Today we’re diving into the Risant Health developing story, including Kaiser’s decision to form the new health system and Geisinger’s decision to join it.

Join 25,000+ executives and professionals from leading healthcare organizations by subscribing here!

Risant Health: Key Takeaways

- Kaiser Permanente formed a new nonprofit health system called Risant Health.

- Risant Health will have significant financial backing as a subsidiary of Kaiser.

- Risant’s first member is Geisinger, based in Pennsylvania. Geisinger’s CEO Jaewon Ryu will lead Risant.

- Over the next 5 years, Risant will target smaller integrated care delivery organizations (e.g., nonprofit health systems with a health insurance offering) with the goal of hitting $35 billion in system revenue.

- The nonprofit health system members will operate independently but hold affiliation with Risant.

- Risant provides a potential lifeline for health systems struggling in the 2023 operating environment to provide population health expertise, capital needs, and capability-based scale.

Kaiser forms Risant Health: Background and Transaction Overview

Here are the main takeaways from what the Risant-Geisinger combination, including what Risant is providing to its first member organization:

- The transaction is structured as a member substitution.

- Kaiser is pumping significant money into Risant. It’s planning to allocate a minimum of $400 million, and up to $5 billion to fund Risant capabilities, future health system investments, and technology.

- Kaiser had to guarantee a lot to Geisinger up front – for one, Risant will make available a minimum of $2 billion to Risant-wide health system members to support expansion plans (building hospitals, ASCs, medical office building, technology investment, routine CAPEX)

- In addition to the $2 billion pool (which includes Geisinger-generated cashflow), Risant will allocate a minimum of $100 million to specifically support Geisinger growth and expansion of its health plans and care delivery services throughout its geographical footprint.

- Risant will also provide at least $115 million in funding to support Geisinger ‘research and education’ enterprises for a minimum of 10 years!

So from the financial disclosures, it sounds like Risant will pool together member resources and cashflow, then Kaiser as the parent organization will provide its deep pockets to also fund capital projects and provide population health expertise.

These promises are exactly why Geisinger joined Risant as the premier acquisition. Geisinger was facing static volumes, competitive threats from the likes of UPMC , and subsequent potential credit downgrades from sustained, low-margins:

