Welcome back to another edition of Hospitalogy, where we break down the business of healthcare together. If you want to subscribe and support me, feel free to do so here:

Join 24,000+ executives and investors from leading healthcare organizations including Privia, Optum, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

Two event updates from me:

- The Yuvo Health team is joining me on May 24 to discuss innovation in Medicaid, and the Medicaid enablement space! RSVP here.

- Local Dallasites! I’m hosting a healthcare happy hour and networking event at Community Brewery on Thursday, June 8. Join me!

Option Care Health merges with Amedisys

Do you hear that sound? It’s the collective groan of equity analysts as they’re forced to update their models for the latest healthcare services merger between home & site infusion operator Option Care Health and home health & hospice provider Amedisys.

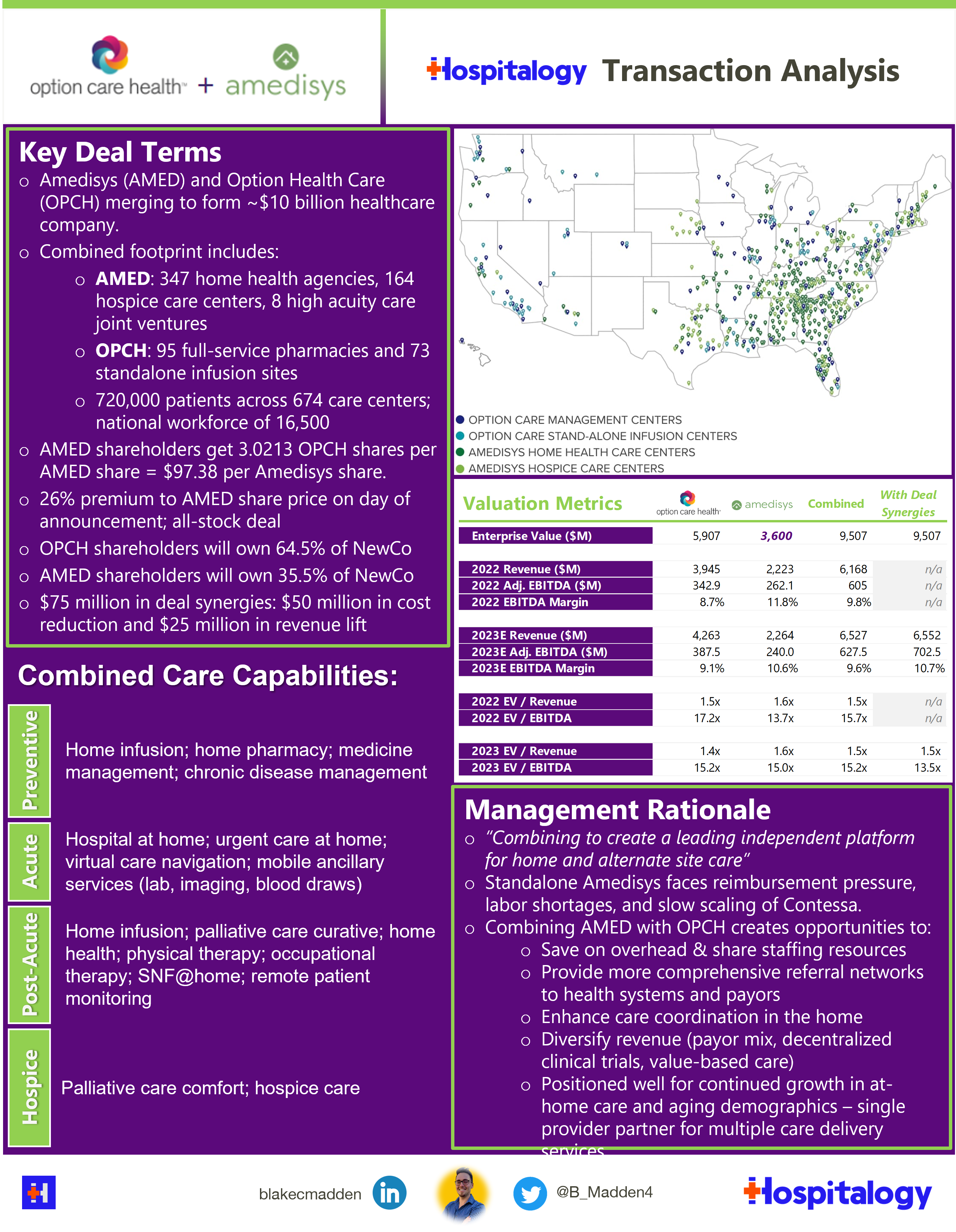

Details: Option Care Health is acquiring Amedisys in an all-stock deal valued at $3.6B or 15.0x forward adjusted EBITDA guidance as provided by Amedisys during its first quarter earnings release.

The merger took analysts by surprise – a dynamic that was painfully obvious on the merger Q&A call. It’s never a good sign when you hear analysts openly questioning the logic, timing, and overall strategy of your multi-billion dollar transaction.

Still, that being said, this AMED-OPCH deal hits on a few high points. The combined entity now holds assets and scale attractive in the post-acute spectrum and at-home care sector. Combined, NewCo (which will be called Option Care – RIP Amedisys) expects to have an easier time negotiating case rates / bundled payments with payors and providing more comprehensive offerings to health system clients. That comprehensive offering could also enable and accelerate the move into risk to jumpstart Contessa and cross-sell infusion services to high acuity, chronic patients.

