Join 25,000+ executives and professionals from leading healthcare organizations by subscribing here!

This edition of Hospitalogy is sponsored by DOCK HEALTH

There’s a revolution coming in healthcare administrative workflows.

Dock Health is set out to streamline everything in your organization.

Emerging as the connective tissue of healthcare, Dock Health delivers seamless, HIPAA-compliant task management software to link clinical and operating teams.

By acting as the administrative hub that integrates into existing leading EHRs, Dock has been successful in delivering major ROI to provider organizations by:

- Simplifying administrative complexity through real-time task management;

- Increasing care efficiency and reliability through collaborative workflow; and

- Automating workflows to cut down on legacy, wasted touchpoints and admin dollars while helping to scale organizations

Try out the Asana of healthcare – Dock Health – today to learn why the company has been on my radar.

a16z, General Catalyst invest $50M in Hippocratic AI

On May 16, a16z and General Catalyst announced their latest venture investment, pumping $50 million in seed money into a new upstart called Hippocratic AI. The media blitz on this one was so strong, you might’ve thought that the firm had succeeded in raising Hippocrates from the dead.

No – instead, Hippocratic AI will focus on building and enhancing a large-language model (LLM) specialized for healthcare to build AI applications. Similar.

Through Hippocratic, I get the sense that the partnering VCs are throwing a ton of money at an area with a ton of potential in healthcare – AI – and the firm seems to have promising benchmark results in the space. Hippocratic AI’s found Munjal Shah has plenty of history in AI-enabled startups, dating all the way back to the early 2000’s.

But then the plot thickened when I saw this tweet from healthcare curmudgeon Matthew Holt related to Shah’s former venture HealthIQ:

Which led me to do some expert sleuthing (i.e., Googling) to find a couple of articles (Exhibit A and Exhibit B) corresponding to Holt’s concerns. To put it concisely, there seems to be some misconduct around layoffs, unpaid commissions, and shareholder destruction.

It’s hard to know the exact details here, so I’ll add some speculation. Were these past issues the natural result of a startup – HealthIQ – slowly crumbling, and is Shah just a big picture founder that got distracted and mishandled the startup? Or was there an active and knowing role in the demise, leaving Health IQ and employees high and dry?

This quote from the Coverager piece doesn’t exactly instill confidence in me: “Former employees described a period that was “filled with lies and deception” in legal letters that Coverager reviewed.”

There’s no doubt that the tone of that coverage is pretty cynical, but it’s not ideal from a PR perspective when you contrast that quote with GC’s language used in the announcement: “When we started discussing this effort with Munjal Shah…we saw a partner who recognized trust as the running currency in the industry.”

I’m reserving judgment until more details emerge (if ever). And in the meantime, let’s figure out exactly what Hippocratic AI turns into with that $50 million to boot. AI holds plenty of promise and potential in healthcare, and it sounds like investors are leveraging every payor and provider relationship to get things moving quickly in a positive direction.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

I’ll leave you with this quote from the legend Hippocrates himself:

“And if incision of the temple is made on the left, spasm seizes the parts on the right, while if the incision is on the right, spasm seizes the parts on the left.”

Err, sorry. Wrong quote.

“Illnesses do not come upon us out of the blue. They are developed from small daily sins against nature. When enough sins have accumulated, illnesses will suddenly appear.”

Hippocratic AI or Hypocritic AI? Time will tell. As we say in the 21st century, “Ball don’t lie.”

Partnerships and Strategy Updates:

A last-minute deal with high-profile involvement from the Mayo Clinic has led to the removal of nurse-to-patient ratios and hospital staffing regulations from Minnesota legislation, a decision that was met with mixed responses from various stakeholders (e.g., perceived good for hospitals, perceived bad for nurses). This controversy emphasizes the complexities of healthcare policy-making, spotlighting the ongoing debates around optimal staffing levels and their impact on patient care against the backdrop of hospital financial realities. Large hospital systems that command huge employment numbers and local economic stability hold massive political power. (Link)

Employees at UPMC have lodged an antitrust complaint against the system, alleging the health system has used its dominant market position to suppress wages for its employees. The situation is one to monitor and actually has interesting implications for vertical integration antitrust cases if it ends up being a big deal. (Link)

This was a good read on Humana and CenterWell, including its strategy in value-based, integrated care to take advantage of its payvidor structure, and stay ahead in the healthcare game. (Link)

Finance and M&A Updates:

