Today we’re switching up our Tuesday and Thursday sends to bring you a piece from the brain of Flare Capital’s Parth Desai, whom you can follow on Twitter and LinkedIn. (You could probably search him up on Threads too if you’re into the whole Twitter doomsday scenario.)

This essay by Parth does a fantastic job of diving into the latest trends in healthcare capital markets, valuation dynamics, and what healthcare startups can learn from the market’s emerging winners.

If you’re new here, please consider subscribing to join 20,000 other healthcare folks across leading organizations! (Subscribe here)

For experienced healthcare folks, I’m building an executive healthcare community. Check out the details here.

What Healthcare Startups Can Learn from The Market’s Emerging Winners

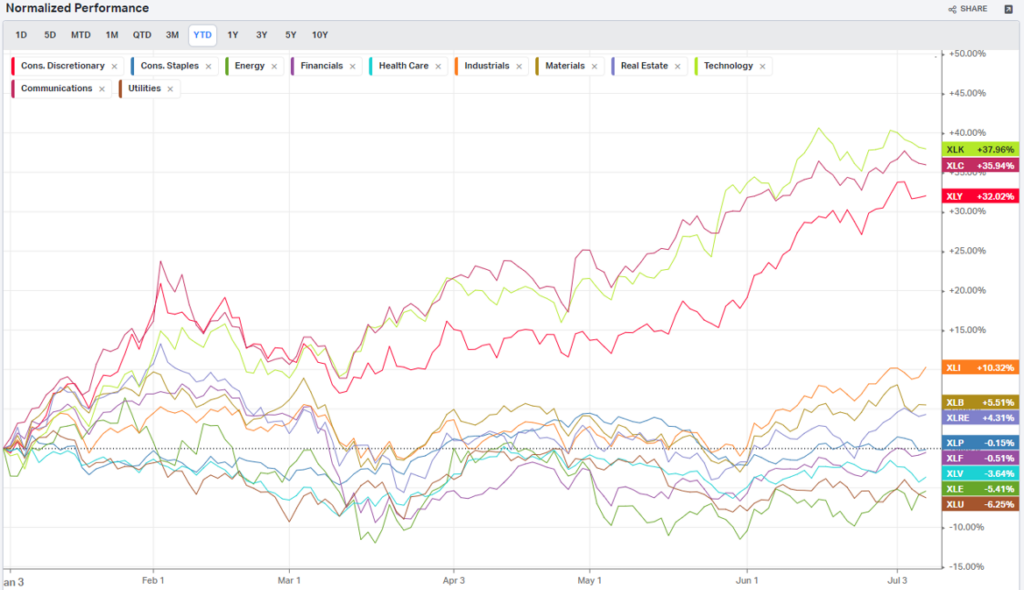

High-quality companies are most easily distinguished from their peers in turbulent capital markets. And capital markets over the last 18 months have been turbulent, to say the least. Amidst the turbulence the healthcare and digital health sector overall has been relatively resilient, perhaps due to its “recession-proof” nature and/or perception. In fact, looking at public markets over the first half of 2023 in the chart below, the health care sector (XLV ETF) has seen more top and bottom-line beats (74%) than any other sector, suggesting good fundamentals and a stable ecosystem, but not necessarily returns (XLV is 9th of 11 sectors in YTD gains). Delving deeper into the data and analyzing 36 recently VC-backed public companies (defined as having previously raised venture capital and gone public after 2010) alongside their 44 legacy peers tells a more interesting story, while also helping to distinguish “high-quality” healthcare companies and their defining characteristics. Like the broader public market, where 2023 gains have so far been driven by a small cohort of large technology companies, recent healthcare gains and valuation premiums are unevenly distributed and correlate to emerging themes such as the artificial intelligence (AI) boom and payment innovation enablement, as well as the enduring profitability characteristics previously detailed in this analysis 18 months ago.