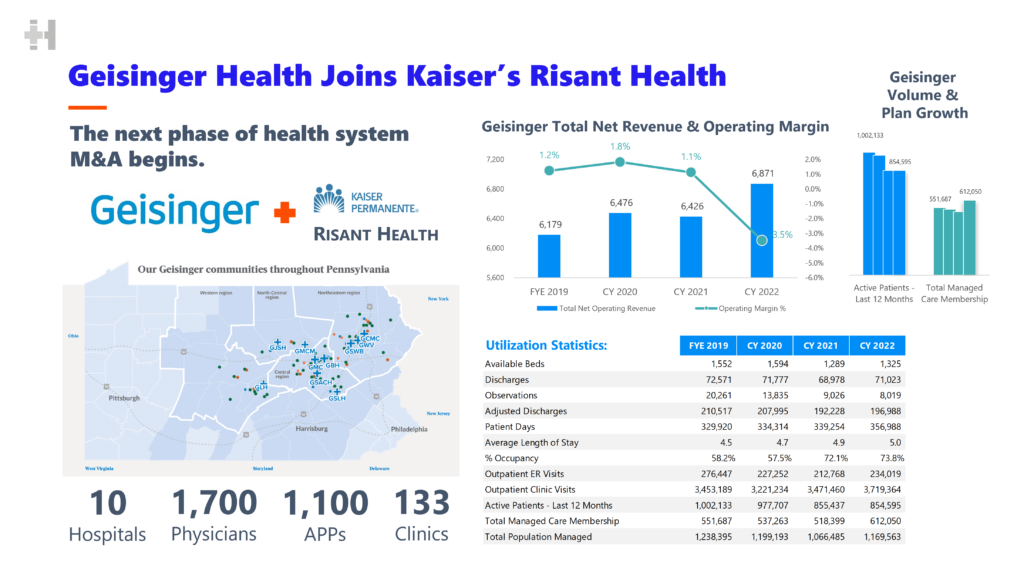

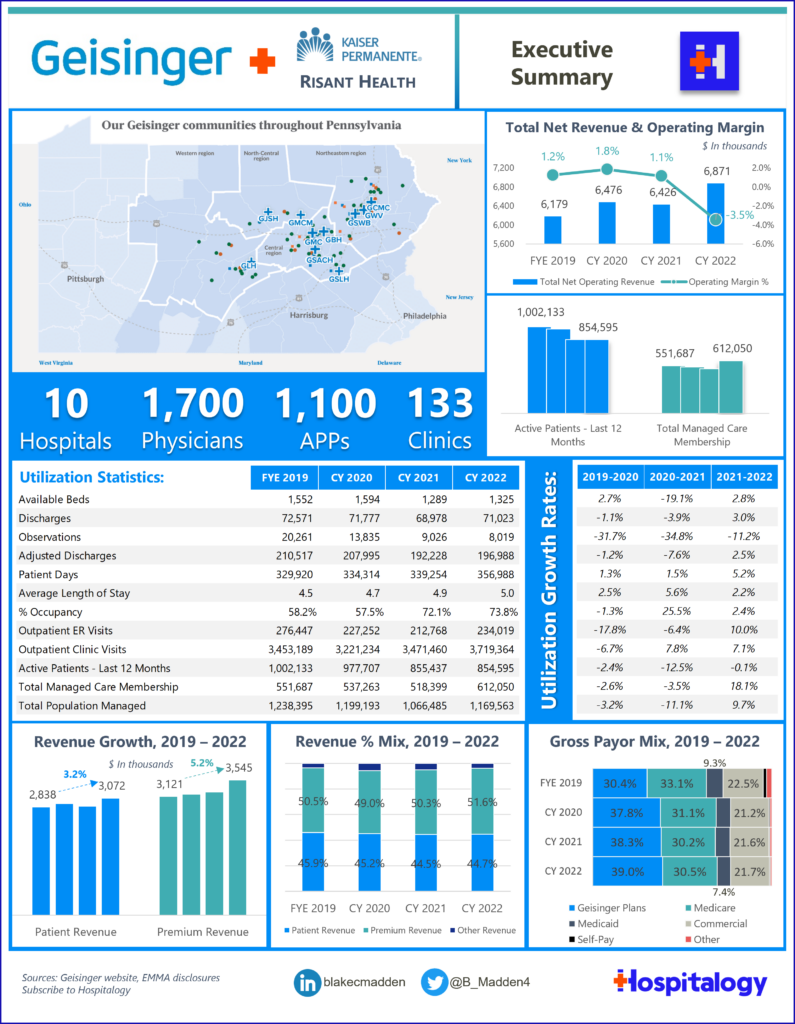

As the first mover into Risant, Geisinger holds an impressive footprint including $6.9 billion in revenue, 600,000+ managed care members, 10 hospitals, 1,700 physicians across 133 clinics, and has been referred to as the ‘Kaiser of the East.’ It’s a smart cultural fit and the perfect Risant constituent:

Risant Solves Potential Hospital Capital Needs

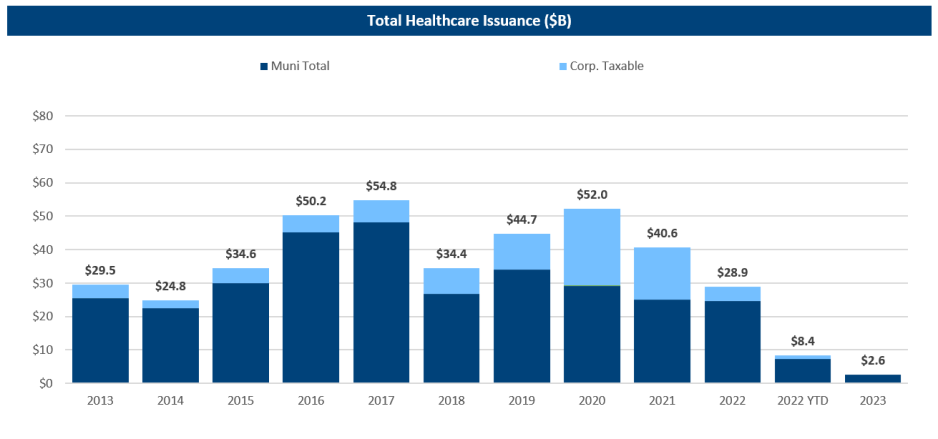

Here’s another important factor we should think about – appetite for health system capital in the rising rate environment has plummeted. The Risant deal holds significant ramifications for health system borrowing costs.