On that note, Contessa is increasingly the linchpin for Amedisys – and now OPCH’s – future growth expectations. The hospital-at-home provider was acquired for $250M but moved Amedisys’ total addressable market from $44B to $73B (not that the TAM number is now up to $100B under OPCH)

Blake’s Take: Most are questioning the realizable synergies and strategy behind this merger, which seemed to come out of left field. But these executives aren’t idiots, and they’ve been partnered on home infusion services since early 2021. More than anything, I’d wager this move is designed to counteract labor woes and Medicare Advantage penetration, which is a headwind for home health providers.

This was a key quote from Option Care Health’s CFO Mike Shapiro on the value prop of the combined organization to both payors and health systems:

“…I think there is just an inherent productivity with our commercial go-to-market strategy. In many of the leading health systems, we have complementary teams that are approaching those health systems every single day. So as we think about how do we deploy technology and the resources we have in the field, I think there’s an opportunity to drive higher referrals just with the resources that we have.

I think beyond that, I think as John has talked about, I think there is an opportunity to take a pretty unique set of capabilities and collaborate with payers who are looking for more economical, more risk-based programs that, again, is broader than just some of the capabilities that each organization has individually.

I think as we think about some of the high-acuity opportunities with the Contessa platform and the technology they bring along with our infrastructure, our network of infusion centers and demonstrated ability to support chronic patients. I think there’s a tremendous opportunity to bring some new-to-world programs, again, especially on the heels of the technology that they possess. – Mike Shapiro, CFO, Option Care Health

