sell insurance that is responsible for the revenue of docs and hospitals? It’s a total monopoly. Current admin is a big fan of UHC, Medicare advantage because it’s the road to single payer government controlled healthcare through an oligarch of insurers. Really scary what is happening.” – physician

“Healthcare is way harder than anyone realizes as a business. Stuff is stuff. But when it comes to caring for humans (and charging for that service) it’s just really complicated. Don’t try to grow too quickly and don’t try to make a quick buck anywhere in healthcare (like OON billing w/ envision or telehealth start ups w ADHD meds) or you’ll get burned. Ultimately when you’re making money too quickly in healthcare someone is losing $ and if it’s the patient then it’ll catch up with you, if it’s insurers they’ll find you. If you’re growing too fast it’s probably because you’re selling a fad or quick fix to the consumer. We (myself humbly included) love a quick fix, but unfortunately that’s not how life or our bodies work. So I’m not shocked that envision went under. Growing too fast and making too much $ off patients who were overbilled for OON charges.” – physician

“Obviously going private and taking on a ton of leverage didn’t help. I bet KKR took enough out of the company over the past few years to offset the destruction of value. I would love to see what their IRR on that one ends up.” – subscriber

That’s it for this week! Join 24,000+ executives and investors from leading healthcare organizations by subscribing here!

Research, Notes, and Resources

- https://www.businesswire.com/news/home/20160615006526/en/Envision-Healthcare-and-AMSURG-Announce-Transformational-Merger

- https://prospect.org/health/envision-healthcare-hits-the-skids/

- https://www.wsj.com/articles/ill-timed-health-care-buyouts-bruise-kkr-and-blackstone-11590658201

- https://www.reuters.com/article/us-teamhealth-m-a-blackstone/blackstone-in-the-lead-to-acquire-team-health-sources-idUSKCN12I2JN

- https://www.wsj.com/articles/kkr-backed-envision-healthcare-plans-chapter-11-bankruptcy-filing-2fff4382

- https://www.wsj.com/articles/kkrs-envision-sparks-lender-dispute-with-centerbridge-angelo-deal-11651524188

- https://impactreport.envisionhealth.com/

- https://cepr.net/envision-on-the-rocks/

- https://pestakeholder.org/wp-content/uploads/2022/12/Envision_CaseStudy_Final_Dec2022.pdf