2023 Year-To-Date Industry ETF Performance

Source: Koyfin Data, as of 07/10/2023

Profitability Continues to Command a Premium

While a cohort of 36 recently VC-backed public companies (Recent Publics) far underperformed 44 of their legacy peers (Legacy Publics) in 2022 (~4x greater average losses), that trend has reversed to date in 2023 (~2x greater average gains). On average, this cohort of Recent Publics estimates to grow roughly 3x as fast as legacy peers between 2022-2023 and also 2023-2024. Perhaps looking at this correlation alone may suggest that investors are once again starting to value growth over fundamentals and free cash flow. However, that’s not necessarily true.

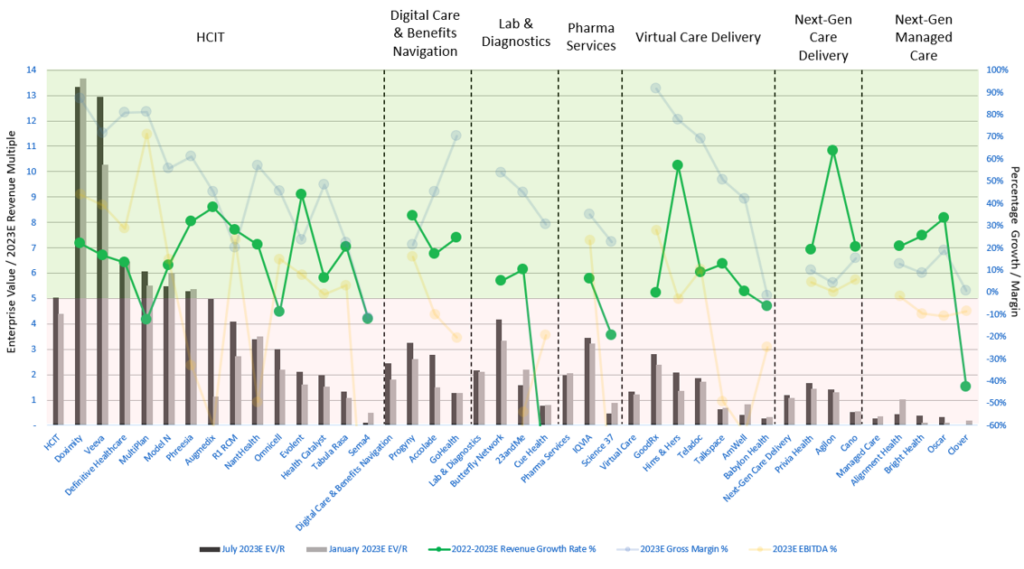

For one, 18-month performance data suggests that the Recent Publics cohort is still simply recovering from losses in 2022 (on average the entire cohort is down 38% between January 2022 and today). Furthermore, from the chart below it is clear there is little to low signal to suggest a correlation between revenue growth alone, and absolute Enterprise Valuation / Revenue (EV/R) premiums, a proxy for forward looking investor enthusiasm. Lastly, multiples remain compressed across all sectors compared to 18 months ago.