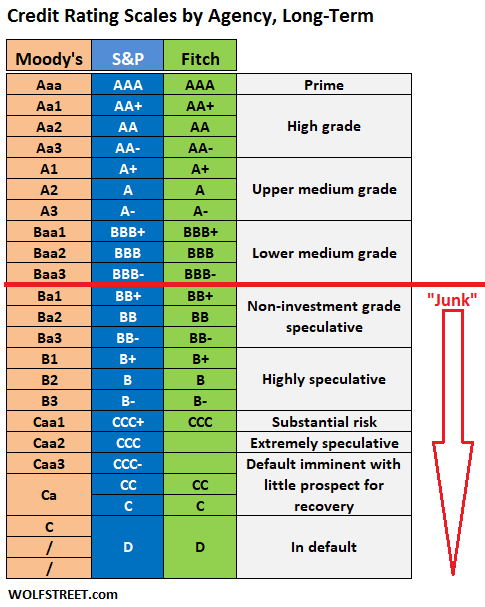

In February, Moody’s hit Geisinger with a ratings downgrade to ‘A2.’ “The downgrade reflects expectations that Geisinger’s will lead to weak operating cash flow for a protracted period.”

Meanwhile, S&P has maintained a credit rating of ‘AA-’ for both Kaiser and Geisinger. But by joining forces with Risant, Geisinger probably prevents any future damage from a borrowing perspective, keeping it off any agency negative credit watch.

Since Kaiser is throwing its might behind Risant, I have to think that Risant would hold a similar credit rating to broader Kaiser, which sits at AA- as of May 12 – potentially allowing for systems to borrow against the Risant-Kaiser rating rather than their own.

If the above holds true (and it may not – I’m speculating and am not a nonprofit bond expert), Risant’s high grade credit rating would present an enticing opportunity for small to mid-sized health systems to join Risant and lower their borrowing costs during a time of extremely low nonprofit health system debt issuance participation.

(image credit – Kaufman Hall; h/t to Gist Healthcare)

From Kaufman Hall, current hospital capital management strategies are not sustainable. Nobody is borrowing!! Warning signals are flashing:

“Good risk management leads to caution in challenging times, but being too careful elevates the probability that temporary problems become permanent. $2.8 billion in quarterly external capital formation ($11.2 billion annualized—pause and let that annualized amount sink in) is not sufficient to maintain the not-for-profit healthcare sector’s care delivery infrastructure, especially when internal capital generation is equally anemic.”

The freeze in the nonprofit capital markets is a significant signal – health systems don’t know what to do right now operationally and they’re scared to take risks. For that reason, they’ll fall behind other well capitalized players that have their strategies formed and their pocketbooks filled with cash. And these dynamics are exactly why right now – however rushed – was the perfect time to announce Risant Health.

The Hospital Strikes Back

Nonprofit health systems are strained financially. The current dynamics of healthcare that I’ve covered here (labor shortages, declining payor mix / MA penetration, emerging competitive threats) are causing budget underperformance. In markets with stronger demographics and population growth (Florida, Texas, North Carolina), utilization is coming back and along with it, margins. But that dynamic doesn’t exist everywhere.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