Medicare Advantage Penetration hits over 50%

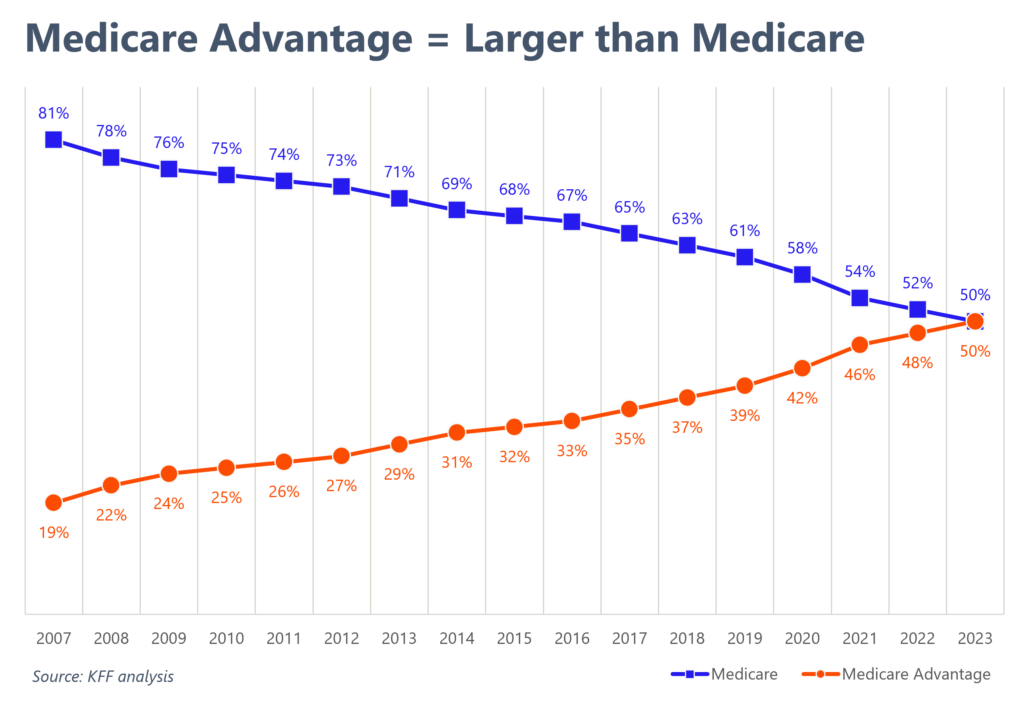

According to a recent KFF analysis, Medicare Advantage penetration now sits above 50%, meaning that more Medicare beneficiaries are picking the program over traditional Medicare.

As discussed in the AMED-OPCH merger, this trend has significant ramifications for both providers (narrow networks, patient steerage, prior auth woes) and total cost of care. MedPAC claims that MA costs taxpayers more than does traditional Medicare, but this assertion is, of course, disputed by insurance personnel.

Regardless, as players like UnitedHealth, Humana, and CVS ramp up their MA services offerings and continue to vertically integrate, expect to see legislation form around increased transparency and required reporting in vertically integrated MA plans. Chinks in the armor are forming around MA, but for now, payors are enjoying their time in the sun.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Partnerships and Strategy Updates:

Surgery Partners announced two new health system partners in late April – OhioHealth and Intermountain. The firm will manage the existing ASCs in the health systems’ portfolios and help develop ASCs in future markets. Recall that Privia is also partnered with Surgery Partners and OhioHealth. Surgery Partners also acquired a stake in the Kansas Spine & Specialty Hospital.

Agilon formed a partnership with Catalyst Health Network, one of the largest CINs in the state of Texas encompassing more than 1,000 providers and 1.5 million patients state-wide. (Link)

Innovaccer partnered with Emcara Health to help Emcara scale its integrated care solution. (Link)

SteadyMD announced a partnership with AmerisourceBergen. Under the Test to Treat model, independent pharmacists can test individuals, then leverage SteadyMD physicians to provide a prescription for certain treatments. (Link)

Cue Health is laying off 26% of its workforce, a tough decision highlighting the challenges faced by the company as it navigates the rapidly changing COVID-19 testing landscape. The move underscores the volatility of the diagnostics market and the need for businesses to adapt to shifting demands in the industry. (Link)

Trinity Health plans to combine ministries and restructure leadership on the West Coast, aiming to streamline operations and reduce admin overhead. (Link)

BCBS Michigan is affiliating with BCBS Vermont, offering support while respecting each organization’s autonomy. The partnership aims to enhance both plans’ capabilities and financial stability, reflecting a growing trend of collaboration among healthcare payers. (Link)

Humana partnered with Longevity Health Plan to expand special needs health plan offerings. Together, they’ll provide SNPs starting in South Carolina and Georgia, then expand to 5 more states in 2024 and more to follow from there. (Link)