Recently VC-Backed Public Company EV/R Multiples vs. Revenue Growth

Source: Pitchbook, as of 07/04/2023

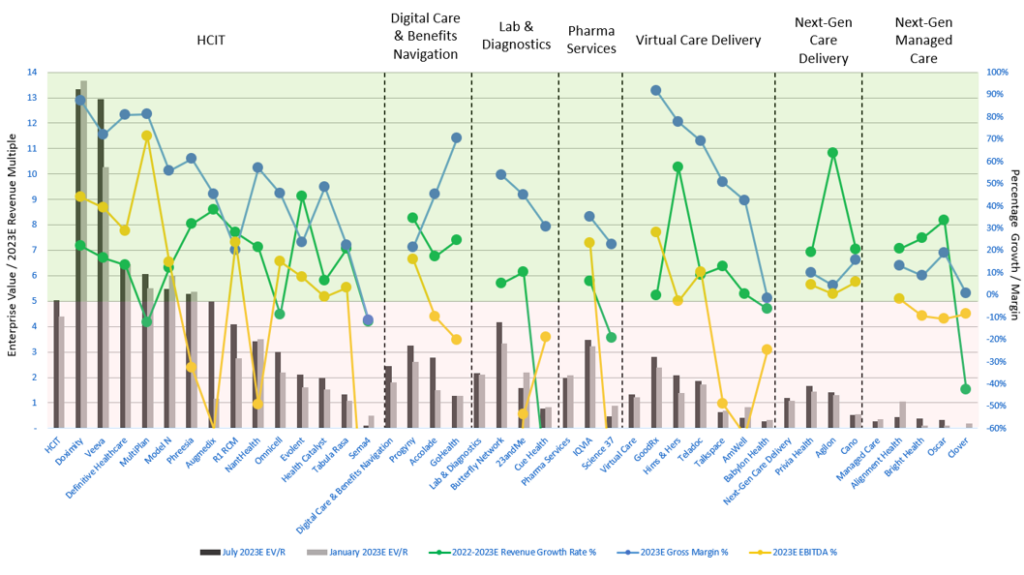

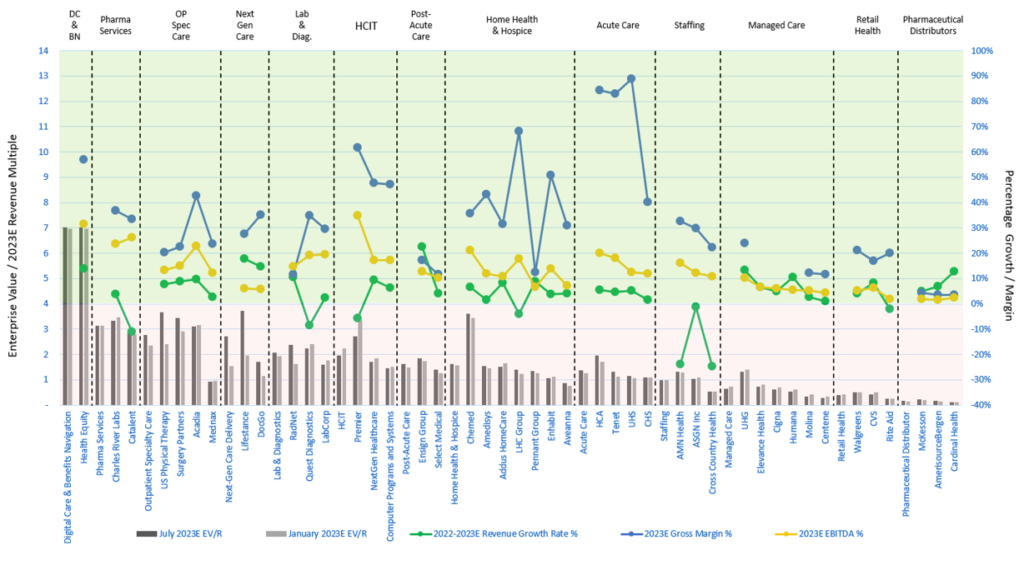

However, when looking at revenue growth alongside core profitability metrics like Gross Margin % and EBITDA Margin % in the charts below, it is evident that higher absolute valuation multiples still have a stronger correlation to profitability and cash flow generation than revenue growth alone. This holds true for both Recent Publics and Legacy Publics. And even moreso when companies are grouped by their sectors. For example, within the Recent Publics healthcare information technology (HCIT) grouping, companies with higher EV/R multiples generally tend to have the highest EBITDA margins. Interestingly, many companies within this grouping that have guided towards the largest YoY forward EBITDA Growth (i.e., R1 RCM, Evolent, Health Catalyst) have also been rewarded with some of the largest multiple expansions over the last 6 months. For example, R1 RCM saw its multiple expand by 49%, guiding towards 43% YoY EBITDA growth this year and Evolent saw its multiple expand by 29% while guiding towards 81% YoY EBITDA growth.

Recently VC-Backed Public Company EV/R vs. Revenue Growth, Gross Margin % and EBITDA %

Source: Pitchbook

Legacy Public Company EV/R vs. Revenue Growth, Gross Margin % and EBITDA %

Source: Pitchbook

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

The correlation is even stronger when considering performance ratios like FCF:Sales, which measures how efficient a company is in converting sales to cash, relative to peers. This is important, because surplus cash can be reinvested back into growth, as opposed to being tied up in capital expenditures. Of the 80 Recently Public and Legacy Public healthcare companies included in this analysis, there were 34 companies with greater than 5% FCF:Sales ratios (a typical threshold for good performance). These 34 companies had an average 3.4x valuation multiple compared to the 1.3x average multiple of 46 companies with lower than 5% FCF:Sales. The spread widens when looking at the 16 companies with greater than 10% FCF:Sales. These companies commanded an average 4.6x multiple vs. the remaining 64 companies with an average 1.6x multiple. When breaking these companies into sector groupings, and comparing them to one another, its clear that higher FCF:Sales efficiency correlates to premium valuations.

But, what do these high FCF:Sales companies have in common? Unsurprisingly, 60% are HCIT businesses and 50% count pharma as a core or primary customer base, demonstrating that the market is inordinately rewarding the capital efficiency of these business models. Particularly HCIT offerings that optimize pharma digital marketing to providers (ie, Doximity, Definitive Healthcare, Phreesia, OptimizeRx) and direct to patients. It may not be coicidence that in 2023, pharma overtook the technology industry as the second-largest sector for ad spending, increasing their spend this year while many others slowed down due to budget constraints. And maybe rightly so as there are over 15 late-stage experimental therapies currently set to launch this year with potential 5-year sales over $1B. Many of these therapies are targeting high-cost and hard to treat conditions such as Alzheimer’s Disease, HIV, Alopecia, Multiple Myeloma and rare disease. Its also worthwhile to note that recent market demand is currently fueling a race among pharma companies to validate the safety and efficacy of existing GLP-1 agonists for weight loss, an estimated $100B+ industry. Given GLP-1s were originally indicated as anti-diabetics, the newer weight loss indication will also require meaningful prescriber education. Therefore, there is a high willingness to pay for actionable data that can help identify and educate the right prescribers for these new therapies, as well as validate clinical efficacy to support formulary placement and outcomes-based contracting. What several of these businesses have proven out is that willingness to pay for this data far exceeds the costs they incur to curate, update and resell it. As healthcare data usability and interoperability foundations continue to improve, similar high-margin categories of opportunity will likely emerge.

These funding trends are also apparent when revisting how value has shifted amongst the Recently Public cohort of companies over the last 18 months. In January of 2022, 2 of the top 5 most valuable publicly traded companies in the Recently Public cohort were virtual care providers and nearly half of the top 20 were managed care or value-based care providers. However, today, 2 of the top 5 most valuable companies are enterprise HCIT companies and 2 of the top 5 also primarily sell to pharma. What’s more, half of the top 20 most valuable companies in this cohort today are now HCIT companies as opposed to managed care or care provider models.

It’s fair to conclude that profitable growth, especially in turbulent times, commands the premium and enterprise HCIT businesses, especially those who tap into pharma’s willingness to pay for commercial go-to-market or research & development, currently best exhibit this characteristic. While this remains an enduring truth, a closer look at trending data, over the last 6 months, provides some indicators on where near-term market enthusiasm seems to be trending.

AI, Payments and New Patients Fueling Multiple Expansion

A handful of companies have seen meaningful multiple expansion over the last 6 months, irrespective of their fundamental profitability. Their relatively strong performance over the first half of this year appears to be correlated to commercial potential and market momentum around artificial intelligence, payment innovation / value-based care enablement and an improving care utilization outlook.