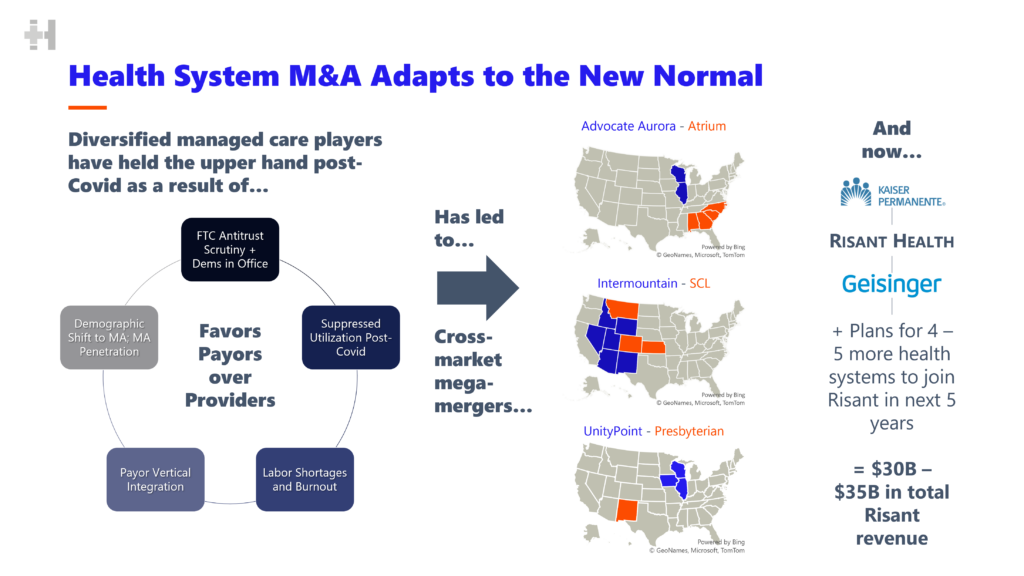

I shared the below slides a few weeks ago as part of a larger healthcare strategic update deck with the Hospitalogy Board Room community. It captures the trends and perfect storm of events happening in healthcare between payors and health systems today – the push-pull that exists.

Right now, it’s more of a forceful PUSH by the payors.

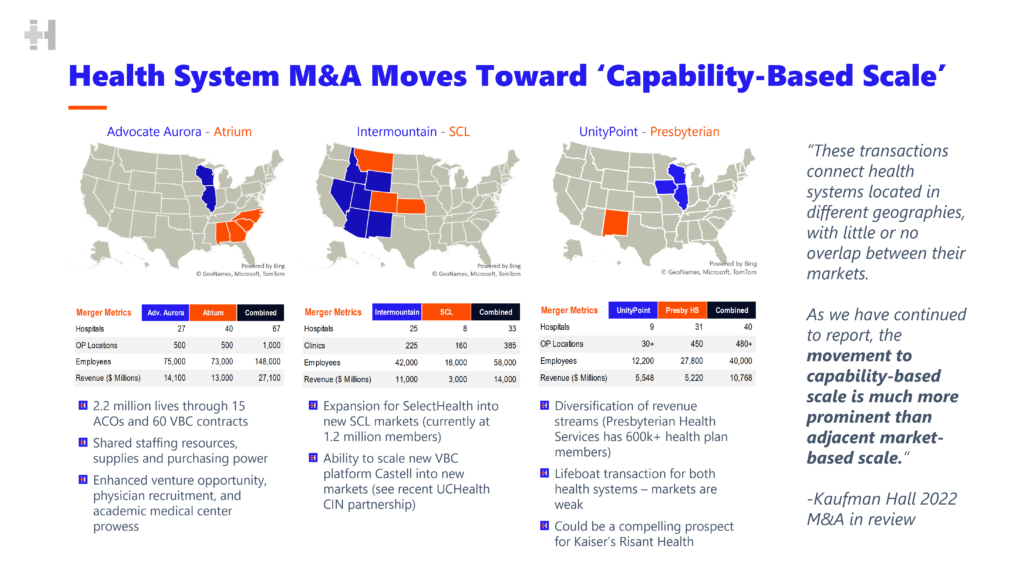

Risant Health’s formation picks up perfectly where we left off in 2022 with cross-market megamergers (Advocate-Atrium in particular) and the evolution of hospital M&A.

And it’s a perfect, natural response to current health system headwinds. The old heads in beds playbook isn’t working – at least not right now. And health systems don’t know what to do operationally – they’re stuck. Everything seems too risky.

Risant is swooping in at the perfect time to save the day. Kaiser is extending an olive branch to health systems that are likely panicking in the face of uncertainty.

Right now I imagine some health system leaders are looking up and thinking “Well, I could create a lot of legwork for my team, involve a bunch of lawyers and consultants, and set up a cross-market JOC for scale or go at our new expansion projects alone…

“…or I could join Risant, which is already pre-baked and has Kaiser-Geisinger in the mix, with the promise of guaranteeing some of my future capital needs/project pipeline and expanding my population health growth strategy.” I mean, that’s what I’d be thinking but I’m not a health system exec!

The Risant Value Prop and how Kaiser Benefits

Here’s the click-baity buzzword Risant Health outward value prop to the healthcare PR folks: “Through Risant Health, we will make our value-based care expertise, technology and services available to community-based health systems, like Geisinger, to strengthen their ability to provide value-based care models with a focus on high-quality and equitable health outcomes,” said Greg. A. Adams, chair and CEO of Kaiser Permanente. (thanks to RevCycle Intelligence)

From the Kaiser site, here are the value props Risant is expected to bring. But this got me thinking: what are the ways everyone (including Kaiser) wins here?

It’s an open-ended question (please feel free to respond with your comments), but here are my thoughts:

1 – I assume Kaiser will provide Risant with management services

2 – Capability-based scale with members. Kaiser and members will find ways to incubate new technology, pilot new initiatives, and streamline best practices across these organizations.

- We’ve already seen the formation of hospital alliances, so there’s precedent for that piece – CivicaRx (addressing generic drug shortages), Truveta (data alliance between health systems), and Evolve (strategic staffing alliance)

3 – ACCESS TO CAPITAL. I’ve already touched on this, but Risant is heavily involved in financing Geisinger’s growth objectives. This promise will be an enticing selling point for other members.

4 – Potential to work toward a national MA plan?

5 – Another avenue for growth and diversification of Kaiser’s footprint.

This is complete anti-thought leader here, but to be honest, it’s hard to identify a lot of the clear synergies from a move like this. It seems as if a lot of M&A strategy lately has been…merge first, get big, and figure out the rest later.

Who are Risant acquisition targets?

While it’s hard to know who will actually join Risant, here are parameters for what I perceive as characteristics for potential member health systems:

- Carving out Geisinger and assuming Risant achieves $35 billion in revenue, that leaves around $25B – $30B in revenue to hit by 2028. From the WSJ piece, Risant is targeting 4-5 more systems. These numbers imply average system revenue of ~$4 billion to ~$7 billion

- The health systems need to have some sort of population health strategy or chassis. Here’s an interesting list to pull from.

- The health systems will likely have some sort of pressing motivation to join – e.g., be on the verge of credit downgrade, emerging competitive threats in the market, fee for service volumes on the decline, or population decline in local health system markets.

- The health systems might hold overlap with existing Kaiser footprint.

Based on the above criteria, and without knowing the nuances involved with each of these systems within their local markets, here are some health systems that more or less fit the mold:

- Samaritan Health Services

- Presbyterian Health Services

- Sentara Healthcare

- Ochsner Health

- Ballad Health

- IU Health (unlikely)

- Piedmont Health (unlikely

You get the idea – there are a number of acquisition targets here for Risant, and it’ll be fun to identify which ones take the bait and why!

Along with the monetary and operational impact, I have high hopes for Risant to deliver better patient care through shared health system best practices, medical cost management, and better access to care throughout local Risant member geographies.

Given that health system mega M&A is evolving into capability-based scale and Risant’s initiative sounds rather fuzzy, things could get pretty creative. While the details are scant and still emerging, Risant is one to watch as a progressive health system platform. Any proposal or project that takes value-based care seriously inside health systems is something worth rooting for.

Still, the ever-present theme in healthcare is that bigger is better, and bigger are getting…bigger…er.

My Take on Risant & the Changing Healthcare Landscape

I view Risant as a health system platform rollup play taking shape. Geisinger is the initial ‘platform’ acquisition to jumpstart the enterprise.