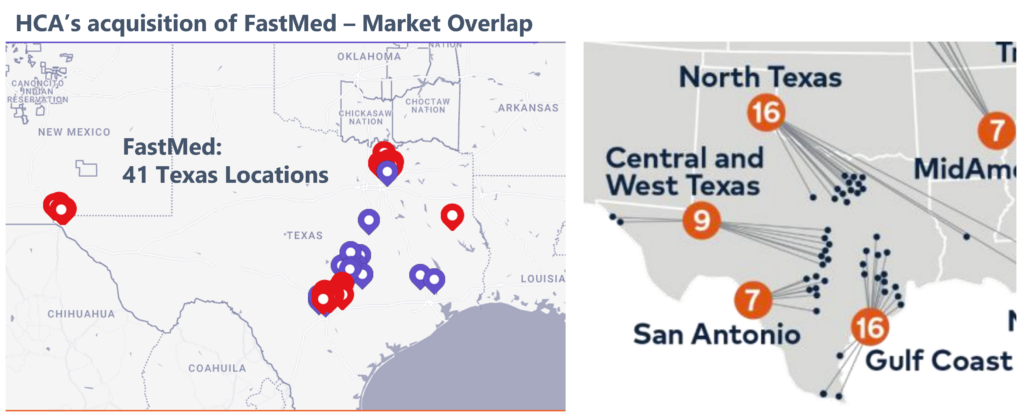

HCA Healthcare acquired 41 urgent care centers from FastMed, continuing its trend of market density in regions of demographic strength (see below). HCA operates 300+ urgent care clinics nationwide now. (Link)

Providence reported an operating loss of $345 million in Q1 of 2023. The system, which operates 51 hospitals, cited – as expected – labor costs as its primary profit deterrent. From an EBITDA standpoint, the nonprofit health system is breakeven. (Link)

CommonSpirit Health reported a $658 million operating loss in Q3 of 2023. The health system also cited rising workforce expenses and lower adjusted revenue per admission – but notably an uptick in volume. (Link)

A recent Crowe report found that hospitals are facing a continued decline in revenues due to mounting delays and denials by commercial insurers, a trend that threatens to destabilize hospital financials further. With denials rising and contributing to an increasing amount of lost revenue annually, the struggle to navigate complex payer processes is becoming an urgent issue for hospital administrators. (Link)

U.S. Physical Therapy announced a $150 million underwritten public offering of common stock, aiming to fund future acquisitions and repay outstanding debts. (Link)

US Renal Care raised $328 million in new capital to expedite its growth in the kidney care space. (Link)

Digital Health and Innovation Updates:

Venture firm LRVHealth has successfully raised a $200 million Fund V from a plethora of leading healthcare providers and payors as part of their mission and thesis to transform the healthcare sector from the inside. By investing in forward-thinking companies across digital health, medical devices, and diagnostics starting with KeyCare and Greater Good Health, LRVHealth is one to watch…closely. (Link)

Today, I’m a true journalist as the Dock Health team shared with me that they’ve successfully raised $5 million in seed funding from an interesting investor group led by MassMutual but also with notable participation from DaVita. I’ve had the chance to talk to Dock’s CEO Michael Docktor (incredible name for a physician by the way) a few times in recent memory, and even though this newsletter is sponsored by Dock Health, I’m separately excited for the Dock team and this announcement to see how they use the funding to simplify administrative complexity in healthcare. (Link)

Florence bought Zipnosis off of Bright Health (which bought Zipnosis back in 2021) in an all-cash offer. Florence, which seems to offer a streamlined ER admin product (patient intake, triaging, documentation) to expand clinical capacity, holds major backing from the likes of Google Ventures and Thrive Capital, and raised $20 million in seed funding announced in late March. Zipnosis offers a white-labeled telehealth solution. As digital health consolidation continues, the merger seems to be centered around a common goal of increasing clinical capacity for provider organizations. (Link)

Cascade Health secured $1.7 million venture funding with an intelligent platform focused on healthcare transparency. With Cascade Health’s products (including a generative AI assistant and API connectivity), there’s a promise of real-time price comparisons and coverage. (Link)

Rumors of several digital health companies calling it quits (emphasis on rumors where there are not links provided):

- FemTec Health (Link)

- Buoy Health allegedly has been unable to raise additional VC funding. It raised $37.5M in 2020.

- Nice Healthcare is in a similar situation, allegedly unable and/or struggling to raise after a $30M Series A in 2022.

This was a good read on the history and current state of data in healthcare. “The ‘holy grail’ vision is to create an internet of healthcare data that various stakeholders in the healthcare ecosystem can conveniently access for their respective use cases.” (Link)

Hospitalogy Top Reads

- Alongside Brendan Keeler, the Healthcare Platform Blog posted an article on how APIs are increasingly enabling the ‘platforming’ of healthcare, transforming how data is shared and utilized in the industry. As APIs facilitate seamless integration and interoperability, they’re set to revolutionize health IT landscapes, opening new avenues for innovation, collaboration, and patient-centered care. (Link)

- Last week I wrote about the downfall of Babylon Health and rise and fall of Envision (I promise we’re on to greener pastures from now on!!)

- I finally got around to publishing my deep dive on Kaiser, Geisinger and Risant. You can read and share it here! (Link)