At the forefront, enthusiasm around AI has propelled the broader stock market over this year. Even outside of the handful of large technology companies most associated with AI technology, AI mentions on all corporate earnings calls are up 64% YoY. Corporates are keen to understand how they should be leveraging the technology to streamline operations, while also driven by a fear of falling behind competitors. Healthcare is no different.

Augmedix, one of few publicly traded healthcare AI companies, saw the largest valuation multiple expansion (332% YoY) among all healthcare companies to date so far this year. Fresh off announcing its partnership with hospital behemoth HCA to co-develop an AI-enabled ambient documentation solution, Augmedix also guided towards a 36% YoY revenue increase in 2023, and 32% increase between 2023 and 2024, both among the highest growth rates in the sector. While the company remains unprofitable, the value proposition of leveraging ambient AI to automate clinical documentation is a natural, high-ROI use case that solves the longstanding administrative burnout challenge that many health systems contend with. The promise of this technology in combination with their traction with large systems like HCA and Dignity suggests a compelling growth opportunity ahead and helps to explain the outsized stock performance. With several emerging private companies also capitalizing on this market opportunity, this is a product space to continue to watch.

Market enthusiasm around AI has also buoyed legacy healthcare companies like Radiology imaging provider RadNet, which has seen a 46% multiple expansion (4th highest among the 40 legacy healthcare companies) so far this year. Along with an improved profitability outlook and a meaningful 10.6% estimated YoY revenue growth outlook, the company has made a flurry of recent investments in its AI division, Aidence (acquired in 2022), including a late 2022 partnership with Google Health around lung nodule malignancy prediction.

Payment model innovation also continues to be an enduringly attractive sub-sector. This includes revenue cycle management (RCM) solution providers (ie, R1 RCM, Health Catalyst) as well as value-based care enablement providers (ie, Evolent, Privia, Agilon), all of which saw multiples expand considerably over the first half of the year. All have offered in line or above consensus outlooks for the year and pipeline momentum with multi-year growth visibility, which has resonated well with the market. As value-based care adoption accelerates in both the primary and specialty care markets, companies like Evolent, for example, have announced new partnerships with Centene and AmSurg in addition to an earlier $250M expansion for specialty care management with Humana. Meanwhile, Optum’s first-quarter revenues grew by 25%, including revenue per consumer served increasing 34% year-over-year, driven by growth in lives covered under value-based care.

On the RCM side, as health systems continue to optimize financial performance (including embracing risk) in a persistently tight labor market and following a few particularly challenging years, demand for RCM optimization services has also grown. R1 RCM posted YoY revenue growth of 42% and forward looking growth of 28%, while Optum Insight saw its revenue backlog grow by 35% (primarily contributed by Change Healthcare). Legacy RCM companies like EMR provider NextGen Healthcare have also guided towards nearly 10% forecasted growth this year.

The final category of outperformance has been amongst a group of inpatient and outpatient care providers (ie, Surgery Partners, US Physical Therapy, Tenet, HCA). Combing through earnings reports suggests this is likely a function of improved operating margins, particularly driven by patients scheduling more elective procedures in outpatient settings post-pandemic. While it appears that stabilizing labor expense growth and increasing inpatient volumes are easing overall margin pressures, its important to note that revenue growth from outpatient care is far outpacing revenue growth from inpatient care. Combined with rate adjustments, denials and redeterminations, it is still not clear whether the current outperformance is either universal, or durable.

Conclusion 18 months ago, when capital market turbulence began, it was assumed that the market would flock to profitable growth rather than growth at all costs. Within healthcare, there were early signals suggesting that enterprise software providers enabling revenue-generating ROI for their customers (especially pharma) would be primed to benefit from this shift. Today, to a certain extent, this continues to hold true. While the healthcare sector overall has maintained strong relative fundamentals, buying decisions are taking longer and overall enthusiasm has tapered, compressing margins and multiples across the board. However, emerging technology like AI is pushing the boundaries of what could soon be possible. Combined with a steady shift towards value-based care payment model efficiency, and the emergence from the pandemic, these trends have been a buoy for what will likely continue to an unpredictable year