The formation of Risant is a health system reaction to ongoing operational challenges within hospitals, emergence of competitive threats (retail, digital health), and payor vertical integration.

Risant’s announcement felt rushed. The company holds just a single page on Kaiser’s website with a few hundred words. Where’s the logo? Where’s the standalone site? Shouldn’t an enterprise with billions of dollars in backing targeting $35 billion in revenue have had some marketing materials put together? I’m sure more details will emerge once it gains some traction and Geisinger joins in 2024, but for now, there are scant details on what this thing actually means. While the initiative sounds amazing on paper, there’s lots of fluff here so far.

Risant holds enormous potential energy, and perhaps the initial merge with Geisinger will give it enough of a push to snowball the new healthcare play to help Risant systems achieve operating success.

It’s not pronounced like this, but I like to rhyme Risant with “croissant” – it just flows off the tongue better, doesn’t it?

Subscriber Commentary on Kaiser and Risant Health

This is an interesting one for everyone to get their head around because of the implications. It’ll be interesting how exec teams looking at affiliation strategies consider the Risant option and bring their Boards along if/when it’s on the table. That puts an onus on Risant to have an understandable, differentiated and very compelling value proposition to their acquisition targets.

Living in the value-based care world, I am excited about the potential here as health systems have not taken sufficient action. Right now payers and new entrants/disrupters/enablers are gaining stronger footholds every quarter in lives, clinics, and integrated offerings. The limitation of these models is that they largely are primary care centric.

That is where I think Risant has a tremendous opportunity which is certainly not a given. Geisinger has a model where they have engaged specialists in VBC for years, including technology, comp model, culture, etc. If they are able to deploy this competency to acquirees through blueprints, best practices, and effective consultation for integration, I think that is the most differentiated component Risant could bring. The aforementioned payers and new entrants are not likely to invest en masse in specialist workforces that can provide this enablement, whereas Risant could do it with fractional FTE physician leaders (that can consult for flexible periods of time) and are still practicing so have that credibility. Beyond that, I think some balance sheet strength will give acquirees more confidence in transitioning to downside. Additionally, Risant’s enablement tools should help at the health system enterprise level appreciating all the complexities. – Joe Maher

As a native Pennsylvanian, this decision by Geisinger to join Risant is directly related to the increasing competition and pressure. When you look at Geisinger’s market, they are surrounded by UPMC, Lehigh Valley Health Network, among others. I see this as a huge population health, value-based care, and growth in the health plan play by Geisinger. They have been a nationally recognized leader in value-based care and now join one of the nation’s clear leaders in population health on both the acute and payor end with Kaiser. – Subscriber

I think we’re witnessing the next stage in the “health solutions consolidation” whereby we’re about to see the birth of multiple healthcare holding companies. Private equity, payers, regional health systems, are all going to start looking very similar with multiple delivery solutions, multiple sites, digital/platform-based capabilities, and insurance market participation. If Risant doesn’t have a venture capital arm yet, they will soon.

Risant may even be an extension of the physician group rollup trend, where the smaller organizations get rolled up into a larger entity that can go toe-to-toe with the Optums of the world.

I don’t know much about either entity, but I wonder if the value prop here for joining orgs (outside of the economies of scale) is better insurance products. MA plans are obviously the blue ocean right now (about to turn red), and a lot of regional health systems that dip their toe in the MA world suck at it. This could be a good way to really bolt-on to a successful payer platform (I think the employer-sponsored plan market is also of interest here). – Zach Anthony

Resources and Field Notes:

Seth Joseph – Risant Health’s Value-Based Platform: A Signal Of Future Health System M&A? (Forbes)

Health System Kaiser Permanente to Combine With Hospital Operator Geisinger (WSJ)

Link to Kaiser financials: https://emma.msrb.org/P21705968-P21312094-P21744130.pdf

Link to Geisinger financials: https://emma.msrb.org/P21705085-P21311403-.pdf

What Kaiser’s Acquisition of Geisinger Means for Value-Based Care (RevCycleIntelligence)

‘We never saw Risant Health coming’: What leaders are saying about the Kaiser-Geisinger deal (Beckers)

How borrowing works and credit ratings. (WolfStreet)