MA plan directories are haunted by “ghost” mental health networks, according to a Senate Finance Committee study, revealing inaccuracies in provider directories and hindering access to care. This finding highlights the urgent need to address gaps in mental health services and improve transparency for Medicare Advantage beneficiaries. (Link)

Finance and M&A Updates:

Johnson & Johnson’s consumer unit IPO was priced at $22 a share, at the higher end of the targeted range of $20 to $23, and is expected to raise at least $3.7 billion. The spinoff will value the new company, Kenvue, at over $40 billion. Kenvue, if you wanna sponsor Hospitalogy I’m all ears! Ha. Ha. (Link)

Bright Health seems to be engaging in a fire sale, announcing this week its intention to sell its California MA business after receiving some inbound interest. (Link)

Reed Smith provided a nice overview of the new law passed by New York state that will require healthcare entities to submit a notice to the State Department of Health concerning any material healthcare transactions. (Link)

Centene divested its healthcare analytics platform Apixio to New Mountain Capital. (Link)

American Oncology Network (AON), a network of community-based oncology practices, has received a $65 million strategic growth investment from AEA Growth. AON provides support to oncology practices, including access to clinical research, diagnostics, and pathology, and financial assistance programs for patients. AEA Growth’s investment will help further AON’s goals of supporting community practices and improving the patient experience. AON generated over $1.1 billion in revenue in 2022 and has almost 200 providers across 77 locations in 17 states. (Link)

California lawmakers approved a $150 million loan to struggling medical centers to prevent further closures after a rural hospital in Madera County closed in December, leaving nearly 160,000 people without a medical center within a 30-minute drive. Other hospitals in California have also struggled to stay open during the pandemic, with a report warning that 20% of the state’s hospitals were at risk of closing. The loan was approved earlier than usual due to the severity of the crisis. (Link)

Digital Health and Startup Updates:

After receiving an unreal 38,000+ comments on current telehealth proposed changes, the DEA has delayed rolling back the public health emergency flexibilities extended to telehealth service providers. It’s a small temporary win for virtual care startups who are vying for a more permanent solution to online prescribing. (Link)

I wanted to point out a some great news from a friend and fellow Longhorn Nick Weber! His firm Ucardia, a cardiac conditioning software developer, acquired Phas3, a pioneer in home-based cardiac rehab and fellow industry leader. Together, Ucardia announced the launch of a remote patient monitoring offering tailored for cardiologist practices. (Link)

Virtual youth and family mental health provider Brightline lays off 20% of its employees on top of the 20% that it let go in November 2022.

Miscellaneous Maddenings

“It has happened again” WFAA channel 8 opened up its nightly news segment. But it wasn’t talking about a blown Cowboys lead.

It was ANOTHER. Mass shooting. This time in my backyard. A place where I shopped with my own family trying to find a bargain on Nike shoes or Polo shirts – the Allen, Texas outlet malls.

At least 8 people died and 7 more were injured just north of me. Please forgive my candor, but there is a special place in hell for those who actively choose to shoot and kill innocent men, women, and children.

Please keep the families and the community in your minds – at least for this week. Til the next one.

Hospitalogy Top Reads

- Just one featured post today, and it’s the NY Times profile of Elizabeth Holmes with the following byline: “Liz Holmes Wants you to Forget About Elizabeth: The black turtlenecks are gone. So is the voice. As the convicted Theranos founder awaits prison, she has adopted a new persona: devoted mother.”

- Color me shocked – I was NOT expecting to see even a slightly flattering Elizabeth Holmes expose on the bingo card in 2023. There are some rebukes throughout the essay, but there is no doubt that the NYT was trying to be provocative to bring some attention to itself with this piece. I’d be the first in line to tell you that I believe in forgiveness and second chances, but there’s also a saying that comes to mind for me in this instance: “When someone shows you who they are, believe them.” Anyone who has read John Carreyrou’s ironclad journalism in Bad Blood knows that Holmes deserves everything coming her way. She actively made choices leading to financial fraud and employee death by suicide.

- This is the equivalent of saying Martin Shkreli now wants to go by ‘Marty’ and has redefined himself: